Employment Verification Template for the State of New Jersey

In New Jersey, the Employment Verification form plays a crucial role in confirming an individual's employment status and income. This form is often required for various purposes, such as applying for loans, renting an apartment, or even seeking government assistance. It typically includes essential details like the employee's name, job title, and the duration of employment. Employers fill out this form to provide accurate information about their employees, ensuring that the verification process is smooth and efficient. Additionally, the form may require the employer's contact information and a signature to validate the provided details. Understanding how to properly complete and submit this form can help individuals navigate their employment verification needs with ease, making it an important document in many professional and personal situations.

Common mistakes

-

Inaccurate Personal Information: Many individuals mistakenly enter incorrect names, addresses, or Social Security numbers. This can lead to delays or complications in the verification process.

-

Missing Employer Details: Failing to provide complete information about the employer, such as the company name or address, can hinder the verification process.

-

Incorrect Dates of Employment: Some people list the wrong start or end dates. This inconsistency can raise red flags for employers and delay the verification.

-

Omitting Job Title: Not including the correct job title can create confusion about the role held within the company. This information is essential for accurate verification.

-

Neglecting to Sign the Form: Forgetting to sign the Employment Verification form is a common oversight. Without a signature, the form may be considered invalid.

-

Providing Incomplete Contact Information: Failing to include a phone number or email address for the employer can complicate the verification process. Clear contact details are necessary for follow-up.

-

Using Inconsistent Formatting: Inconsistent formatting, such as different date styles or varying capitalization, can make the form appear unprofessional and may lead to misunderstandings.

-

Not Reviewing the Form: Skipping the review process before submission can lead to overlooked errors. Taking a moment to double-check the information can prevent unnecessary issues.

Other Common Employment Verification State Templates

Texas Income Letter - Useful for professional licensing applications requiring verification.

For a thorough understanding of the transaction process, it’s advisable to review this vital resource: "important Georgia Motorcycle Bill of Sale considerations" at https://georgiapdf.com/motorcycle-bill-of-sale/.

Key takeaways

When filling out and using the New Jersey Employment Verification form, it is essential to understand several key points. Below are important takeaways to consider:

- The form is used to verify employment status for various purposes, including loan applications and public assistance.

- Accurate information is critical. Ensure that all details regarding the employee's name, position, and employment dates are correct.

- Employers must provide their contact information on the form. This allows for verification if needed.

- The employee should review the completed form before submission to confirm that all information is accurate and complete.

- There is no fee associated with completing the Employment Verification form.

- Employers are required to respond to verification requests promptly to facilitate the employee's needs.

- Confidentiality must be maintained. Only authorized individuals should have access to the completed forms.

- The form may be submitted electronically or in paper format, depending on the requesting party's preferences.

- Keep a copy of the completed form for your records. This may be necessary for future reference.

- Be aware of any specific instructions provided by the requesting party regarding the completion and submission of the form.

Understanding these points can help ensure a smooth process when using the New Jersey Employment Verification form.

New Jersey Employment Verification Example

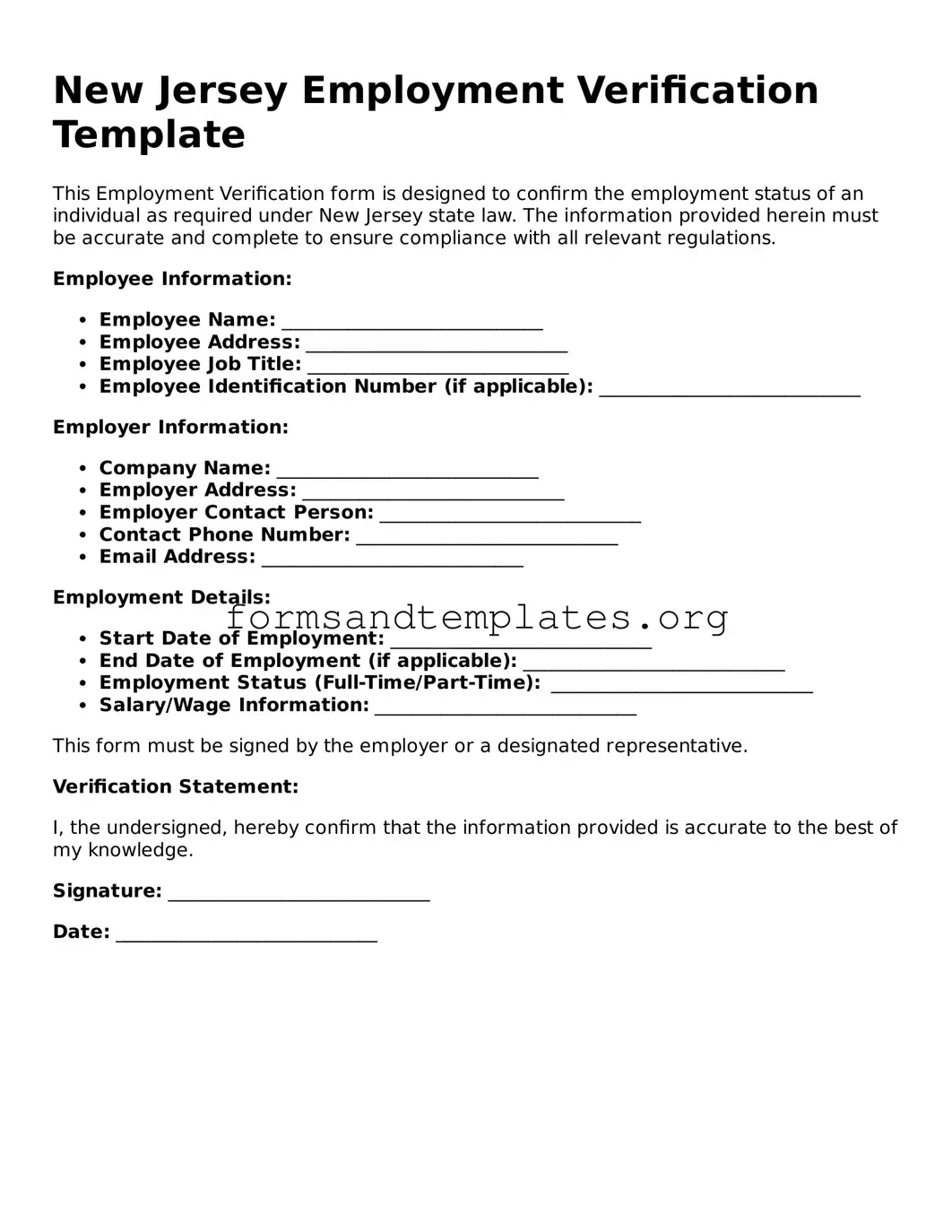

New Jersey Employment Verification Template

This Employment Verification form is designed to confirm the employment status of an individual as required under New Jersey state law. The information provided herein must be accurate and complete to ensure compliance with all relevant regulations.

Employee Information:

- Employee Name: ____________________________

- Employee Address: ____________________________

- Employee Job Title: ____________________________

- Employee Identification Number (if applicable): ____________________________

Employer Information:

- Company Name: ____________________________

- Employer Address: ____________________________

- Employer Contact Person: ____________________________

- Contact Phone Number: ____________________________

- Email Address: ____________________________

Employment Details:

- Start Date of Employment: ____________________________

- End Date of Employment (if applicable): ____________________________

- Employment Status (Full-Time/Part-Time): ____________________________

- Salary/Wage Information: ____________________________

This form must be signed by the employer or a designated representative.

Verification Statement:

I, the undersigned, hereby confirm that the information provided is accurate to the best of my knowledge.

Signature: ____________________________

Date: ____________________________

Understanding New Jersey Employment Verification

What is the New Jersey Employment Verification form?

The New Jersey Employment Verification form is a document used by employers to confirm an employee's job status and details. This form is often required for various purposes, including loan applications, housing approvals, and government assistance programs. It typically includes information such as the employee's job title, dates of employment, and salary details.

Who needs to complete the Employment Verification form?

Employers are responsible for completing the Employment Verification form when requested by an employee or a third party. Employees may need this verification for several reasons, including:

- Applying for a mortgage or loan

- Seeking rental housing

- Applying for government benefits

In these cases, the employer's timely response can help facilitate the employee's needs.

How is the Employment Verification form submitted?

The submission process for the Employment Verification form can vary based on the employer's policies. Typically, the following steps are involved:

- The employee requests the form from their employer.

- The employer fills out the required information accurately.

- The completed form is then provided to the employee or sent directly to the requesting third party.

Employers may choose to send the form via email, fax, or postal mail, depending on the preferences of the employee or the third party involved.

What information is typically included in the Employment Verification form?

The Employment Verification form generally contains the following information:

- Employee's full name

- Employee's job title

- Dates of employment (start date and end date, if applicable)

- Current or most recent salary

- Employer's contact information

Providing accurate and complete information is crucial, as it ensures that the verification serves its intended purpose effectively.

How to Use New Jersey Employment Verification

Completing the New Jersey Employment Verification form requires careful attention to detail. After filling out the form, it will need to be submitted to the appropriate authority for processing. Ensure all information is accurate to avoid delays.

- Obtain the New Jersey Employment Verification form from the official website or your employer.

- Begin with the employee's personal information. Fill in the employee's full name, address, and contact details.

- Enter the employee's Social Security Number. This is essential for verification purposes.

- Provide the name and address of the employer. Ensure this information is up to date.

- Include the employee's job title and the dates of employment. Specify the start date and, if applicable, the end date.

- Detail the employee's salary or hourly wage. Be accurate to reflect the current compensation.

- Sign and date the form. Ensure that the signature is from an authorized representative of the employer.

- Review the completed form for any errors or omissions. Correct any inaccuracies before submission.

- Submit the form to the designated recipient. This may be a government agency or an internal department, depending on the requirements.