Attorney-Verified Mobile Home Purchase Agreement Template

When considering the purchase of a mobile home, understanding the Mobile Home Purchase Agreement form is crucial for both buyers and sellers. This document serves as a binding contract that outlines the terms and conditions of the sale, ensuring that both parties are protected throughout the transaction. Key aspects of the form include the identification of the buyer and seller, detailed descriptions of the mobile home, and the agreed-upon purchase price. Additionally, it addresses important factors such as financing options, contingencies, and any warranties or disclosures related to the condition of the home. By clearly defining the responsibilities of each party, the agreement helps prevent misunderstandings and disputes that may arise during the buying process. Overall, a well-structured Mobile Home Purchase Agreement is essential for a smooth and successful transaction, allowing both buyers and sellers to move forward with confidence.

Common mistakes

-

Incomplete Information: Failing to provide all required personal details can lead to delays. Buyers often overlook sections that ask for contact information or identification numbers.

-

Incorrect Pricing: Listing the purchase price inaccurately is a common error. Buyers should ensure that the price matches the agreed-upon amount in negotiations.

-

Omitting Terms and Conditions: Not specifying important terms can create confusion later. Essential details like payment methods, financing terms, and contingencies should always be included.

-

Neglecting Signatures: A signature is crucial for the agreement's validity. Buyers sometimes forget to sign or fail to obtain the seller's signature, rendering the document unenforceable.

-

Ignoring Legal Disclosures: Many states require specific disclosures regarding the mobile home’s condition. Buyers may overlook these requirements, which can lead to legal complications.

-

Failing to Review for Errors: Typos and mistakes can change the meaning of the agreement. A thorough review is necessary to ensure accuracy and clarity in every section.

-

Not Understanding the Financing Options: Buyers sometimes select financing options without fully understanding them. It is vital to clarify terms, interest rates, and payment schedules before signing.

-

Forgetting to Include Contingencies: Contingencies protect buyers from unforeseen issues. Neglecting to include them can expose buyers to risks that they might have otherwise avoided.

Fill out Other Templates

Dvla Form - Organ donation registration can be selected on the D1 form.

To ensure a smooth transfer of vehicle ownership, it's important to understand the significance of a properly executed Vehicle Release of Liability form, as it safeguards both the seller and buyer against future claims related to the vehicle.

Talent Release Form - Finally, the Actor Release form helps ensure a smooth post-production process without legal complications.

Key takeaways

Filling out and using the Mobile Home Purchase Agreement form is an important step in the process of buying a mobile home. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Mobile Home Purchase Agreement outlines the terms and conditions of the sale. It serves as a legally binding contract between the buyer and the seller.

- Accurate Information: Ensure that all information entered on the form is accurate. This includes names, addresses, and details about the mobile home.

- Review Terms Carefully: Read through all terms and conditions before signing. Pay attention to payment terms, warranties, and any contingencies.

- Seek Clarification: If any part of the agreement is unclear, do not hesitate to ask questions. Understanding every aspect is crucial for both parties.

- Include All Necessary Details: Make sure to include details such as the purchase price, deposit amount, and closing date. These elements are vital for a smooth transaction.

- Sign and Date: Both the buyer and seller must sign and date the agreement. This step is essential for the contract to be enforceable.

- Keep Copies: After the agreement is signed, retain copies for your records. This will help in case any disputes arise in the future.

Mobile Home Purchase Agreement Example

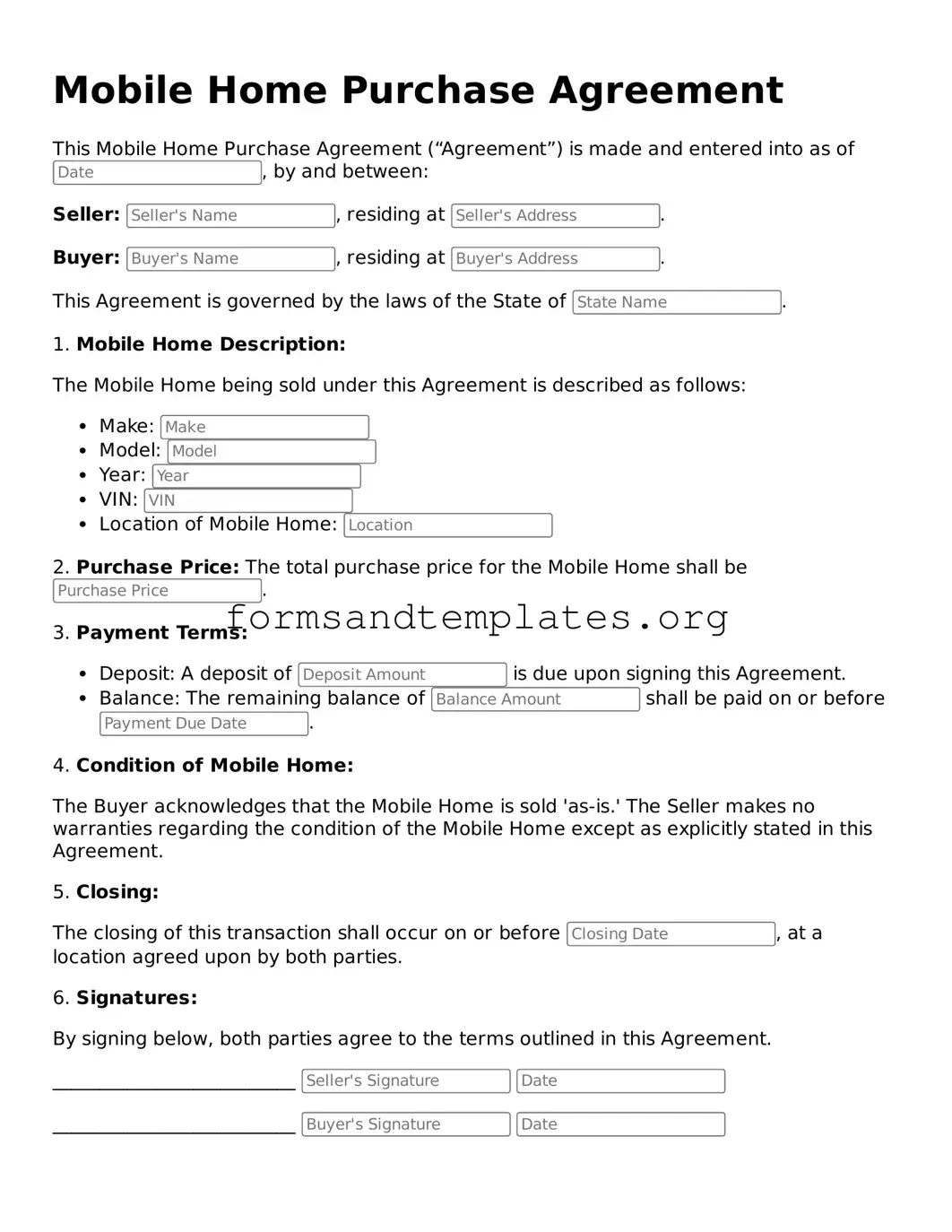

Mobile Home Purchase Agreement

This Mobile Home Purchase Agreement (“Agreement”) is made and entered into as of , by and between:

Seller: , residing at .

Buyer: , residing at .

This Agreement is governed by the laws of the State of .

1. Mobile Home Description:

The Mobile Home being sold under this Agreement is described as follows:

- Make:

- Model:

- Year:

- VIN:

- Location of Mobile Home:

2. Purchase Price: The total purchase price for the Mobile Home shall be .

3. Payment Terms:

- Deposit: A deposit of is due upon signing this Agreement.

- Balance: The remaining balance of shall be paid on or before .

4. Condition of Mobile Home:

The Buyer acknowledges that the Mobile Home is sold 'as-is.' The Seller makes no warranties regarding the condition of the Mobile Home except as explicitly stated in this Agreement.

5. Closing:

The closing of this transaction shall occur on or before , at a location agreed upon by both parties.

6. Signatures:

By signing below, both parties agree to the terms outlined in this Agreement.

__________________________

__________________________

This document can be executed in counterparts, each of which shall be deemed an original, and all of which together shall constitute one and the same instrument.

Understanding Mobile Home Purchase Agreement

What is a Mobile Home Purchase Agreement?

A Mobile Home Purchase Agreement is a legal document that outlines the terms and conditions under which a mobile home is bought and sold. This agreement serves to protect both the buyer and the seller by detailing important aspects of the transaction, such as the purchase price, payment terms, and responsibilities of both parties.

Why is a Mobile Home Purchase Agreement important?

This agreement is crucial because it provides clarity and security for both parties involved in the transaction. It helps prevent misunderstandings by clearly stating what each party is agreeing to. Additionally, having a formal document can be beneficial in case of disputes, as it serves as a reference point for the terms agreed upon.

What should be included in a Mobile Home Purchase Agreement?

Typically, a Mobile Home Purchase Agreement should include the following key elements:

- Identification of the buyer and seller

- Description of the mobile home, including the make, model, and VIN

- Purchase price and payment terms

- Contingencies, if any (e.g., financing or inspections)

- Closing date and transfer of ownership details

- Signatures of both parties

Can I customize the Mobile Home Purchase Agreement?

Yes, you can customize the agreement to fit your specific needs. While there are standard components that should be included, you may add additional clauses or conditions that reflect your unique situation. However, it’s advisable to ensure that any modifications comply with local laws and regulations.

Is it necessary to have a lawyer review the Mobile Home Purchase Agreement?

While it’s not strictly necessary, having a lawyer review the agreement can provide an extra layer of security. A legal professional can help ensure that the terms are fair and that the agreement complies with state laws. This can be especially important for first-time buyers or sellers who may not be familiar with the process.

What happens if one party breaches the Mobile Home Purchase Agreement?

If one party fails to uphold their end of the agreement, it can lead to a breach of contract. The non-breaching party may have several options, including:

- Negotiating a resolution with the breaching party

- Pursuing legal action for damages

- Seeking specific performance, which means asking the court to enforce the terms of the agreement

How can I ensure that the Mobile Home Purchase Agreement is legally binding?

To make the agreement legally binding, both parties must sign it. Additionally, it’s important that both parties have the legal capacity to enter into a contract. This means they should be of legal age and mentally competent. Having the agreement notarized can also add an extra layer of legitimacy.

What are common contingencies in a Mobile Home Purchase Agreement?

Contingencies are conditions that must be met for the agreement to be valid. Common contingencies in a Mobile Home Purchase Agreement may include:

- Financing contingency: The buyer must secure financing to complete the purchase.

- Inspection contingency: The buyer has the right to inspect the mobile home before finalizing the sale.

- Sale of existing home: The buyer may need to sell their current home before purchasing the mobile home.

How long does it take to complete a Mobile Home Purchase Agreement?

The time it takes to complete a Mobile Home Purchase Agreement can vary. Typically, the process can take anywhere from a few days to a few weeks, depending on factors such as the complexity of the agreement, the responsiveness of both parties, and any contingencies that need to be satisfied. Planning ahead and maintaining open communication can help expedite the process.

What should I do after signing the Mobile Home Purchase Agreement?

After signing the agreement, both parties should keep a copy for their records. It’s also essential to fulfill any obligations outlined in the agreement, such as making payments or completing inspections. Finally, prepare for the closing process, which involves transferring ownership and finalizing any remaining details of the sale.

How to Use Mobile Home Purchase Agreement

Filling out the Mobile Home Purchase Agreement form is a crucial step in the process of buying or selling a mobile home. Completing this form accurately ensures that both parties understand the terms of the transaction. The following steps will guide you through the necessary information to include in the agreement.

- Begin by entering the date of the agreement at the top of the form.

- Provide the names and addresses of both the buyer and the seller. Ensure that all names are spelled correctly.

- Detail the description of the mobile home. Include information such as the make, model, year, and any identifying numbers, like the VIN.

- Specify the purchase price of the mobile home. Clearly state the total amount agreed upon.

- Indicate the payment terms. This may include the amount of any deposit, the balance due, and the method of payment.

- Outline any contingencies that must be met before the sale can be finalized, such as inspections or financing approvals.

- Include any disclosures required by law, such as information about the condition of the mobile home or any known issues.

- Both parties should sign and date the agreement at the bottom of the form to confirm their acceptance of the terms.

Once the form is completed and signed, it is advisable to keep copies for both the buyer and seller. This documentation serves as a record of the agreement and can be referenced in the future if needed.