Printable Gift Letter Template

The Gift Letter form plays a crucial role in the world of real estate transactions, particularly for homebuyers who receive financial assistance from family or friends. This document serves as a formal declaration that the funds provided are indeed a gift, not a loan, which can significantly impact mortgage approval processes. By clearly stating the donor's intent, the Gift Letter helps lenders assess the buyer's financial situation more accurately. Essential components of the form typically include the donor's name, relationship to the recipient, the amount of the gift, and a statement affirming that repayment is not expected. Additionally, some lenders may require the donor's signature, further validating the authenticity of the gift. Understanding the nuances of this form is vital for both buyers and their supporters, as it can facilitate a smoother transaction and help avoid potential complications down the line.

Common mistakes

-

Not Including the Donor's Information: Many people forget to provide the full name, address, and contact information of the person giving the gift. This information is crucial for verification purposes.

-

Omitting the Recipient's Information: The recipient's details should also be clearly stated. This includes their full name and address, which helps establish the relationship between the donor and recipient.

-

Failing to Specify the Gift Amount: Clearly stating the amount of the gift is essential. Without this, lenders may question the legitimacy of the funds.

-

Not Indicating the Purpose of the Gift: It’s important to mention that the funds are a gift and not a loan. This distinction helps avoid misunderstandings during the mortgage approval process.

-

Ignoring Signature Requirements: Both the donor and recipient must sign the letter. A missing signature can lead to delays or rejection of the application.

-

Using Incorrect Dates: All dates in the letter should be accurate. Inaccurate or missing dates can raise red flags during the review process.

-

Not Providing Additional Documentation: Some lenders may require proof of the donor's ability to give the gift. Failing to include bank statements or other documentation can complicate matters.

-

Making it Vague: The language used in the letter should be clear and straightforward. Ambiguity can lead to misunderstandings and complications.

-

Neglecting to Mention Relationship: It's helpful to specify the relationship between the donor and recipient. This context can provide additional assurance to lenders.

-

Not Keeping a Copy: Always retain a copy of the gift letter for personal records. This can be useful for future reference or in case any issues arise.

Find Common Documents

Tst Medical Abbreviation - This form is used to document the Tuberculosis (TB) skin test procedure.

For those looking to secure a rental space in Georgia, understanding the Georgia Lease Agreement essentials can be invaluable. This document serves as a crucial foundation for the landlord-tenant relationship, outlining responsibilities and expectations for both parties. Ensuring you are well-informed about the terms can lead to a smoother leasing experience.

Guardianship Paperwork - It is possible to request special provisions for the child’s care in the form.

Lyft Rideshare Inspection Form - Document the presence of all required safety equipment.

Key takeaways

When filling out and using a Gift Letter form, it’s important to keep several key points in mind. These takeaways can help ensure that the process goes smoothly and that all necessary information is included.

- Understand the Purpose: A Gift Letter is typically used to document a financial gift, especially in real estate transactions. It clarifies that the money is a gift and not a loan.

- Include Essential Information: The form should include details such as the donor's name, address, relationship to the recipient, and the amount of the gift.

- Signatures Matter: Both the donor and the recipient should sign the letter. This adds credibility and confirms that both parties agree on the nature of the transaction.

- Be Honest: Ensure that all information provided is accurate. Misrepresenting a gift can lead to complications, especially during mortgage underwriting.

- Check Lender Requirements: Different lenders may have specific requirements regarding Gift Letters. Always verify what your lender needs to avoid delays.

By following these key takeaways, you can navigate the Gift Letter process with confidence and clarity.

Gift Letter Example

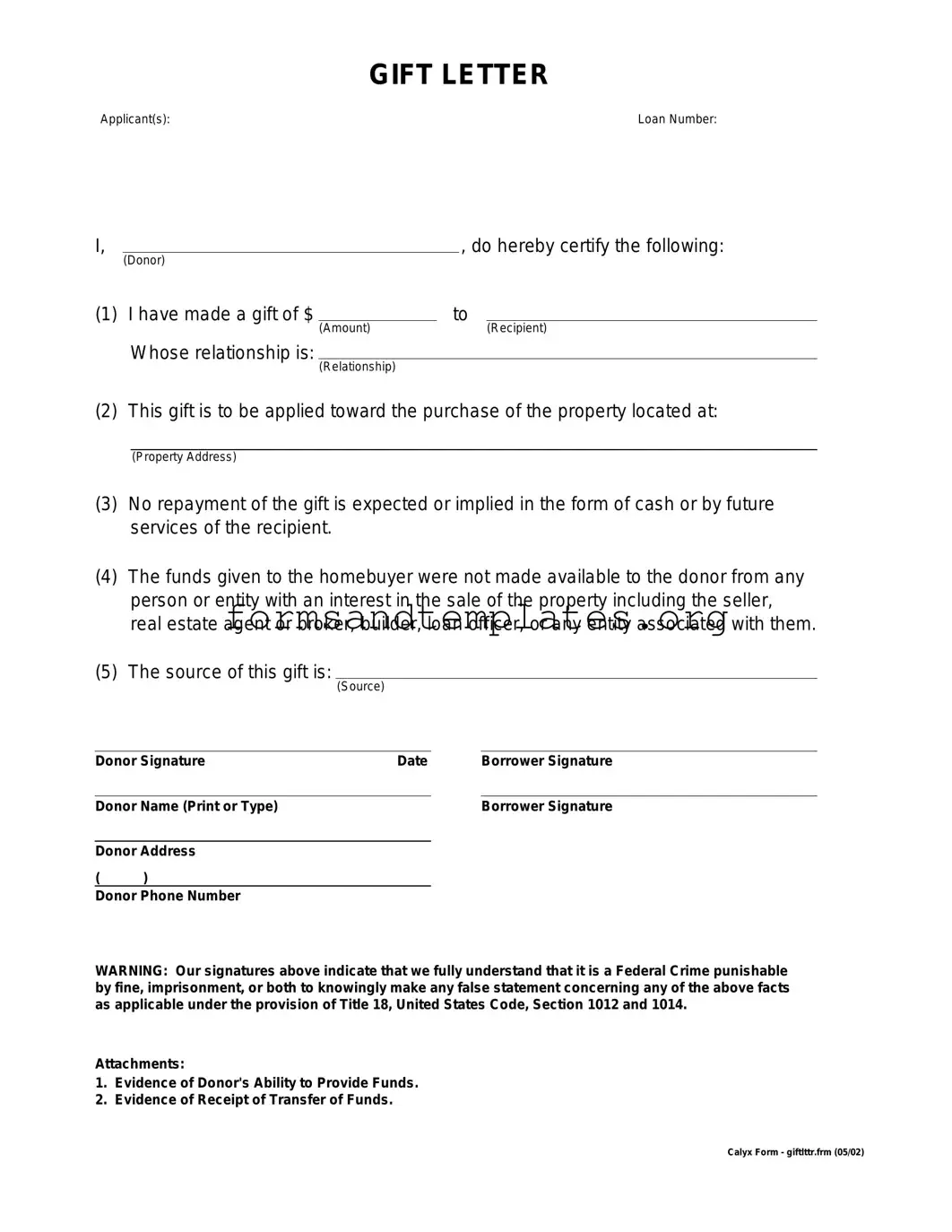

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Understanding Gift Letter

What is a Gift Letter form?

A Gift Letter form is a document that outlines the details of a monetary gift given to someone, typically for a home purchase. It serves as proof that the funds are a gift and not a loan, which is important for lenders during the mortgage approval process.

Why is a Gift Letter form necessary?

Lenders require a Gift Letter form to ensure that the funds provided for a home purchase are indeed a gift. This helps them determine the buyer's financial stability and prevents issues related to undisclosed debt. The letter confirms that the donor does not expect repayment.

Who can give a gift for a home purchase?

Generally, family members, close friends, or relatives can provide a gift for a home purchase. Lenders may have specific guidelines about who qualifies as an acceptable donor, so it’s important to check with the lender before proceeding.

What information should be included in a Gift Letter form?

A Gift Letter should include:

- The donor's name, address, and relationship to the recipient

- The recipient's name and address

- The amount of the gift

- A statement confirming that the funds are a gift and do not need to be repaid

- The date the gift was given

- The donor's signature

Can I use a Gift Letter for any type of loan?

Not all loans allow for gift funds. Most commonly, conventional and FHA loans accept gift letters, but it's essential to verify with your lender. Some loan programs may have restrictions or specific requirements regarding the use of gift funds.

Do I need to provide proof of the gift?

Yes, lenders often require additional documentation to verify the gift. This might include bank statements from the donor showing the withdrawal of funds and the recipient's account showing the deposit. This helps confirm the legitimacy of the transaction.

Is there a limit on how much I can receive as a gift?

While there is no specific limit on the amount you can receive as a gift, lenders may have guidelines that affect how much can be counted towards your down payment. For instance, certain loan types may require a portion of your own funds in addition to any gift funds.

How does a Gift Letter affect my mortgage application?

A properly completed Gift Letter can strengthen your mortgage application by showing lenders that you have additional support for your down payment. It can help you qualify for a loan more easily, as it demonstrates financial assistance without increasing your debt burden.

Can I use a Gift Letter if I’m refinancing?

Typically, Gift Letters are used for home purchases rather than refinancing. However, if you are refinancing and receiving a gift to help with closing costs, it's best to consult your lender. They can provide guidance on whether a Gift Letter is appropriate in that situation.

How to Use Gift Letter

Filling out a Gift Letter form is an important step in documenting the financial support you are receiving. This process ensures clarity and transparency in your financial transactions. Once the form is completed, you will be able to present it to relevant parties, such as lenders or financial institutions, as proof of the gift.

- Begin by entering the date at the top of the form.

- Provide the name and address of the donor, who is giving the gift.

- Clearly state the recipient’s name and address, the person receiving the gift.

- Indicate the amount of the gift in the designated section.

- Include a brief description of the purpose of the gift, if required.

- Have the donor sign the form to validate the gift.

- Ensure that the donor provides their contact information, including phone number and email address.

- Review the completed form for accuracy before submission.

Once you have filled out the form, make sure to keep a copy for your records. This documentation may be necessary for future reference or financial transactions.