Printable Florida Financial Affidavit Short 12.902(b) Template

The Florida Financial Affidavit Short 12.902(b) form plays a crucial role in family law cases, particularly during divorce proceedings. This form is designed to provide a concise overview of an individual's financial situation, helping the court make informed decisions regarding alimony, child support, and asset division. It requires the disclosure of income, expenses, assets, and liabilities, allowing both parties to present a clear picture of their financial circumstances. The form is streamlined for those with simpler financial situations, making it easier to complete compared to the long version. Accuracy is essential, as any discrepancies can lead to complications in the legal process. By filling out the 12.902(b) form, individuals ensure that their financial information is transparent, which can facilitate fair negotiations and settlements. Understanding how to properly fill out this form is vital for anyone navigating the complexities of family law in Florida.

Common mistakes

-

Incomplete Information: One of the most common mistakes is not filling out all required sections of the form. Each question must be answered thoroughly to provide a clear picture of your financial situation.

-

Inaccurate Figures: Double-checking the numbers is essential. Mistakes in income, expenses, or asset values can lead to misunderstandings or disputes later on.

-

Neglecting to Update: Financial situations can change. Failing to update the affidavit with recent income changes, new expenses, or asset acquisitions can result in outdated information being presented.

-

Forgetting Supporting Documents: Many people overlook the importance of attaching necessary documents, such as pay stubs, tax returns, or bank statements, which can help substantiate the information provided.

-

Misunderstanding Definitions: It's crucial to understand what terms like "income" and "expenses" mean in the context of the form. Misinterpretations can lead to incorrect reporting.

-

Omitting Liabilities: Some individuals mistakenly leave out debts or liabilities. Including all financial obligations is vital for a complete and accurate representation of one’s financial status.

-

Rounding Off Numbers: Precision is key when filling out the affidavit. Rounding off figures may seem harmless, but it can lead to significant discrepancies over time.

-

Not Seeking Help: Many individuals attempt to fill out the form without assistance. Consulting with a professional can provide clarity and ensure that everything is filled out correctly.

Find Common Documents

Asurion Phone - Asurion F-017-08 MEN encourages thorough documentation of concerns.

For a seamless experience when transferring ownership, it's important to review our guide on the crucial elements involved in a Trailer Bill of Sale document. To gain further insights, please visit this resource on Trailer Bill of Sale.

What Happens When a Joint Tenant Dies in California - Property details in the form help local authorities update public records.

What Does a Esa Letter Look Like - The letter generally needs to be updated annually to reflect current mental health assessments.

Key takeaways

Filling out the Florida Financial Affidavit Short 12.902(b) form is an important step in various legal proceedings, especially in family law cases. Here are some key takeaways to keep in mind:

- Accuracy is Essential: Ensure that all information is correct and reflects your current financial situation. Inaccuracies can lead to complications in your case.

- Complete All Sections: Every section of the form must be filled out. Leaving sections blank can raise red flags and may delay the process.

- Use Clear and Concise Language: When describing your financial situation, clarity helps. Avoid vague terms and be as specific as possible.

- Include Supporting Documentation: Attach any necessary documents that verify your income and expenses. This can strengthen your affidavit.

- Review Before Submission: Double-check your form for any errors or omissions. A thorough review can save you from potential issues later on.

- Seek Assistance if Needed: If you find the process overwhelming, don’t hesitate to reach out for help. Legal aid organizations or professionals can provide valuable guidance.

By following these takeaways, you can navigate the process of completing the Florida Financial Affidavit Short 12.902(b) form with greater confidence and clarity.

Florida Financial Affidavit Short 12.902(b) Example

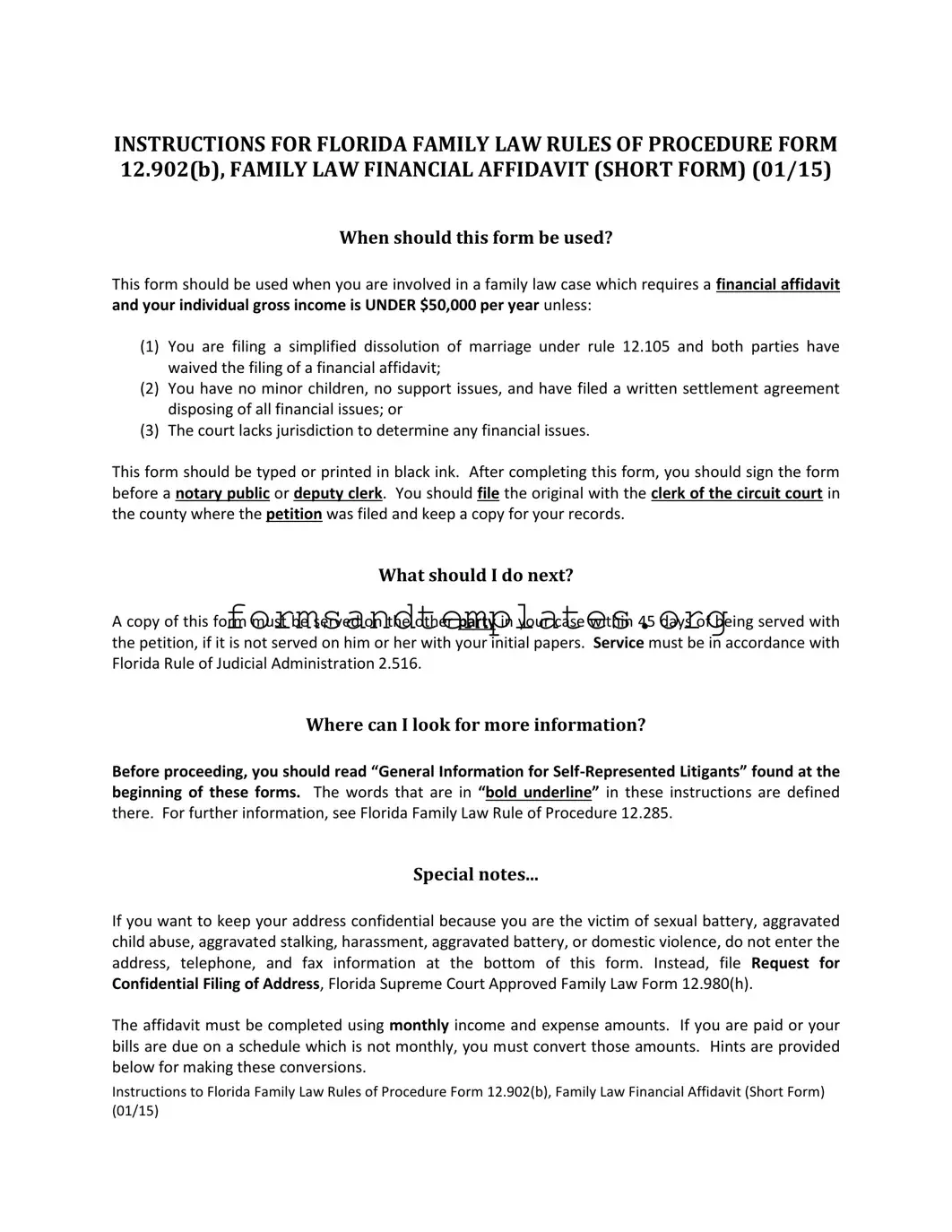

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULES OF PROCEDURE FORM 12.902(b), FAMILY LAW FINANCIAL AFFIDAVIT (SHORT FORM) (01/15)

When should this form be used?

This form should be used when you are involved in a family law case which requires a financial affidavit and your individual gross income is UNDER $50,000 per year unless:

(1)You are filing a simplified dissolution of marriage under rule 12.105 and both parties have waived the filing of a financial affidavit;

(2)You have no minor children, no support issues, and have filed a written settlement agreement disposing of all financial issues; or

(3)The court lacks jurisdiction to determine any financial issues.

This form should be typed or printed in black ink. After completing this form, you should sign the form before a notary public or deputy clerk. You should file the original with the clerk of the circuit court in the county where the petition was filed and keep a copy for your records.

What should I do next?

A copy of this form must be served on the other party in your case within 45 days of being served with the petition, if it is not served on him or her with your initial papers. Service must be in accordance with Florida Rule of Judicial Administration 2.516.

Where can I look for more information?

Before proceeding, you should read “General Information for

Special notes...

If you want to keep your address confidential because you are the victim of sexual battery, aggravated child abuse, aggravated stalking, harassment, aggravated battery, or domestic violence, do not enter the address, telephone, and fax information at the bottom of this form. Instead, file Request for Confidential Filing of Address, Florida Supreme Court Approved Family Law Form 12.980(h).

The affidavit must be completed using monthly income and expense amounts. If you are paid or your bills are due on a schedule which is not monthly, you must convert those amounts. Hints are provided below for making these conversions.

Instructions to Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (01/15)

Hourly - If you are paid by the hour, you may convert your income to monthly as follows:

Hourly amount |

x |

Hours worked per week = |

Weekly amount |

|

Weekly amount |

x |

52 Weeks per year |

= |

Yearly amount |

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

Daily - If you are paid by the day, you may convert your income to monthly as follows:

Daily amount |

x |

Days worked per week |

= |

Weekly amount |

Weekly amount |

x |

52 Weeks per year |

= |

Yearly amount |

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

Weekly - If you are paid by the week, you may convert your income to monthly as follows:

Weekly amount |

x |

52 Weeks per year |

= |

Yearly amount |

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

x |

26 |

= |

Yearly amount |

|

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

2 |

= |

Monthly Amount |

Expenses may be converted in the same manner.

Remember, a person who is NOT an attorney is called a nonlawyer. If a nonlawyer helps you fill out these forms, that person must give you a copy of a Disclosure from Nonlawyer, Florida Family Law Rules of Procedure Form 12.900(a), before he or she helps you. A nonlawyer helping you fill out these forms also must put his or her name, address, and telephone number on the bottom of the last page of every form he or she helps you complete.

Instructions to Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (01/15)

IN THE CIRCUIT COURT OF THE |

|

|

JUDICIAL CIRCUIT, |

|||

IN AND FOR |

|

|

COUNTY, FLORIDA |

|||

|

|

|

|

Case No.: ______________________ |

||

|

|

|

|

Division: _______________________ |

||

|

, |

|

|

|

||

Petitioner, |

|

|

|

|||

and |

|

|

|

|||

|

, |

|

|

|

||

Respondent. |

|

|

|

|||

FAMILY LAW FINANCIAL AFFIDAVIT (SHORT FORM)

(Under $50,000 Individual Gross Annual Income)

I, {full legal name} |

|

|

|

|

, being sworn, certify that the following |

||

information is true: |

|

|

|

|

|||

My Occupation: |

|

|

|

Employed by: ___________________________ |

|||

Business Address: ________________________________________________________________ |

|||||||

Pay rate: $ |

|

( ) every week ( |

) every other week ( ) twice a month ( ) monthly |

||||

( ) other: ____________ |

|

|

|

||||

___ Check here if unemployed and explain on a separate sheet your efforts to find employment.

SECTION I. PRESENT MONTHLY GROSS INCOME:

All amounts must be MONTHLY. See the instructions with this form to figure out money amounts for anything that is NOT paid monthly. Attach more paper, if needed. Items included under “other” should be listed separately with separate dollar amounts.

1.$______ Monthly gross salary or wages

2.______ Monthly bonuses, commissions, allowances, overtime, tips, and similar payments

3._______Monthly business income from sources such as

4._______Monthly disability benefits/SSI

5._______Monthly Workers’ Compensation

6._______Monthly Unemployment Compensation

7._______Monthly pension, retirement, or annuity payments

8._______Monthly Social Security benefits

9.______ Monthly alimony actually received (Add 9a and 9b)

9a. From this case: $ _______

9b. From other case(s): _______

10._______ Monthly interest and dividends

11._______Monthly rental income (gross receipts minus ordinary and necessary expenses

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (01/15)

required to produce income) (Attach sheet itemizing such income and expense items.)

12._______ Monthly income from royalties, trusts, or estates

13._______ Monthly reimbursed expenses and

14._______ Monthly gains derived from dealing in property (not including nonrecurring gains)

15._______ Any other income of a recurring nature (list source) _________________________

16.__________________________________________________________________________

17.$ _______ TOTAL PRESENT MONTHLY GROSS INCOME (Add lines

PRESENT MONTHLY DEDUCTIONS:

18.$______Monthly federal, state, and local income tax (corrected for filing status and allowable dependents and income tax liabilities)

a.Filing Status ____________

b.Number of dependents claimed _______

19._______ Monthly FICA or

20._______ Monthly Medicare payments

21._______ Monthly mandatory union dues

22._______ Monthly mandatory retirement payments

23._______ Monthly health insurance payments (including dental insurance), excluding portion paid for any minor children of this relationship

24._______ Monthly

25._______Monthly

25a. from this case: $ _______

25b. from other case(s):$ _______

26.$_______ TOTAL DEDUCTIONS ALLOWABLE UNDER SECTION 61.30, FLORIDA STATUTES (Add lines 18 through 25).

27.$_______ PRESENT NET MONTHLY INCOME (Subtract line 26 from line 17)

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form)(01/15)

SECTION II. AVERAGE MONTHLY EXPENSES

Proposed/Estimated Expenses. If this is a dissolution of marriage case and your expenses as listed below do not reflect what you actually pay currently, you should write “estimate” next to each amount that is estimated.

A. HOUSEHOLD: |

|

Mortgage or rent |

$ _______ |

Property taxes |

$_______ |

Utilities |

$_______ |

Telephone |

$ _______ |

Food |

$ _______ |

Meals outside home |

$_______ |

Maintenance/Repairs |

$ _______ |

Other: __________ |

$_______ |

B. AUTOMOBILE |

|

Gasoline |

$ _______ |

Repairs |

$_______ |

Insurance |

$_______ |

C.CHILD(REN)’S EXPENSES

Day care |

$ _______ |

Lunch money |

$_______ |

Clothing |

$ _______ |

Grooming |

$_______ |

Gifts for holidays |

$ _______ |

Medical/Dental (uninsured) |

$ _______ |

Other: ______________ |

$ _______ |

D.INSURANCE Medical/Dental (if not listed on

lines 23 or 45) |

$ _______ |

||

Child(ren)’s medical/dental |

$ _______ |

||

Life |

$ _______ |

||

Other: |

|

|

$ _______ |

E. OTHER EXPENSES NOT LISTED ABOVE

Clothing |

$ _______ |

Medical/Dental (uninsured) |

$_______ |

Grooming |

$ _______ |

Entertainment |

$_______ |

Gifts |

$_______ |

Religious organizations |

$_______ |

Miscellaneous |

$_______ |

Other: ______________ |

$ _______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

F. PAYMENTS TO CREDITORS |

|

CREDITOR: |

MONTHLY |

|

PAYMENT |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

____________________ |

$_______ |

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (01/15)

28. $_______ TOTAL MONTHLY EXPENSES (add ALL monthly amounts in A through F above)

SUMMARY

29.$_______ TOTAL PRESENT MONTHLY NET INCOME (from line 27 of SECTION I. INCOME)

30.$_______ TOTAL MONTHLY EXPENSES (from line 28 above)

31.$_______ SURPLUS (If line 29 is more than line 30, subtract line 30 from line 29. This is the amount of your surplus. Enter that amount here.)

32.($_______) (DEFICIT) (If line 30 is more than line 29, subtract line 29 from line 30. This is the amount of your deficit. Enter that amount here.)

SECTION III. ASSETS AND LIABILITIES

Use the nonmarital column only if this is a petition for dissolution of marriage and you believe an item is “nonmarital,” meaning it belongs to only one of you and should not be divided. You should indicate to whom you believe the item(s) or debt belongs. (Typically, you will only use this column if property/debt was owned/owed by one spouse before the marriage. See the “General Information for

A. ASSETS:

DESCRIPTION OF ITEM(S). List a description of each separate item |

Current |

Nonmarital |

||

owned by you (and/or your spouse, if this is a petition for dissolution |

(check correct |

|||

of marriage). LIST ONLY LAST 4 DIGITS OF ACCOUNT NUMBERS. Check |

Fair |

column) |

||

the line next to any asset(s) which you are requesting the judge |

Market |

|

|

|

award to you. |

Value |

|

|

|

|

husband |

wife |

||

|

|

|

||

|

Cash (on hand) |

$ |

|

|

|

Cash (in banks or credit unions) |

|

|

|

|

Stocks, Bonds, Notes |

|

|

|

|

Real estate: (Home) |

|

|

|

|

(Other) |

|

|

|

|

Automobiles |

|

|

|

|

Other personal property |

|

|

|

|

Retirement plans (Profit Sharing, Pension, IRA, 401(k)s, etc.) |

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____Check here if additional pages are attached. |

|

|

|

Total Assets (add next column) |

$ |

|

|

|

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (01/15)

B. LIABILITIES:

DESCRIPTION OF ITEM(S). List a description of each separate debt |

Current |

Nonmarital |

||

(check correct |

||||

owed by you (and/or your spouse, if this is a petition for dissolution |

Amount |

column) |

||

of marriage). LIST ONLY LAST 4 DIGITS OF ACCOUNT NUMBERS. Check |

Owed |

|||

the line next to any debt(s) for which you believe you should be |

|

|

|

|

responsible. |

|

husband |

wife |

|

|

Mortgages on real estate: First mortgage on home |

$ |

|

|

|

Second mortgage on home |

|

|

|

|

Other mortgages |

|

|

|

|

|

|

|

|

|

Auto loans |

|

|

|

|

|

|

|

|

|

Charge/credit card accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____Check here if additional pages are attached. |

|

|

|

Total Debts (add next column) |

$ |

|

|

|

C. CONTINGENT ASSETS AND LIABILITIES:

INSTRUCTIONS: If you have any POSSIBLE assets (income potential, accrued vacation or sick leave, bonus, inheritance, etc.) or POSSIBLE liabilities (possible lawsuits, future unpaid taxes, contingent tax liabilities, debts assumed by another), you must list them here.

|

|

Contingent Assets |

|

Possible |

|

Nonmarital |

|

|

|

|

|

|

(check correct |

||

|

Check the line next to any contingent asset(s) which you are requesting the |

|

Value |

|

column) |

||

|

|

|

|||||

|

judge award to you. |

|

|

|

husband |

wife |

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||

Total Contingent Assets |

$ |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent Liabilities |

|

|

|

Nonmarital |

|

|

|

|

|

Possible |

|

(check correct |

|

|

Check the line next to any contingent debt(s) for which you believe you |

|

Amount |

|

column) |

||

|

should be responsible. |

|

Owed |

|

husband |

wife |

|

|

|

|

|

||||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||

Total Contingent Liabilities |

$ |

|

|

|

|||

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (01/15)

SECTION IV. CHILD SUPPORT GUIDELINES WORKSHEET

(Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet, MUST be filed with the court at or prior to a hearing to establish or modify child support. This requirement cannot be waived by the parties.)

[Check one only]

____ A Child Support Guidelines Worksheet IS or WILL BE filed in this case. This case involves the

establishment or modification of child support.

____ A Child Support Guidelines Worksheet IS NOT being filed in this case. The establishment or

modification of child support is not an issue in this case.

I certify that a copy of this document was [check all used]: ( )

( ) hand delivered to the person(s) listed below on {date} ________________________________.

Other party or his/her attorney:

Name: _____________________________

Address: ____________________________

City, State, Zip: _______________________

Fax Number: _________________________

I understand that I am swearing or affirming under oath to the truthfulness of the claims made in this affidavit and that the punishment for knowingly making a false statement includes fines and/or imprisonment.

Dated:

Signature of Party

Printed Name: ________________________________

Address: ___________________________________

City, State, Zip: ______________________________

Fax Number: ________________________________

STATE OF FLORIDA

COUNTY OF

Sworn to or affirmed and signed before me on |

|

|

by |

|

. |

|

|

|

|

________________________________ |

|

||

|

|

|

|

NOTARY PUBLIC or DEPUTY CLERK |

|

|

|

|

|

________________________________ |

|

||

|

|

|

|

[Print, type, or stamp commissioned |

|

|

|

|

|

|

name of notary or deputy clerk.] |

|

|

____ Personally known |

|

|

|

|

||

____ Produced identification |

|

|

|

|

||

Type of identification produced |

|

|

|

|

|

|

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (01/15)

IF A NONLAWYER HELPED YOU FILL OUT THIS FORM, HE/SHE MUST FILL IN THE BLANKS BELOW:

[fill in all blanks] This form was prepared for the: {choose only one} ( |

) Petitioner ( ) Respondent |

||

This form was completed with the assistance of: |

|

|

|

{name of individual} |

|

|

, |

{name of business} ___________________________________________________________________, |

|

||||

{address} |

________________________________, |

||||

{city} |

|

________,{state} ________ {telephone number} |

. |

||

|

|

|

|

|

|

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (01/15)

Understanding Florida Financial Affidavit Short 12.902(b)

What is the Florida Financial Affidavit Short 12.902(b) form?

The Florida Financial Affidavit Short 12.902(b) form is a legal document used in family law cases, particularly during divorce proceedings. It provides a summary of an individual's financial situation, including income, expenses, assets, and liabilities. This form is essential for the court to understand each party's financial standing and make informed decisions regarding alimony, child support, and division of property.

Who is required to complete this form?

Typically, both parties involved in a divorce or paternity case must complete a financial affidavit. The requirement may vary depending on the specific circumstances of the case, but generally, any individual seeking financial relief or disputing financial matters in court will need to provide this information.

How do I fill out the Florida Financial Affidavit Short 12.902(b) form?

To complete the form, follow these steps:

- Begin by entering your personal information, including your name, address, and case number.

- List your income sources, such as salary, bonuses, and any other earnings.

- Detail your monthly expenses, including housing, utilities, groceries, and any other regular payments.

- Provide information about your assets, including bank accounts, real estate, and personal property.

- Disclose your liabilities, such as loans, credit card debts, and any other financial obligations.

Make sure to review your entries for accuracy and completeness before submitting the form to the court.

What happens if I fail to submit this form?

Failing to submit the Florida Financial Affidavit Short 12.902(b) form can have serious consequences. The court may view this as a lack of transparency regarding your financial situation. This could lead to delays in your case or unfavorable rulings, such as the denial of financial relief or support requests. It is crucial to comply with all court requirements to ensure a fair hearing.

Can I amend the form after submission?

Yes, you can amend the Florida Financial Affidavit Short 12.902(b) form if your financial situation changes or if you discover errors after submission. To amend the form, you should complete a new version of the affidavit, clearly marking it as an amendment. Submit it to the court and provide a copy to the other party involved in the case. Transparency is vital, so ensure that all changes are accurately reflected.

Is there a deadline for submitting this form?

Yes, there are deadlines for submitting the Florida Financial Affidavit Short 12.902(b) form, which may vary depending on the specific court and case type. Generally, it is required to be filed before the final hearing in a divorce or paternity case. It is advisable to check with the court or consult an attorney to confirm the exact deadlines applicable to your situation.

How to Use Florida Financial Affidavit Short 12.902(b)

Filling out the Florida Financial Affidavit Short 12.902(b) form is a crucial step in various legal proceedings, especially in family law cases. This form requires you to provide detailed information about your financial situation. Completing it accurately will help ensure that your financial status is clearly understood by the court.

- Begin by downloading the Florida Financial Affidavit Short 12.902(b) form from the Florida State Courts website or obtain a physical copy from the local courthouse.

- At the top of the form, fill in your name, address, and contact information. Make sure this information is current and accurate.

- Next, indicate your employment status. Specify whether you are employed, unemployed, or self-employed. If employed, include your employer's name and address.

- In the income section, list all sources of income. This includes wages, bonuses, rental income, and any other earnings. Be precise and truthful.

- Move on to the expenses section. Document your monthly expenses, such as housing, utilities, food, transportation, and any other necessary expenditures. Include all relevant details.

- Then, provide information regarding your assets. List items such as bank accounts, real estate, vehicles, and any other valuable property you own.

- Next, detail your liabilities. This includes any debts, loans, or financial obligations you have. Being thorough will help present a clear picture of your financial situation.

- Once you have filled out all sections, review the form for accuracy. Ensure that all figures are correct and that you have not missed any information.

- Finally, sign and date the form at the designated area. Make sure to follow any additional instructions regarding filing the form with the court.

After completing the form, the next step involves submitting it to the appropriate court, along with any required supporting documents. Be prepared to provide additional information if requested, as this will help clarify your financial status during the legal proceedings.