Attorney-Verified Letter of Intent to Purchase Business Template

When considering the purchase of a business, a Letter of Intent (LOI) serves as a crucial first step in the negotiation process. This document outlines the key terms and conditions that both the buyer and seller agree upon before finalizing the sale. It typically includes important details such as the purchase price, payment structure, and any contingencies that must be met. The LOI also addresses the timeline for due diligence and the closing process, ensuring both parties have a clear understanding of their responsibilities. Additionally, it may outline confidentiality agreements to protect sensitive information during negotiations. By clearly stating intentions, the LOI helps set the stage for a smooth transaction and minimizes misunderstandings down the line.

Common mistakes

-

Inadequate Detail on Terms: Many individuals fail to provide sufficient detail regarding the terms of the purchase. This can include vague descriptions of the purchase price, payment terms, or contingencies. Clear and precise language is crucial to avoid misunderstandings later.

-

Neglecting to Include Key Dates: Important deadlines often get overlooked. Without clear timelines for due diligence, closing dates, or other critical milestones, the process can become chaotic. It is essential to specify these dates to keep all parties aligned.

-

Ignoring Confidentiality Provisions: Some people forget to address confidentiality. This can lead to sensitive information being disclosed prematurely. Including a confidentiality clause protects both the buyer and seller during negotiations.

-

Omitting Contingencies: Failing to include contingencies can be a significant oversight. Buyers should outline any conditions that must be met before the sale is finalized, such as financing approval or satisfactory inspections. Without these, buyers may find themselves in a vulnerable position.

Create Popular Types of Letter of Intent to Purchase Business Templates

Commercial Lease Proposal - It can serve as a basis for good faith negotiations going forward.

For those looking to navigate the necessary paperwork for homeschooling, the California Homeschool Letter of Intent is a crucial form that outlines your educational intentions. This important documentation not only aids in fulfilling legal requirements but also provides clarity throughout the homeschooling process. To learn more, refer to the comprehensive guide on the Homeschool Letter of Intent procedures.

Key takeaways

When considering the Letter of Intent to Purchase a Business, keep these key takeaways in mind:

- Clarity is crucial. Clearly state your intentions regarding the purchase. This helps prevent misunderstandings later.

- Include key terms. Outline essential details such as the purchase price, payment terms, and timelines.

- Confidentiality matters. If sensitive information is shared, include a confidentiality clause to protect both parties.

- Non-binding nature. Remember that a Letter of Intent is typically non-binding, meaning it does not create a legal obligation to complete the purchase.

- Due diligence is important. Use the letter as a starting point for conducting due diligence on the business you intend to purchase.

- Consult professionals. Consider involving legal and financial advisors to ensure all aspects are covered appropriately.

- Final agreement is key. Understand that the Letter of Intent is just the first step; a final purchase agreement will be necessary to complete the transaction.

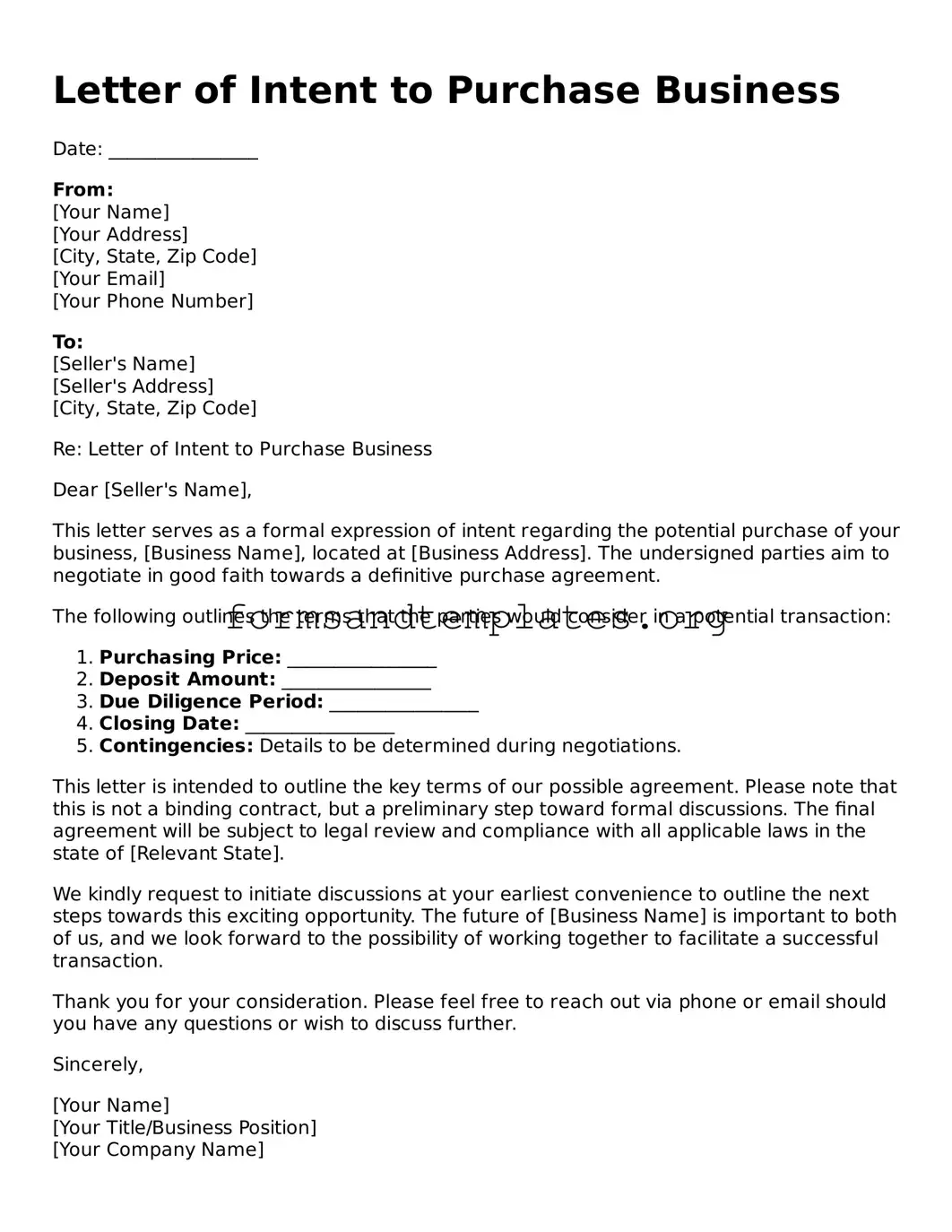

Letter of Intent to Purchase Business Example

Letter of Intent to Purchase Business

Date: ________________

From:

[Your Name]

[Your Address]

[City, State, Zip Code]

[Your Email]

[Your Phone Number]

To:

[Seller's Name]

[Seller's Address]

[City, State, Zip Code]

Re: Letter of Intent to Purchase Business

Dear [Seller's Name],

This letter serves as a formal expression of intent regarding the potential purchase of your business, [Business Name], located at [Business Address]. The undersigned parties aim to negotiate in good faith towards a definitive purchase agreement.

The following outlines the terms that the parties would consider in a potential transaction:

- Purchasing Price: ________________

- Deposit Amount: ________________

- Due Diligence Period: ________________

- Closing Date: ________________

- Contingencies: Details to be determined during negotiations.

This letter is intended to outline the key terms of our possible agreement. Please note that this is not a binding contract, but a preliminary step toward formal discussions. The final agreement will be subject to legal review and compliance with all applicable laws in the state of [Relevant State].

We kindly request to initiate discussions at your earliest convenience to outline the next steps towards this exciting opportunity. The future of [Business Name] is important to both of us, and we look forward to the possibility of working together to facilitate a successful transaction.

Thank you for your consideration. Please feel free to reach out via phone or email should you have any questions or wish to discuss further.

Sincerely,

[Your Name]

[Your Title/Business Position]

[Your Company Name]

Understanding Letter of Intent to Purchase Business

What is a Letter of Intent to Purchase Business?

A Letter of Intent (LOI) to purchase a business is a document that outlines the preliminary terms and conditions under which a buyer intends to acquire a business. It serves as a framework for negotiations and can include details such as the purchase price, payment structure, and any contingencies that must be met before the sale is finalized. While the LOI is not a legally binding contract, it demonstrates the buyer's serious interest and commitment to the transaction.

What should be included in a Letter of Intent?

When drafting a Letter of Intent, it is important to include several key elements to ensure clarity and mutual understanding. Common components include:

- Purchase Price: Specify the amount the buyer is willing to pay for the business.

- Payment Terms: Outline how the buyer intends to finance the purchase, including any deposits or installment payments.

- Due Diligence Period: Define the time frame during which the buyer can investigate the business's financial and operational status.

- Exclusivity Clause: Consider including a provision that prevents the seller from negotiating with other potential buyers for a specified period.

- Confidentiality Agreement: Address how sensitive information will be handled during the negotiation process.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not legally binding, meaning it does not create an enforceable obligation to complete the transaction. However, certain sections of the LOI, such as confidentiality agreements or exclusivity clauses, may carry legal weight. It is essential for both parties to clearly indicate which parts of the LOI are intended to be binding and which are not. Consulting with a legal professional can help clarify these distinctions.

Why is a Letter of Intent important?

A Letter of Intent is crucial for several reasons:

- Clarifies Intent: It helps both parties understand each other's intentions and expectations before entering into a formal agreement.

- Facilitates Negotiation: The LOI serves as a starting point for negotiations, allowing both sides to address any potential issues early in the process.

- Provides Structure: By outlining key terms, the LOI provides a roadmap for the transaction, helping to prevent misunderstandings later on.

- Builds Trust: A well-crafted LOI can establish goodwill and foster a positive relationship between the buyer and seller.

How to Use Letter of Intent to Purchase Business

Once you have decided to move forward with purchasing a business, the next step involves filling out the Letter of Intent to Purchase Business form. This document outlines your intention to buy the business and establishes the groundwork for negotiations. Careful attention to detail is essential, as this form sets the tone for the transaction.

- Gather Necessary Information: Collect all relevant details about the business you wish to purchase, including its name, address, and any pertinent financial information.

- Identify the Parties: Clearly state your name and contact information as the buyer, along with the seller's name and contact information.

- Describe the Business: Provide a brief description of the business, including its type, location, and any unique aspects that may be relevant to the sale.

- Outline the Purchase Terms: Specify the proposed purchase price and any conditions or contingencies that may apply, such as financing or inspections.

- Include a Timeline: Indicate your desired timeline for completing the purchase, including any key dates for negotiations or due diligence.

- Sign and Date: Both parties should sign and date the document to acknowledge their agreement to the terms outlined in the letter.

After completing the form, it’s essential to communicate openly with the seller. This step fosters a positive relationship and ensures that both parties are aligned on the next stages of the purchasing process.