Durable Power of Attorney Template for the State of New Jersey

In New Jersey, a Durable Power of Attorney (DPOA) is a vital legal document that empowers an individual to designate another person to make financial and legal decisions on their behalf. This form remains effective even if the principal becomes incapacitated, ensuring that their affairs are managed according to their wishes. The DPOA can cover a wide range of responsibilities, from handling bank transactions to managing real estate and making healthcare decisions. It is essential to choose a trusted agent, as this person will have significant authority over the principal's financial matters. Additionally, the form must be completed with specific requirements in mind, including the need for signatures and witnesses, to ensure its validity. Understanding the implications of this powerful tool can provide peace of mind, knowing that one’s interests will be protected even in challenging circumstances.

Common mistakes

-

Not Choosing the Right Agent: Selecting someone who is not trustworthy or who may have conflicting interests can lead to complications. Choose someone who understands your wishes and can act in your best interest.

-

Failure to Specify Powers: Leaving the powers vague or not clearly defining what the agent can and cannot do may lead to misunderstandings. Be specific about the authority you are granting.

-

Not Signing in Front of Witnesses: New Jersey law requires that the form be signed in front of a notary or witnesses. Skipping this step can invalidate the document.

-

Ignoring State Requirements: Each state has its own rules regarding durable power of attorney forms. Not adhering to New Jersey’s specific requirements can result in the document being rejected.

-

Failing to Update the Document: Life changes, such as marriage, divorce, or the death of an agent, necessitate updates to your durable power of attorney. Regularly review and revise the document as needed.

-

Not Discussing with the Agent: Failing to communicate your wishes with the appointed agent can lead to confusion. Have an open conversation about your expectations and preferences.

-

Overlooking Alternate Agents: Designating only one agent without a backup can create issues if the primary agent is unavailable. Always name an alternate to ensure your affairs are managed.

Other Common Durable Power of Attorney State Templates

Virginia Financial Power of Attorney - Carefully selecting your agent can provide your family with confidence in managing your affairs if the need arises.

In order to ensure clarity and protect against potential legal issues, it is crucial for participants to understand the significance of the Release of Liability form, which outlines the inherent risks associated with various activities; for those interested, more information and templates can be found at California Templates.

Financial Power of Attorney Arizona - It provides a straightforward mechanism for your agent to act responsibly and effectively.

Key takeaways

When considering a Durable Power of Attorney (DPOA) in New Jersey, it’s essential to understand several key points to ensure that the document serves its intended purpose effectively. Here are some important takeaways:

- Purpose of the DPOA: A Durable Power of Attorney allows you to appoint someone to make decisions on your behalf if you become unable to do so. This can include financial, legal, and medical decisions.

- Choosing an Agent: Selecting the right person as your agent is crucial. This should be someone you trust implicitly, as they will have significant authority over your affairs.

- Durability: The term "durable" means that the power of attorney remains in effect even if you become incapacitated. This is a key feature that differentiates it from a regular power of attorney.

- Specific Powers: You can specify which powers you want to grant to your agent. Be clear about the scope of authority, whether it’s broad or limited to specific tasks.

- Signing Requirements: In New Jersey, the DPOA must be signed in the presence of a notary public. This adds an extra layer of validity to the document.

- Revocation: You can revoke a Durable Power of Attorney at any time as long as you are mentally competent. Ensure that you communicate this revocation to your agent and any institutions that may have a copy of the DPOA.

Understanding these key points can help ensure that your Durable Power of Attorney is effective and serves your needs as intended.

New Jersey Durable Power of Attorney Example

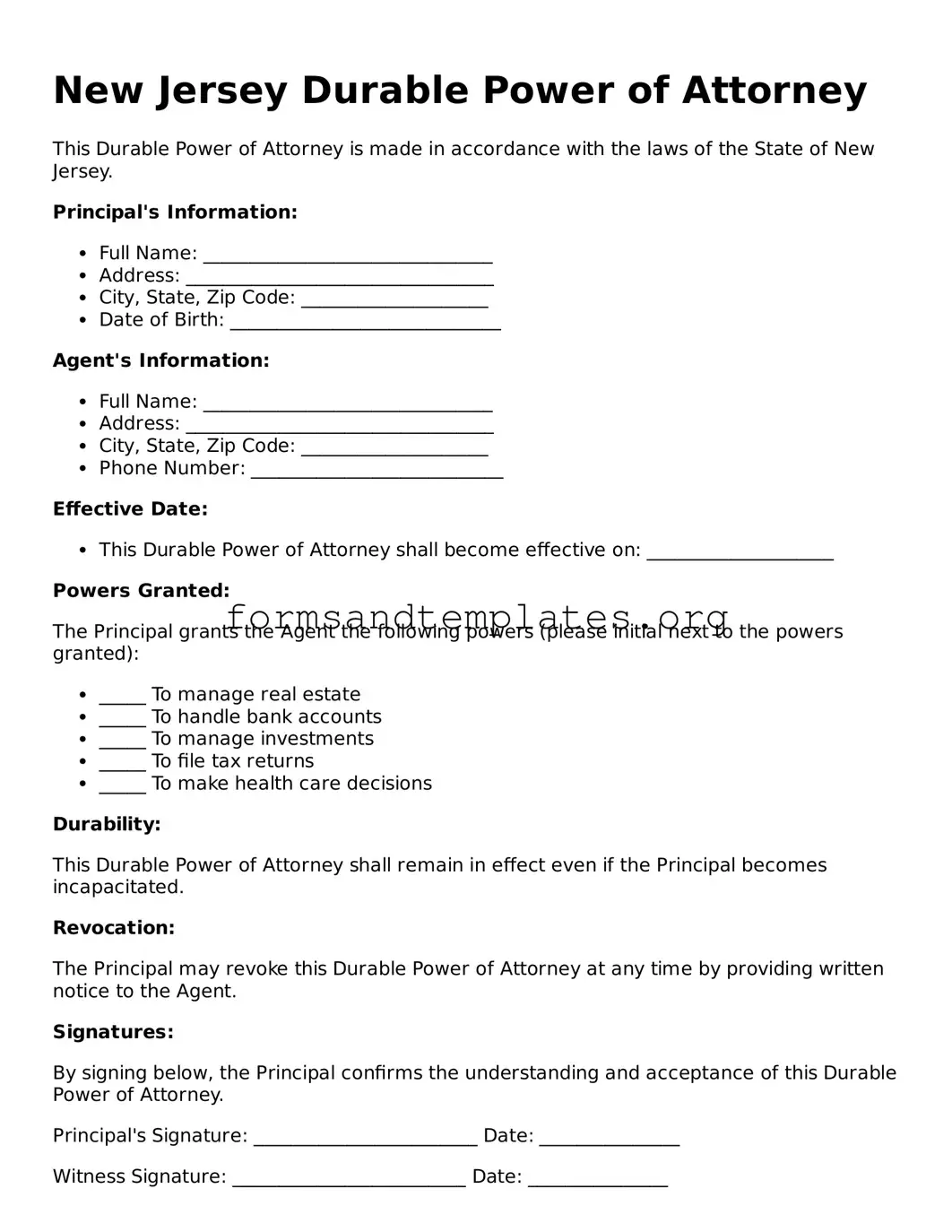

New Jersey Durable Power of Attorney

This Durable Power of Attorney is made in accordance with the laws of the State of New Jersey.

Principal's Information:

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip Code: ____________________

- Date of Birth: _____________________________

Agent's Information:

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip Code: ____________________

- Phone Number: ___________________________

Effective Date:

- This Durable Power of Attorney shall become effective on: ____________________

Powers Granted:

The Principal grants the Agent the following powers (please initial next to the powers granted):

- _____ To manage real estate

- _____ To handle bank accounts

- _____ To manage investments

- _____ To file tax returns

- _____ To make health care decisions

Durability:

This Durable Power of Attorney shall remain in effect even if the Principal becomes incapacitated.

Revocation:

The Principal may revoke this Durable Power of Attorney at any time by providing written notice to the Agent.

Signatures:

By signing below, the Principal confirms the understanding and acceptance of this Durable Power of Attorney.

Principal's Signature: ________________________ Date: _______________

Witness Signature: _________________________ Date: _______________

Witness Signature: _________________________ Date: _______________

This document was executed in the State of New Jersey.

Understanding New Jersey Durable Power of Attorney

What is a Durable Power of Attorney in New Jersey?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to appoint someone else, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This authority remains in effect even if the principal becomes incapacitated. In New Jersey, the DPOA can cover a wide range of decisions, including financial matters, real estate transactions, and healthcare decisions, depending on the specific language included in the document.

How do I create a Durable Power of Attorney in New Jersey?

Creating a Durable Power of Attorney in New Jersey involves several steps:

- Choose a trustworthy agent who understands your wishes and can act in your best interest.

- Draft the DPOA document, ensuring it clearly outlines the powers granted to the agent.

- Sign the document in the presence of a notary public. New Jersey law requires notarization for the DPOA to be valid.

- Consider providing copies to your agent, family members, and any financial institutions or healthcare providers that may need it.

What powers can I grant to my agent in a Durable Power of Attorney?

The powers granted in a Durable Power of Attorney can be broad or limited, depending on your preferences. Common powers include:

- Managing bank accounts and investments

- Handling real estate transactions

- Paying bills and managing debts

- Making healthcare decisions if specified

It is crucial to clearly specify the scope of authority in the document to avoid any confusion later.

Can I revoke a Durable Power of Attorney in New Jersey?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To revoke the DPOA, you should:

- Draft a written revocation document.

- Notify your agent of the revocation.

- Distribute copies of the revocation to any institutions or individuals who had a copy of the original DPOA.

It is advisable to consult with a legal professional to ensure the revocation is executed correctly and to avoid any potential disputes.

How to Use New Jersey Durable Power of Attorney

Filling out the New Jersey Durable Power of Attorney form is an important step in ensuring your financial and legal matters are handled according to your wishes. Once you complete the form, it will need to be signed and witnessed properly to ensure its validity. Follow these steps to fill out the form correctly.

- Begin by downloading the New Jersey Durable Power of Attorney form from a reliable source or obtain a hard copy from a legal office.

- At the top of the form, enter your full name and address in the designated spaces.

- Next, provide the name and address of the person you are appointing as your agent. This person will act on your behalf.

- Specify any limitations or specific powers you want to grant to your agent. If there are no limitations, you can leave this section blank.

- Indicate the effective date of the Durable Power of Attorney. You can choose to have it take effect immediately or at a later date.

- Review the section that outlines your rights and the agent's responsibilities. Make sure you understand what you are agreeing to.

- Sign and date the form at the bottom. Your signature must be witnessed by at least one person who is not your agent.

- Have the witness sign and date the form in the appropriate section.

- Consider having the form notarized to add an extra layer of authenticity, although this is not always required.

After completing the form, keep a copy for your records and provide a copy to your agent. This ensures that they have the necessary documentation to act on your behalf when needed.