Attorney-Verified Gift Deed Template

When it comes to transferring property or assets without the exchange of money, a Gift Deed form plays a crucial role. This legal document outlines the intent of the donor to give a gift to the recipient, known as the donee. It typically includes essential details such as the description of the property, the identities of both parties, and any conditions attached to the gift. Importantly, the Gift Deed must be signed and often requires witnesses to validate the transaction. Understanding the nuances of this form is vital, as it ensures that both the giver and receiver are protected under the law. Additionally, it can have tax implications, so being informed about potential liabilities is key. Whether you’re considering gifting real estate, personal property, or financial assets, knowing how to properly execute a Gift Deed can simplify the process and provide peace of mind.

Common mistakes

-

Incomplete Information: Many people forget to fill out all required fields. Each section of the Gift Deed form is important. Missing information can lead to delays or complications in the process.

-

Incorrect Property Description: Failing to accurately describe the property being gifted is a common error. The legal description should be clear and precise to avoid confusion or disputes later.

-

Not Including Witnesses: Some individuals overlook the requirement for witnesses. A Gift Deed typically needs to be signed in the presence of at least one witness. This step is crucial for the validity of the deed.

-

Forgetting to Notarize: Neglecting to have the document notarized can invalidate the Gift Deed. Notarization adds an extra layer of authenticity and can prevent future legal challenges.

-

Ignoring State-Specific Requirements: Each state may have unique rules regarding Gift Deeds. Failing to research and comply with these specific regulations can lead to issues down the line.

-

Not Keeping Copies: After filling out the form, some forget to make copies of the Gift Deed. Keeping a copy for personal records is essential for reference and proof of the gift in the future.

Create Popular Types of Gift Deed Templates

Quitclaim Deed Form New Jersey - It is advisable to consult a real estate professional when using it.

When engaging in a vehicle transaction, having a properly completed California Motor Vehicle Bill of Sale is crucial to avoid any misunderstandings. This document not only facilitates the transfer of ownership but also serves as a safeguard for both the buyer and seller. To simplify this process, you can access the necessary template by visiting California Templates, ensuring that all vital information is captured accurately.

Correction Deed Form California - It addresses errors in property descriptions.

Key takeaways

Filling out a Gift Deed form is an important process for transferring property or assets without any exchange of money. Here are some key takeaways to consider:

- Understand the Purpose: A Gift Deed serves to legally document the transfer of ownership from one person to another without compensation.

- Identify the Parties: Clearly state the names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Describe the Gift: Provide a detailed description of the property or asset being gifted, including its location and any relevant identification numbers.

- Include Intent: The donor must express a clear intention to give the gift without expecting anything in return.

- Signatures Required: Both the donor and the recipient should sign the document. In some cases, witnesses may also need to sign.

- Consider Notarization: While not always required, having the Gift Deed notarized can add an extra layer of legitimacy and help prevent disputes.

- File Appropriately: Depending on the type of gift, you may need to file the Gift Deed with local government offices, especially for real estate transfers.

- Tax Implications: Be aware of potential gift tax implications. Gifts above a certain value may need to be reported to the IRS.

By following these guidelines, you can ensure that your Gift Deed is filled out correctly and serves its intended purpose effectively.

Gift Deed Example

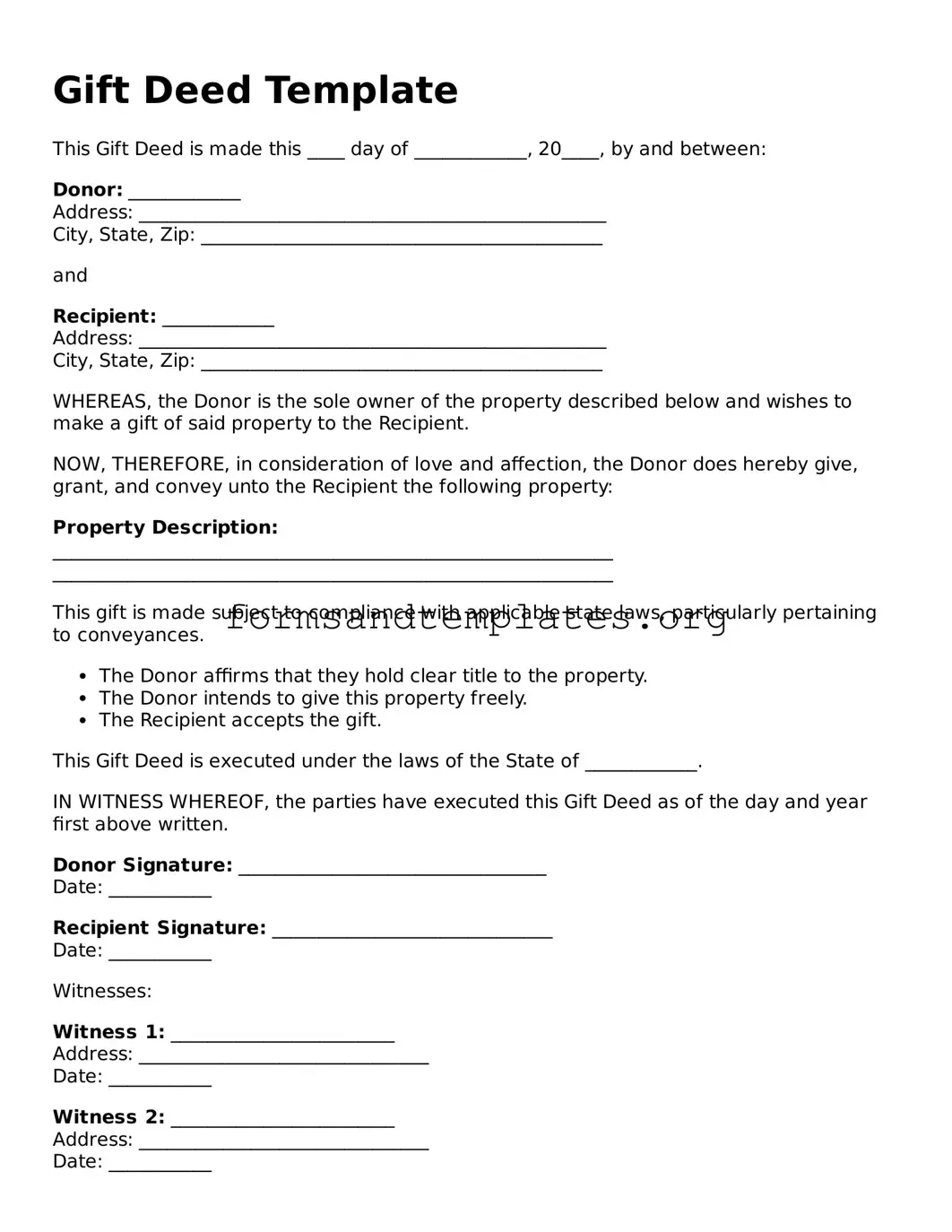

Gift Deed Template

This Gift Deed is made this ____ day of ____________, 20____, by and between:

Donor: ____________

Address: __________________________________________________

City, State, Zip: ___________________________________________

and

Recipient: ____________

Address: __________________________________________________

City, State, Zip: ___________________________________________

WHEREAS, the Donor is the sole owner of the property described below and wishes to make a gift of said property to the Recipient.

NOW, THEREFORE, in consideration of love and affection, the Donor does hereby give, grant, and convey unto the Recipient the following property:

Property Description:

____________________________________________________________

____________________________________________________________

This gift is made subject to compliance with applicable state laws, particularly pertaining to conveyances.

- The Donor affirms that they hold clear title to the property.

- The Donor intends to give this property freely.

- The Recipient accepts the gift.

This Gift Deed is executed under the laws of the State of ____________.

IN WITNESS WHEREOF, the parties have executed this Gift Deed as of the day and year first above written.

Donor Signature: _________________________________

Date: ___________

Recipient Signature: ______________________________

Date: ___________

Witnesses:

Witness 1: ________________________

Address: _______________________________

Date: ___________

Witness 2: ________________________

Address: _______________________________

Date: ___________

Understanding Gift Deed

What is a Gift Deed?

A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another person without any exchange of money. This can include real estate, personal property, or other valuable items. The donor (the person giving the gift) voluntarily transfers their rights to the recipient (the person receiving the gift). It's a formal way to document the intent to give and ensure that the transfer is recognized legally.

Do I need to pay taxes on a gift made through a Gift Deed?

Generally, gifts are not considered taxable income for the recipient. However, the donor may be subject to gift tax if the value of the gift exceeds a certain threshold set by the IRS. For 2023, this threshold is $17,000 per recipient. If the gift exceeds this amount, the donor may need to file a gift tax return. Always consult a tax professional to understand the implications specific to your situation.

What information is required to complete a Gift Deed?

To complete a Gift Deed, you typically need the following information:

- The full names and addresses of both the donor and the recipient.

- A clear description of the property or assets being gifted.

- The date of the gift.

- Any conditions or terms related to the gift, if applicable.

Having this information ready will help streamline the process and ensure that the deed is properly executed.

Is it necessary to have the Gift Deed notarized?

While not always required, having a Gift Deed notarized is highly recommended. Notarization adds an extra layer of authenticity and can help prevent disputes in the future. Some states may have specific requirements regarding notarization, especially for real estate gifts. Check local laws to ensure compliance and to protect both parties involved in the transaction.

How to Use Gift Deed

Once you have your Gift Deed form ready, it’s important to fill it out carefully to ensure that all information is accurate. This will help prevent any potential issues in the future. Below are the steps you should follow to complete the form effectively.

- Begin by entering the date at the top of the form. This should be the date when the gift is being made.

- In the first section, provide the full name and address of the person giving the gift (the donor).

- Next, fill in the recipient's (the donee's) full name and address in the designated area.

- Clearly describe the gift being transferred. Include details such as the type of property, its location, and any identifying information.

- Indicate whether the gift is being made with any conditions or if it is an outright gift. If there are conditions, specify them clearly.

- Both the donor and the donee should sign the form. Make sure that signatures are dated appropriately.

- If required, have the form notarized. This adds an extra layer of validity and may be necessary in your state.

- Finally, make copies of the completed form for both parties’ records.

After completing the form, ensure that all parties understand the implications of the gift. It’s advisable to keep a copy of the signed document in a safe place, as it may be needed for future reference.