Printable Fl Dr 312 Template

The FL DR 312 form, formally known as the Affidavit of No Florida Estate Tax Due, plays a crucial role in the estate settlement process in Florida. This form is specifically designed for personal representatives of estates where no Florida estate tax is owed, and where a federal estate tax return is not required. By completing this affidavit, the personal representative affirms their position and provides essential details about the decedent, including their name, date of death, and domicile at the time of death. The form serves as a declaration that the estate does not owe any Florida estate tax under Chapter 198 of the Florida Statutes. It also acknowledges the personal representative's liability for the distribution of the estate's property. Notably, the FL DR 312 form must be filed with the appropriate clerk of the circuit court in the county where the decedent owned property, rather than being sent to the Florida Department of Revenue. This affidavit is not just a formality; it acts as evidence of nonliability for Florida estate tax and effectively removes any existing estate tax lien. Understanding when and how to use this form is essential for ensuring a smooth estate administration process, making it a vital resource for personal representatives navigating the complexities of estate management.

Common mistakes

-

Incomplete Personal Information: Failing to provide the full name of the personal representative can lead to delays. Ensure all fields are filled out accurately.

-

Incorrect Decedent Information: The name of the decedent must be printed clearly. Any discrepancies may cause complications in processing the form.

-

Missing Date of Death: Omitting the date of death is a common mistake. This date is crucial for determining tax obligations.

-

Improper Domicile Information: It is essential to specify the state where the decedent was domiciled at the time of death. Errors in this section can affect the validity of the affidavit.

-

Failure to Check Citizenship Status: Not indicating whether the decedent was a U.S. citizen or not can lead to confusion regarding tax liabilities.

-

Neglecting to Sign the Affidavit: The personal representative must sign the affidavit. An unsigned form is not valid and will be rejected.

-

Incorrect Filing Location: Submitting the form to the Florida Department of Revenue instead of the appropriate clerk of the court can result in unnecessary delays.

-

Omitting Contact Information: Failing to include a telephone number or mailing address can hinder communication regarding the form's status.

-

Ignoring Filing Deadlines: It is vital to file the form in a timely manner. Delays can lead to complications in the estate settlement process.

Find Common Documents

Time Card Printable - Tracks employee attendance and work shifts.

Notice of Intent to Lien Florida Pdf - This form is vital in ensuring transparency between contractors and property owners.

For those looking to understand the importance of a comprehensive General Power of Attorney document, it is crucial to recognize how this form empowers an individual to manage crucial decisions on behalf of another, safeguarding their interests when they are unable to do so themselves.

Taxs - The form can reflect adjustments to income due to contributions to retirement accounts.

Key takeaways

When dealing with the Fl Dr 312 form, also known as the Affidavit of No Florida Estate Tax Due, it is important to understand its purpose and the proper procedures for completion and submission. Here are some key takeaways:

- Eligibility for Use: This form should be completed when an estate is not subject to Florida estate tax and does not require a federal estate tax return.

- Filing Location: The completed form must be filed with the clerk of the circuit court in the county where the decedent owned property. Do not send it to the Florida Department of Revenue.

- Personal Responsibility: By signing the form, the personal representative acknowledges personal liability for the distribution of estate property, confirming that no Florida estate tax is owed.

- Importance of Accuracy: The affidavit must be accurate and truthful. Under penalties of perjury, the personal representative must declare that the information provided is correct to the best of their knowledge.

- Exclusion of Federal Filing: If a federal estate tax return is required, this form cannot be used. Be aware of the federal thresholds for filing, which vary by year.

Completing and submitting the Fl Dr 312 form correctly can help streamline the process of settling an estate, ensuring that all parties involved are informed and protected from potential tax liabilities.

Fl Dr 312 Example

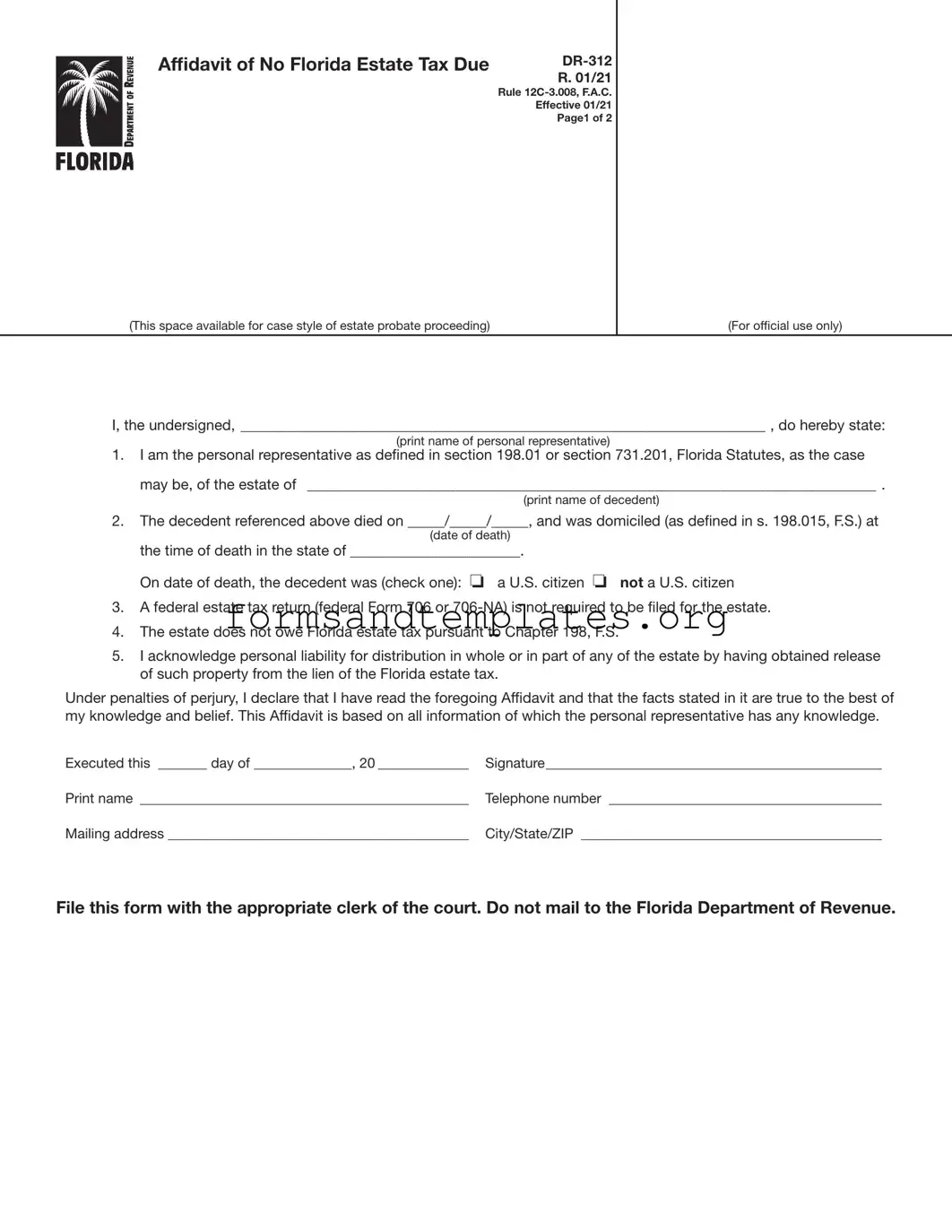

Affidavit of No Florida Estate Tax Due

Rule

Effective 01/21

Page1 of 2

(This space available for case style of estate probate proceeding) |

(For official use only) |

I, the undersigned, _______________________________________________________________________ , do hereby state:

(print name of personal representative)

1.I am the personal representative as defined in section 198.01 or section 731.201, Florida Statutes, as the case may be, of the estate of _____________________________________________________________________________ .

(print name of decedent)

2.The decedent referenced above died on _____/_____/_____, and was domiciled (as defined in s. 198.015, F.S.) at

(date of death)

the time of death in the state of _______________________.

On date of death, the decedent was (check one): o a U.S. citizen o not a U.S. citizen

3.A federal estate tax return (federal Form 706 or

4.The estate does not owe Florida estate tax pursuant to Chapter 198, F.S.

5.I acknowledge personal liability for distribution in whole or in part of any of the estate by having obtained release of such property from the lien of the Florida estate tax.

Under penalties of perjury, I declare that I have read the foregoing Affidavit and that the facts stated in it are true to the best of my knowledge and belief. This Affidavit is based on all information of which the personal representative has any knowledge.

Executed this _______ day of ______________, 20 _____________ |

Signature________________________________________________ |

Print name _______________________________________________ |

Telephone number _______________________________________ |

Mailing address ___________________________________________ |

City/State/ZIP ___________________________________________ |

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

R. 01/21

Page 2 of 2

Instructions for Completing Form

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

General Information

If Florida estate tax is not due and a federal estate tax return (federal Form 706 or

Form

The

Where to File Form

Form

When to Use Form

Form

and a federal estate tax return (federal Form 706 or

Federal thresholds for filing federal Form 706 only: (For informational purposes only. Please confirm with Form 706 instructions.)

Date of Death |

Dollar Threshold |

(year) |

for Filing Form 706 |

|

(value of gross estate) |

|

|

2000 and 2001 |

$675,000 |

|

|

2002 and 2003 |

$1,000,000 |

|

|

2004 and 2005 |

$1,500,000 |

|

|

For 2006 and forward |

|

go to the IRS website at |

|

www.irs.gov to obtain |

|

thresholds. |

|

|

|

For thresholds for filing federal Form

If an administration proceeding is pending for an estate, Form

To Contact Us

Information, forms, and tutorials are available on the Department’s website floridarevenue.com

If you have any questions, or need assistance, call Taxpayer Services at

To find a taxpayer service center near you, go to: floridarevenue.com/taxes/servicecenters

For written replies to tax questions, write to: Taxpayer Services - Mail Stop

5050 W Tennessee St Tallahassee FL

Subscribe to Receive Email Alerts from the Department.

Subscribe to receive an email when Tax Information Publications and proposed rules are posted to the Department’s website. Subscribe today at floridarevenue.com/dor/subscribe.

Reference Material

Rule Chapter

Understanding Fl Dr 312

-

What is the FL DR 312 form?

The FL DR 312 form, officially known as the Affidavit of No Florida Estate Tax Due, is a legal document used in Florida to affirm that an estate is not subject to Florida estate tax. This form must be completed by the personal representative of the estate when there is no requirement to file a federal estate tax return.

-

Who can file the FL DR 312 form?

The form can be filed by the personal representative of the estate, as defined by Florida law. This includes individuals who are in actual or constructive possession of the decedent's property. Essentially, anyone managing the estate can complete and submit this affidavit.

-

When should the FL DR 312 form be used?

This form should be used when the estate is not liable for Florida estate tax under Chapter 198 of the Florida Statutes, and when a federal estate tax return (Form 706 or 706-NA) is not required. If the estate meets these criteria, filing the FL DR 312 helps to confirm the absence of tax liability.

-

Where do I file the FL DR 312 form?

The FL DR 312 form must be filed with the clerk of the circuit court in the county or counties where the decedent owned property. It is important to note that this form should not be mailed to the Florida Department of Revenue.

-

What information is required to complete the FL DR 312 form?

To complete the form, you will need to provide:

- Your name as the personal representative.

- The decedent's name and date of death.

- The state where the decedent was domiciled at the time of death.

- Confirmation of the decedent's citizenship status.

- A declaration that no federal estate tax return is required.

-

What happens after filing the FL DR 312 form?

Once the FL DR 312 form is filed, it serves as evidence of nonliability for Florida estate tax and removes any estate tax lien imposed by the Florida Department of Revenue. This can facilitate the distribution of the estate's assets.

-

Can the FL DR 312 form be used if a federal estate tax return is required?

No, the FL DR 312 form cannot be used if the estate is required to file a federal estate tax return (Form 706 or 706-NA). In such cases, the appropriate federal forms must be completed and submitted instead.

-

What are the penalties for false statements on the FL DR 312 form?

The personal representative acknowledges personal liability for any incorrect information provided in the affidavit. Under penalties of perjury, submitting false information can lead to legal consequences, including fines or criminal charges.

-

How can I get assistance with the FL DR 312 form?

If you have questions or need assistance, you can contact the Florida Department of Revenue's Taxpayer Services at 850-488-6800. They are available Monday through Friday, excluding holidays. Additionally, resources and tutorials are available on their website.

-

Is there a specific format for the FL DR 312 form?

Yes, the FL DR 312 form has a specific layout that includes designated spaces for the required information. It is important to follow the format closely, including leaving the 3-inch by 3-inch space in the upper right corner blank for the clerk's use.

How to Use Fl Dr 312

Completing the Fl Dr 312 form requires careful attention to detail. This affidavit serves as a declaration that no Florida estate tax is due for the estate in question. It is essential to ensure that all sections are filled out accurately to avoid delays in processing.

- Obtain the Fl Dr 312 form from the Florida Department of Revenue website or the appropriate clerk's office.

- In the designated space at the top, print the name of the personal representative who will be completing the form.

- Next, print the name of the decedent in the provided line.

- Enter the date of death in the format of MM/DD/YYYY.

- Indicate the state where the decedent was domiciled at the time of death.

- Check the appropriate box to indicate whether the decedent was a U.S. citizen or not.

- Confirm that a federal estate tax return (Form 706 or 706-NA) is not required for the estate.

- State that the estate does not owe Florida estate tax under Chapter 198, F.S.

- Acknowledge personal liability for any distribution of the estate by signing the form.

- Print your name below your signature.

- Provide your telephone number, mailing address, and city/state/ZIP code in the specified fields.

- Ensure that the 3-inch by 3-inch space in the upper right corner remains blank for the clerk’s use.

- File the completed form with the clerk of the circuit court in the county where the decedent owned property. Do not mail it to the Florida Department of Revenue.