Attorney-Verified Lady Bird Deed Template

The Lady Bird Deed, often referred to as an enhanced life estate deed, serves as a powerful tool for property owners looking to transfer their real estate while retaining certain rights during their lifetime. This unique form allows individuals to maintain control over their property, enabling them to live in, sell, or mortgage the property without needing consent from the beneficiaries. Upon the owner’s passing, the property automatically transfers to the designated beneficiaries, bypassing the often lengthy and costly probate process. Additionally, this deed can provide significant tax benefits and protect the property from creditors, making it an appealing option for estate planning. Understanding the nuances of the Lady Bird Deed is essential for anyone considering it as part of their estate strategy, as it combines the benefits of a traditional life estate with added flexibility and security.

Common mistakes

-

Not Including All Property Owners: It's crucial to list all individuals who have ownership rights to the property. Omitting a co-owner can lead to complications later on.

-

Incorrect Property Description: Ensure that the property is accurately described. This includes the address and legal description. Mistakes here can cause issues with the deed's validity.

-

Not Specifying the Right of Survivorship: If multiple owners are involved, clarify whether the right of survivorship applies. This detail can significantly impact how the property is handled after one owner passes away.

-

Failing to Sign the Deed: A deed is not valid without the necessary signatures. All owners must sign, and if applicable, a notary should witness the signing.

-

Not Understanding the Tax Implications: Some people overlook potential tax consequences associated with a Lady Bird Deed. It's wise to consult with a tax professional to avoid surprises later.

-

Neglecting to Record the Deed: After filling out the form, it’s essential to file it with the appropriate county office. Failing to do so can render the deed ineffective.

-

Using Incomplete or Incorrect Forms: Always ensure you have the most current version of the Lady Bird Deed form. Using outdated or incorrect forms can lead to legal issues.

-

Ignoring State-Specific Requirements: Each state may have different rules regarding Lady Bird Deeds. Be aware of your state’s specific requirements to ensure compliance.

-

Not Seeking Professional Help: Filling out legal forms can be complex. Many people try to do it alone but consulting with an attorney or a legal expert can save time and prevent errors.

Lady Bird Deed - Tailored for State

Create Popular Types of Lady Bird Deed Templates

Deed of Gift Template - A Gift Deed typically includes details about the nature and value of the gift.

When considering your financial and legal options, understanding the importance of a well-structured General Power of Attorney is crucial. This document can provide significant benefits, particularly in unexpected situations. To learn more about how to properly fill out this essential form, refer to our guide on the General Power of Attorney document.

Key takeaways

When considering the Lady Bird Deed, it is essential to understand its unique features and benefits. Below are some key takeaways that can help in filling out and utilizing this form effectively.

- Property Transfer: The Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime.

- Avoiding Probate: One of the significant advantages is that properties transferred via a Lady Bird Deed typically bypass the probate process, simplifying the transfer after the owner's death.

- Retained Rights: The grantor retains the right to sell, mortgage, or change the property without the consent of the beneficiaries, providing flexibility and control.

- Tax Benefits: This deed may help avoid capital gains taxes for beneficiaries, as the property receives a step-up in basis upon the owner's death.

- State Variations: Be aware that the acceptance and specifics of the Lady Bird Deed can vary by state, so it is crucial to check local laws and regulations.

Understanding these aspects can significantly enhance the effectiveness of using a Lady Bird Deed, ensuring that property owners make informed decisions about their estate planning.

Lady Bird Deed Example

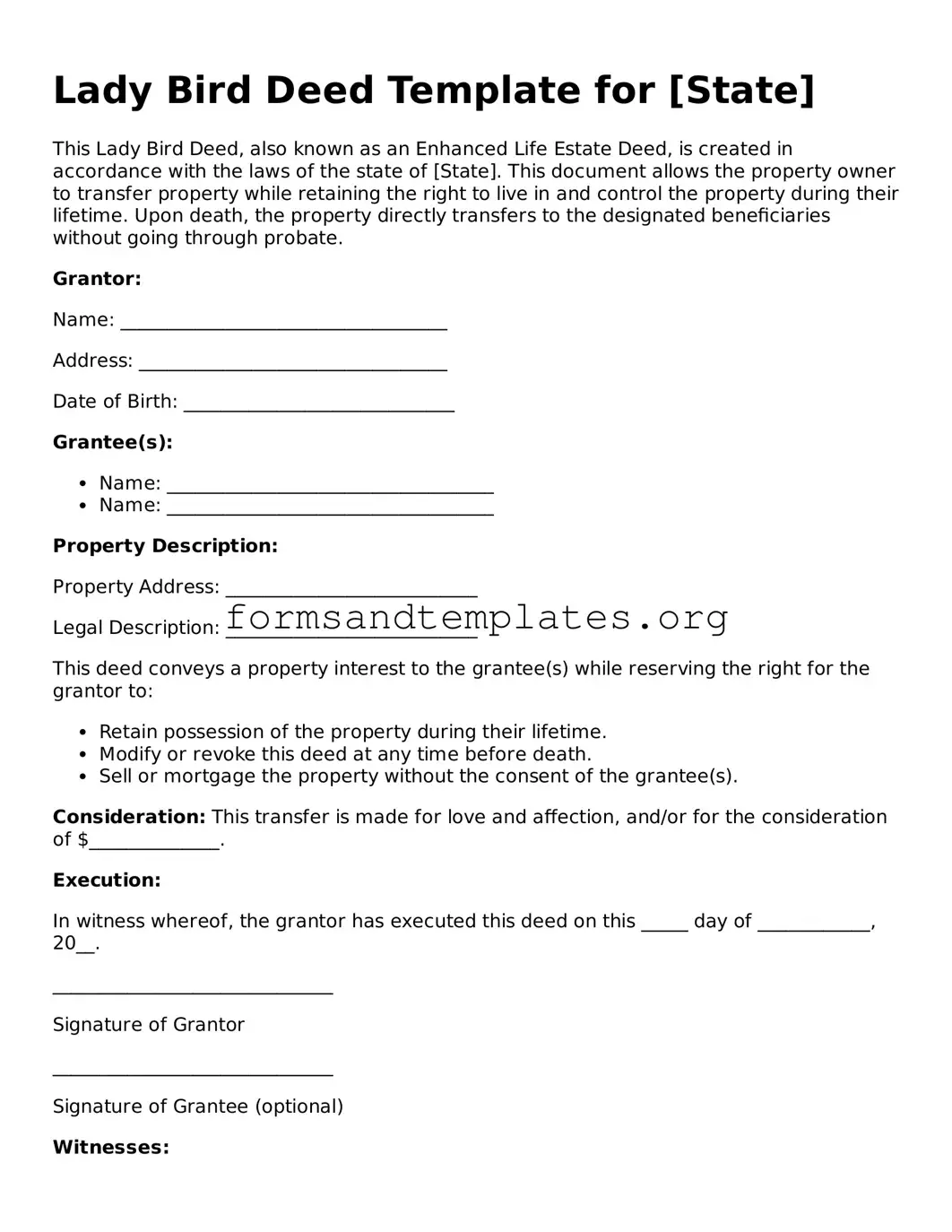

Lady Bird Deed Template for [State]

This Lady Bird Deed, also known as an Enhanced Life Estate Deed, is created in accordance with the laws of the state of [State]. This document allows the property owner to transfer property while retaining the right to live in and control the property during their lifetime. Upon death, the property directly transfers to the designated beneficiaries without going through probate.

Grantor:

Name: ___________________________________

Address: _________________________________

Date of Birth: _____________________________

Grantee(s):

- Name: ___________________________________

- Name: ___________________________________

Property Description:

Property Address: ___________________________

Legal Description: ___________________________

This deed conveys a property interest to the grantee(s) while reserving the right for the grantor to:

- Retain possession of the property during their lifetime.

- Modify or revoke this deed at any time before death.

- Sell or mortgage the property without the consent of the grantee(s).

Consideration: This transfer is made for love and affection, and/or for the consideration of $______________.

Execution:

In witness whereof, the grantor has executed this deed on this _____ day of ____________, 20__.

______________________________

Signature of Grantor

______________________________

Signature of Grantee (optional)

Witnesses:

Signature: ______________________________ Date: _______________

Signature: ______________________________ Date: _______________

State of [State], County of ____________________

This instrument was acknowledged before me on the _____ day of ______________, 20__, by ___________.

______________________________

Notary Public

My commission expires: _______________

Understanding Lady Bird Deed

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their property to a beneficiary while retaining the right to use and control the property during their lifetime. This deed is particularly useful for avoiding probate and ensuring that the property passes directly to the beneficiary upon the owner’s death. It provides flexibility and can help protect the property from creditors in certain situations.

Who can benefit from using a Lady Bird Deed?

Individuals who wish to transfer their property to family members or loved ones while retaining control over the property can benefit from a Lady Bird Deed. It is especially advantageous for:

- Homeowners looking to simplify the transfer of their property after death.

- Those wanting to avoid the lengthy and costly probate process.

- Individuals concerned about potential nursing home costs and asset protection.

Are there any tax implications associated with a Lady Bird Deed?

Generally, a Lady Bird Deed does not trigger a gift tax at the time of transfer. The property retains its stepped-up basis, which can be beneficial for the beneficiary when they sell the property. However, tax laws can be complex, and it is advisable to consult with a tax professional to understand any specific implications related to your situation.

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed involves several steps:

- Obtain the correct form for your state, as requirements may vary.

- Fill out the form with accurate property details and the names of the beneficiaries.

- Sign the deed in front of a notary public.

- Record the deed with the appropriate county office to ensure it is legally recognized.

It is recommended to seek assistance from a legal professional to ensure that the deed is completed correctly and meets all legal requirements.

How to Use Lady Bird Deed

Filling out the Lady Bird Deed form is an important step in transferring property while retaining certain rights. After completing the form, you will need to file it with the appropriate county office to ensure it is legally recognized. Follow the steps below to accurately fill out the form.

- Begin by entering the name of the property owner(s) at the top of the form. Ensure the names match those on the current property deed.

- Next, provide the complete address of the property being transferred. Include street number, street name, city, state, and ZIP code.

- In the designated section, specify the name(s) of the beneficiary or beneficiaries who will receive the property upon the owner’s passing.

- Indicate the relationship of the beneficiaries to the property owner. This could be a spouse, child, or other family member.

- Fill in any additional information requested, such as the legal description of the property. This may be found on the current deed or property tax documents.

- Sign and date the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Make copies of the completed and notarized form for your records.

- Finally, file the original form with the county clerk’s office in the county where the property is located. Be sure to pay any required filing fees.