Attorney-Verified Investment Letter of Intent Template

When embarking on an investment journey, clarity and mutual understanding between parties are essential. The Investment Letter of Intent (LOI) serves as a pivotal document in this process, outlining the preliminary terms and conditions that will guide future negotiations. This form typically includes key elements such as the amount of investment, the proposed structure of the deal, and the intended timeline for completion. Additionally, it may address confidentiality provisions, exclusivity periods, and any contingencies that could affect the transaction. By providing a framework for discussions, the LOI helps to align expectations and reduce misunderstandings. While it is not legally binding in the same way a contract is, it signals a serious commitment from the investor and lays the groundwork for more detailed agreements to follow. Understanding the nuances of this form can significantly enhance the investment process, making it smoother and more efficient for all parties involved.

Common mistakes

-

Inaccurate Information: Providing incorrect details about personal or financial information can lead to significant delays or even rejection of the investment. Double-check all entries for accuracy.

-

Missing Signatures: Failing to sign the form can render it invalid. Ensure that all required signatures are present before submission.

-

Omitting Required Documents: Many forms require additional documentation. Be sure to include all necessary attachments to avoid processing issues.

-

Not Reading Instructions: Skipping the instructions can lead to misunderstandings about what is required. Take the time to read all guidelines carefully.

-

Incorrect Formatting: Submitting the form in an incorrect format can cause delays. Follow the specified format for both the document and any attached files.

-

Ignoring Deadlines: Missing submission deadlines can result in lost opportunities. Keep track of all important dates and plan accordingly.

-

Not Providing Contact Information: Failing to include up-to-date contact information can hinder communication. Always provide a reliable way for the investment team to reach you.

-

Assuming Clarity: Using vague language or assumptions can lead to misunderstandings. Be clear and precise in all descriptions and statements.

-

Neglecting to Review: Submitting the form without a final review can result in overlooked mistakes. Always take a moment to review your completed form before sending it off.

Create Popular Types of Investment Letter of Intent Templates

Intent to Homeschool Letter - A declaration of commitment to provide a home-based education.

Letter of Intent Purchase Business - Helps in assessing strategic advantages of the purchase.

Letter of Intent to Marry - Couples may utilize this document to articulate their reasons for marriage.

Key takeaways

When filling out and using the Investment Letter of Intent form, keep these key takeaways in mind:

- Clarity is crucial. Clearly state your investment intentions and objectives. This helps all parties understand your goals.

- Be thorough. Include all relevant details, such as the amount of investment, timelines, and any conditions that may apply.

- Review the terms. Carefully read through any terms and conditions outlined in the form. Ensure you agree with them before signing.

- Consult professionals. If unsure about any aspect of the form, seek advice from legal or financial professionals to avoid potential pitfalls.

- Keep copies. Always retain a copy of the completed form for your records. This will be useful for future reference.

- Follow up. After submission, follow up with the relevant parties to confirm receipt and discuss next steps.

Investment Letter of Intent Example

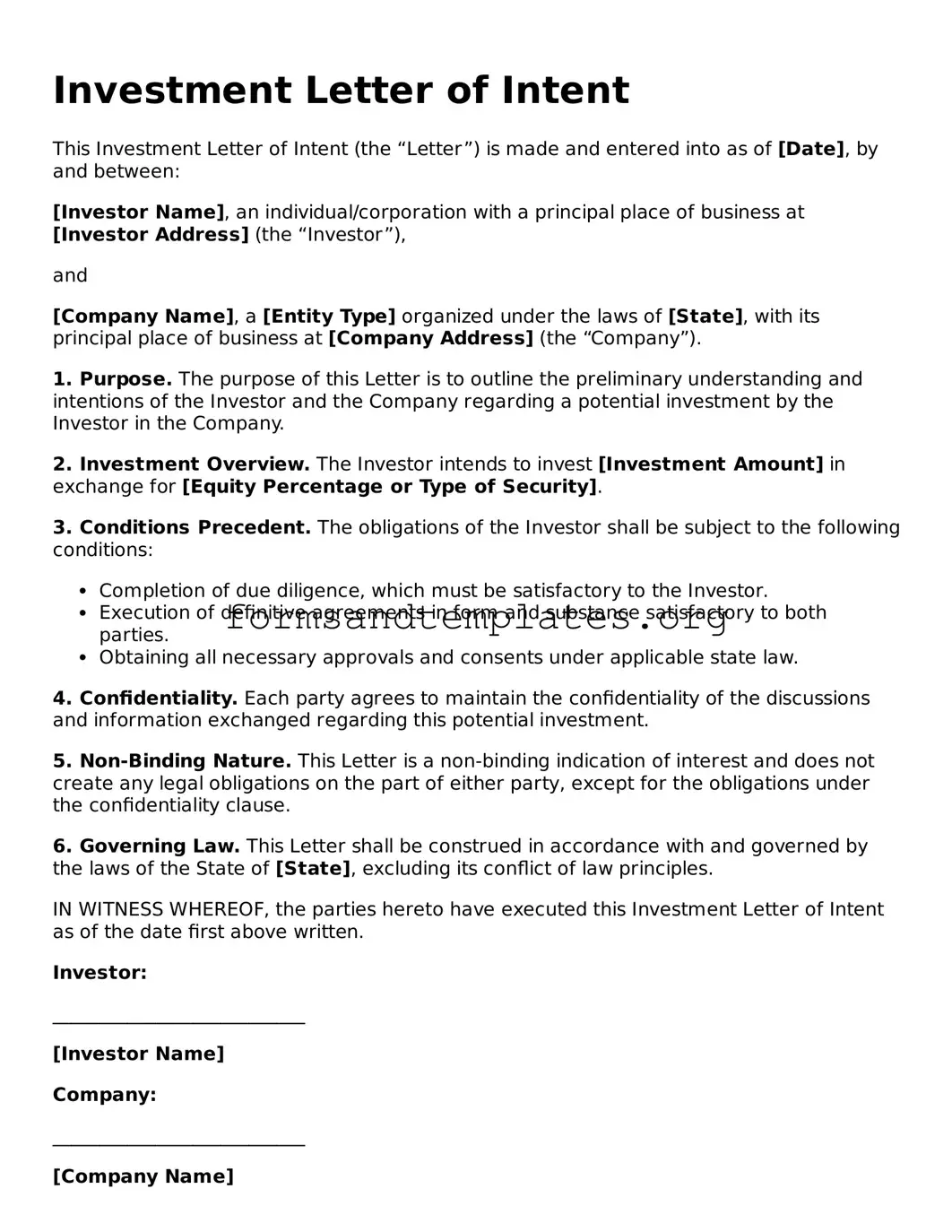

Investment Letter of Intent

This Investment Letter of Intent (the “Letter”) is made and entered into as of [Date], by and between:

[Investor Name], an individual/corporation with a principal place of business at [Investor Address] (the “Investor”),

and

[Company Name], a [Entity Type] organized under the laws of [State], with its principal place of business at [Company Address] (the “Company”).

1. Purpose. The purpose of this Letter is to outline the preliminary understanding and intentions of the Investor and the Company regarding a potential investment by the Investor in the Company.

2. Investment Overview. The Investor intends to invest [Investment Amount] in exchange for [Equity Percentage or Type of Security].

3. Conditions Precedent. The obligations of the Investor shall be subject to the following conditions:

- Completion of due diligence, which must be satisfactory to the Investor.

- Execution of definitive agreements in form and substance satisfactory to both parties.

- Obtaining all necessary approvals and consents under applicable state law.

4. Confidentiality. Each party agrees to maintain the confidentiality of the discussions and information exchanged regarding this potential investment.

5. Non-Binding Nature. This Letter is a non-binding indication of interest and does not create any legal obligations on the part of either party, except for the obligations under the confidentiality clause.

6. Governing Law. This Letter shall be construed in accordance with and governed by the laws of the State of [State], excluding its conflict of law principles.

IN WITNESS WHEREOF, the parties hereto have executed this Investment Letter of Intent as of the date first above written.

Investor:

___________________________

[Investor Name]

Company:

___________________________

[Company Name]

Understanding Investment Letter of Intent

What is an Investment Letter of Intent (LOI)?

An Investment Letter of Intent (LOI) is a preliminary agreement that outlines the intentions of parties involved in a potential investment. It serves as a formal expression of interest, detailing the basic terms and conditions that will govern the investment. While not legally binding in the same way as a contract, it sets the stage for further negotiations and due diligence. Typically, it includes information such as the amount of investment, the structure of the deal, and any contingencies that must be met before the final agreement is executed.

Why is an LOI important in the investment process?

The LOI plays a crucial role in the investment process for several reasons:

- Clarity: It provides clarity on the expectations and intentions of both parties, reducing the chances of misunderstandings.

- Framework for Negotiation: The LOI serves as a framework for further negotiations, allowing both parties to address any concerns before entering into a binding agreement.

- Due Diligence: It often includes provisions for due diligence, enabling the investor to assess the viability of the investment before committing fully.

- Time-Saving: By outlining the key terms upfront, it can expedite the overall process, saving time for both parties.

What should be included in an Investment LOI?

When drafting an Investment LOI, it is essential to include several key elements to ensure clarity and mutual understanding:

- Investment Amount: Clearly state the amount of capital being invested.

- Structure of the Investment: Outline whether the investment will be in the form of equity, debt, or another structure.

- Conditions Precedent: Specify any conditions that must be met before the investment can proceed.

- Timeline: Provide an estimated timeline for the completion of the investment process.

- Confidentiality Clause: Include provisions to protect sensitive information shared during negotiations.

Is an Investment LOI legally binding?

The Investment LOI is generally not considered a legally binding contract. However, certain sections may be binding, such as confidentiality agreements or exclusivity clauses. It is crucial to clearly indicate which parts of the LOI are intended to be binding and which are not. This distinction helps prevent any potential legal disputes down the line. Always consult with a legal professional to ensure that the LOI aligns with your intentions and provides the necessary protections.

How to Use Investment Letter of Intent

Once you have the Investment Letter of Intent form in front of you, it's time to fill it out carefully. Make sure you have all the necessary information ready. This includes your personal details and specifics about the investment. Following these steps will help ensure that your form is completed correctly and submitted without issues.

- Start with your full name. Write it clearly at the top of the form.

- Provide your contact information, including your phone number and email address.

- Enter the date of filling out the form. This is usually required for record-keeping.

- Fill in the details of the investment. Include the type of investment and the amount you intend to invest.

- If applicable, provide any relevant background information about yourself or your organization.

- Review all the information you have entered to ensure accuracy.

- Sign and date the form at the designated area. Your signature confirms your intent.

- Submit the form according to the provided instructions, whether electronically or via mail.

After you submit the form, the next steps will involve waiting for a response. You may receive further instructions or confirmation regarding your investment. Keep an eye on your email or phone for any updates.