Printable Independent Contractor Pay Stub Template

In the realm of freelance work and independent contracting, clear financial documentation is essential for both contractors and the businesses that hire them. The Independent Contractor Pay Stub form serves as a crucial tool in this regard, providing a transparent record of earnings for services rendered. This form typically includes vital details such as the contractor's name, the pay period, and the total amount earned, ensuring that all parties are on the same page regarding compensation. Additionally, it may outline deductions, if any, which can include taxes or fees, giving contractors a comprehensive view of their net earnings. By utilizing this pay stub, independent contractors can maintain organized financial records, which is particularly beneficial come tax season. Furthermore, businesses benefit from issuing pay stubs, as it fosters trust and accountability, making the payment process smoother and more professional. Understanding the components and importance of this form can empower both contractors and employers, paving the way for a more efficient working relationship.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to provide accurate personal details. This includes their name, address, and Social Security number. Any discrepancies can lead to issues with tax reporting and payment processing.

-

Misclassification of Employment Status: Some people mistakenly classify themselves as employees rather than independent contractors. This error can have significant tax implications and affect eligibility for certain benefits.

-

Omitting Payment Details: It is common for individuals to overlook entering the correct payment amount or the date of payment. Accurate financial information is essential for both the contractor and the payer to maintain clear records.

-

Failure to Include Deductions: Many contractors neglect to account for necessary deductions, such as taxes or insurance. This omission can lead to unexpected tax liabilities and financial confusion down the line.

Find Common Documents

Guardianship Paperwork - The form may differ based on state laws and local regulations.

Daycare Invoice - Clear documentation of services enhances trust between parties.

When engaging in the transfer of ownership for a mobile home, it is essential to utilize the correct documentation to avoid any legal issues. The Virginia Mobile Home Bill of Sale serves as a vital legal document that not only facilitates the transaction but also provides proof of ownership transfer. For your convenience, you can obtain the necessary documentation by accessing the Mobile Home Bill of Sale form, which outlines the essential details required for a smooth transfer, such as the buyer and seller's information, the mobile home's description, and the sale price.

Dvla Form - If your name or address has changed, you need to provide the previous information.

Key takeaways

When filling out and using the Independent Contractor Pay Stub form, keep these key takeaways in mind:

- Accurate Information: Ensure all personal and payment details are correct. This includes the contractor's name, address, and payment amount.

- Clear Payment Breakdown: Clearly outline the services provided and the corresponding payment for each. This helps in maintaining transparency.

- Tax Considerations: Remember that independent contractors are responsible for their own taxes. Include any necessary tax deductions if applicable.

- Payment Dates: Specify the date of payment. This helps both parties track when services were rendered and payments were made.

- Record Keeping: Keep a copy of the pay stub for your records. This is important for both financial tracking and tax purposes.

- Professional Format: Use a clean and professional layout. A well-organized pay stub reflects professionalism and can enhance trust.

- Contact Information: Include contact information for any questions or clarifications. This fosters communication between the contractor and the client.

- Review Regularly: Regularly review the pay stub process to ensure compliance with any changes in tax laws or payment practices.

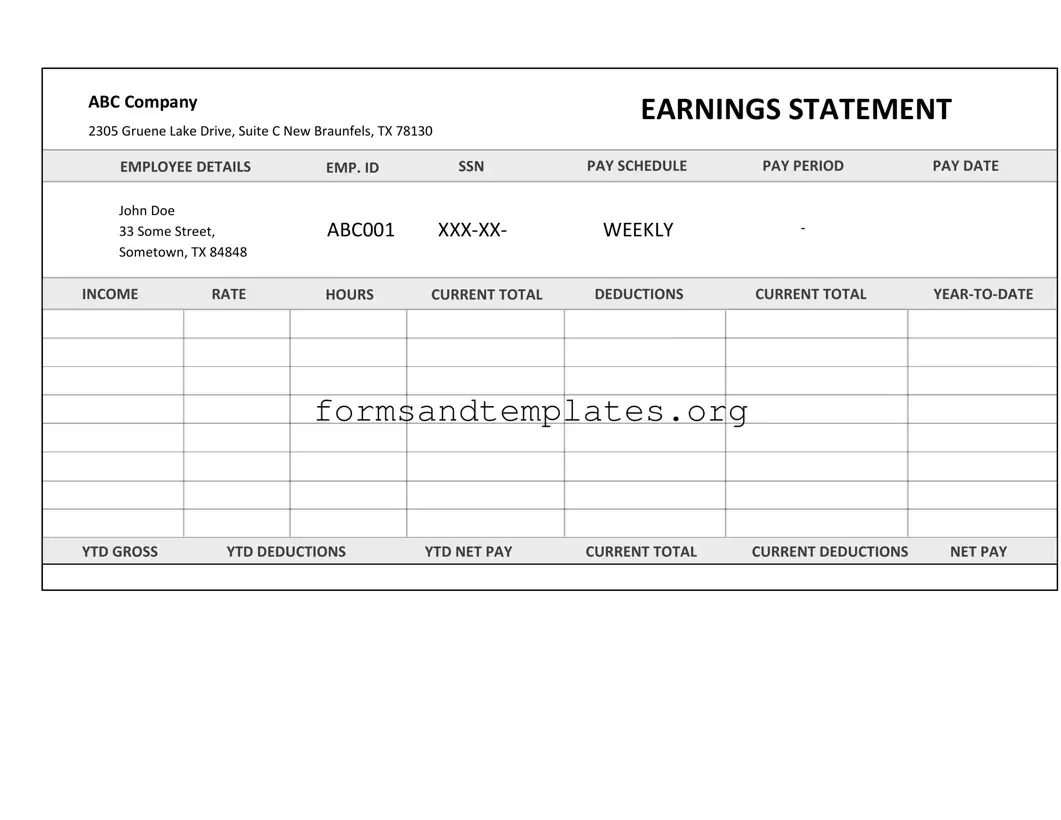

Independent Contractor Pay Stub Example

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Understanding Independent Contractor Pay Stub

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for an independent contractor during a specific pay period. It serves as a record of payment and can be used for tax purposes, helping contractors track their income and expenses.

Who should use the Independent Contractor Pay Stub?

This pay stub is designed for independent contractors who provide services to clients or businesses. If you are self-employed or work on a contract basis, utilizing this form can help you maintain accurate financial records.

What information is included in the pay stub?

The pay stub typically includes the following information:

- Your name and contact information

- The client's name and contact information

- Pay period dates

- Total earnings for the period

- Any deductions (e.g., taxes, fees)

- Net pay after deductions

How do I fill out the Independent Contractor Pay Stub?

To complete the pay stub, follow these steps:

- Enter your personal information at the top of the form.

- Provide the client's details.

- Specify the pay period for which you are reporting earnings.

- List your total earnings and any deductions.

- Calculate the net pay and review for accuracy.

Can I customize the Independent Contractor Pay Stub?

Yes, you can customize the pay stub to fit your needs. While it is important to include all necessary information, you may choose to add additional details that are relevant to your work or preferences.

How often should I issue a pay stub?

The frequency of issuing pay stubs depends on your payment schedule with clients. Common practices include weekly, bi-weekly, or monthly pay stubs. It is advisable to provide them consistently to maintain clear records.

Is the Independent Contractor Pay Stub required by law?

While there is no federal law requiring independent contractors to issue pay stubs, doing so is highly recommended. It provides clarity and transparency for both the contractor and the client, and it can be beneficial for tax reporting purposes.

Where can I obtain an Independent Contractor Pay Stub form?

You can find Independent Contractor Pay Stub forms online, often available for free or for purchase from various websites. Additionally, many accounting software programs offer templates that can be easily customized to your needs.

How to Use Independent Contractor Pay Stub

When it comes to managing payments for independent contractors, filling out the pay stub form accurately is crucial. This ensures that both the contractor and the hiring party have a clear record of the work completed and the payment made. Follow these steps to fill out the Independent Contractor Pay Stub form correctly.

- Start with the Contractor's Information: Fill in the contractor's name, address, and contact details at the top of the form.

- Enter the Pay Period: Specify the start and end dates for the work period being compensated.

- Detail the Work Description: Provide a brief description of the services rendered during the pay period.

- Include Payment Information: Indicate the total amount earned for the pay period.

- List Deductions: If applicable, note any deductions taken from the total amount, such as taxes or fees.

- Calculate Net Pay: Subtract any deductions from the total amount earned to determine the net pay.

- Sign and Date: The contractor should sign and date the form to confirm the accuracy of the information provided.

By following these steps, the Independent Contractor Pay Stub form will be filled out correctly, ensuring clarity and accuracy in payment records.