Printable IRS 433-F Template

The IRS 433-F form plays a crucial role in the tax collection process, particularly for individuals facing financial difficulties. This form is designed to provide the Internal Revenue Service with a comprehensive overview of a taxpayer's financial situation. By detailing income, expenses, assets, and liabilities, it helps the IRS assess a taxpayer's ability to pay their tax debts. Completing the 433-F accurately is essential, as it can influence the outcome of various tax relief options, including installment agreements or offers in compromise. Furthermore, the form serves as a tool for the IRS to determine whether a taxpayer qualifies for certain programs aimed at easing their financial burden. Understanding the nuances of this form can empower taxpayers to navigate their obligations more effectively, ensuring they are treated fairly while managing their tax responsibilities.

Common mistakes

-

Failing to provide complete information. Incomplete forms can lead to delays in processing.

-

Not including all sources of income. Every source, including part-time jobs and freelance work, should be reported.

-

Underestimating living expenses. Providing realistic figures for monthly expenses is crucial for an accurate assessment.

-

Omitting assets. All assets, including bank accounts, vehicles, and real estate, must be disclosed.

-

Providing outdated information. Ensure that all details, such as income and expenses, reflect current circumstances.

-

Not signing and dating the form. A signature is necessary to validate the information provided.

-

Ignoring instructions. Carefully reading the instructions can help avoid common pitfalls.

-

Failing to keep copies. Retaining a copy of the submitted form is important for future reference.

-

Submitting the form to the wrong address. Ensure that the form is sent to the correct IRS office to avoid processing delays.

Find Common Documents

Form I9 - Incorrectly completed I-9 forms can lead to increased scrutiny from federal authorities.

When engaging in the sale or purchase of a vehicle, having a properly completed California Motor Vehicle Bill of Sale is crucial for both parties. This document not only confirms the transfer of ownership but also ensures that important details such as the vehicle's identification number and sale price are documented. To facilitate this process, you can find a reliable template for the bill of sale at California Templates.

Horse Training Agreement Template - Inherent risks include unpredictable behaviors of horses, which owners acknowledge and accept.

Ca Sdi - Those unsure about the DE 2501 can seek assistance from the EDD or legal experts.

Key takeaways

When dealing with the IRS 433-F form, understanding its purpose and how to fill it out correctly is crucial. Here are some key takeaways that can help you navigate the process more effectively:

- Purpose of the Form: The IRS 433-F form is primarily used to collect financial information from individuals who owe taxes and are seeking to make payment arrangements.

- Required Information: You will need to provide detailed information about your income, expenses, assets, and liabilities. This includes bank statements, pay stubs, and any other relevant financial documents.

- Accuracy is Key: Ensure that all information is accurate and up-to-date. Inaccuracies can lead to delays or complications in your payment arrangement.

- Completing the Form: The form consists of multiple sections. Take your time to fill out each section thoroughly, as incomplete forms may be rejected.

- Signature Requirement: Don’t forget to sign and date the form. An unsigned form will not be processed.

- Submission Methods: You can submit the completed form via mail or fax, depending on the IRS instructions. Make sure to check the latest guidelines.

- Follow Up: After submission, follow up with the IRS to confirm that they received your form and that it is being processed.

- Potential Outcomes: Depending on the information provided, the IRS may offer various payment options, including installment agreements or offers in compromise.

- Seek Assistance if Needed: If you find the process overwhelming, consider seeking help from a tax professional or legal advisor who can guide you through the steps.

- Stay Informed: Keep yourself updated on any changes to IRS policies or procedures that may affect your situation or the use of the form.

By keeping these takeaways in mind, you can approach the IRS 433-F form with greater confidence and clarity.

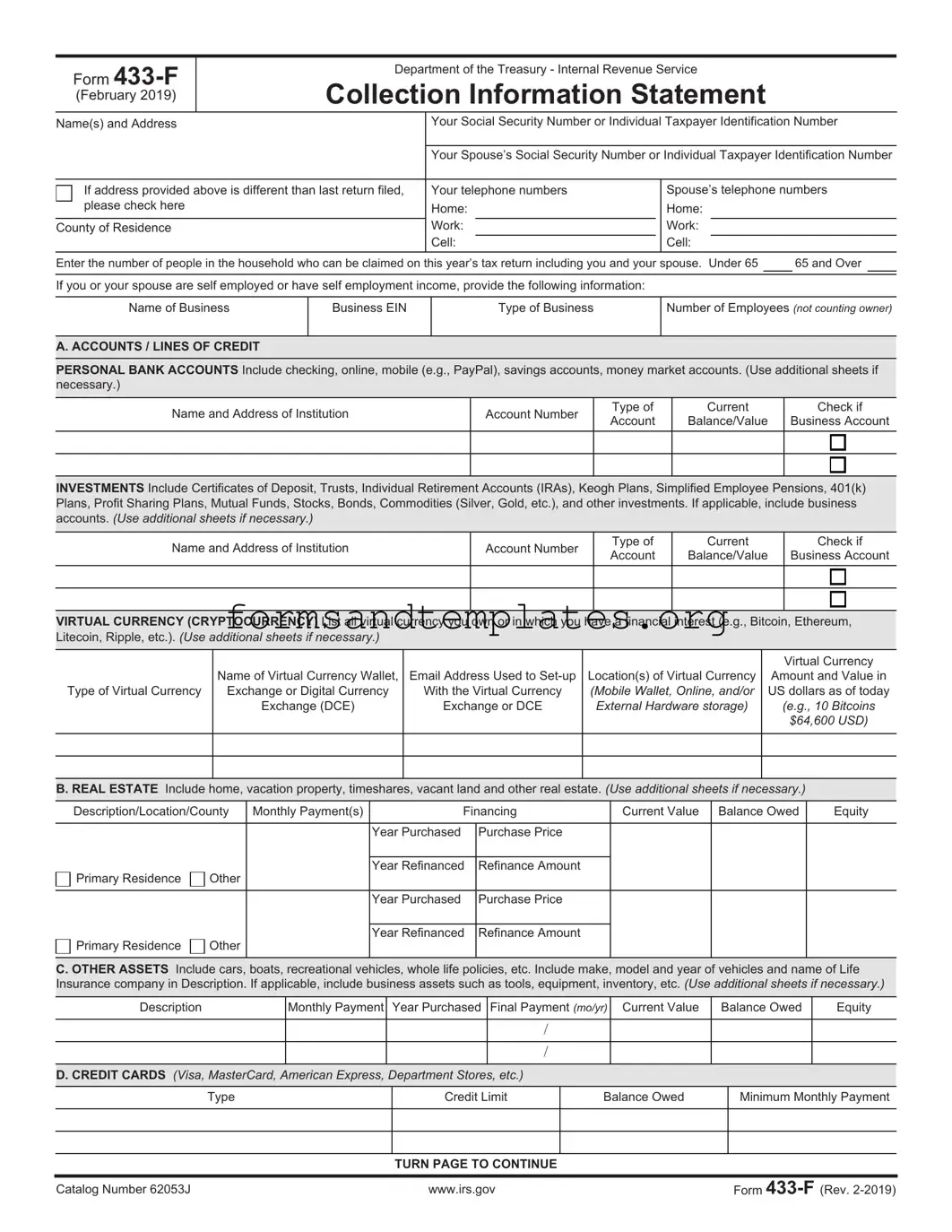

IRS 433-F Example

Form

(February 2019)

Department of the Treasury - Internal Revenue Service

Collection Information Statement

Name(s) and Address |

Your Social Security Number or Individual Taxpayer Identification Number |

|||||||

|

|

|

|

|

||||

|

Your Spouse’s Social Security Number or Individual Taxpayer Identification Number |

|||||||

|

|

|

|

|

|

|||

If address provided above is different than last return filed, |

Your telephone numbers |

|

Spouse’s telephone numbers |

|||||

please check here |

Home: |

|

Home: |

|

|

|

||

County of Residence |

Work: |

|

|

Work: |

|

|

|

|

|

Cell: |

|

|

Cell: |

|

|

|

|

Enter the number of people in the household who can be claimed on this year’s tax return including you and your spouse. Under 65 |

|

65 and Over |

||||||

|

|

|

|

|

|

|

|

|

If you or your spouse are self employed or have self employment income, provide the following information:

Name of Business

Business EIN

Type of Business

Number of Employees (not counting owner)

A. ACCOUNTS / LINES OF CREDIT

PERSONAL BANK ACCOUNTS Include checking, online, mobile (e.g., PayPal), savings accounts, money market accounts. (Use additional sheets if necessary.)

Name and Address of Institution

Account Number

Type of Account

Current

Balance/Value

Check if

Business Account

INVESTMENTS Include Certificates of Deposit, Trusts, Individual Retirement Accounts (IRAs), Keogh Plans, Simplified Employee Pensions, 401(k) Plans, Profit Sharing Plans, Mutual Funds, Stocks, Bonds, Commodities (Silver, Gold, etc.), and other investments. If applicable, include business accounts. (Use additional sheets if necessary.)

Name and Address of Institution

Account Number

Type of Account

Current

Balance/Value

Check if

Business Account

VIRTUAL CURRENCY (CRYPTOCURRENCY) List all virtual currency you own or in which you have a financial interest (e.g., Bitcoin, Ethereum, Litecoin, Ripple, etc.). (Use additional sheets if necessary.)

Type of Virtual Currency

Name of Virtual Currency Wallet,

Exchange or Digital Currency

Exchange (DCE)

Email Address Used to

With the Virtual Currency

Exchange or DCE

Location(s) of Virtual Currency (Mobile Wallet, Online, and/or External Hardware storage)

Virtual Currency

Amount and Value in US dollars as of today (e.g., 10 Bitcoins $64,600 USD)

B. REAL ESTATE Include home, vacation property, timeshares, vacant land and other real estate. (Use additional sheets if necessary.)

Description/Location/County |

Monthly Payment(s) |

Financing |

Current Value |

Balance Owed |

Equity |

||

|

|

|

|

|

|

|

|

|

|

|

Year Purchased |

Purchase Price |

|

|

|

|

|

|

|

|

|

|

|

Primary Residence |

Other |

|

Year Refinanced |

Refinance Amount |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Year Purchased |

Purchase Price |

|

|

|

|

|

|

|

|

|

|

|

Primary Residence |

Other |

|

Year Refinanced |

Refinance Amount |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

C. OTHER ASSETS Include cars, boats, recreational vehicles, whole life policies, etc. Include make, model and year of vehicles and name of Life Insurance company in Description. If applicable, include business assets such as tools, equipment, inventory, etc. (Use additional sheets if necessary.)

Description |

Monthly Payment Year Purchased Final Payment (mo/yr) Current Value |

Balance Owed |

Equity |

/

/

D. CREDIT CARDS (Visa, MasterCard, American Express, Department Stores, etc.)

Type

Credit Limit

Balance Owed

Minimum Monthly Payment

TURN PAGE TO CONTINUE

Catalog Number 62053J |

www.irs.gov |

Form |

Page 2 of 4

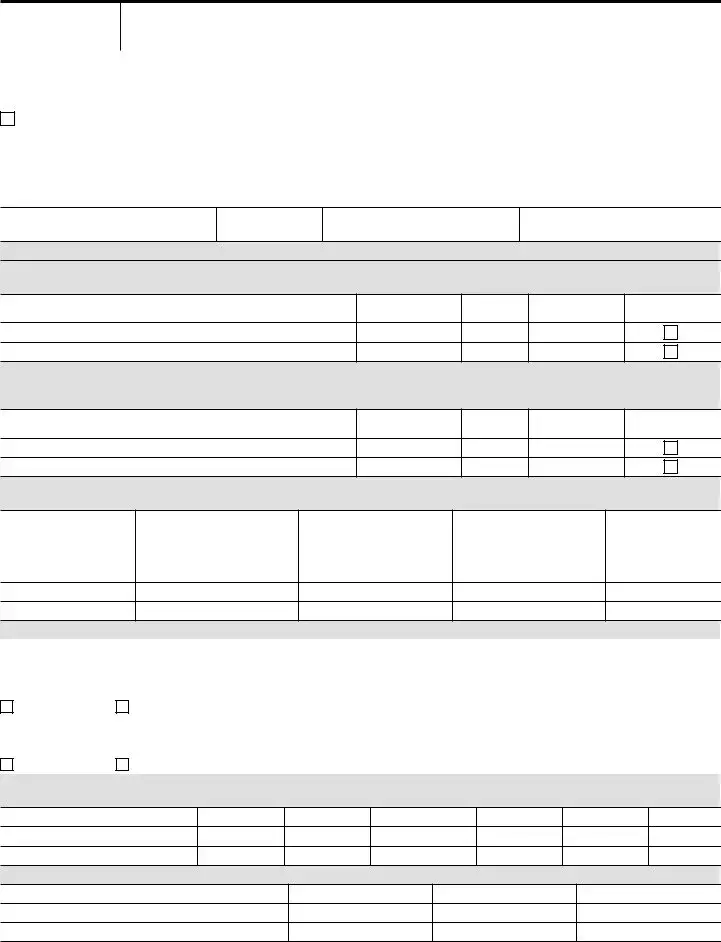

E. BUSINESS INFORMATION Complete E1 for Accounts Receivable owed to you or your business. (Use additional sheets if necessary.) Complete E2 if you or your business accepts credit card payments. Include virtual currency wallet, exchange or digital currency exchange.

E1. Accounts Receivable owed to you or your business

Name |

Address |

Amount Owed |

|

|

|

|

|

|

|

|

|

List total amount owed from additional sheets

Total amount of accounts receivable available to pay to IRS now

E2. Name of individual or business on account

Credit Card

(Visa, Master Card, etc.)

Issuing Bank Name and Address

Merchant Account Number

F. EMPLOYMENT INFORMATION If you have more than one employer, include the information on another sheet of paper. (If attaching a copy of current pay stub, you do not need to complete this section.)

Your current Employer (name and address)

How often are you paid (check one) |

|

|

|

|

|

||||

Weekly |

Biweekly |

Monthly |

|||||||

Gross per pay period |

|

|

|

|

|

|

|

|

|

Taxes per pay period (Fed) |

|

(State) |

(Local) |

||||||

How long at current employer |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

Spouse’s current Employer (name and address)

How often are you paid (check one)

Weekly |

Biweekly |

|

Monthly |

||||||

Gross per pay period |

|

|

|

|

|

|

|

|

|

Taxes per pay period (Fed) |

|

|

(State) |

(Local) |

|||||

How long at current employer |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

G.

Alimony Income

Child Support Income

Net Self Employment Income

Net Rental Income

Unemployment Income

Pension Income

Interest/Dividends Income

Social Security Income

Other:

H. MONTHLY NECESSARY LIVING EXPENSES List monthly amounts. (For expenses paid other than monthly, see instructions.)

1. Food / Personal Care See instructions. If you do not spend more than |

4. Medical |

Actual Monthly |

IRS Allowed |

||

the standard allowable amount for your family size, fill in the Total amount |

Health Insurance |

Expenses |

|

||

only. |

|

|

|

|

|

Actual Monthly |

IRS Allowed |

|

|

||

|

Out of Pocket Health Care |

|

|

||

|

Expenses |

|

|

||

Food |

|

|

Expenses |

|

|

|

|

|

|

||

|

|

Total |

|

|

|

Housekeeping Supplies |

|

|

|

|

|

Clothing and Clothing Services |

|

|

5. Other |

Actual Monthly |

IRS Allowed |

Personal Care Products & Services |

|

|

|

Expenses |

|

|

|

|

|

||

Miscellaneous |

|

|

Child / Dependent Care |

|

|

Total |

|

|

Estimated Tax Payments |

|

|

2. Transportation |

Actual Monthly |

IRS Allowed |

Term Life Insurance |

|

|

|

Expenses |

Retirement (Employer Required) |

|

|

|

|

|

|

|

||

Gas / Insurance / Licenses / |

|

|

Retirement (Voluntary) |

|

|

Parking / Maintenance etc. |

|

|

Union Dues |

|

|

Public Transportation |

|

|

Delinquent State & Local Taxes |

|

|

Total |

|

|

(minimum payment) |

|

|

3. Housing & Utilities |

Actual Monthly |

IRS Allowed |

Student Loans (minimum |

|

|

|

Expenses |

payment) |

|

|

|

|

|

|

|

||

Rent |

|

|

Court Ordered Child Support |

|

|

Electric, Oil/Gas, Water/Trash |

|

|

Court Ordered Alimony |

|

|

Telephone/Cell/Cable/Internet |

|

|

Other Court Ordered Payments |

|

|

Real Estate Taxes and Insurance |

|

|

Other (specify) |

|

|

(if not included in B above) |

|

|

Other (specify) |

|

|

Maintenance and Repairs |

|

|

Other (specify) |

|

|

Total |

|

|

Total |

|

|

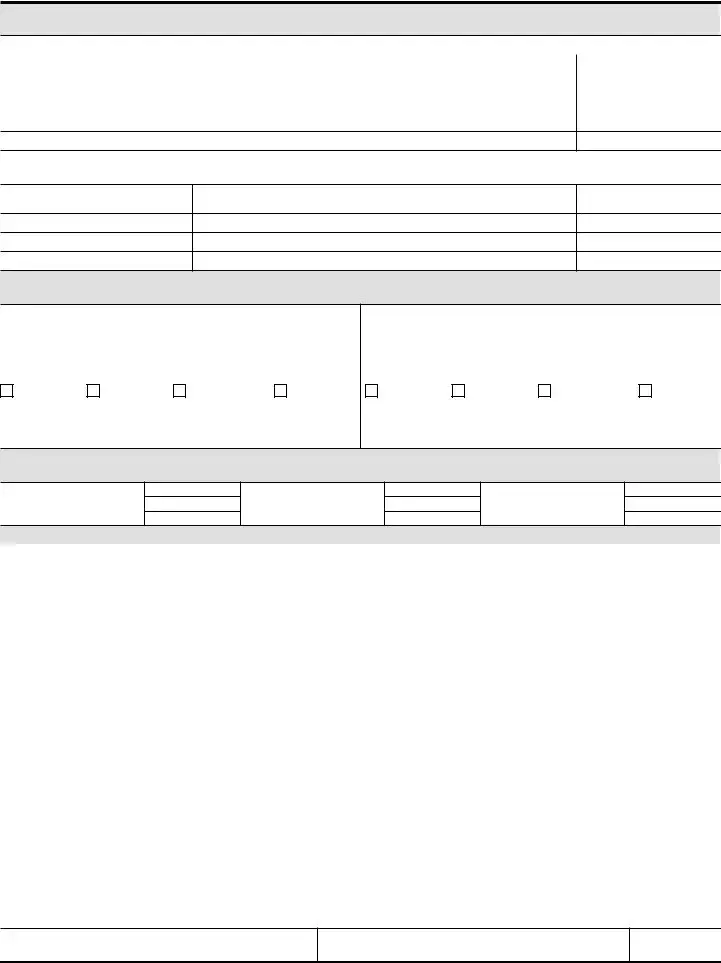

Under penalty of perjury, I declare to the best of my knowledge and belief this statement of assets, liabilities and other information is true, correct and complete.

Your signature

Spouse’s signature

Date

Catalog Number 62053J |

www.irs.gov |

Form |

Page 3 of 4

Instructions for Form

What is the purpose of Form 433F?

Form

Note: You may be able to establish an Online Payment Agreement on the IRS web site. To apply online, go to https://www.irs.gov, click on “I need to pay my taxes,” and select “Installment Agreement” under the heading “What if I can't pay now?”

If you are requesting an Installment Agreement, you should submit Form 9465, Installment Agreement Request, along with Form

Please retain a copy of your completed form and supporting documentation. After we review your completed form, we may contact you for additional information. For example, we may ask you to send supporting documentation of your current income or substantiation of your stated expenditures.

If any section on this form is too small for the information you need to supply, please use a separate sheet.

Section A – Accounts / Lines of Credit

List all accounts, even if they currently have no balance. However, do not enter bank loans in this section. Include business accounts, if applicable. If you are entering information for a stock or bond, etc. and a question does not apply, enter N/A.

Section B – Real Estate

List all real estate you own or are purchasing including your home. Include insurance and taxes if they are included in your monthly payment. The county/description is needed if different than the address and county you listed above. To determine equity, subtract the amount owed for each piece of real estate from its current market value.

Section C – Other Assets

List all cars, boats and recreational vehicles with their make, model and year. If a vehicle is leased, write “lease” in the “year purchased” column. List whole life insurance policies with the name of the insurance company. List other assets with a description such as “paintings”, “coin collection”, or “antiques”. If applicable, include business assets, such as tools, equipment, inventory, and intangible assets such as domain names, patents, copyrights, etc. To determine equity, subtract the amount owed from its current market value. If you are entering information for an asset and a question does not apply, enter N/A.

Section D – Credit Cards

List all credit cards and lines of credit, even if there is no balance owed.

Section E – Business Information

Complete this section if you or your spouse are

E1: List all Accounts Receivable owed to you or your business. Include federal, state and local grants and contracts.

E2: Complete if you or your business accepts credit card payments (e.g., Visa, MasterCard, etc.) and/or virtual currency wallet, exchange or digital currency exchange.

Section F – Employment Information

Complete this section if you or your spouse are wage earners.

If attaching a copy of current pay stub, you do not need to complete this section.

Section G –

List all

Net

spouse earns after you pay ordinary and necessary monthly business expenses. This figure should relate to the yearly net profit from Schedule C on your Form 1040 or your current year profit and loss statement. Please attach a copy of Schedule C or your current year profit and loss statement. If net income is a loss, enter “0”.

Net Rental Income is the amount you earn after you pay ordinary and necessary monthly rental expenses. This figure should relate to the amount reported on Schedule E of your Form 1040.

Do not include depreciation expenses. Depreciation is a

If net rental income is a loss, enter “0”.

Other Income includes distributions from partnerships and subchapter S corporations reported on Schedule

Section H – Monthly Necessary Living Expenses

Enter monthly amounts for expenses. For any expenses not paid monthly, convert as follows:

If a bill is paid … |

Calculate the monthly |

|

amount by … |

||

|

||

Quarterly |

Dividing by 3 |

|

|

|

|

Weekly |

Multiplying by 4.3 |

|

|

|

|

Biweekly (every two |

Multiplying by 2.17 |

|

weeks) |

||

|

||

Semimonthly (twice |

Multiplying by 2 |

|

each month) |

||

|

Catalog Number 62053J |

www.irs.gov |

Form |

Page 4 of 4

For expenses claimed in boxes 1 and 4, you should provide the IRS allowable standards, or the actual amount you pay if the amount exceeds the IRS allowable standards. IRS allowable standards can be found by accessing https://www.irs.gov/

Substantiation may be required for any expenses over the standard once the financial analysis is completed.

The amount claimed for Miscellaneous cannot exceed the standard amount for the number of people in your family. The miscellaneous allowance is for expenses incurred that are not included in any other allowable living expense items. Examples are credit card payments, bank fees and charges, reading material and school supplies.

If you do not have access to the IRS web site, itemize your actual expenses and we will ask you for additional proof, if required. Documentation may include pay statements, bank and investment statements, loan statements and bills for recurring expenses, etc.

Housing and Utilities – Includes expenses for your primary residence. You should only list amounts for utilities, taxes and insurance that are not included in your mortgage or rent payments.

Rent – Do not enter mortgage payment here. Mortgage payment is listed in Section B.

Transportation – Include the total of maintenance, repairs, insurance, fuel, registrations, licenses, inspections, parking, and tolls for one month.

Public Transportation – Include the total you spend for public transportation if you do not own a vehicle or if you have public transportation costs in addition to vehicle expenses.

Medical – You are allowed expenses for health insurance and

Health insurance – Enter the monthly amount you pay for yourself or your family.

covered by health insurance, and include:

•Medical services

•Prescription drugs

•Dental expenses

•Medical supplies, including eyeglasses and contact lenses. Medical procedures of a purely cosmetic nature, such as plastic surgery or elective dental work are generally not allowed.

Child / Dependent Care – Enter the monthly amount you pay for the care of dependents that can be claimed on your Form 1040.

Estimated Tax Payments – Calculate the monthly

amount you pay for estimated taxes by dividing the quarterly amount due on your Form 1040ES by 3.

Life Insurance – Enter the amount you pay for term life insurance only. Whole life insurance has cash value and should be listed in Section C.

Delinquent State & Local Taxes – Enter the minimum

amount you are required to pay monthly. Be prepared to provide a copy of the statement showing the amount you owe and if applicable, any agreement you have for monthly payments.

Student Loans – Minimum payments on student loans for the taxpayer’s

Court Ordered Payments – For any court ordered

payments, be prepared to submit a copy of the court order portion showing the amount you are ordered to pay, the signatures, and proof you are making the payments. Acceptable forms of proof are copies of cancelled checks or copies of bank or pay statements.

Other Expenses not listed above – We may allow

other expenses in certain circumstances. For example, if the expenses are necessary for the health and welfare of the taxpayer or family, or for the production of income. Specify the expense and list the minimum monthly payment you are billed.

Catalog Number 62053J |

www.irs.gov |

Form |

Understanding IRS 433-F

What is the IRS 433-F form?

The IRS 433-F form is a financial disclosure form used by the Internal Revenue Service (IRS) to gather information about a taxpayer's financial situation. This form is typically required when a taxpayer is applying for an installment agreement or when the IRS is evaluating a taxpayer's ability to pay their tax debt. By providing detailed information about income, expenses, assets, and liabilities, the IRS can better assess the taxpayer's financial capacity.

Who needs to fill out the IRS 433-F form?

Taxpayers who owe money to the IRS and wish to set up a payment plan may need to fill out the IRS 433-F form. It is particularly relevant for those who have received a notice from the IRS regarding their tax debt. Additionally, individuals who are seeking an Offer in Compromise, which allows them to settle their tax debt for less than the full amount owed, will also need to complete this form.

What information is required on the IRS 433-F form?

The IRS 433-F form requires various pieces of financial information, including:

- Personal information such as name, address, and Social Security number.

- Details about income, including wages, self-employment income, and any other sources of income.

- Monthly expenses, which cover categories like housing, utilities, food, transportation, and health care.

- Assets, including bank accounts, real estate, vehicles, and other valuable property.

- Liabilities, which include any debts owed to creditors.

Providing accurate and complete information is crucial, as it helps the IRS make informed decisions regarding your tax situation.

How do I submit the IRS 433-F form?

Submitting the IRS 433-F form can be done in several ways. You can mail the completed form to the address provided in the instructions. Alternatively, if you are working with an IRS representative or a tax professional, they may submit it on your behalf. It's important to keep a copy of the form for your records. If you are submitting the form as part of an Offer in Compromise, make sure to follow any additional instructions specific to that process.

How to Use IRS 433-F

Filling out the IRS 433-F form is an important step in addressing your tax situation. This form helps the IRS understand your financial situation, which can be crucial for negotiating payment plans or settling tax debts. Follow these steps to complete the form accurately.

- Begin by downloading the IRS 433-F form from the IRS website or obtain a physical copy.

- At the top of the form, enter your name, Social Security number, and address. Make sure this information is accurate.

- Provide your marital status. Indicate whether you are single, married filing jointly, married filing separately, or head of household.

- List your dependents, if applicable. Include their names and relationship to you.

- In the income section, detail all sources of income. This includes wages, self-employment income, and any other earnings.

- Next, outline your monthly expenses. Include categories such as housing, utilities, food, transportation, and healthcare.

- Document your assets. This may include cash, bank accounts, real estate, vehicles, and any other valuable items you own.

- After filling out all sections, review your entries for accuracy. Double-check that all figures are correct and that you haven’t missed any important details.

- Sign and date the form. This step is crucial, as your signature verifies that the information provided is true and accurate.

- Make a copy of the completed form for your records before submitting it to the IRS.

Once you have filled out the form, you can submit it to the IRS as directed. Be sure to keep a copy for your records, as it may be needed in future communications with the IRS.