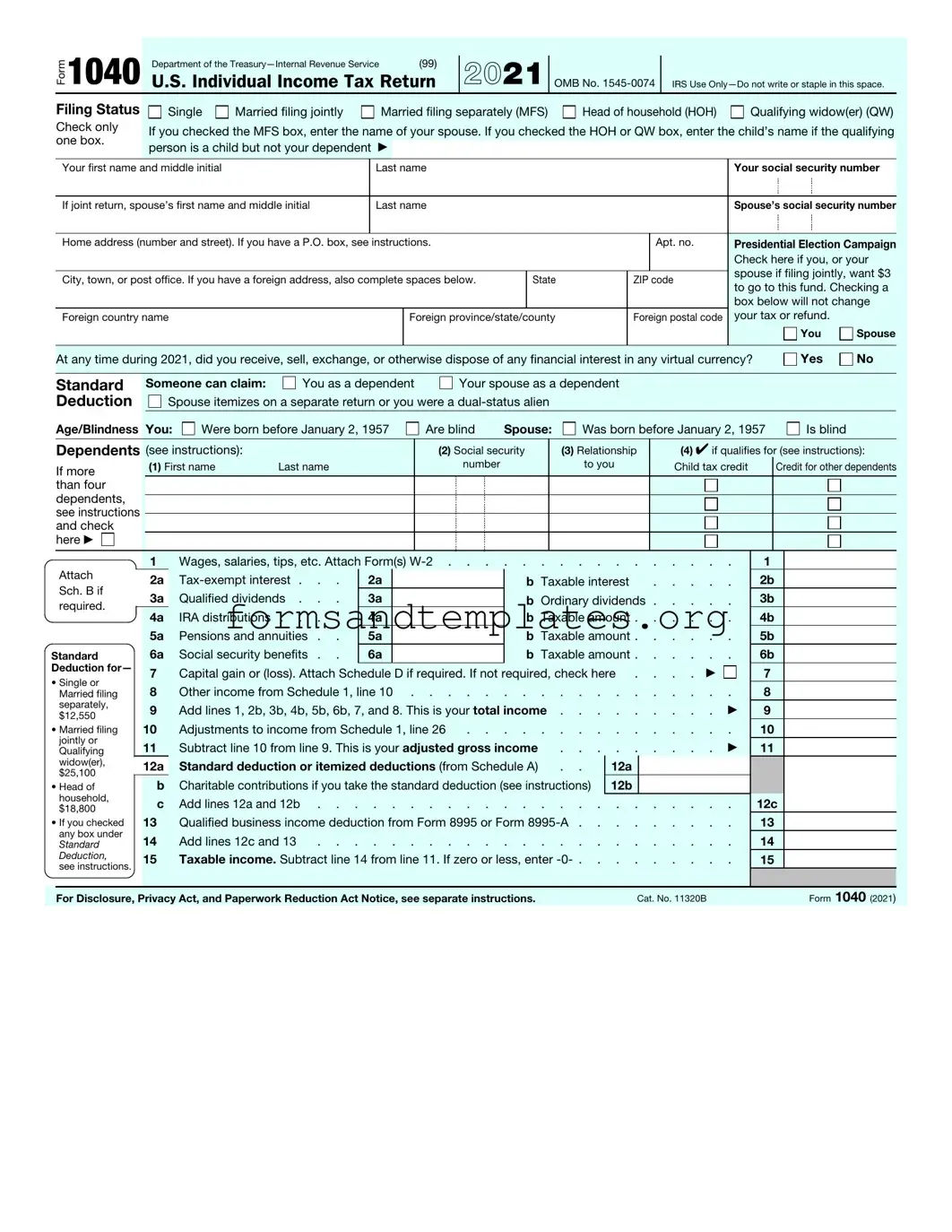

Printable IRS 1040 Template

The IRS 1040 form is a crucial document for individuals filing their annual income tax returns in the United States. This form serves as a comprehensive summary of a taxpayer's financial situation for the year, allowing the Internal Revenue Service to assess how much tax is owed or if a refund is due. It requires detailed information about income sources, including wages, dividends, and interest, as well as deductions and credits that can reduce taxable income. Taxpayers must also report any additional taxes owed, such as self-employment tax or penalties for early withdrawal from retirement accounts. The 1040 form comes in various versions, including the standard 1040, 1040-SR for seniors, and 1040-NR for non-residents, catering to different filing needs. Understanding the 1040 form is essential for ensuring compliance with tax laws and maximizing potential refunds, making it a vital part of the tax preparation process for millions of Americans every year.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to double-check their names, Social Security numbers, and addresses. Errors in this information can delay processing and lead to complications.

-

Filing Status Errors: Choosing the wrong filing status can significantly affect tax liability. Common mistakes include misidentifying whether one qualifies for "Head of Household" or "Married Filing Jointly."

-

Math Errors: Simple arithmetic mistakes can lead to incorrect calculations of income, deductions, and credits. These errors may result in underpayment or overpayment of taxes.

-

Omitting Income: Some taxpayers forget to report all sources of income, such as freelance work, interest, or dividends. This oversight can lead to penalties and interest on unpaid taxes.

-

Incorrect Deductions and Credits: Claiming deductions or credits without proper documentation can lead to disallowed claims. Taxpayers should ensure they meet eligibility requirements and retain necessary records.

-

Neglecting to Sign and Date: Failing to sign and date the form is a common mistake. An unsigned return is considered invalid, which can delay processing and refunds.

Find Common Documents

Business Credit Application Template - Use this form to apply for loans, credit lines, or credit cards.

For individuals looking to navigate the complexities of vehicle ownership transfer, the essential guide on the Motor Vehicle Bill of Sale is available here: comprehensive insights into the Motor Vehicle Bill of Sale. This document ensures that all necessary details are accurately recorded, providing peace of mind during the transaction.

Ca Sdi - It’s important to provide all required documentation along with the DE 2501.

Key takeaways

When it comes to filing your taxes, the IRS 1040 form is a crucial document. Here are some key takeaways to keep in mind:

- Understand Your Filing Status: Your filing status affects your tax rate and eligibility for certain deductions. Make sure to choose the one that best fits your situation.

- Gather All Necessary Documents: Before starting, collect all relevant documents, such as W-2s, 1099s, and any receipts for deductions. This will streamline the process.

- Take Advantage of Deductions and Credits: Familiarize yourself with available deductions and credits. They can significantly reduce your taxable income and overall tax bill.

- Double-Check Your Information: Accuracy is key. Review all entries carefully to avoid mistakes that could lead to delays or penalties.

- File on Time: Be mindful of the filing deadline to avoid late fees. If you need more time, consider filing for an extension, but remember that any taxes owed are still due by the original deadline.

IRS 1040 Example

Form

1040

Department of the |

(99) |

U.S. Individual Income Tax Return

2021

OMB No.

IRS Use

Filing Status

Check only one box.

|

Single |

|

Married filing jointly |

|

Married filing separately (MFS) |

|

Head of household (HOH) |

|

Qualifying widow(er) (QW) |

|

|

|

|

|

If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child’s name if the qualifying person is a child but not your dependent ▶

|

Your first name and middle initial |

|

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Your social security number |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

If joint return, spouse’s first name and middle initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s social security number |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Home address (number and street). If you have a P.O. box, see instructions. |

|

|

|

|

|

|

|

|

|

Apt. no. |

Presidential Election Campaign |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you, or your |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

spouse if filing jointly, want $3 |

||||||||||||||

|

City, town, or post office. If you have a foreign address, also complete spaces below. |

|

State |

|

|

|

|

ZIP code |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

to go to this fund. Checking a |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

box below will not change |

||||||||||||||

|

Foreign country name |

|

|

|

|

|

|

|

|

|

|

Foreign province/state/county |

|

|

|

|

Foreign postal code |

your tax or refund. |

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You |

|

|

Spouse |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? |

|

|

|

|

|

|

Yes |

|

|

No |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Standard |

|

Someone can claim: |

|

|

|

You as a dependent |

|

|

Your spouse as a dependent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Deduction |

|

|

|

|

|

Spouse itemizes on a separate return or you were a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Age/Blindness You: |

|

|

Were born before January 2, 1957 |

|

|

Are blind |

Spouse: |

|

|

Was born before January 2, 1957 |

|

|

|

|

Is blind |

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Dependents (see instructions): |

|

|

|

|

|

|

|

|

|

(2) Social security |

|

(3) Relationship |

(4) ✔ if qualifies for (see instructions): |

||||||||||||||||||||||||||||||||||||||||

|

If more |

|

|

(1) First name |

Last name |

|

|

|

|

|

|

|

number |

|

|

|

|

|

to you |

Child tax credit |

|

|

Credit for other dependents |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

than four |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

dependents, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

see instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

and check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

here ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach |

|

|

1 |

|

|

|

|

Wages, salaries, tips, etc. Attach Form(s) |

. |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

2 |

a |

|

|

2a |

|

|

|

|

|

|

|

|

b Taxable interest |

. . . . |

|

|

. |

|

|

2b |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Sch. B if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

3 |

a |

|

|

Qualified dividends . . . |

3a |

|

|

|

|

|

|

|

|

b Ordinary dividends . . . . |

. |

|

|

3b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

required. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

4a |

IRA distributions . . . . |

4a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

4b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

5a |

Pensions and annuities . . |

5a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

5b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Standard |

|

|

6a |

Social security benefits . . |

6a |

|

|

|

|

|

|

|

|

b Taxable amount |

. |

|

|

6b |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Deduction for— |

7 |

|

|

|

|

Capital gain or (loss). Attach Schedule D if required. If not required, check here . |

. . . ▶ |

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

• Single or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8 |

|

|

|

|

Other income from Schedule 1, line 10 |

. |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

Married filing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

separately, |

9 |

|

|

|

|

Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income |

▶ |

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

$12,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

• Married filing |

10 |

|

|

|

|

Adjustments to income from Schedule 1, line 26 |

. |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

jointly or |

11 |

|

|

|

|

Subtract line 10 from line 9. This is your adjusted gross income |

. . . . . . . . . |

|

|

▶ |

|

11 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Qualifying |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

widow(er), |

|

|

|

12 |

a |

|

|

Standard deduction or itemized deductions (from Schedule A) |

. . |

12a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

$25,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

b |

Charitable contributions if you take the standard deduction (see instructions) |

12b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

• Head of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

household, |

|

|

|

c |

Add lines 12a and 12b |

. |

|

|

12c |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

$18,800 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

• If you checked |

13 |

|

|

|

|

Qualified business income deduction from Form 8995 or Form |

. |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

any box under |

14 |

|

|

|

|

Add lines 12c and 13 |

. . . . . . . . . . . . . . . . . . . . . . |

|

|

. |

|

|

14 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Standard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

Deduction, |

15 |

|

|

|

|

Taxable income. Subtract line 14 from line 11. If zero or less, enter |

. |

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

see instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. |

|

|

|

|

Cat. No. 11320B |

|

|

|

|

|

|

|

|

|

Form 1040 (2021) |

||||||||||||||||||||||||||||||||||||||

|

|

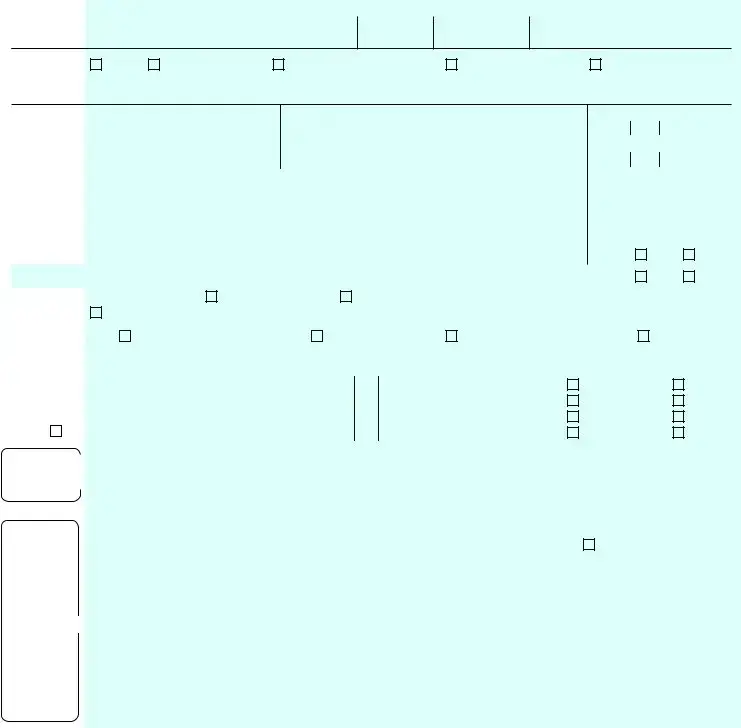

Form 1040 (2021) |

Page 2 |

|

16 |

Tax (see instructions). Check if any from Form(s): 1 |

8814 |

2 |

4972 |

|

3 |

|

|

. . |

16 |

|

|||

|

17 |

Amount from Schedule 2, line 3 |

. . . . . . . . |

17 |

|

||||||||||

|

18 |

Add lines 16 and 17 |

. . . . . . . . |

18 |

|

||||||||||

|

19 |

Nonrefundable child tax credit or credit for other dependents from Schedule 8812 |

19 |

|

|||||||||||

|

20 |

Amount from Schedule 3, line 8 |

. . . . . . . . |

20 |

|

||||||||||

|

21 |

Add lines 19 and 20 |

. . . . . . . . |

21 |

|

||||||||||

|

22 |

Subtract line 21 from line 18. If zero or less, enter |

. . . . . . . . |

22 |

|

||||||||||

|

23 |

Other taxes, including |

. . . . . . . . |

23 |

|

||||||||||

|

24 |

Add lines 22 and 23. This is your total tax |

. . . . . |

. . |

▶ |

24 |

|

||||||||

|

25 |

Federal income tax withheld from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Form(s) |

|

25a |

|

|

|

|

|

|

|||||

|

b |

Form(s) 1099 |

|

25b |

|

|

|

|

|

|

|||||

|

c |

Other forms (see instructions) |

|

25c |

|

|

|

|

|

|

|||||

|

d |

Add lines 25a through 25c |

. . . . . . . . |

25d |

|

||||||||||

If you have a |

26 |

2021 estimated tax payments and amount applied from 2020 return . . |

. . . . . . . . |

26 |

|

||||||||||

27a |

Earned income credit (EIC) |

|

27a |

|

|

|

|

|

|

||||||

qualifying child, |

|

|

|

|

|

|

|

||||||||

attach Sch. EIC. |

|

Check here if you were born after January 1, 1998, and before |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

January 2, 2004, and you satisfy all the other requirements for |

|

|

|

|

|

|

|

|

|

||||

|

|

taxpayers who are at least age 18, to claim the EIC. See instructions ▶ |

|

|

|

|

|

|

|

|

|

||||

|

b |

Nontaxable combat pay election . . . . |

27b |

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Prior year (2019) earned income . . . . |

27c |

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

Refundable child tax credit or additional child tax credit from Schedule 8812 |

|

28 |

|

|

|

|

|

|

|||||

|

29 |

American opportunity credit from Form 8863, line 8 |

|

29 |

|

|

|

|

|

|

|||||

|

30 |

Recovery rebate credit. See instructions |

|

30 |

|

|

|

|

|

|

|||||

|

31 |

Amount from Schedule 3, line 15 |

|

31 |

|

|

|

|

|

|

|||||

|

32 |

Add lines 27a and 28 through 31. These are your total other payments and refundable credits |

▶ |

32 |

|

||||||||||

|

33 |

Add lines 25d, 26, and 32. These are your total payments . . . . |

. . . . . |

. . |

▶ |

33 |

|

||||||||

Refund |

34 |

If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid |

|

. . |

34 |

|

|||||||||

35a |

Amount of line 34 you want refunded to you. If Form 8888 is attached, check here . . |

. |

▶ |

|

35a |

|

|||||||||

|

|

|

|||||||||||||

Direct deposit? |

▶ b |

Routing number |

|

▶ c Type: |

|

|

Checking |

|

Savings |

|

|

||||

See instructions. |

▶ d |

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

Amount of line 34 you want applied to your 2022 estimated tax . |

. |

▶ |

|

36 |

|

|

|

|

|

|

|||

Amount |

37 |

Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions |

|

. |

▶ |

37 |

|

||||||||

You Owe |

38 |

Estimated tax penalty (see instructions) . . . |

. . . . . |

. |

▶ |

|

38 |

|

|

|

|

|

|

||

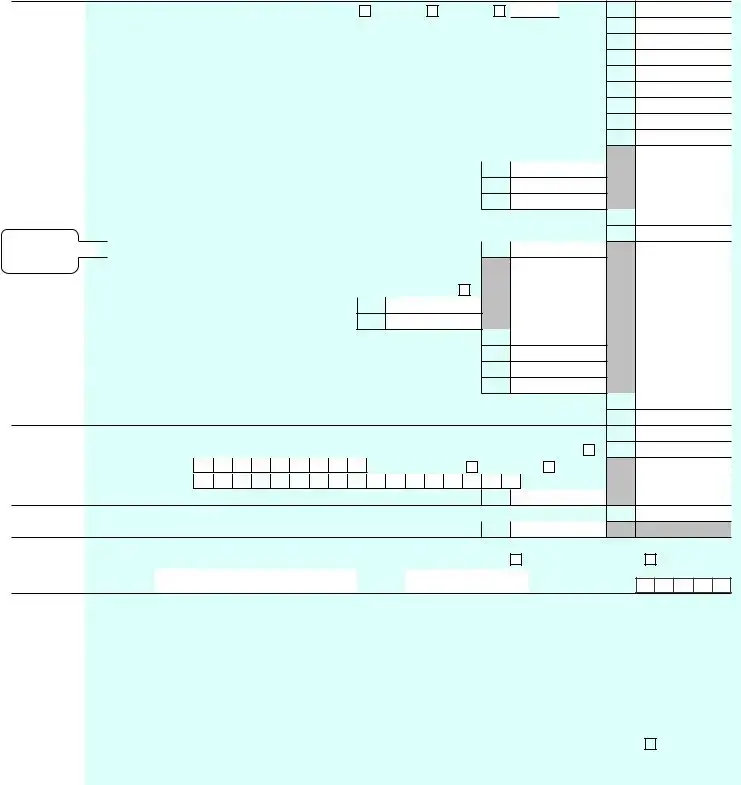

Third Party |

Do |

you want to allow another person to discuss this return with the IRS? See |

|

|

|

|

|

|

|||||||

Designee |

instructions |

. . . . . . . . . . . . . . . . . . . |

. |

▶ |

Yes. Complete below. |

No |

|||||||||

|

Designee’s |

|

Phone |

|

|

|

|

|

Personal identification |

|

|||||

|

name ▶ |

|

no. ▶ |

|

|

|

|

|

number (PIN) ▶ |

|

|

||||

Sign

Here

Joint return? See instructions. Keep a copy for your records.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature |

Date |

Your occupation |

If the IRS sent you an Identity |

||||||

|

|

|

Protection PIN, enter it here |

||||||

|

|

|

(see inst.) ▶ |

|

|

|

|

|

|

Spouse’s signature. If a joint return, both must sign. |

Date |

Spouse’s occupation |

If the IRS sent your spouse an |

||||||

▲ |

|

|

Identity Protection PIN, enter it here |

||||||

|

|

|

(see inst.) ▶ |

|

|

|

|

|

|

Phone no. |

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

Preparer’s name |

Preparer’s signature |

Date |

PTIN |

|

Check if: |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

Phone no. |

|

|

|

|

|

|

|

Use Only |

|

|

|

|

|

|

|

|

|

||

|

|

Firm’s address ▶ |

|

|

|

Firm’s EIN |

▶ |

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

Go to www.irs.gov/Form1040 for instructions and the latest information. |

|

|

|

|

|

Form 1040 (2021) |

|||||

Understanding IRS 1040

What is the IRS 1040 form?

The IRS 1040 form is the standard individual income tax return form used by U.S. taxpayers. It allows individuals to report their income, claim deductions and credits, and calculate their tax liability for the year. The form is essential for ensuring compliance with federal tax laws and is typically due by April 15 each year, unless an extension is filed.

Who needs to file a 1040 form?

Most U.S. citizens and residents who earn income are required to file a 1040 form. This includes individuals who:

- Earn wages or salary from employment.

- Receive income from self-employment.

- Collect interest, dividends, or rental income.

- Have capital gains from the sale of assets.

Even if your income is below the filing threshold, you may still want to file to claim a refund or certain credits.

What are the main sections of the 1040 form?

The 1040 form consists of several key sections, including:

- Personal Information: This includes your name, address, and Social Security number.

- Income: Report all sources of income, including wages, interest, and self-employment income.

- Deductions: Here, you can claim standard or itemized deductions to reduce your taxable income.

- Tax and Credits: Calculate your tax liability and apply any credits you may qualify for.

- Other Taxes: Report any additional taxes owed, such as self-employment tax.

- Payments: Include any tax payments you have made throughout the year, such as withholding from your paycheck.

- Refund or Amount Owed: Determine if you will receive a refund or if you owe additional taxes.

How do I file my 1040 form?

You can file your 1040 form in several ways:

- Electronically: Use tax preparation software or hire a tax professional to file online. E-filing is often faster and more secure.

- By Mail: You can print the form, fill it out, and send it to the appropriate IRS address based on your state and whether you are enclosing a payment.

- In-Person: Some tax preparation services offer in-person assistance to help you complete and file your return.

Regardless of the method chosen, ensure that you keep copies of your completed form and any supporting documents for your records.

What should I do if I need more time to file?

If you need extra time to prepare your 1040 form, you can file for an extension using Form 4868. This extension grants you an additional six months to file your return. However, it is important to note that an extension to file is not an extension to pay any taxes owed. You should estimate your tax liability and pay any amount due by the original deadline to avoid penalties and interest.

How to Use IRS 1040

Completing the IRS 1040 form is an important step in fulfilling your tax obligations. This process can seem daunting, but with a clear understanding of the necessary steps, you can navigate it with confidence. Below are the steps to guide you through filling out the form effectively.

- Gather your documents. Collect all necessary financial documents, such as W-2s, 1099s, and any other income statements.

- Begin with your personal information. Fill in your name, address, and Social Security number at the top of the form.

- Indicate your filing status. Choose the appropriate filing status from the options provided, such as single, married filing jointly, or head of household.

- Report your income. Enter your total income from all sources, including wages, salaries, and any other income streams.

- Claim deductions. If you qualify for any deductions, fill in the relevant amounts. This may include standard or itemized deductions.

- Calculate your taxable income. Subtract your deductions from your total income to determine your taxable income.

- Determine your tax liability. Use the IRS tax tables to find out how much tax you owe based on your taxable income.

- Account for credits. If you qualify for any tax credits, apply them to reduce your total tax liability.

- Complete additional sections. If applicable, fill out any additional forms or schedules that pertain to your tax situation.

- Sign and date the form. Ensure that you and your spouse (if filing jointly) sign and date the form before submitting.

- Submit your form. Choose to file electronically or mail your completed form to the appropriate IRS address.

Once you have completed these steps, you will have fulfilled your requirement to file your taxes for the year. Remember to keep copies of your documents and the completed form for your records. If you have any questions or concerns, consider seeking assistance from a tax professional.