Operating Agreement Template for the State of New Jersey

In the realm of business formation, particularly for Limited Liability Companies (LLCs) in New Jersey, the Operating Agreement serves as a crucial document that outlines the internal workings of the company. This agreement delineates the rights, responsibilities, and obligations of the members, ensuring that all parties are on the same page regarding the management and operation of the business. It addresses key elements such as ownership percentages, profit distribution, and procedures for adding or removing members. Furthermore, the Operating Agreement can stipulate how decisions are made, including voting rights and the process for resolving disputes. By providing a clear framework, this document not only protects the interests of the members but also enhances the credibility of the LLC in the eyes of potential investors and partners. Understanding the significance of this form is essential for anyone looking to establish a solid foundation for their business in New Jersey.

Common mistakes

-

Inaccurate Member Information: People often enter incorrect names or addresses for members. This can lead to confusion and potential legal issues.

-

Omitting Ownership Percentages: Failing to specify each member's ownership percentage can create disputes later. It's essential to be clear about each member's stake in the business.

-

Neglecting Voting Rights: Some forget to outline voting rights. Without this information, decision-making can become complicated and contentious.

-

Not Defining Roles and Responsibilities: Members may skip detailing their roles. This can lead to misunderstandings about who is responsible for what tasks.

-

Ignoring Profit and Loss Distribution: Failing to specify how profits and losses will be distributed among members can result in disagreements down the line.

-

Leaving Out Dissolution Procedures: Some people do not include how the company will dissolve if necessary. Having a clear plan can prevent complications in the future.

-

Not Including Amendment Procedures: Omitting how to amend the agreement can cause issues if changes are needed. It's important to have a clear process in place.

-

Failing to Review for Accuracy: Many individuals do not double-check their entries. A thorough review can catch mistakes before they become problematic.

Other Common Operating Agreement State Templates

Llc Operating Agreement Tennessee - An Operating Agreement outlines the management structure of a limited liability company (LLC).

When entering into a rental arrangement, it is essential to have a solid understanding of the California Residential Lease Agreement, which clearly defines the obligations of both landlord and tenant. This legal document not only protects your interests but also contributes to a smooth rental experience. For a reliable and comprehensive form, consider visiting California Templates to access the necessary paperwork.

Cost for Llc - The Operating Agreement outlines the management structure of an LLC.

Key takeaways

When it comes to forming a business in New Jersey, an Operating Agreement is an essential document for Limited Liability Companies (LLCs). Here are some key takeaways to keep in mind when filling out and using the New Jersey Operating Agreement form:

- Understand the Purpose: An Operating Agreement outlines the management structure and operating procedures of your LLC. It helps clarify the roles of members and protects your limited liability status.

- Customize Your Agreement: While templates are available, tailor the Operating Agreement to fit the unique needs of your business. This includes specifying management roles, profit distribution, and decision-making processes.

- Include Essential Elements: Key components to include are the LLC's name, principal office address, member information, and the purpose of the business. Ensure all members agree on these details.

- Clarify Member Contributions: Document the initial contributions of each member, whether they are monetary, property, or services. This clarity can prevent disputes later on.

- Address Voting Rights: Define how voting will occur among members. Will decisions require a simple majority, or will certain actions need unanimous consent? Specify this clearly.

- Plan for Changes: Life is unpredictable. Include provisions for adding new members, transferring ownership, or handling a member’s departure. This foresight can save time and stress in the future.

- Keep It Updated: As your business evolves, so should your Operating Agreement. Regularly review and amend it to reflect any significant changes in membership or operations.

- Consult a Professional: While you can draft the agreement yourself, seeking legal advice can ensure that your document complies with New Jersey laws and adequately protects your interests.

By keeping these takeaways in mind, you can create a comprehensive and effective Operating Agreement that serves your LLC well into the future.

New Jersey Operating Agreement Example

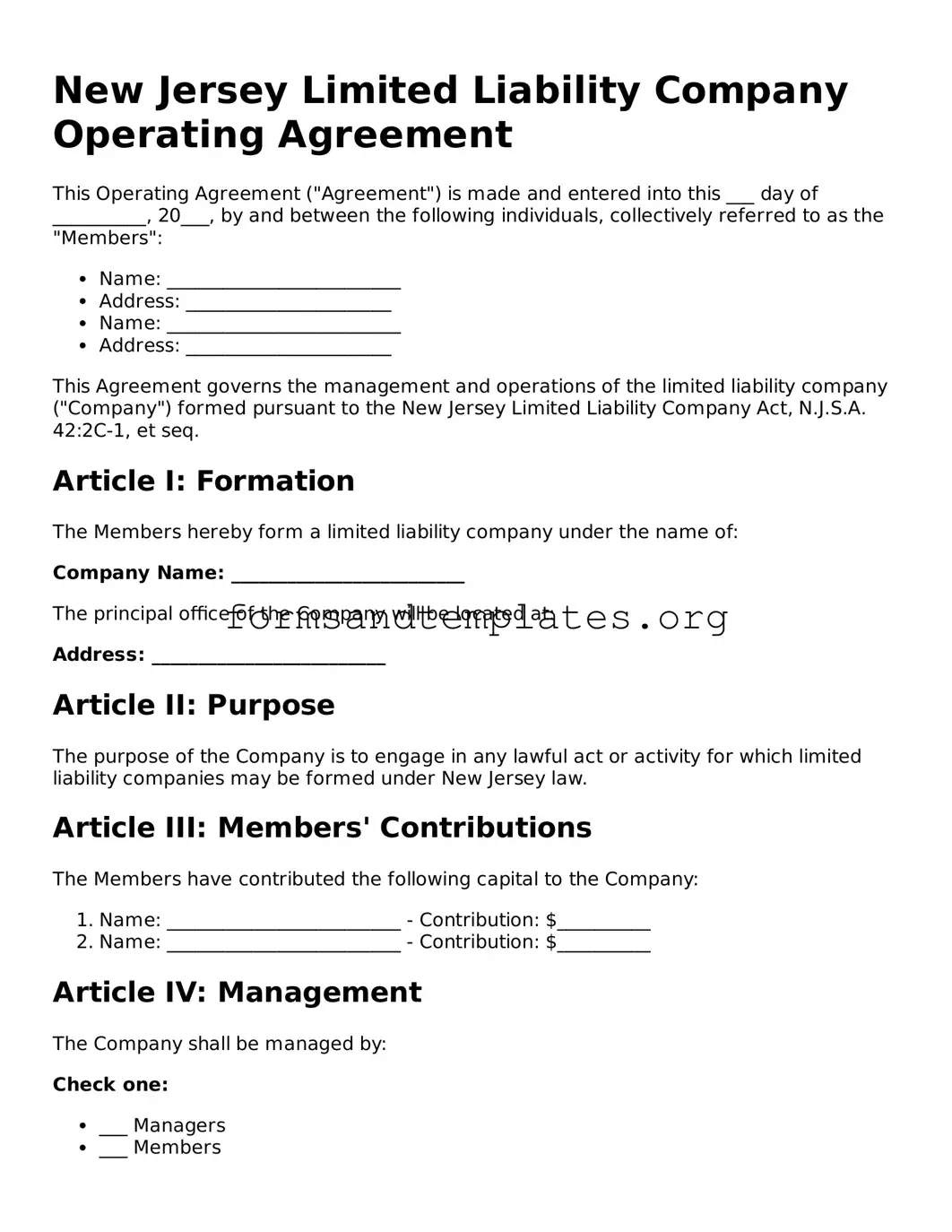

New Jersey Limited Liability Company Operating Agreement

This Operating Agreement ("Agreement") is made and entered into this ___ day of __________, 20___, by and between the following individuals, collectively referred to as the "Members":

- Name: _________________________

- Address: ______________________

- Name: _________________________

- Address: ______________________

This Agreement governs the management and operations of the limited liability company ("Company") formed pursuant to the New Jersey Limited Liability Company Act, N.J.S.A. 42:2C-1, et seq.

Article I: Formation

The Members hereby form a limited liability company under the name of:

Company Name: _________________________

The principal office of the Company will be located at:

Address: _________________________

Article II: Purpose

The purpose of the Company is to engage in any lawful act or activity for which limited liability companies may be formed under New Jersey law.

Article III: Members' Contributions

The Members have contributed the following capital to the Company:

- Name: _________________________ - Contribution: $__________

- Name: _________________________ - Contribution: $__________

Article IV: Management

The Company shall be managed by:

Check one:

- ___ Managers

- ___ Members

If managed by Managers, please list the Managers:

- Name: _________________________

- Name: _________________________

Article V: Profits and Losses

Profits and losses of the Company shall be allocated to the Members in proportion to their respective contributions as follows:

- Name: _________________________ - Percentage: ________%

- Name: _________________________ - Percentage: ________%

Article VI: Distributions

Distributions shall be made to the Members at the times and in the amounts as determined by the Managers or Members, as applicable.

Article VII: Indemnification

The Company shall indemnify and hold harmless each Member against any and all expenses and liabilities incurred in connection with the Company to the fullest extent permitted by New Jersey law.

Article VIII: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New Jersey.

Signatures

In witness whereof, the Members have executed this Operating Agreement as of the day and year first above written.

_________________________

Member Signature

_________________________

Member Signature

Understanding New Jersey Operating Agreement

What is a New Jersey Operating Agreement?

An Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in New Jersey. It serves as an internal guideline for members, detailing their rights, responsibilities, and the distribution of profits and losses.

Is an Operating Agreement required in New Jersey?

While New Jersey does not legally require LLCs to have an Operating Agreement, it is highly recommended. Having one can help prevent misunderstandings among members and provide a clear framework for operations, especially in the event of disputes.

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC, but it is often best to consult with a legal professional. This ensures that the document complies with state laws and meets the specific needs of the business.

What should be included in the Operating Agreement?

Key components of an Operating Agreement may include:

- Names and addresses of members

- Management structure (member-managed or manager-managed)

- Voting rights and procedures

- Capital contributions from members

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution methods

How can members amend the Operating Agreement?

Members can amend the Operating Agreement by following the procedures outlined in the document itself. Generally, this requires a majority vote or unanimous consent, depending on what the members have agreed upon.

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, New Jersey’s default LLC laws will apply. This may not align with the members' intentions and can lead to complications in management, profit distribution, and member relationships.

Can the Operating Agreement be a verbal agreement?

While verbal agreements can be made, they are not advisable for an Operating Agreement. A written document provides clarity and serves as a legal record, which is crucial for resolving disputes and ensuring all members are on the same page.

How often should the Operating Agreement be reviewed?

It is a good practice to review the Operating Agreement regularly, especially when there are significant changes in the business, such as adding new members or changing the management structure. Regular reviews help ensure the document remains relevant and effective.

Can one member have more power than others in the Operating Agreement?

Yes, the Operating Agreement can specify different voting rights and powers among members. This allows for flexibility in management and can accommodate varying levels of involvement and investment from each member.

Where should the Operating Agreement be kept?

The Operating Agreement should be stored in a safe and accessible location, such as a secure file or a cloud storage service. All members should have access to it, ensuring everyone can refer to the document when needed.

How to Use New Jersey Operating Agreement

Completing the New Jersey Operating Agreement form is an important step for business owners looking to establish clear guidelines for their company. After filling out the form, it is advisable to keep a copy for your records and distribute it to all members of the organization.

- Start by gathering necessary information about your business, including its name, address, and the names of all members.

- Open the New Jersey Operating Agreement form. Ensure that you have the most current version available.

- Fill in the name of the LLC at the top of the form. This should match the name registered with the state.

- Provide the principal address of the LLC. This is where official correspondence will be sent.

- List the names and addresses of all members. Include their ownership percentages if applicable.

- Detail the management structure of the LLC. Specify whether it will be member-managed or manager-managed.

- Outline the purpose of the LLC. This can be a brief description of the business activities.

- Include provisions for meetings. Indicate how often meetings will be held and how members will be notified.

- Specify the voting rights of members. Clarify how decisions will be made and what constitutes a quorum.

- Address the process for adding or removing members. Include any necessary conditions or procedures.

- Review the form for accuracy. Ensure all information is complete and correctly entered.

- Sign and date the form. All members should sign to acknowledge their agreement to the terms outlined.