Attorney-Verified Durable Power of Attorney Template

The Durable Power of Attorney (DPOA) is a crucial legal document that empowers an individual, known as the agent or attorney-in-fact, to make decisions on behalf of another person, referred to as the principal. This form is particularly significant because it remains effective even if the principal becomes incapacitated, ensuring that their financial and healthcare matters can be managed without interruption. The DPOA can cover a wide range of responsibilities, including handling bank transactions, managing real estate, and making medical decisions. It is essential for individuals to select a trusted agent, as this person will have substantial authority over the principal's affairs. Additionally, the DPOA can be tailored to suit specific needs, allowing the principal to define the scope of the agent's powers. Understanding the implications and benefits of a Durable Power of Attorney is vital for anyone looking to safeguard their interests and ensure their wishes are honored during times of incapacity.

Common mistakes

-

Not specifying the powers granted: Many individuals fail to clearly outline the specific powers they wish to grant to their agent. This can lead to confusion or disputes about what the agent is authorized to do.

-

Choosing the wrong agent: Selecting someone who may not have the best interests of the principal in mind can result in mismanagement of the principal's affairs. It is crucial to choose a trustworthy and competent person.

-

Failing to sign and date the document: A Durable Power of Attorney is not valid unless it is properly signed and dated by the principal. Omitting this step can invalidate the entire document.

-

Not having witnesses or notarization: Depending on state laws, the document may require witnesses or notarization to be legally binding. Neglecting this requirement can render the document ineffective.

-

Overlooking state-specific requirements: Each state has different laws regarding Durable Power of Attorney forms. Failing to adhere to these specific requirements can lead to legal challenges.

-

Not reviewing the document periodically: Life circumstances change, and so might the principal's wishes. Regularly reviewing the document ensures it remains relevant and accurately reflects current intentions.

-

Not discussing the decision with the agent: It is important to communicate with the chosen agent about their role and responsibilities. Lack of communication can lead to misunderstandings and conflicts.

-

Ignoring alternative agents: Designating only one agent without naming an alternative can create complications if the primary agent is unavailable or unwilling to act.

-

Assuming the document is permanent: Some individuals mistakenly believe that once a Durable Power of Attorney is created, it cannot be revoked. In fact, the principal retains the right to revoke it at any time, as long as they are competent.

Durable Power of Attorney - Tailored for State

Create Popular Types of Durable Power of Attorney Templates

Power of Attorney Document - Proper safeguards in this document can help mitigate potential disputes between agents and principals.

Temporary Power of Attorney for Child - Clarify who can make choices regarding your child’s health, education, and welfare during your absence with this document.

The Employment Verification document is vital for both employers and employees, ensuring clear communication regarding an employee's work history. For those seeking to understand the procedures better, locate necessary details within this critical essential Employment Verification form guide.

How to Revoke Power of Attorney in California - Utilizing this form provides a formal acknowledgment of your decisions, safeguarding against any unintended actions.

Key takeaways

Filling out a Durable Power of Attorney (DPOA) form is an important step in planning for the future. Here are some key takeaways to keep in mind:

- Understand the purpose of a DPOA. It allows someone you trust to make decisions on your behalf if you become unable to do so.

- Choose your agent carefully. This person should be reliable and understand your wishes.

- Be specific about the powers you grant. You can limit your agent's authority to certain areas, like financial matters or healthcare decisions.

- Consider a backup agent. If your first choice is unavailable or unable to act, having a secondary agent ensures your needs are still met.

- Sign the document in front of a notary. This step helps to validate the DPOA and makes it more likely to be accepted by institutions.

- Keep copies of the DPOA in accessible places. Share copies with your agent, healthcare providers, and financial institutions as needed.

- Review and update the DPOA regularly. Life changes, and your wishes may evolve, so it’s important to keep the document current.

- Know the laws in your state. DPOA requirements can vary, so familiarize yourself with local regulations to ensure your document is valid.

Durable Power of Attorney Example

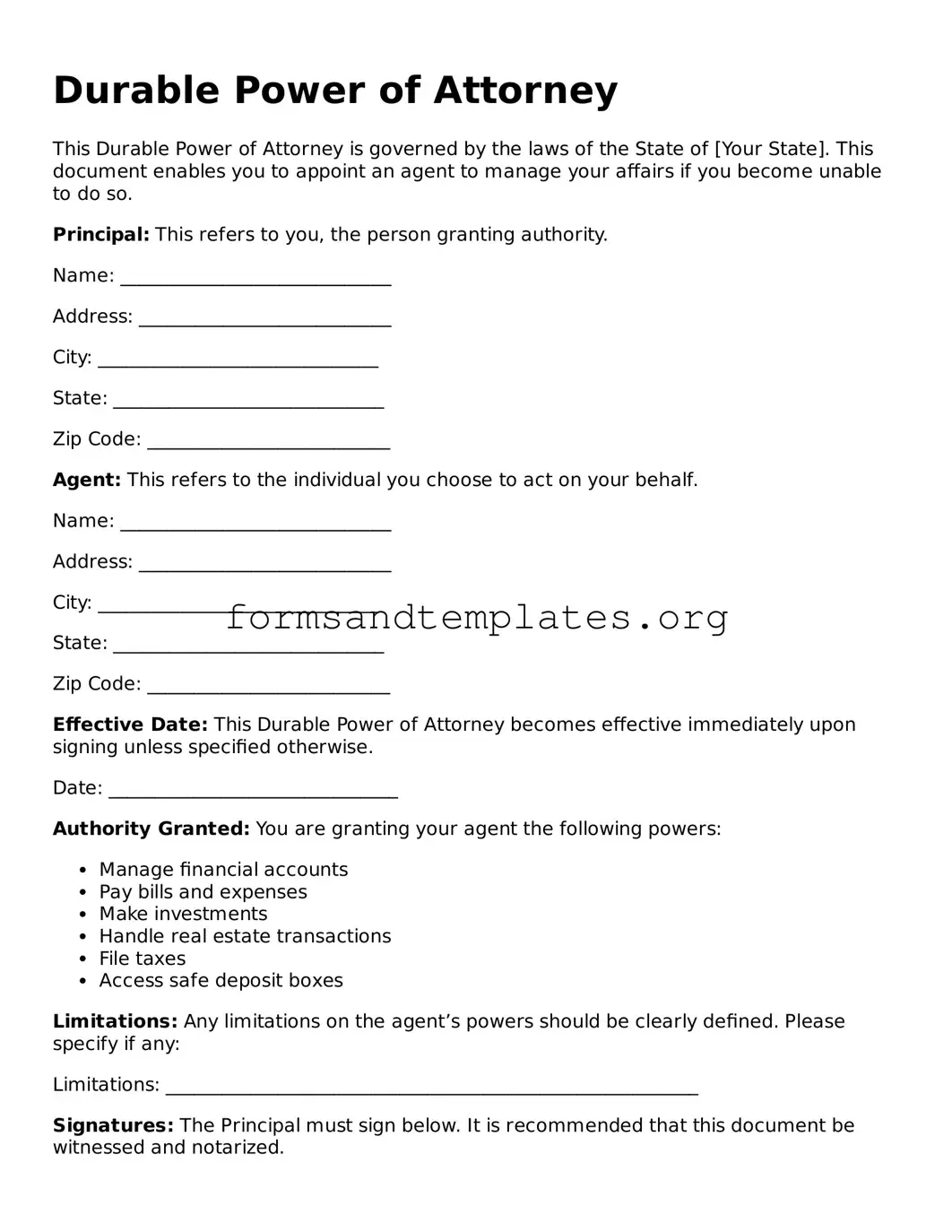

Durable Power of Attorney

This Durable Power of Attorney is governed by the laws of the State of [Your State]. This document enables you to appoint an agent to manage your affairs if you become unable to do so.

Principal: This refers to you, the person granting authority.

Name: _____________________________

Address: ___________________________

City: ______________________________

State: _____________________________

Zip Code: __________________________

Agent: This refers to the individual you choose to act on your behalf.

Name: _____________________________

Address: ___________________________

City: ______________________________

State: _____________________________

Zip Code: __________________________

Effective Date: This Durable Power of Attorney becomes effective immediately upon signing unless specified otherwise.

Date: _______________________________

Authority Granted: You are granting your agent the following powers:

- Manage financial accounts

- Pay bills and expenses

- Make investments

- Handle real estate transactions

- File taxes

- Access safe deposit boxes

Limitations: Any limitations on the agent’s powers should be clearly defined. Please specify if any:

Limitations: _________________________________________________________

Signatures: The Principal must sign below. It is recommended that this document be witnessed and notarized.

Signature of Principal: _________________________________

Date: ________________________________________________

Witness: Two witnesses are encouraged for this document.

Witness 1 Signature: _________________________________

Witness 1 Name: _____________________________________

Date: ________________________________________________

Witness 2 Signature: _________________________________

Witness 2 Name: _____________________________________

Date: ________________________________________________

Notary Public:

State of [Your State], County of _________________________

Subscribed and sworn to before me this ____ day of __________, 20__.

Notary Signature: ______________________________________

My Commission Expires: ________________________________

Understanding Durable Power of Attorney

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows one person, known as the principal, to appoint another person, called the agent or attorney-in-fact, to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated. The DPOA can cover a range of decisions, including financial matters, healthcare, and property management.

When should I consider creating a Durable Power of Attorney?

Creating a DPOA is advisable when you want to ensure that someone you trust can make decisions for you in case you become unable to do so. This could be due to illness, injury, or advanced age. It’s also a good idea to set up a DPOA if you anticipate needing assistance with financial or medical decisions in the future.

Who can be appointed as an agent in a Durable Power of Attorney?

Generally, any competent adult can be appointed as an agent. This could be a family member, close friend, or a trusted advisor. It’s crucial to choose someone who understands your wishes and can act in your best interests. Additionally, some states may have specific requirements regarding who can serve as an agent.

What decisions can my agent make on my behalf?

The authority granted to your agent can vary based on your preferences. Common areas of decision-making include:

- Managing financial accounts and investments

- Paying bills and taxes

- Buying or selling property

- Making healthcare decisions

You can specify the scope of authority in the DPOA document, allowing for broad or limited powers as you see fit.

How do I create a Durable Power of Attorney?

Creating a DPOA typically involves the following steps:

- Choose your agent carefully.

- Determine the powers you want to grant.

- Draft the DPOA document, which may require specific language based on your state’s laws.

- Sign the document in the presence of a notary public or witnesses, if required by your state.

Consulting with an attorney can help ensure that the document meets all legal requirements.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a DPOA at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions or individuals who may have relied on the original DPOA. It’s also a good idea to destroy any copies of the original document to prevent confusion.

What happens if I don’t have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, your family may need to go through a court process to have a guardian or conservator appointed. This can be time-consuming, costly, and may not reflect your personal wishes. Having a DPOA in place helps avoid these complications and ensures that your preferences are respected.

How to Use Durable Power of Attorney

After obtaining the Durable Power of Attorney form, it’s important to fill it out accurately to ensure that your wishes are clearly communicated. Follow the steps below to complete the form correctly.

- Begin by entering your full name and address at the top of the form.

- Next, provide the name and address of the person you are appointing as your agent. This person will act on your behalf.

- Specify the powers you wish to grant to your agent. This may include decisions about finances, healthcare, or property management.

- Indicate whether the power of attorney is effective immediately or if it will only take effect under certain circumstances.

- Sign and date the form at the designated area. Ensure that your signature matches the name you provided at the top.

- Have the form notarized, if required by your state. This adds an extra layer of validity to the document.

- Finally, make copies of the completed form for your records and provide copies to your agent and any relevant institutions.