Printable Mortgage Statement Template

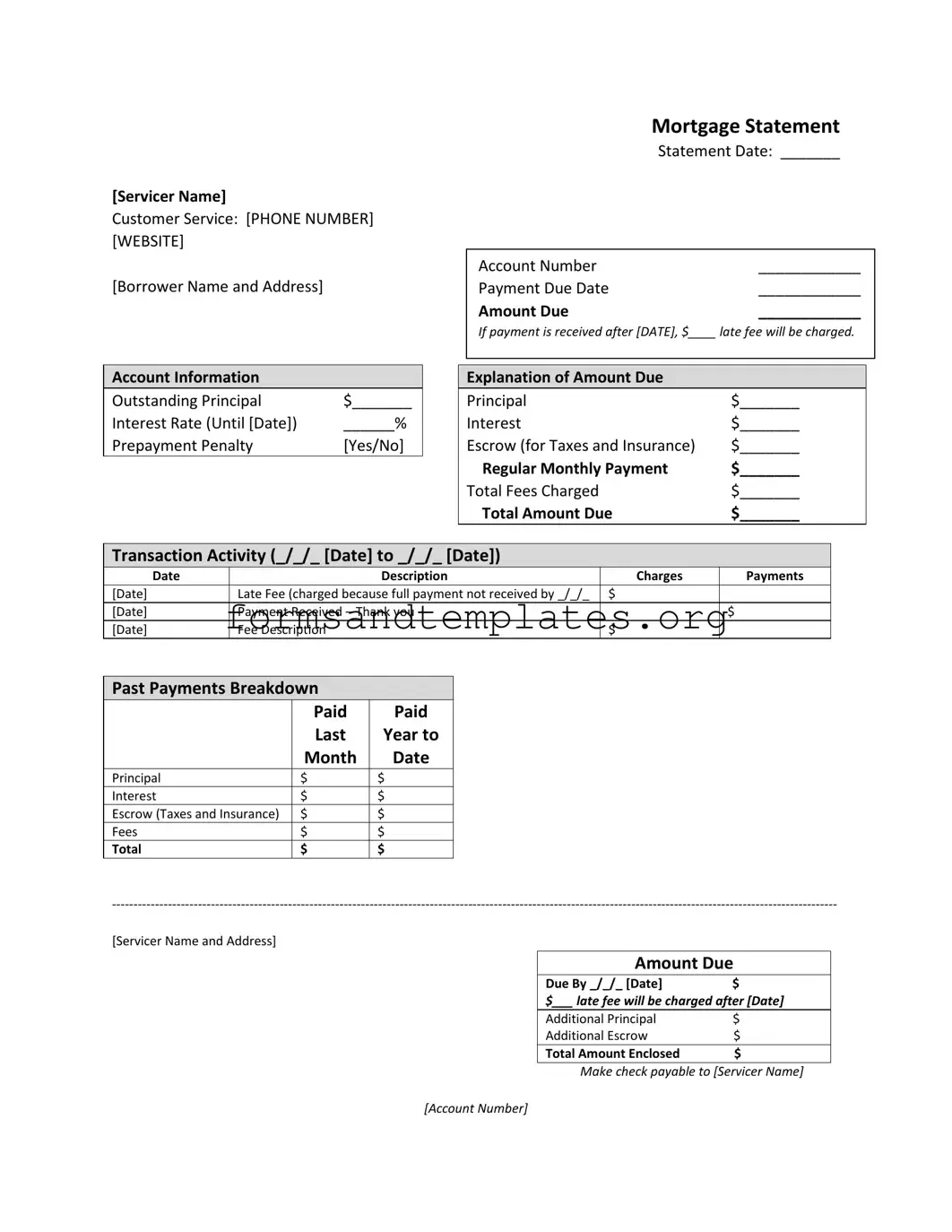

The Mortgage Statement form serves as a crucial document for homeowners, providing them with essential information regarding their mortgage account. At the top of the form, individuals will find the servicer's name, customer service contact details, and the borrower's name and address, ensuring that all parties are clearly identified. The statement date, account number, and payment due date are prominently displayed, along with the total amount due. Homeowners should pay close attention to the late fee policy, which outlines the financial consequences of late payments. The account information section breaks down the outstanding principal, interest rate, and any applicable prepayment penalties, giving borrowers a comprehensive view of their financial obligations. Furthermore, the explanation of the amount due clarifies how each component contributes to the total, including principal, interest, and escrow for taxes and insurance. Transaction activity records recent payments and any fees charged, while the past payments breakdown offers a historical perspective on payments made over the last year. Additionally, the form includes important messages that address partial payments and the implications of delinquency, warning borrowers of potential fees and the risk of foreclosure. For those experiencing financial difficulties, resources for mortgage counseling or assistance are provided, emphasizing the servicer's commitment to supporting borrowers during challenging times.

Common mistakes

-

Failing to include the servicer name and customer service contact information.

-

Not providing the borrower's name and address accurately, which can lead to processing delays.

-

Leaving the account number section blank or incorrectly filled out, causing confusion in tracking payments.

-

Overlooking the statement date, which is crucial for understanding the payment timeline.

-

Incorrectly filling out the payment due date, leading to potential late fees.

-

Not specifying the amount due accurately, which can result in miscommunication about payment obligations.

-

Ignoring the outstanding principal and interest rate sections, which are essential for understanding the loan status.

-

Failing to check if a prepayment penalty applies, which can affect future payment decisions.

-

Neglecting to review the transaction activity for any discrepancies in charges and payments.

-

Not paying attention to the delinquency notice, which outlines the consequences of late payments.

Find Common Documents

Broward Animal Care - The use of USDA licensed vaccines is significant, ensuring safety and effectiveness for your pet.

Having a clear understanding of the leasing process is essential for both landlords and tenants, and utilizing resources like the California Templates can simplify this experience by providing you with an easy-to-use form for your rental agreements.

Asurion Phone - It serves as a foundation for addressing customer concerns effectively.

Key takeaways

Understanding the Mortgage Statement form is crucial for homeowners. Here are some key takeaways to help you navigate this important document:

- Servicer Information: Always check the servicer's name, customer service number, and website. This information is essential for any inquiries.

- Account Details: Verify your account number, statement date, and payment due date to ensure accuracy.

- Amount Due: Pay close attention to the total amount due. This includes principal, interest, and any fees.

- Late Fees: Be aware of the late fee policy. A specified amount will be charged if payment is received after the due date.

- Outstanding Principal: Review the outstanding principal balance. This reflects how much you still owe on your loan.

- Transaction Activity: Look at the transaction history for a clear picture of charges and payments made over the specified period.

- Partial Payments: Understand that partial payments do not apply directly to your mortgage. They are held in a suspense account until the full amount is paid.

- Delinquency Notice: Take any delinquency notice seriously. If you are late, it may lead to additional fees or foreclosure.

- Recent Account History: Review the recent payment history to identify any unpaid balances or late payments.

- Financial Assistance: If you are facing financial difficulties, seek information about mortgage counseling or assistance options available to you.

By keeping these points in mind, you can manage your mortgage more effectively and avoid potential pitfalls.

Mortgage Statement Example

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Understanding Mortgage Statement

What is a Mortgage Statement?

A Mortgage Statement is a document provided by your mortgage servicer that outlines important information regarding your mortgage account. This statement typically includes details such as your outstanding principal balance, interest rate, payment due date, and the total amount due. It serves as a record of your payment history and can help you track your mortgage payments over time.

What information can I find on my Mortgage Statement?

Your Mortgage Statement contains several key pieces of information:

- Account Information: This section lists your outstanding principal, interest rate, and any prepayment penalties.

- Payment Details: You will see the amount due, payment due date, and any late fees that may apply if payment is not received on time.

- Transaction Activity: This part provides a record of recent transactions, including payments made and any fees charged.

- Past Payments Breakdown: Here, you can find a summary of payments made in the past year, categorized by principal, interest, escrow, and fees.

What happens if I miss a payment?

If you miss a payment, your Mortgage Statement will reflect that you are delinquent. It is crucial to address missed payments promptly, as continued delinquency can lead to additional fees and even foreclosure. Your statement will indicate how many days you are delinquent and the total amount required to bring your loan current. Make sure to review the statement closely for any late fees that may apply after a certain date.

What should I do if I am experiencing financial difficulty?

If you find yourself struggling to make your mortgage payments, it is important to take action. The Mortgage Statement may include information about mortgage counseling or assistance programs available to you. Reach out to your mortgage servicer’s customer service, as they can provide guidance on options such as loan modifications, forbearance, or other forms of assistance. Taking proactive steps can help you avoid potential foreclosure and keep your home.

How to Use Mortgage Statement

Filling out the Mortgage Statement form requires careful attention to detail. This form helps you track your mortgage payments and outstanding balance. Follow these steps to ensure that you complete the form accurately.

- Begin by entering the Servicer Name in the designated field.

- Provide the Customer Service Phone Number and Website for your mortgage servicer.

- Fill in your Borrower Name and Address in the appropriate sections.

- Enter the Statement Date, Account Number, and Payment Due Date.

- Specify the Amount Due for the current payment period.

- Note the late fee that will be charged if payment is received after the specified date.

- Fill out the Account Information section, including Outstanding Principal and Interest Rate.

- Indicate whether there is a Prepayment Penalty by marking Yes or No.

- In the Explanation of Amount Due section, break down the total amount into Principal, Interest, Escrow, and Total Fees Charged.

- Calculate and enter the Total Amount Due.

- For the Transaction Activity, list the dates and descriptions of charges and payments.

- Complete the Past Payments Breakdown by entering the amounts paid for Principal, Interest, Escrow, and Fees over the last year.

- Fill in the Amount Due and the Due By date.

- Note any additional amounts for Principal and Escrow.

- Calculate the Total Amount Enclosed and make sure to write a check payable to the Servicer Name with your Account Number.

- Review the Important Messages for any notes regarding partial payments or delinquency notices.

Once you have completed the form, double-check all entries for accuracy. This will help you avoid any potential issues with your mortgage payments. Be sure to keep a copy for your records.