Printable Generic Direct Deposit Template

When it comes to managing your finances efficiently, the Generic Direct Deposit form is an essential tool that simplifies the process of receiving payments directly into your bank account. This form is designed to facilitate the authorization of electronic deposits, whether for payroll, expense reimbursements, or other payments. Key components of the form include personal identification details such as your name and Social Security number, as well as critical banking information like your account number and routing transit number. It's important to ensure that all fields are accurately filled out, including the type of account—either savings or checking. The form also requires your signature to authorize the financial institution to initiate credit entries and, if necessary, make adjustments for any errors. Additionally, if the account is a joint account, consent from the co-owner is required. Completing this form correctly not only streamlines your payment process but also ensures that your funds are securely deposited without delay. Remember to verify your account details with your bank before submission to avoid any complications.

Common mistakes

-

Leaving boxes blank: It's crucial to fill in all boxes on the form. Missing information can lead to delays or errors in processing your direct deposit.

-

Incorrect account numbers: Double-check your account number. Including hyphens is important, but omitting spaces and special symbols is equally vital.

-

Wrong routing transit number: Ensure that all nine boxes of the routing number are filled. The first two digits must fall between 01-12 or 21-32. A wrong routing number can send your funds to the wrong bank.

-

Not verifying with the bank: Before submitting the form, call your financial institution. Confirm that they accept direct deposits and that the information provided is accurate.

-

Neglecting to sign: Forgetting to sign the form is a common mistake. Your signature is necessary to authorize the deposit, so don’t overlook this step.

-

Using a deposit slip: Some people mistakenly use a deposit slip to verify their routing number. This can lead to errors, as the routing number on a deposit slip may differ from the one needed for direct deposits.

-

Joint accounts: If the account is joint or in someone else's name, remember that the other account holder must also sign the form. Failing to do so can complicate the process.

-

Not keeping a copy: After filling out the form, always make a copy for your records. This ensures you have a reference in case any issues arise later.

Find Common Documents

Form W3 - The form serves as a transmittal for W-2 information for employers with multiple employees.

For those navigating the intricacies of motorcycle sales, the informative resource on the important Motorcycle Bill of Sale process can be invaluable in ensuring a smooth transaction.

Profit and Loss Balance Sheet Template - This form helps clarify the impact of expenses on net income.

Sch C - This form supports the accountability of self-employed income generation.

Key takeaways

Filling out the Generic Direct Deposit form is a straightforward process, but attention to detail is crucial. Here are some key takeaways to ensure a smooth experience:

- Complete All Fields: Make sure to fill in every box on the form. Missing information can delay your direct deposit setup.

- Provide Accurate Information: Double-check your Social Security number, account number, and routing transit number for accuracy.

- Choose the Right Account Type: Indicate whether your account is a savings or checking account. This is essential for proper processing.

- Signature Required: Sign and date the form to authorize the transactions. Without your signature, the form is not valid.

- Joint Accounts: If the account is joint or belongs to someone else, that individual must also sign the form to authorize the deposit.

- Contact Your Bank: It’s a good idea to call your financial institution to confirm that they accept direct deposits.

- Verify Routing and Account Numbers: Use your bank’s official documentation to check your routing and account numbers, not a deposit slip.

- Understand the Effective Date: Specify the effective date for the direct deposit. This will determine when the deposits will start.

- Keep a Copy: After completing the form, retain a copy for your records. This will be useful for future reference.

By following these takeaways, you can ensure that your direct deposit is set up correctly and efficiently. Taking the time to fill out the form accurately will save you from potential headaches down the line.

Generic Direct Deposit Example

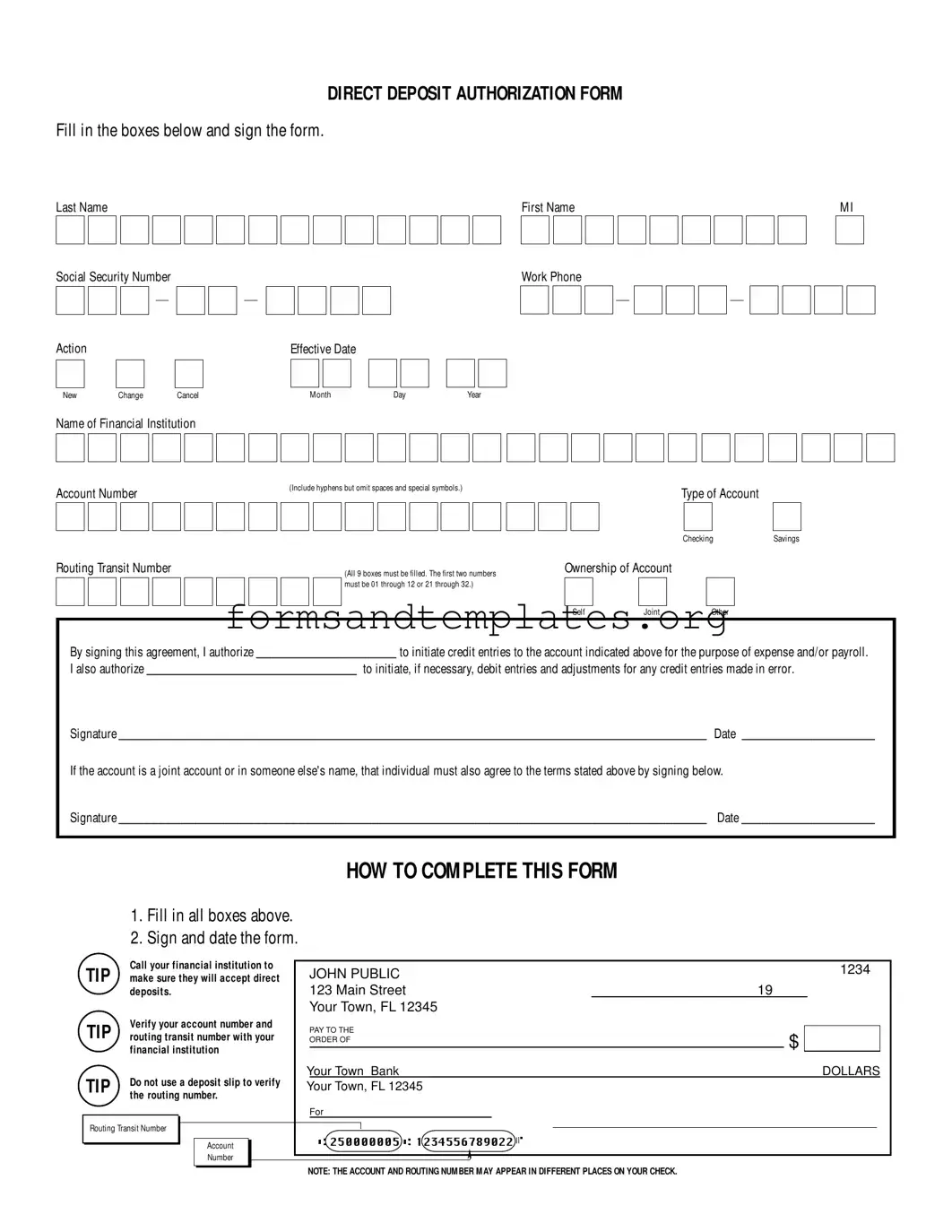

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

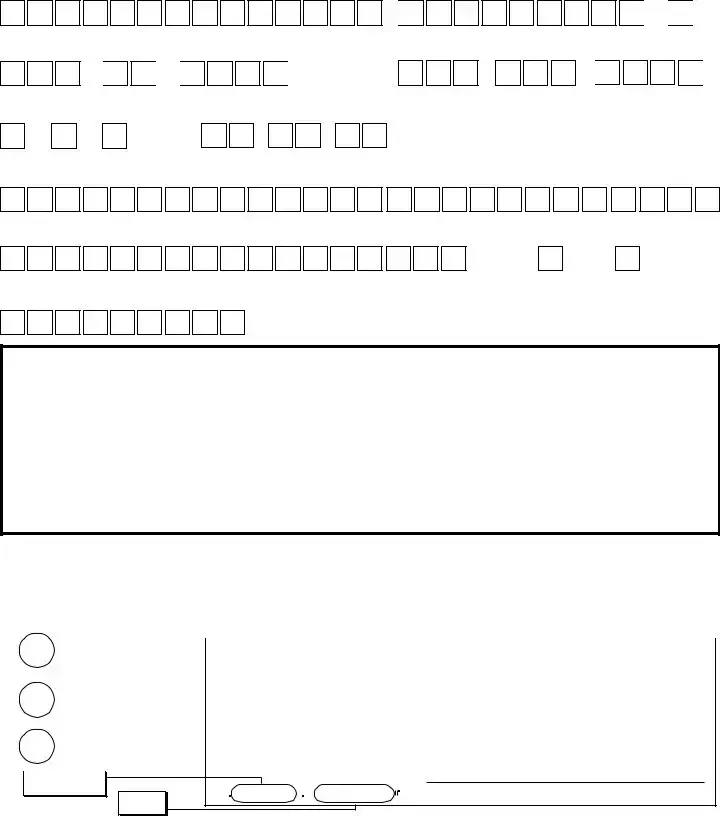

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Understanding Generic Direct Deposit

-

What is the Generic Direct Deposit form?

-

The Generic Direct Deposit form is a document that allows you to authorize your employer or another organization to deposit funds directly into your bank account. This is often used for payroll, expense reimbursements, or other payments. By using this form, you streamline the payment process and ensure timely deposits without needing paper checks.

-

How do I fill out the Generic Direct Deposit form?

-

Filling out the form is straightforward. Here’s how to do it:

- Enter your last name, first name, and middle initial in the designated boxes.

- Provide your Social Security Number.

- Select the action you want to take: New, Change, or Cancel.

- Fill in the effective date for the changes.

- Include your work phone number.

- Write the name of your financial institution and your account number.

- Choose the type of account: Savings or Checking.

- Fill in the routing transit number, ensuring all nine boxes are filled correctly.

- Indicate the ownership of the account.

- Sign and date the form.

-

What is a routing transit number?

-

A routing transit number is a unique nine-digit code that identifies your bank or credit union. It is essential for processing direct deposits and other transactions. Make sure to verify this number with your financial institution to avoid any issues.

-

What should I do if I have a joint account?

-

If you have a joint account, both account holders must agree to the terms of the direct deposit. This means that both parties need to sign the form. Make sure to discuss this with your co-account holder before submitting the form.

-

Can I use a deposit slip to verify my routing number?

-

No, it is not advisable to use a deposit slip for verification. Instead, contact your financial institution directly to confirm your routing transit number and account number. This ensures you have the correct information for your direct deposit.

-

How long does it take for direct deposit to start?

-

The time it takes for direct deposit to begin can vary. Generally, it may take one to two pay cycles for the setup to process. It’s best to check with your employer or the organization initiating the deposits for specific timelines.

-

What should I do if I change banks?

-

If you change banks, you need to complete a new Generic Direct Deposit form. Make sure to provide the new bank's name, your new account number, and the new routing transit number. Notify your employer or the organization making the deposits as soon as possible to prevent any interruptions.

-

What happens if I make a mistake on the form?

-

If you make a mistake, it’s important to correct it before submitting the form. Double-check all entries, especially the routing and account numbers. If you realize there’s an error after submission, contact your employer or the organization immediately to rectify the situation.

-

Is my information secure on the Generic Direct Deposit form?

-

Yes, your information is generally secure when you submit the Generic Direct Deposit form to your employer or organization. However, always ensure that you are submitting it through secure channels. Be cautious about sharing sensitive information and only provide it to trusted sources.

How to Use Generic Direct Deposit

After completing the Generic Direct Deposit form, you will submit it to your employer or the designated financial department. Ensure that all information is accurate to avoid any delays in processing your direct deposit request.

- Fill in your last name, first name, and middle initial in the designated boxes.

- Enter your Social Security Number in the format: XXX-XX-XXXX.

- Select the action you wish to take: New, Change, or Cancel.

- Provide the effective date by filling in the month, day, and year.

- Input your work phone number in the format: XXX-XXX-XXXX.

- Write the name of your financial institution in the appropriate box.

- Fill in your account number, including hyphens, but omit spaces and special symbols.

- Select the type of account: Savings or Checking.

- Enter the Routing Transit Number, ensuring all 9 boxes are filled and the first two numbers are between 01-12 or 21-32.

- Indicate the ownership of the account by selecting Self, Joint, or Other.

- Sign the form where indicated, and include the date of your signature.

- If applicable, have the other account holder sign the form and date it as well.

It is advisable to call your financial institution to confirm they will accept direct deposits. Additionally, verify your account number and routing transit number with them, but do not use a deposit slip for this verification.