Printable Intent To Lien Florida Template

The Intent To Lien Florida form serves as a critical document for contractors, suppliers, and service providers who have not received payment for their work on a property. This form notifies property owners of an impending lien that may be filed against their property if payment issues are not resolved. It includes essential information such as the date of the notice, the names and addresses of the property owner and general contractor, and a detailed description of the property involved. Additionally, the form outlines the amount owed for services rendered and specifies the legal requirements set forth by Florida statutes, which mandate that this notice be sent at least 45 days before filing a lien. The notice emphasizes the importance of addressing payment concerns within a 30-day period to avoid potential legal actions, including foreclosure proceedings and additional costs. By providing clear communication regarding payment expectations, the Intent To Lien Florida form aims to facilitate resolution and prevent disputes from escalating.

Common mistakes

-

Neglecting to Include the Date: Failing to write the date at the top of the form can lead to confusion about the timeline for the lien process.

-

Incorrect Property Owner Information: Providing inaccurate or incomplete names and addresses of the property owner can result in the notice being deemed invalid.

-

Omitting the General Contractor's Details: If applicable, not including the full legal name and mailing address of the general contractor may lead to complications in communication.

-

Failure to Specify the Property Description: Not clearly defining the property with both the street address and legal description can create ambiguity about which property the lien pertains to.

-

Missing Payment Amount: Leaving out the specific amount owed for work performed can weaken the claim and confuse the recipient.

-

Ignoring the 30-Day Response Requirement: Not highlighting the importance of the 30-day response period may lead the property owner to underestimate the urgency of the situation.

-

Not Including Contact Information: Failing to provide a phone number or email address for follow-up communication can hinder the resolution process.

-

Inadequate Certificate of Service: Not properly completing the certificate of service section can lead to questions about whether the notice was delivered correctly.

-

Using Ambiguous Language: Writing in vague terms instead of clear, direct language can create misunderstandings about the intent and seriousness of the notice.

-

Neglecting to Sign the Notice: A missing signature renders the notice unofficial and undermines its credibility.

Find Common Documents

Schedule of Availability Template - Please outline any upcoming commitments that may affect your schedule.

A California Non-disclosure Agreement (NDA) is a legal document designed to protect confidential information shared between parties. By establishing clear boundaries around sensitive data, this form helps prevent unauthorized disclosure and misuse. If you need to safeguard your proprietary information, consider filling out the NDA form by clicking the button below, or visit California Templates for more resources.

Free Printable Physical Exam Forms - Ensure all parts of the form are completed to avoid return visits.

Key takeaways

When filling out and using the Intent To Lien Florida form, consider the following key takeaways:

- Timeliness is crucial. Ensure the notice is sent at least 45 days before filing a lien.

- Correct details matter. Include the full legal names and mailing addresses of both the property owner and the general contractor, if applicable.

- Specify the amount owed. Clearly state the unpaid amount for work performed on the project.

- Understand the consequences. Failure to respond within 30 days may lead to a lien being recorded, which could result in foreclosure.

- Keep records. Document the method of service for the notice, as this is important for legal compliance.

- Communicate clearly. Encourage the property owner to contact you promptly to resolve the issue and avoid further action.

- Be aware of waivers. Confirm that no waivers or releases of lien have been received, as these can impact the validity of the lien claim.

Intent To Lien Florida Example

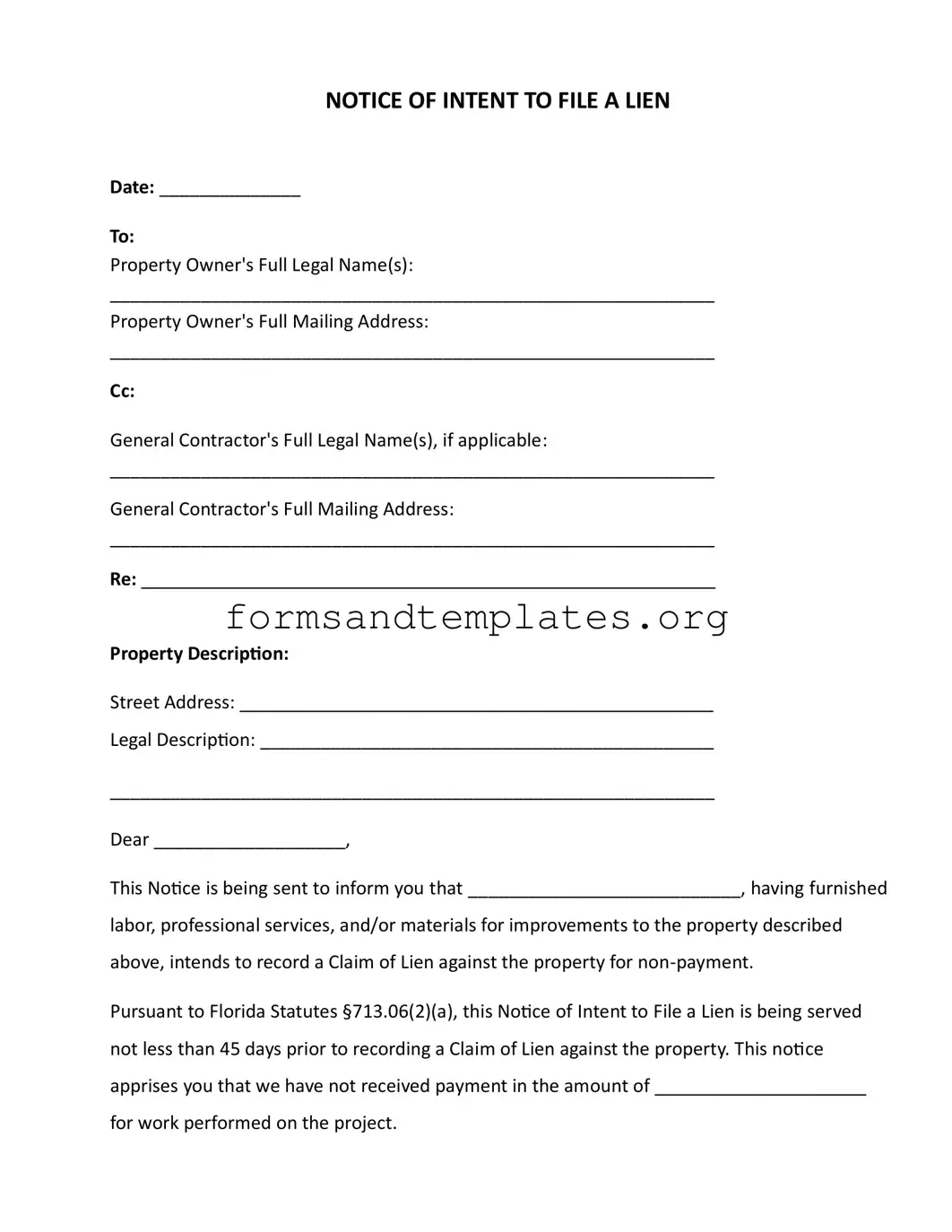

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Understanding Intent To Lien Florida

What is the Intent to Lien Florida form?

The Intent to Lien Florida form is a legal notice that informs property owners that a contractor, subcontractor, or supplier intends to file a lien against their property due to non-payment for services or materials provided. This notice is an important step in the lien process, allowing the property owner to address the payment issue before a lien is officially recorded.

Who needs to use this form?

This form is typically used by contractors, subcontractors, or suppliers who have provided labor, materials, or services for a property improvement project and have not received payment. It serves as a formal notification to the property owner that they are considering taking legal action to secure payment.

What information is required on the form?

The form requires several key pieces of information, including:

- Date of the notice

- Property owner's full legal name and mailing address

- General contractor's name and mailing address (if applicable)

- Description of the property, including street address and legal description

- The amount owed for the work performed

Providing accurate information is crucial to ensure the notice is effective and legally sound.

How long before filing a lien must the notice be sent?

According to Florida law, the notice must be served at least 45 days before the actual lien is recorded. This timeframe gives the property owner an opportunity to resolve the payment issue before further legal action is taken.

What happens if the property owner does not respond?

If the property owner fails to make payment or provide a satisfactory response within 30 days of receiving the notice, the contractor or supplier may proceed to file a lien against the property. This could lead to serious consequences, including foreclosure proceedings and additional costs for the property owner, such as attorney fees and court costs.

Can the lien be avoided?

Yes, the lien can often be avoided if the property owner addresses the payment issue promptly. Communication is key. The contractor or supplier typically prefers to resolve the matter amicably, so reaching out to discuss payment options can be beneficial for both parties.

Is legal representation necessary when dealing with a lien?

While it is not mandatory to have legal representation when dealing with a lien, it can be helpful, especially if the situation escalates. A lawyer can provide guidance on the best course of action and help navigate any legal complexities that may arise.

How to Use Intent To Lien Florida

After filling out the Intent to Lien form, the next step involves delivering the completed document to the property owner and, if applicable, the general contractor. It is essential to ensure that the form is served properly, as this can impact your rights regarding the lien. Keeping a copy of the notice for your records is also advisable.

- Begin by entering the Date at the top of the form.

- Fill in the Property Owner's Full Legal Name(s) in the designated space.

- Provide the Property Owner's Full Mailing Address below their name.

- If applicable, include the General Contractor's Full Legal Name(s) in the next section.

- Write the General Contractor's Full Mailing Address beneath their name.

- In the Re: section, briefly describe the project or the nature of the work.

- For the Property Description, enter the Street Address of the property.

- Next, provide the Legal Description of the property, which may require specific legal terms.

- Address the letter to the property owner by filling in their name in the salutation.

- In the body of the letter, indicate who is sending the notice, along with a brief statement of the work performed.

- Clearly state the amount owed for the work performed.

- Include a reminder about the timeline for payment and the consequences of non-payment.

- Sign the letter with your Name, Title, Phone Number, and Email Address.

- Complete the CERTIFICATE OF SERVICE section by filling in the date and the name of the person served.

- Indicate the method of delivery by checking the appropriate box.

- Finally, sign your name in the designated area.