Attorney-Verified Employee Loan Agreement Template

When employees find themselves in need of financial assistance, an Employee Loan Agreement form can serve as a vital tool for both the employer and the employee. This form outlines the terms of the loan, including the amount borrowed, the interest rate, and the repayment schedule. It also specifies the duration of the loan and any conditions that must be met for repayment. By clearly defining the responsibilities of both parties, the agreement helps to prevent misunderstandings and provides a framework for resolving any disputes that may arise. Additionally, it often includes provisions for late payments and the consequences of defaulting on the loan. Such clarity not only protects the employer's interests but also supports the employee in managing their financial obligations effectively. Understanding the components of this agreement is essential for fostering a positive employer-employee relationship and ensuring that both parties are on the same page regarding financial support.

Common mistakes

-

Not reading the entire agreement. Many people skip over important details, which can lead to misunderstandings later.

-

Failing to provide accurate personal information. Mistakes in names, addresses, or contact details can cause delays or issues with the loan.

-

Overlooking the loan amount. It's crucial to double-check that the requested amount matches what was discussed with the employer.

-

Ignoring repayment terms. People often forget to review how and when they need to repay the loan, which can lead to confusion.

-

Not understanding interest rates. Some may not realize that loans can accrue interest, affecting the total amount owed.

-

Forgetting to sign and date the form. A missing signature can render the agreement invalid, causing unnecessary complications.

-

Neglecting to ask questions. If something isn’t clear, it’s important to seek clarification rather than making assumptions.

-

Not keeping a copy of the agreement. Always save a copy for personal records to refer back to if needed.

-

Rushing through the form. Taking your time to fill it out accurately can prevent future headaches.

Key takeaways

Filling out and using the Employee Loan Agreement form requires careful attention to detail. Below are key takeaways to ensure clarity and compliance.

- Understand the Purpose: The agreement outlines the terms of the loan, including repayment schedules and interest rates. Familiarize yourself with its purpose before filling it out.

- Provide Accurate Information: Ensure that all personal and financial information is correct. Mistakes can lead to misunderstandings or legal issues later on.

- Specify Loan Amount: Clearly state the amount being borrowed. This figure should match the amount agreed upon by both the employee and employer.

- Detail Repayment Terms: Outline the repayment schedule, including due dates and payment methods. Clarity in this section helps prevent disputes.

- Include Interest Rates: If applicable, specify any interest rates on the loan. This should be clearly defined to avoid confusion.

- Signatures Required: Both the employee and an authorized representative of the employer must sign the agreement. This formalizes the contract and makes it legally binding.

- Keep Copies: After the agreement is signed, both parties should retain copies for their records. This ensures that each party has access to the terms agreed upon.

Employee Loan Agreement Example

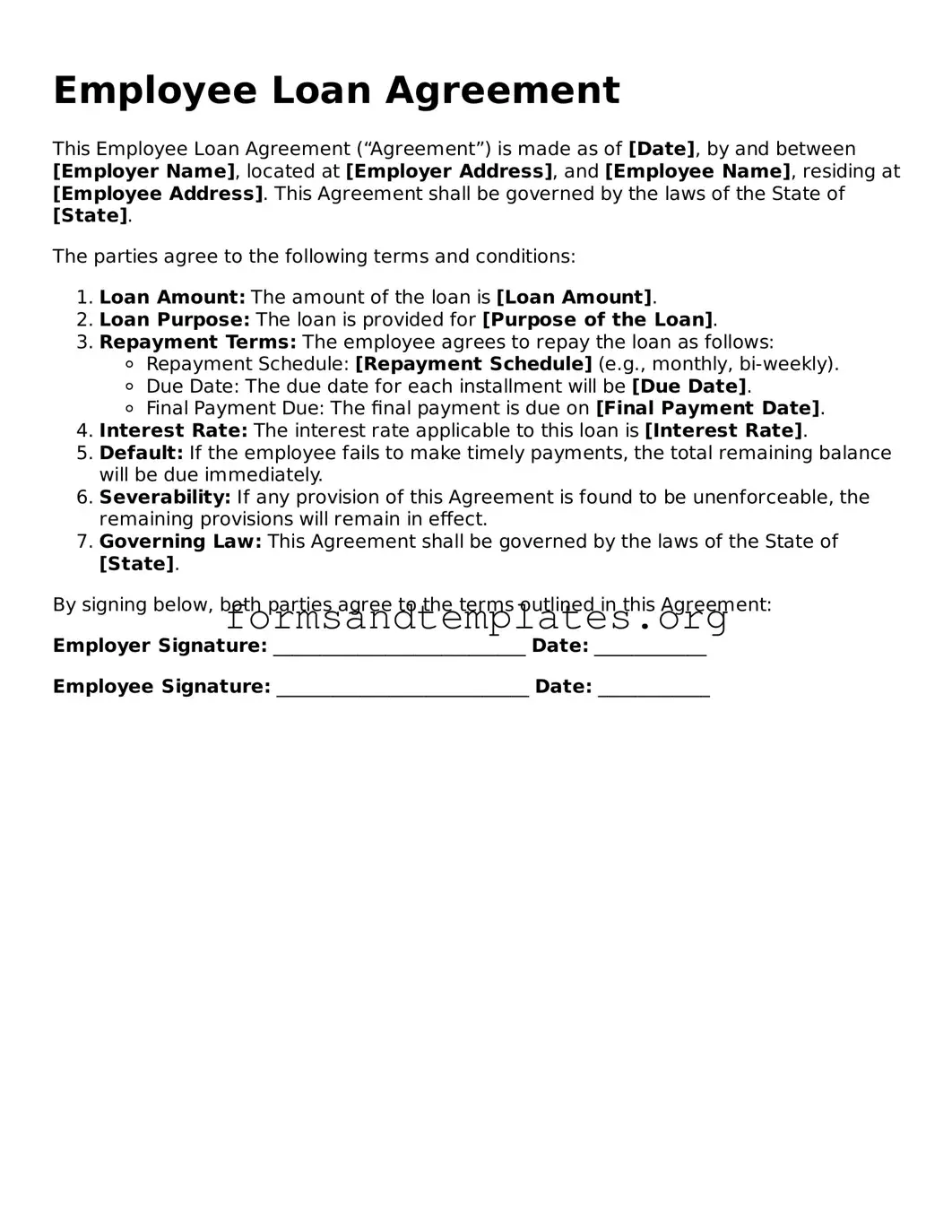

Employee Loan Agreement

This Employee Loan Agreement (“Agreement”) is made as of [Date], by and between [Employer Name], located at [Employer Address], and [Employee Name], residing at [Employee Address]. This Agreement shall be governed by the laws of the State of [State].

The parties agree to the following terms and conditions:

- Loan Amount: The amount of the loan is [Loan Amount].

- Loan Purpose: The loan is provided for [Purpose of the Loan].

- Repayment Terms: The employee agrees to repay the loan as follows:

- Repayment Schedule: [Repayment Schedule] (e.g., monthly, bi-weekly).

- Due Date: The due date for each installment will be [Due Date].

- Final Payment Due: The final payment is due on [Final Payment Date].

- Interest Rate: The interest rate applicable to this loan is [Interest Rate].

- Default: If the employee fails to make timely payments, the total remaining balance will be due immediately.

- Severability: If any provision of this Agreement is found to be unenforceable, the remaining provisions will remain in effect.

- Governing Law: This Agreement shall be governed by the laws of the State of [State].

By signing below, both parties agree to the terms outlined in this Agreement:

Employer Signature: ___________________________ Date: ____________

Employee Signature: ___________________________ Date: ____________

Understanding Employee Loan Agreement

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer provides a loan to an employee. It specifies the loan amount, repayment schedule, interest rate (if applicable), and other relevant details to ensure clarity and protect both parties.

Who can apply for an Employee Loan?

Typically, any employee who meets the eligibility criteria set by the employer can apply for a loan. Criteria may include factors such as length of employment, job performance, and financial need. Employers may also have specific policies regarding which positions are eligible for loans.

What information is required to complete the form?

To complete the Employee Loan Agreement form, you will generally need to provide:

- Your personal information (name, employee ID, etc.)

- The loan amount requested

- The purpose of the loan

- Your proposed repayment schedule

- Any other required documentation, such as proof of income or financial need

What are the repayment terms?

Repayment terms vary based on the agreement. Typically, they include:

- The total loan amount

- The repayment period (e.g., months or years)

- The frequency of payments (e.g., monthly, bi-weekly)

- The interest rate, if applicable

It is crucial to understand these terms before signing the agreement to avoid any misunderstandings later.

Can the loan be forgiven?

Loan forgiveness depends on the specific terms outlined in the Employee Loan Agreement. Some employers may offer forgiveness if certain conditions are met, such as continued employment for a specified duration or achieving specific performance goals. Always clarify this with your employer before proceeding.

What happens if I cannot repay the loan?

If you find yourself unable to repay the loan, it is essential to communicate with your employer as soon as possible. The agreement may outline consequences for non-repayment, which could include wage deductions or legal action. Open communication can help find a solution, such as restructuring the repayment plan.

Is there an interest rate on the loan?

Interest rates are not always applicable but may be included in the agreement. If there is an interest rate, it should be clearly stated in the document. Understanding whether the loan is interest-free or has a specific rate will help you plan your finances accordingly.

How is the loan amount determined?

The loan amount is typically determined based on several factors, including:

- Your financial needs

- Your salary and ability to repay

- Company policies regarding loan limits

Employers may also consider your length of service and overall performance when deciding the loan amount.

Can I apply for multiple loans?

Applying for multiple loans may be possible, but it often depends on company policy. Employers may limit the number of loans an employee can have at one time to manage risk. Always check with your HR department or review the company policy for specifics.

Where can I get assistance with the form?

If you need help completing the Employee Loan Agreement form, consider reaching out to your HR department. They can provide guidance on the application process and clarify any terms or conditions you may not understand. Additionally, some employers may offer financial counseling services to assist employees.

How to Use Employee Loan Agreement

Completing the Employee Loan Agreement form is an important step in formalizing the terms of a loan between an employer and an employee. This document outlines the conditions under which the loan is granted, including repayment terms and any applicable interest rates. Follow these steps carefully to ensure that all necessary information is accurately provided.

- Begin by entering the date at the top of the form. This date should reflect when the agreement is being signed.

- Fill in the employee's full name. Ensure that the spelling is correct to avoid any confusion later.

- Provide the employee's job title and department. This helps to identify the employee within the organization.

- Next, input the loan amount. Clearly state the total sum being borrowed.

- Specify the purpose of the loan. This could be for personal reasons, medical expenses, or any other valid reason.

- Indicate the repayment terms. Include details such as the repayment schedule (e.g., weekly, bi-weekly, or monthly) and the duration of the loan.

- If applicable, list the interest rate for the loan. Ensure that this is clearly stated to avoid misunderstandings.

- Include any collateral if required. This could be an asset that secures the loan.

- Both the employee and the employer should sign and date the agreement at the bottom of the form. This confirms that both parties agree to the terms outlined.

Once the form is filled out, review it for accuracy before finalizing the agreement. Keep a copy for your records and provide one to the employee as well.