Attorney-Verified Mortgage Lien Release Template

When a homeowner pays off their mortgage, it's essential to formally release the lender's claim on the property. This is where the Mortgage Lien Release form comes into play. It serves as an official document that notifies the public and the homeowner that the lender no longer holds a financial interest in the property. By completing this form, the lender acknowledges that the mortgage has been satisfied, and it allows the homeowner to clear the title of any encumbrances. This process not only protects the homeowner's rights but also ensures that the property can be freely sold or transferred in the future. The form typically includes important details such as the property address, the names of the parties involved, and the date of the mortgage payoff. Once executed, the form must be filed with the appropriate county office to make the release legally binding and publicly recorded. Understanding this form is crucial for any homeowner looking to secure their property rights after fulfilling their mortgage obligations.

Common mistakes

-

Incomplete Information: Many people forget to fill out all required fields. Missing information can delay the processing of the release.

-

Incorrect Property Details: Double-check the property address and legal description. Errors can lead to complications in releasing the lien.

-

Not Signing the Form: Some individuals overlook the necessity of signing the document. Without a signature, the form is invalid.

-

Wrong Date: Entering an incorrect date can cause confusion. Ensure the date reflects when the form is completed.

-

Failure to Notarize: Depending on state requirements, notarization may be necessary. Skipping this step can result in rejection.

-

Submitting to the Wrong Office: It's crucial to send the release form to the correct authority. Research where to file to avoid delays.

-

Not Keeping Copies: Failing to make copies of the submitted form can lead to issues later. Always keep a record for your files.

-

Ignoring Fees: Some jurisdictions may require a fee for processing the release. Check for any applicable charges before submission.

-

Not Following Up: After submitting the form, it's wise to follow up. Confirming that the lien has been released provides peace of mind.

Create Popular Types of Mortgage Lien Release Templates

How to Fill Out a Conditional Waiver and Release on Progress Payment - Used by contractors to ensure they relinquish lien rights once they are paid.

When participating in various activities, it's crucial to be aware of the potential risks involved; therefore, utilizing a Release of Liability form can offer important protections. By signing this document, individuals understand that they are waiving certain rights, so it's advisable to familiarize oneself with the process and the implications it carries. For those in need of a suitable form, you can find a helpful resource at California Templates, where you can easily fill out the required documentation.

Car Accident Settlement Letter Template - A written agreement addressing vehicle damage resolution.

Employee Photo Consent Form - Employees are advised to read the form carefully before signing.

Key takeaways

When dealing with the Mortgage Lien Release form, understanding its significance and proper usage is crucial. Here are some key takeaways to keep in mind:

- Purpose of the Form: The Mortgage Lien Release form is used to officially remove a mortgage lien from a property title once the mortgage has been paid off.

- Timeliness: It is important to file the form promptly after the mortgage is settled to avoid potential complications with property ownership and future transactions.

- Required Information: Ensure that the form includes all necessary details, such as the property address, the names of the borrower and lender, and the loan number.

- Signatures: Both the lender and borrower must sign the form. This step confirms that the mortgage obligation has been fulfilled.

- Filing Process: After completion, the form should be filed with the appropriate county office or land records office to ensure public record accuracy.

- Copy Retention: Keep a copy of the filed form for your records. This serves as proof that the lien has been released.

- Legal Advice: If there are any uncertainties or complications, consulting with a legal professional can provide clarity and ensure compliance with local laws.

By keeping these points in mind, individuals can navigate the Mortgage Lien Release process more effectively and ensure their property records reflect their current ownership status.

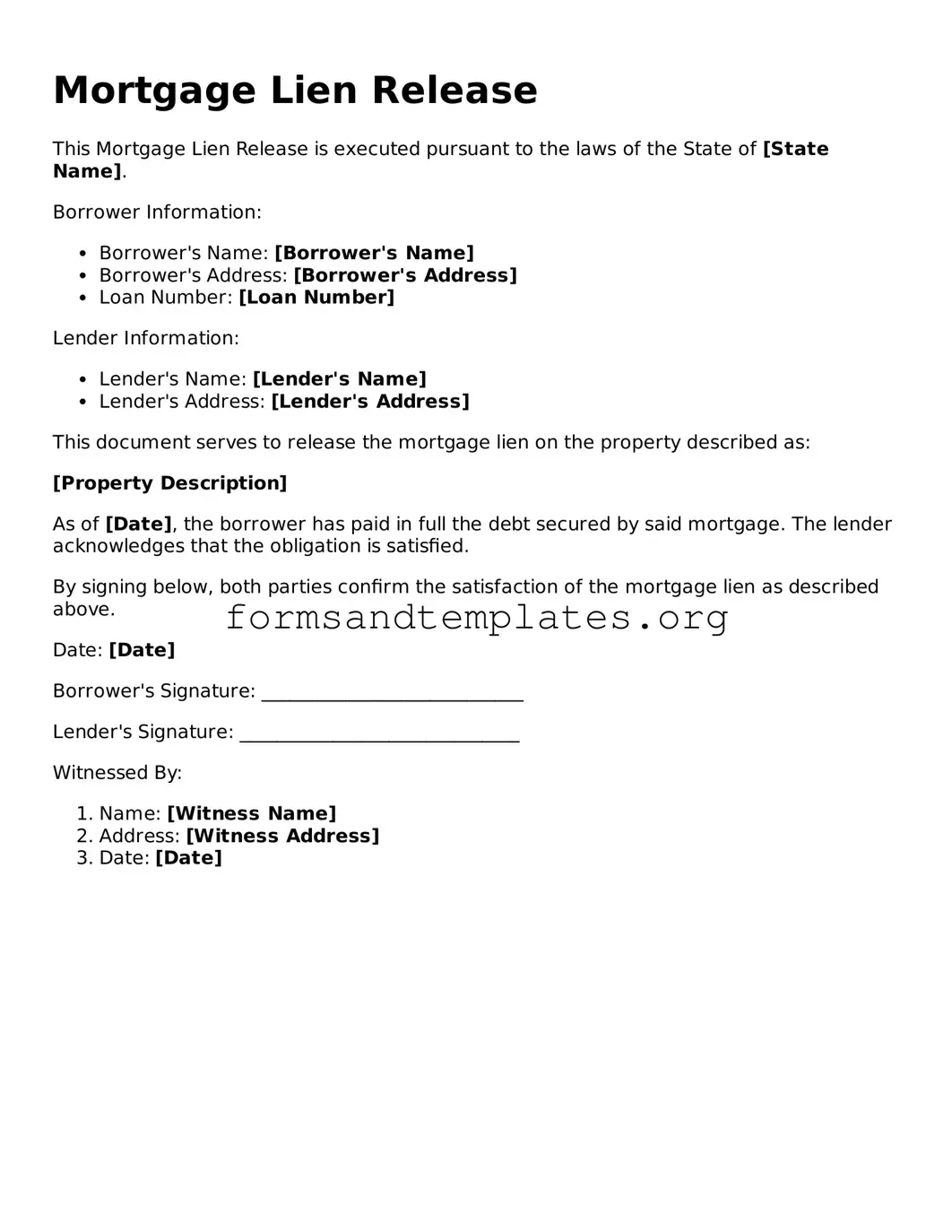

Mortgage Lien Release Example

Mortgage Lien Release

This Mortgage Lien Release is executed pursuant to the laws of the State of [State Name].

Borrower Information:

- Borrower's Name: [Borrower's Name]

- Borrower's Address: [Borrower's Address]

- Loan Number: [Loan Number]

Lender Information:

- Lender's Name: [Lender's Name]

- Lender's Address: [Lender's Address]

This document serves to release the mortgage lien on the property described as:

[Property Description]

As of [Date], the borrower has paid in full the debt secured by said mortgage. The lender acknowledges that the obligation is satisfied.

By signing below, both parties confirm the satisfaction of the mortgage lien as described above.

Date: [Date]

Borrower's Signature: ____________________________

Lender's Signature: ______________________________

Witnessed By:

- Name: [Witness Name]

- Address: [Witness Address]

- Date: [Date]

Understanding Mortgage Lien Release

What is a Mortgage Lien Release form?

A Mortgage Lien Release form is a legal document that formally removes a mortgage lien from a property. This occurs once the borrower has fulfilled their obligations under the mortgage agreement, typically by paying off the loan in full. The form serves as proof that the lender no longer has a claim against the property.

When is a Mortgage Lien Release necessary?

A Mortgage Lien Release is necessary when a mortgage loan has been completely paid off. Once the borrower has settled their debt, the lender must provide a release to clear the lien from the property records. This is crucial for the property owner to establish clear title to the property.

Who is responsible for filing the Mortgage Lien Release?

The lender is generally responsible for preparing and filing the Mortgage Lien Release. However, the borrower may also request a copy of the release to ensure it is filed appropriately. It is essential that the release is recorded with the local county recorder’s office to update public records.

What information is included in the Mortgage Lien Release form?

The Mortgage Lien Release form typically includes the following information:

- The names of the borrower and lender.

- The property address associated with the mortgage.

- The mortgage loan number.

- A statement confirming that the mortgage has been paid in full.

- The date of the release.

- The signatures of the lender and, if required, a witness or notary public.

How does one obtain a Mortgage Lien Release?

To obtain a Mortgage Lien Release, the borrower should contact the lender after paying off the mortgage. The lender will prepare the release form and provide it to the borrower. Once received, the borrower should ensure it is filed with the appropriate county office.

What happens if the Mortgage Lien Release is not filed?

If the Mortgage Lien Release is not filed, the lien may remain on the property record. This can create issues for the property owner, such as difficulties in selling or refinancing the property. It is important for the borrower to follow up with the lender to ensure the release is properly recorded.

Can a Mortgage Lien Release be contested?

Yes, a Mortgage Lien Release can be contested if there is a dispute regarding the payment status of the mortgage or if there are claims of fraud. If a borrower believes that a lien has not been released correctly, they should seek legal advice to address the situation promptly.

Is there a fee associated with filing a Mortgage Lien Release?

Yes, there may be a fee associated with filing a Mortgage Lien Release, which varies by jurisdiction. The lender may charge a processing fee, and there may also be recording fees charged by the county recorder’s office. It is advisable to inquire about any potential costs before proceeding with the release.

How to Use Mortgage Lien Release

After completing the Mortgage Lien Release form, you will need to submit it to the appropriate county office where the property is located. This step is essential to ensure that the lien is officially removed from public records. Follow these steps to fill out the form accurately.

- Begin by entering the name of the borrower in the designated section. Make sure to use the full legal name.

- Next, provide the name of the lender or the financial institution that issued the mortgage.

- Fill in the property address. Include the street number, street name, city, state, and zip code.

- Locate the section for the loan number. Enter the unique identifier assigned to the mortgage.

- In the next field, indicate the date the mortgage was originally executed. This is usually found on the original mortgage documents.

- Sign the form in the designated area. Ensure that the signature matches the name provided earlier.

- Date your signature to confirm when you completed the form.

- If required, have the form notarized. This may involve signing it in front of a notary public.

- Finally, make copies of the completed form for your records before submitting it.