Attorney-Verified LLC Share Purchase Agreement Template

When considering the transfer of ownership in a limited liability company (LLC), the LLC Share Purchase Agreement plays a pivotal role in ensuring a smooth and legally sound transaction. This document outlines the essential terms of the sale, including the purchase price, the number of shares being sold, and the obligations of both the seller and the buyer. It also addresses critical aspects such as representations and warranties, which provide assurances regarding the company's financial health and operational status. Additionally, the agreement typically includes provisions for indemnification, protecting the buyer from potential liabilities that may arise post-sale. By detailing the conditions under which the shares are sold, including any necessary approvals or consents, the agreement serves as a roadmap for both parties, minimizing misunderstandings and potential disputes. In essence, the LLC Share Purchase Agreement not only facilitates the transfer of ownership but also lays the groundwork for a transparent and mutually beneficial relationship between the involved parties.

Common mistakes

-

Incomplete Information: One of the most common mistakes is leaving out crucial details. Ensure that all sections are filled out completely. Missing information can lead to misunderstandings or disputes later.

-

Incorrect Share Valuation: Accurately valuing shares is essential. Overvaluing or undervaluing shares can create financial issues for both parties. Consider getting a professional appraisal if needed.

-

Not Specifying Payment Terms: Clearly outline how payment will be made. Whether it’s a lump sum or installments, specify the amounts and due dates to avoid confusion.

-

Ignoring State Regulations: Each state has specific laws regarding LLC agreements. Failing to comply with these can lead to legal problems. Research your state’s requirements before submitting the form.

-

Forgetting to Include Conditions: If there are specific conditions or contingencies tied to the sale, make sure they are included. This could involve financing arrangements or other stipulations that must be met.

-

Not Having the Agreement Reviewed: Before finalizing the agreement, have it reviewed by a legal professional. This step can catch potential issues that you might have overlooked.

Fill out Other Templates

Bpo Template - Marketing strategies are outlined to optimize property exposure and sale potential.

The California Operating Agreement form is a crucial document that outlines the management structure and operational procedures of a limited liability company (LLC) in California. This agreement serves as a blueprint for how the LLC will function, detailing the rights and responsibilities of its members. To ensure your LLC operates smoothly, consider filling out the form by visiting California Templates.

Schedule of Availability Template - Indicate any personal obligations that may affect your work hours.

Key takeaways

When dealing with an LLC Share Purchase Agreement, understanding the nuances can significantly impact the transaction's success. Here are some key takeaways to consider:

- Clarity of Terms: Ensure that all terms of the agreement are clearly defined. Ambiguities can lead to disputes later on.

- Seller and Buyer Information: Accurately fill in the details of both the seller and the buyer. This includes names, addresses, and any relevant identification numbers.

- Share Details: Specify the number of shares being sold and the price per share. This information is crucial for both parties to understand the financial implications.

- Payment Terms: Outline how payment will be made. Will it be a lump sum or in installments? Clear payment terms help prevent misunderstandings.

- Representations and Warranties: Both parties should make representations about their authority to enter the agreement and the condition of the shares. This builds trust and accountability.

- Governing Law: Indicate which state’s laws will govern the agreement. This is important for resolving any potential disputes.

- Signatures: Ensure that all parties sign the agreement. Without signatures, the document lacks legal enforceability.

By keeping these points in mind, individuals can navigate the complexities of an LLC Share Purchase Agreement with greater confidence and clarity.

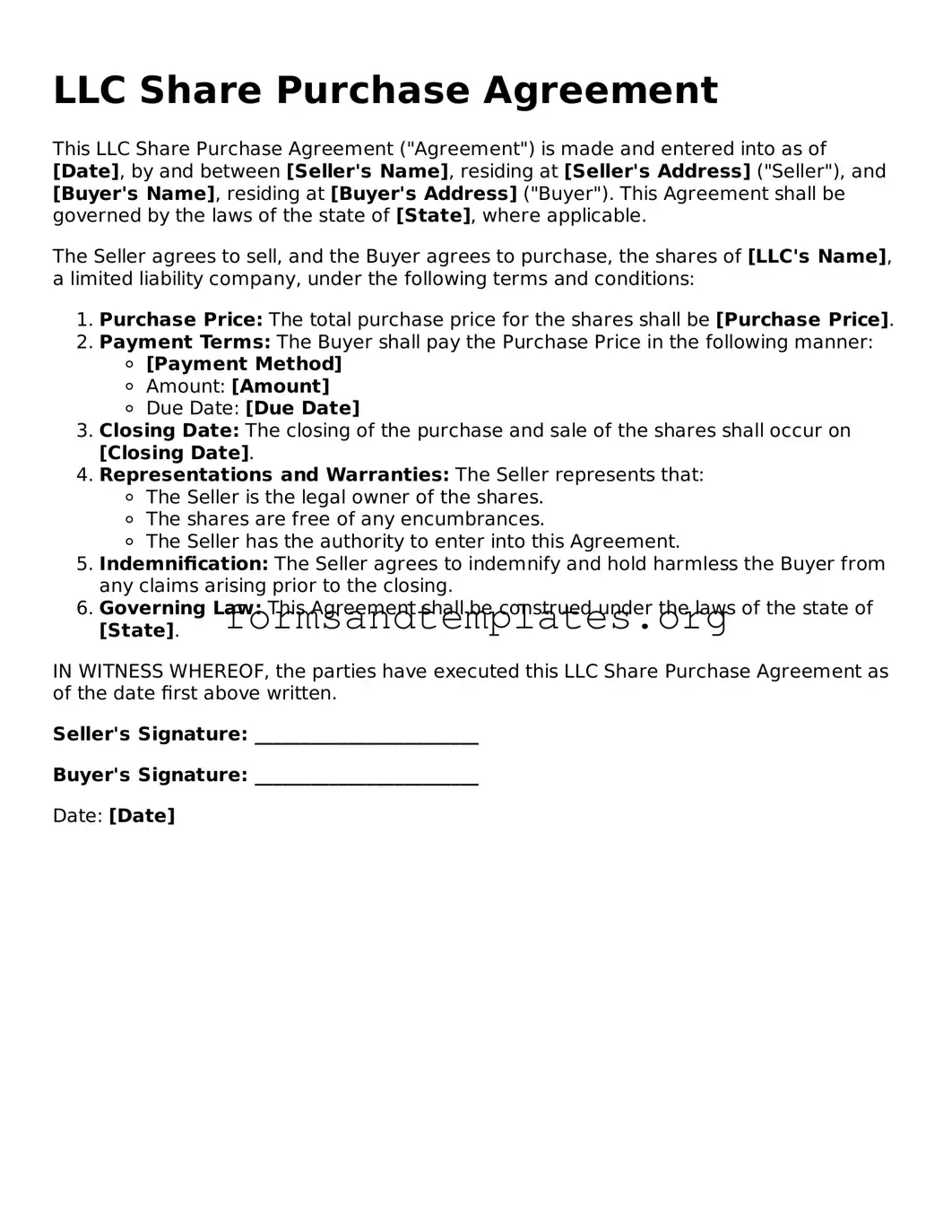

LLC Share Purchase Agreement Example

LLC Share Purchase Agreement

This LLC Share Purchase Agreement ("Agreement") is made and entered into as of [Date], by and between [Seller's Name], residing at [Seller's Address] ("Seller"), and [Buyer's Name], residing at [Buyer's Address] ("Buyer"). This Agreement shall be governed by the laws of the state of [State], where applicable.

The Seller agrees to sell, and the Buyer agrees to purchase, the shares of [LLC's Name], a limited liability company, under the following terms and conditions:

- Purchase Price: The total purchase price for the shares shall be [Purchase Price].

- Payment Terms: The Buyer shall pay the Purchase Price in the following manner:

- [Payment Method]

- Amount: [Amount]

- Due Date: [Due Date]

- Closing Date: The closing of the purchase and sale of the shares shall occur on [Closing Date].

- Representations and Warranties: The Seller represents that:

- The Seller is the legal owner of the shares.

- The shares are free of any encumbrances.

- The Seller has the authority to enter into this Agreement.

- Indemnification: The Seller agrees to indemnify and hold harmless the Buyer from any claims arising prior to the closing.

- Governing Law: This Agreement shall be construed under the laws of the state of [State].

IN WITNESS WHEREOF, the parties have executed this LLC Share Purchase Agreement as of the date first above written.

Seller's Signature: ________________________

Buyer's Signature: ________________________

Date: [Date]

Understanding LLC Share Purchase Agreement

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which shares in a Limited Liability Company (LLC) are bought and sold. This agreement serves as a crucial tool for both buyers and sellers, ensuring that all parties understand their rights and obligations. It typically includes details such as the number of shares being purchased, the purchase price, payment terms, and any warranties or representations made by the seller. By formalizing the transaction, this agreement helps to prevent misunderstandings and provides a clear framework for the sale.

Who should use an LLC Share Purchase Agreement?

Any individual or entity involved in the sale or purchase of shares in an LLC should consider using an LLC Share Purchase Agreement. This includes:

- Current members of the LLC looking to sell their shares.

- New investors interested in purchasing shares to become members of the LLC.

- Business partners wishing to transfer ownership stakes among themselves.

Using this agreement is essential for protecting the interests of both buyers and sellers, ensuring that the transaction is legally binding and clearly defined.

What key elements should be included in an LLC Share Purchase Agreement?

When drafting an LLC Share Purchase Agreement, several key elements should be included to ensure clarity and legal protection:

- Parties Involved: Clearly identify the buyer and seller, including their contact information.

- Description of Shares: Specify the type and number of shares being sold, along with any relevant details about the LLC.

- Purchase Price: State the agreed-upon price for the shares and the payment terms, including any deposits or installment plans.

- Representations and Warranties: Include any assurances made by the seller regarding the shares, such as their validity and the absence of liens.

- Closing Conditions: Outline the conditions that must be met before the sale is finalized, such as approvals from other members or regulatory bodies.

Including these elements helps to create a comprehensive agreement that minimizes the risk of disputes.

Can an LLC Share Purchase Agreement be modified after it is signed?

Yes, an LLC Share Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Modifications can be made for various reasons, such as changes in the purchase price or adjustments in the payment schedule. To ensure that the modifications are enforceable, it is advisable to document the changes in writing and have both parties sign the amended agreement. This practice not only provides clarity but also protects both parties' interests by creating a clear record of the agreed-upon changes.

How to Use LLC Share Purchase Agreement

Filling out the LLC Share Purchase Agreement form is an important step in formalizing the transfer of ownership in an LLC. After completing the form, both parties will have a clear record of the agreement, which can help prevent misunderstandings in the future.

- Begin by entering the date of the agreement at the top of the form.

- Identify the parties involved. Write the full legal names of the buyer and the seller.

- Provide the address for both the buyer and the seller. This should include the street address, city, state, and zip code.

- Specify the name of the LLC whose shares are being purchased.

- Indicate the number of shares being sold. Be clear about the quantity and any specific classes of shares if applicable.

- State the purchase price for the shares. Include the currency and any payment terms, such as due dates or payment methods.

- Include any representations and warranties made by the seller regarding the shares. This can include statements about ownership and the condition of the LLC.

- Sign and date the agreement. Both the buyer and the seller should sign, indicating their acceptance of the terms.

- Make copies of the signed agreement for both parties to keep for their records.