Printable Goodwill donation receipt Template

The Goodwill donation receipt form serves as a vital document for individuals and organizations alike, facilitating the process of charitable giving while ensuring proper record-keeping. This form is typically issued to donors upon making a contribution of goods or clothing to Goodwill Industries, a nonprofit organization dedicated to providing job training and employment services. It includes essential details such as the donor's name, the date of the donation, and a description of the items contributed. Importantly, the receipt does not assign a monetary value to the donated items; instead, it allows the donor to assess the fair market value for tax deduction purposes. Donors must keep this receipt for their records, as it may be required during tax season to substantiate charitable contributions. By providing a clear and concise acknowledgment of the donation, the Goodwill donation receipt form not only promotes transparency but also encourages ongoing support for the organization's mission to empower individuals through work and education.

Common mistakes

-

Not providing a detailed description of donated items: Many individuals simply list "clothes" or "household items" without specifying what those items are. A more detailed description helps in accurately valuing the donation.

-

Failing to estimate the value of items: Donors often overlook the importance of estimating the fair market value of their donations. This information is crucial for tax purposes and should be included on the receipt.

-

Neglecting to keep a copy of the receipt: Some donors forget to retain a copy of the receipt for their records. This can lead to difficulties when filing taxes or verifying the donation later on.

-

Not signing the receipt: A common oversight is failing to sign the receipt. A signature confirms the donation and is necessary for it to be considered valid.

Find Common Documents

Rochdale Village Income Requirements - Participate in community gardening programs and green initiatives.

Consider establishing a reliable Durable Power of Attorney to ensure that your financial and legal decisions are managed effectively in the event of incapacity. This document empowers a trusted individual to act on your behalf, safeguarding your interests. For further details on how to complete and submit the form, visit our guide on the important Durable Power of Attorney process.

Miscellaneous Information - The 1099-MISC is particularly important for self-employed individuals and side hustlers.

Affidavit of Death of Joint Tenant - The process of completing this form can help bring closure after a trustee's passing.

Key takeaways

When donating items to Goodwill, it's essential to understand how to properly fill out and use the donation receipt form. Here are some key takeaways to keep in mind:

- Keep a Record: Always retain a copy of your donation receipt for your records. This will help you when filing taxes or tracking your charitable contributions.

- Itemize Your Donations: List each item you donate, along with its estimated value. This detail can be helpful for tax deductions.

- Understand Valuation: Familiarize yourself with how to estimate the fair market value of your items. Goodwill provides guidelines to assist with this process.

- Sign and Date: Ensure you sign and date the receipt. This adds authenticity to your donation and confirms the transaction.

- Check for Accuracy: Before leaving, double-check that all information on the receipt is correct. Mistakes can lead to issues later.

- Use for Tax Deductions: Donations to Goodwill are tax-deductible. Use your receipt to claim these deductions when filing your taxes.

- Follow Local Guidelines: Be aware that some states may have specific requirements regarding donation receipts. Always check local regulations.

By following these steps, you can ensure that your donation process is smooth and beneficial for both you and Goodwill.

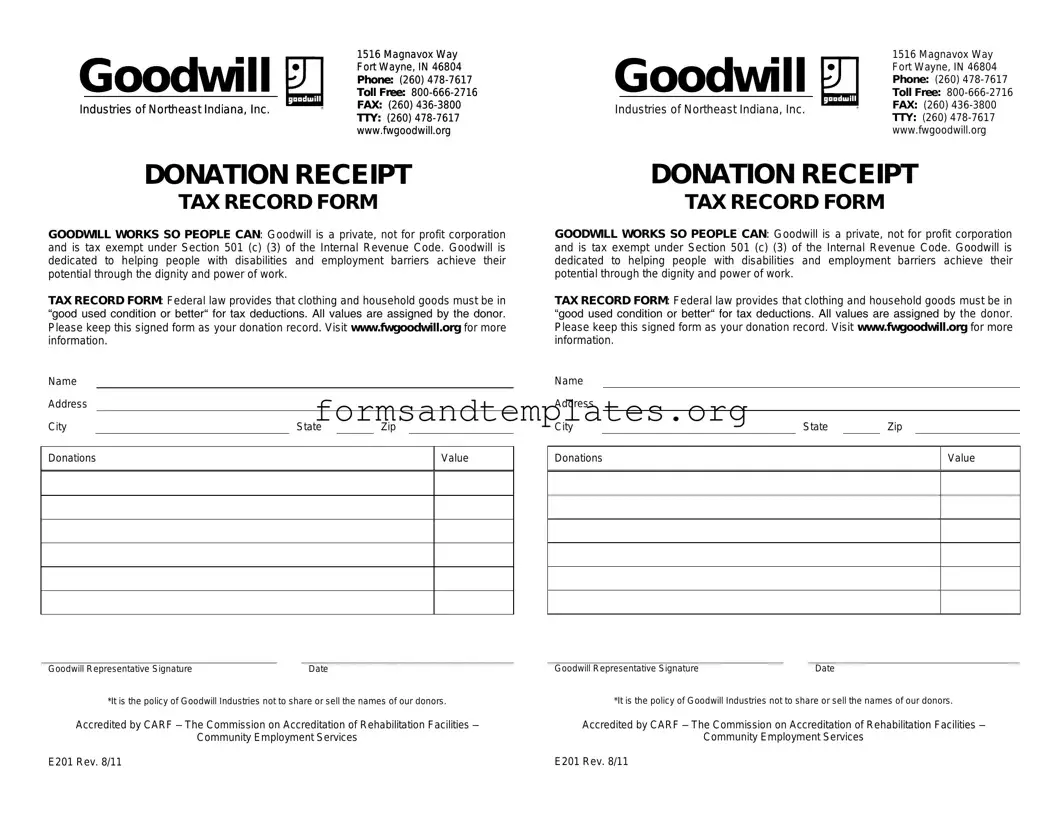

Goodwill donation receipt Example

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Understanding Goodwill donation receipt

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided to donors when they make a charitable contribution to Goodwill Industries. This receipt serves as proof of the donation and can be used for tax purposes. It typically includes details such as the date of the donation, a description of the items donated, and the estimated value of those items.

Why do I need a Goodwill donation receipt?

Having a Goodwill donation receipt is important for several reasons:

- It provides documentation for tax deductions. Donors can claim a deduction for charitable contributions on their tax returns, and the receipt serves as proof of the donation.

- It helps track your charitable giving. Keeping records of donations can assist in managing your finances and understanding your contributions over time.

- It supports Goodwill's mission. By documenting your donations, you contribute to Goodwill's ability to provide job training and employment services to individuals in need.

How do I obtain a Goodwill donation receipt?

You can obtain a Goodwill donation receipt in several ways:

- When you drop off your items at a Goodwill location, staff members will usually provide a receipt on the spot.

- If you schedule a pick-up for your donations, the driver will provide a receipt at the time of collection.

- You can also request a receipt from Goodwill’s website or customer service if you have made a donation but did not receive one.

What information is included on the receipt?

A typical Goodwill donation receipt includes:

- The date of the donation

- A description of the items donated (e.g., clothing, furniture, household goods)

- An estimated value of the items (though donors should assess the value themselves)

- The name and address of the Goodwill location receiving the donation

Can I estimate the value of my donated items?

Yes, donors are responsible for estimating the value of their donated items. Goodwill does not assign a value but may provide guidelines on how to determine the fair market value of items. Resources like thrift store pricing guides or online valuation tools can be helpful in this process.

What if I lose my Goodwill donation receipt?

If you lose your Goodwill donation receipt, it may be challenging to claim a tax deduction for that donation. However, you can contact the Goodwill location where you made the donation. They may be able to provide a duplicate receipt or help you verify your donation through their records.

Is there a limit on how much I can donate to Goodwill?

There is no specific limit on how much you can donate to Goodwill. However, for tax deduction purposes, the IRS does have guidelines on how much you can deduct based on your income and the value of your donations. It’s advisable to keep detailed records of all donations, especially if they exceed a certain amount.

How can I use my Goodwill donation receipt for tax purposes?

To use your Goodwill donation receipt for tax purposes, follow these steps:

- Keep the receipt with your tax records for the year you made the donation.

- When filing your taxes, report the total value of your donations on Schedule A if you are itemizing deductions.

- Be prepared to provide the receipt if requested by the IRS, especially for larger donations.

How to Use Goodwill donation receipt

Once you have gathered your items for donation, it is important to accurately fill out the Goodwill donation receipt form. This receipt serves as documentation for your charitable contribution, which may be useful for tax purposes. Follow these steps to ensure the form is completed correctly.

- Begin by writing the date of the donation at the top of the form.

- Enter your name and address in the designated fields. This information is necessary for record-keeping.

- List the items you are donating. Be specific about each item, including quantity and condition.

- Assign a fair market value to each item. This value should reflect what you believe the items are worth at a thrift store.

- Sign the form to certify that the information provided is accurate. This step is crucial for validating your donation.

- Keep a copy of the completed receipt for your records. This will be important when filing your taxes.