Printable Membership Ledger Template

The Membership Ledger form serves as a crucial tool for tracking the issuance and transfer of membership interests within a company. This document meticulously records essential details, such as the name of the company, the certificates issued, and the parties involved in the transactions. Each entry captures vital information, including the amount paid for the membership interest, the date of transfer, and the names and places of residence of the members. Additionally, it highlights the certificate numbers associated with each membership interest, ensuring clarity and accountability. The ledger also includes a section for documenting any surrendered certificates, allowing for a comprehensive overview of the current balance of membership interests held by each member. By maintaining an accurate Membership Ledger, companies can effectively manage their membership interests and ensure compliance with relevant regulations.

Common mistakes

-

Incorrect Company Name: Failing to enter the correct name of the company can lead to confusion and potential legal issues.

-

Missing Certificate Numbers: Not including certificate numbers for issued or transferred interests makes tracking difficult.

-

Omitting Dates: Forgetting to include the date of issuance or transfer can create discrepancies in record-keeping.

-

Incorrect Amounts: Entering the wrong amount paid for membership interests can lead to financial inaccuracies.

-

Incomplete Member Information: Not providing full names or addresses of members can hinder communication and verification.

-

Failure to Indicate Transfers: Not clearly marking whether interests are original issues or transfers can complicate the ledger.

-

Neglecting to Update Balances: Not updating the number of membership interests held after transfers can misrepresent ownership.

-

Using Unclear Abbreviations: Abbreviating terms without explanation can lead to misunderstandings about the entries.

-

Not Double-Checking Entries: Failing to review the form for errors before submission can result in significant problems down the line.

Find Common Documents

W9 2023 - Trusts, estates, and corporations can also complete a W-9 to provide their tax identification numbers.

When navigating important legal matters, having a strong foundation is vital. A reliable way to ensure you're prepared is to utilize a comprehensive General Power of Attorney document that will allow you to delegate authority effectively. This form plays a crucial role in maintaining control over decisions concerning your financial and health affairs.

Non Employee Compensation 1099 - Box 2 indicates if certain goods meant for resale were sold to the recipient.

Key takeaways

When filling out and using the Membership Ledger form, keep these key takeaways in mind:

- Accurate Information: Ensure that all entries, including the company name and member details, are accurate to avoid confusion.

- Complete Transfers: Document all transfers of membership interest clearly, specifying both the transferor and transferee's names.

- Record Payments: Include the amount paid for each membership interest or unit issued to maintain a clear financial record.

- Track Certificates: Note the certificate numbers associated with each membership interest to facilitate easy tracking and retrieval.

- Maintain Balance: Keep an updated balance of membership interests held to reflect any changes due to transfers or issuances.

Membership Ledger Example

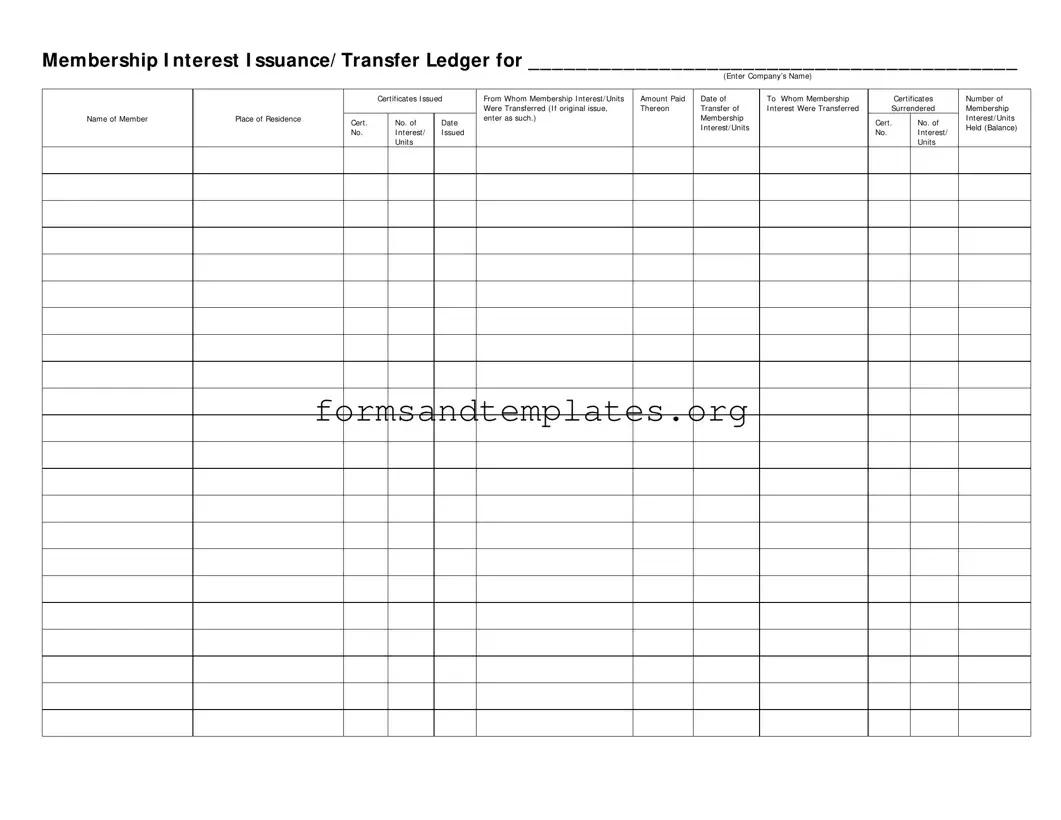

Membership I nt erest I ssuance/ Transfer Ledger for _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Enter Company’s Name)

|

|

|

Certificates I ssued |

From Whom Membership I nterest/ Units |

Amount Paid |

Date of |

To Whom Membership |

||

|

|

|

|

|

|

Were Transferred (I f original issue, |

Thereon |

Transfer of |

I nterest Were Transferred |

Name of Member |

Place of Residence |

Cert . |

|

No. of |

Date |

enter as such.) |

|

Membership |

|

|

|

|

|

|

I nterest/ Units |

|

|||

|

|

No. |

|

I nterest/ |

I ssued |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates

Surrendered

Cert . |

No. of |

No. |

I nterest/ |

|

Units |

|

|

Number of Membership

I nterest/ Units Held (Balance)

Understanding Membership Ledger

What is the purpose of the Membership Ledger form?

The Membership Ledger form is designed to track the issuance and transfer of membership interests or units within a company. It provides a clear record of who holds membership interests, the amount paid for those interests, and any transfers that occur over time. This documentation is essential for maintaining accurate ownership records and ensuring compliance with company regulations.

How do I fill out the Membership Ledger form?

To complete the form, follow these steps:

- Enter the company’s name at the top of the form.

- Record the details of each certificate issued, including the name of the member, the amount paid, and the date of issuance.

- For any transfers, indicate the name of the individual to whom the membership interest was transferred, along with the date of transfer.

- Document any certificates surrendered and note the balance of membership interests held by each member.

Who should use the Membership Ledger form?

This form is primarily used by companies that issue membership interests or units. It is relevant for company secretaries, accountants, and anyone responsible for maintaining ownership records. Additionally, members may want to reference the ledger to confirm their ownership status.

What information is required on the form?

The form requires the following information:

- Company name

- Details of certificates issued (including member name, amount paid, and date)

- Transfer details (name of new member and transfer date)

- Certificate numbers

- Balance of membership interests held

Is it necessary to keep the Membership Ledger updated?

Yes, maintaining an updated Membership Ledger is crucial. An accurate ledger ensures that ownership records reflect current members and their interests. This practice helps prevent disputes and supports transparency within the organization.

What happens if I make a mistake on the form?

If an error occurs while filling out the Membership Ledger, it is important to correct it promptly. Cross out the mistake clearly, write the correct information next to it, and initial the change. This practice helps maintain the integrity of the records while providing a clear audit trail.

Can the Membership Ledger be used for electronic records?

Yes, the Membership Ledger can be maintained electronically. Many companies choose to use software solutions to track membership interests. However, ensure that electronic records are secure and regularly backed up to prevent data loss.

How long should the Membership Ledger be retained?

It is advisable to retain the Membership Ledger for a minimum of seven years. This retention period aligns with common business practices and legal requirements for record-keeping. Keeping historical records can be beneficial for audits and resolving any future disputes.

What should I do if I have further questions about the Membership Ledger form?

If additional questions arise, consider consulting with a legal or financial advisor who specializes in corporate governance. They can provide tailored guidance based on your specific circumstances and ensure compliance with all relevant regulations.

How to Use Membership Ledger

Filling out the Membership Ledger form is a straightforward process that requires careful attention to detail. Once you have completed the form, it will serve as an official record of membership interests and transfers for your organization. Below are the steps to guide you through the process of filling out the form accurately.

- Begin by entering the Company’s Name at the top of the form in the designated space.

- In the section labeled Certificates Issued From, write the name of the individual or entity that issued the membership interest or units.

- Next, fill in the Membership Interest/Units field with the specific number of units being issued or transferred.

- Indicate the Amount Paid for the membership interest or units in the corresponding box.

- Provide the Date when the membership interest or units were issued or transferred.

- In the section titled To Whom Membership Were Transferred, enter the name of the individual or entity receiving the membership interest or units.

- If this is an original issue, make sure to note that in the appropriate area.

- In the Name of Member field, write the name of the member associated with the membership interest or units.

- Fill in the Place of Residence for the member, providing a complete address.

- In the Cert. No. field, enter the certificate number associated with the membership interest or units.

- Document the Date of the transfer, if applicable, in the designated space.

- For the Membership Interest/Units Issued section, record the number of units that were issued.

- In the Certificates Surrendered area, indicate the number of certificates that were surrendered during the transfer process.

- Finally, fill in the Number of Membership Interest/Units Held (Balance) to reflect the current holdings of the member.