Attorney-Verified Loan Agreement Template

When individuals or businesses seek to borrow money, a Loan Agreement form serves as a crucial document that outlines the terms and conditions of the loan. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral required. It is designed to protect both the lender and the borrower by clearly stating the obligations and rights of each party involved. In addition, the Loan Agreement may specify any fees associated with the loan, the consequences of late payments, and the process for resolving disputes. By establishing a mutual understanding of the financial arrangement, this form helps to prevent misunderstandings and provides a framework for accountability. Understanding the components of a Loan Agreement is vital for anyone considering borrowing or lending money, as it lays the foundation for a successful financial transaction.

Common mistakes

-

Not reading the entire agreement carefully. Many people skim through the document, missing important terms and conditions.

-

Providing incorrect personal information. Ensure that your name, address, and Social Security number are accurate to avoid delays.

-

Failing to disclose existing debts. Lenders need a complete picture of your financial situation.

-

Overlooking the interest rate. Double-check the rate to understand how much you will be paying over time.

-

Ignoring the repayment schedule. Know when payments are due and how much they will be.

-

Not asking questions. If something is unclear, seek clarification before signing.

-

Skipping the fine print. Important details about fees and penalties often hide in the fine print.

-

Assuming all loan agreements are the same. Each lender has different terms and conditions.

-

Not keeping a copy of the signed agreement. Always retain a copy for your records in case of disputes.

Loan Agreement - Tailored for State

Loan Agreement Form Types

Fill out Other Templates

High School Transcript - Transcripts help to validate a student’s effort and accomplishments in school.

When purchasing or selling an RV, having the right documentation is vital, and the California Templates provides an easy way to obtain the essential RV Bill of Sale form. This ensures that all aspects of the transaction are accounted for, avoiding any potential issues in the future.

Blank Bill of Lading - Shippers rely on this document for tracking shipments during transport.

Key takeaways

When filling out and using a Loan Agreement form, consider the following key takeaways:

- Understand the Purpose: A Loan Agreement outlines the terms of the loan, protecting both the lender and the borrower.

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower to avoid confusion.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed to ensure both parties are on the same page.

- Detail the Interest Rate: Include the interest rate, whether it is fixed or variable, to clarify repayment expectations.

- Outline the Repayment Terms: Specify how and when payments will be made, including the payment schedule.

- Include Late Fees: If applicable, state any penalties for late payments to encourage timely repayment.

- Address Default Conditions: Clearly define what constitutes a default and the consequences that follow.

- Signatures Required: Ensure that both parties sign the agreement to make it legally binding.

- Keep Copies: Each party should retain a signed copy of the agreement for their records.

- Consult a Professional: If unsure about any terms, consider seeking legal advice to ensure clarity and compliance.

By following these guidelines, you can create a clear and effective Loan Agreement that serves both parties well.

Loan Agreement Example

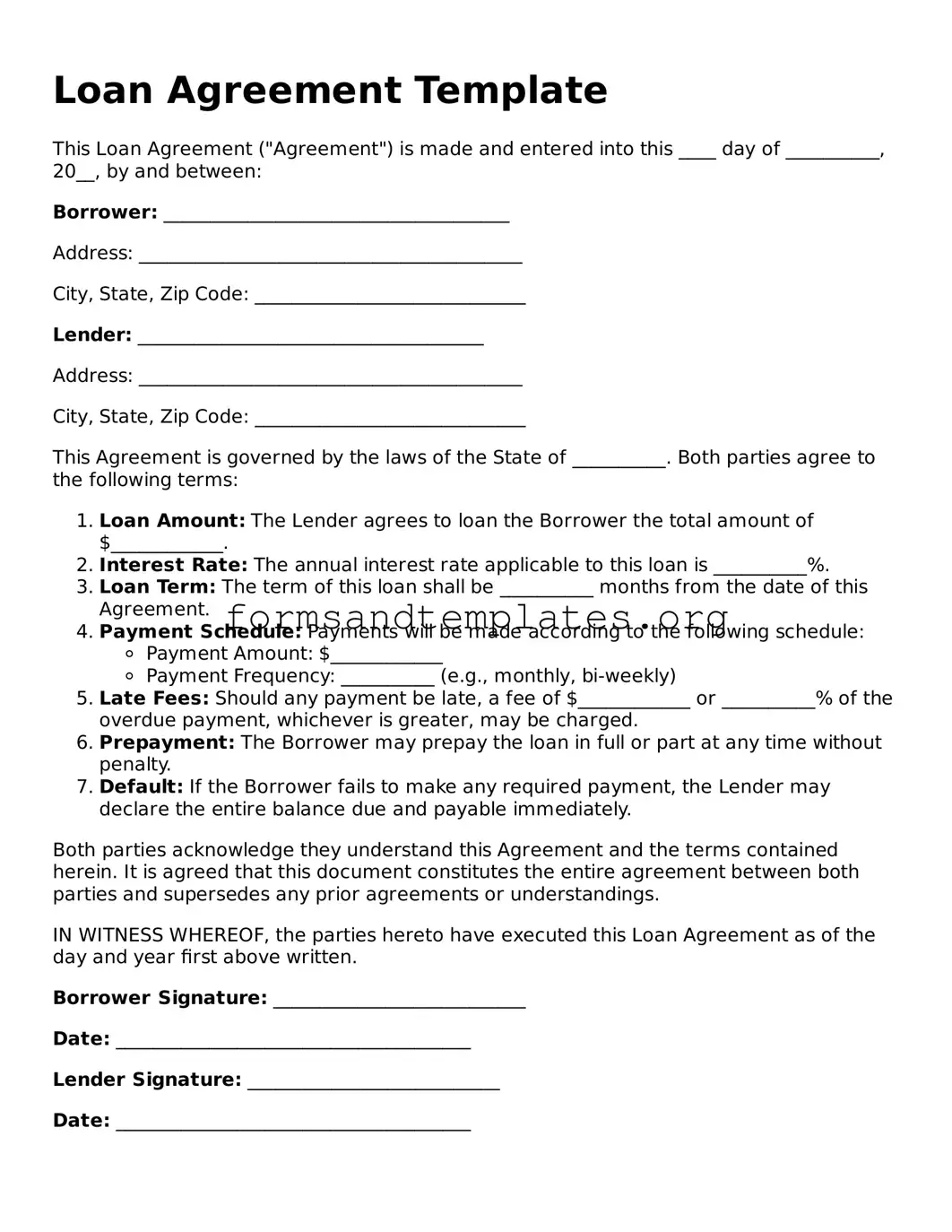

Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into this ____ day of __________, 20__, by and between:

Borrower: _____________________________________

Address: _________________________________________

City, State, Zip Code: _____________________________

Lender: _____________________________________

Address: _________________________________________

City, State, Zip Code: _____________________________

This Agreement is governed by the laws of the State of __________. Both parties agree to the following terms:

- Loan Amount: The Lender agrees to loan the Borrower the total amount of $____________.

- Interest Rate: The annual interest rate applicable to this loan is __________%.

- Loan Term: The term of this loan shall be __________ months from the date of this Agreement.

- Payment Schedule: Payments will be made according to the following schedule:

- Payment Amount: $____________

- Payment Frequency: __________ (e.g., monthly, bi-weekly)

- Late Fees: Should any payment be late, a fee of $____________ or __________% of the overdue payment, whichever is greater, may be charged.

- Prepayment: The Borrower may prepay the loan in full or part at any time without penalty.

- Default: If the Borrower fails to make any required payment, the Lender may declare the entire balance due and payable immediately.

Both parties acknowledge they understand this Agreement and the terms contained herein. It is agreed that this document constitutes the entire agreement between both parties and supersedes any prior agreements or understandings.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the day and year first above written.

Borrower Signature: ___________________________

Date: ______________________________________

Lender Signature: ___________________________

Date: ______________________________________

Understanding Loan Agreement

What is a Loan Agreement form?

A Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies the amount borrowed, the interest rate, repayment schedule, and any collateral involved. This document serves to protect both parties by clearly defining their rights and obligations.

What key elements should be included in a Loan Agreement?

A comprehensive Loan Agreement should include the following key elements:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the principal amount.

- Repayment Schedule: Details on how and when payments will be made.

- Term of the Loan: The duration over which the loan will be repaid.

- Collateral: Any assets pledged to secure the loan.

- Default Terms: Conditions under which the borrower would be considered in default.

Why is it important to have a written Loan Agreement?

A written Loan Agreement is crucial for several reasons. It provides clarity and prevents misunderstandings between the lender and borrower. In case of disputes, a written document serves as evidence in court. It also helps to ensure that both parties are aware of their rights and responsibilities, reducing the likelihood of conflicts down the line.

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it is signed, but this typically requires mutual consent from both parties. Any changes should be documented in writing and signed by both the lender and the borrower to ensure clarity and enforceability. Verbal agreements or informal changes may not hold up legally.

What happens if a borrower defaults on a Loan Agreement?

If a borrower defaults on a Loan Agreement, the lender has several options. These may include:

- Charging late fees or penalties as outlined in the agreement.

- Demanding immediate repayment of the remaining balance.

- Taking legal action to recover the owed amount.

- Seizing collateral if applicable.

Default can severely impact the borrower's credit score and financial standing, so it’s important to communicate with the lender if repayment issues arise.

Is it necessary to have a lawyer review a Loan Agreement?

While it is not legally required to have a lawyer review a Loan Agreement, it is highly advisable. A legal expert can help identify potential issues, ensure that the terms are fair, and confirm that the document complies with relevant laws. This step can provide peace of mind and protect against future disputes.

How to Use Loan Agreement

Filling out a Loan Agreement form is an important step in securing a loan. It ensures that both the borrower and lender understand their obligations. Follow these steps carefully to complete the form accurately.

- Read the Instructions: Before you start, take a moment to read any instructions provided with the form. This will help you understand what information is required.

- Enter Personal Information: Fill in your full name, address, and contact details. Make sure this information is accurate.

- Provide Loan Details: Specify the amount of the loan you are requesting. Include the purpose of the loan, such as buying a car or consolidating debt.

- Set Terms: Indicate the repayment terms, including the interest rate and the duration of the loan. Be clear about how often payments will be made.

- Sign the Agreement: Once you have filled out all sections, sign and date the form. Your signature confirms that you agree to the terms outlined.

- Submit the Form: After signing, submit the form to the lender as instructed, whether that’s by email, mail, or in person.