Printable Louisiana act of donation Template

The Louisiana Act of Donation form is an essential legal document that facilitates the transfer of property or assets from one individual to another without the exchange of money. This form is particularly significant in the context of estate planning, allowing individuals to make gifts of their property while they are still alive. By using this form, donors can specify the details of the donation, including the type of property being transferred, the identity of the recipient, and any specific conditions that may apply to the gift. Not only does this document help clarify the intentions of the donor, but it also provides legal protection for both parties involved. Furthermore, the act of donation can have tax implications, which makes understanding the form's requirements and consequences even more critical. Whether you are looking to make a simple gift of personal property or a more complex transfer of real estate, navigating the Act of Donation form is a key step in ensuring that your wishes are honored and legally recognized.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. This includes missing names, addresses, or descriptions of the property being donated. Every section must be filled out accurately to avoid delays.

-

Incorrect Signatures: Signatures are crucial for the validity of the form. Some people neglect to have all necessary parties sign the document. Ensure that all donors and witnesses sign where required to prevent legal complications.

-

Failure to Notarize: Notarization is often a requirement for the act of donation. Some individuals overlook this step, believing it is unnecessary. A notarized document adds a layer of authenticity and can prevent disputes in the future.

-

Ignoring State-Specific Requirements: Each state has unique regulations regarding acts of donation. People sometimes fill out the form without checking Louisiana’s specific guidelines. Familiarize yourself with these rules to ensure compliance and avoid rejection.

Find Common Documents

Blank Ncoer Support Form - NCOs utilize this report in career advancement discussions.

If you’re seeking to understand the benefits of a Durable Power of Attorney, this essential document empowers someone to make important financial and legal decisions on your behalf in times of need. To learn more and access the necessary form, visit the key resource for Durable Power of Attorney guidance.

Order a Birth Certificate - It provides a legal record needed for various administrative purposes, including enrollment in school.

Michigan Divorce Forms - The structure of the form guides the user effectively.

Key takeaways

Filling out the Louisiana Act of Donation form is an important step for anyone looking to donate property or assets. Understanding the key aspects of this process can help ensure that the donation is legally binding and meets all necessary requirements.

- Understand the Purpose: The Act of Donation is a legal document used to transfer ownership of property from one person to another without any exchange of money.

- Complete Information: Ensure that all required information, such as the names of both the donor and the donee, is accurately filled out. This includes details about the property being donated.

- Consider Legal Requirements: In Louisiana, certain formalities must be followed for the donation to be valid. This may include notarization and witnesses.

- Tax Implications: Donors should be aware of potential tax consequences related to the donation. Consulting a tax professional can provide clarity on this matter.

- Revocation of Donation: Understand that a donation can be revoked under certain circumstances. Familiarize yourself with the conditions that allow for this action.

- Record the Donation: Once completed, it is advisable to record the Act of Donation with the appropriate parish office. This step helps protect the donor's and donee's rights.

By keeping these key takeaways in mind, individuals can navigate the process of filling out and using the Louisiana Act of Donation form more effectively.

Louisiana act of donation Example

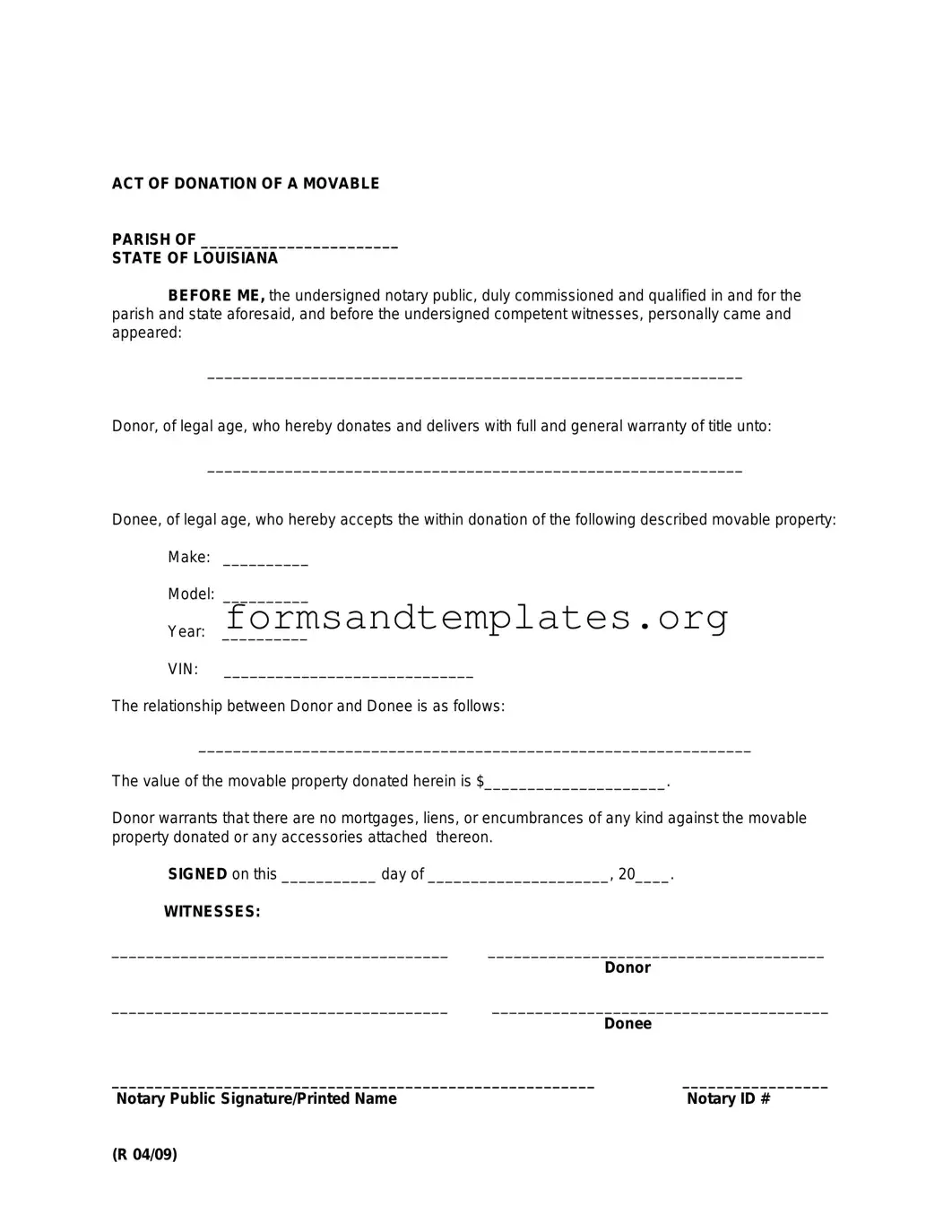

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Understanding Louisiana act of donation

What is the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document used to transfer ownership of property or assets from one person to another without any payment involved. This form is commonly used for gifts between family members or friends.

Who can use the Act of Donation Form?

Any individual who wishes to donate property or assets can use the Act of Donation Form. Donors must be of legal age and mentally competent. Recipients can be anyone, including family members, friends, or charitable organizations.

What types of property can be donated?

Various types of property can be donated using this form, including:

- Real estate, such as land or houses

- Personal property, like vehicles or jewelry

- Financial assets, including bank accounts or stocks

Is the Act of Donation Form legally binding?

Yes, once properly completed and signed, the Act of Donation Form is legally binding. It creates a formal record of the donation and can be enforced in court if necessary.

Do I need witnesses or notarization for the form?

In Louisiana, the Act of Donation Form typically requires either a notary public or witnesses to be valid. Having a notary ensures that the document is officially recognized and can help prevent disputes later.

Are there any tax implications for donating property?

Yes, there can be tax implications for both the donor and the recipient. Donors may need to report the donation on their tax returns, and recipients may face gift tax obligations. It is advisable to consult with a tax professional for specific guidance.

How do I complete the Act of Donation Form?

To complete the form, follow these steps:

- Provide the full names and addresses of both the donor and recipient.

- Describe the property being donated in detail.

- Sign and date the form in the presence of a notary or witnesses.

Where should I file the Act of Donation Form?

The Act of Donation Form should be filed with the appropriate parish clerk of court in Louisiana. This ensures that the donation is officially recorded and can be referenced in the future.

How to Use Louisiana act of donation

After obtaining the Louisiana Act of Donation form, you will need to complete it accurately. This form is essential for transferring property ownership. Follow these steps carefully to ensure all necessary information is provided.

- Begin by entering the date at the top of the form.

- Fill in the names of the donor and the donee. Ensure that the names are spelled correctly.

- Provide the addresses for both the donor and donee. Include city, state, and zip code.

- Describe the property being donated. Include details such as type of property, location, and any relevant identification numbers.

- Specify any conditions or restrictions related to the donation, if applicable.

- Both the donor and donee must sign the form. Ensure that signatures are dated.

- Have the form notarized to validate the donation. This step is crucial for legal acceptance.

Once the form is completed and notarized, it should be filed with the appropriate local authorities to finalize the donation process.