Attorney-Verified Deed of Trust Template

The Deed of Trust form serves as a critical document in real estate transactions, particularly when a borrower secures a loan to purchase property. This legal instrument establishes a relationship among three key parties: the borrower, the lender, and a neutral third party known as the trustee. The borrower, often referred to as the trustor, conveys the title of the property to the trustee, who holds it as security for the loan until the borrower repays the debt in full. In the event of default, the trustee has the authority to initiate foreclosure proceedings on behalf of the lender, ensuring that the lender's interests are protected. This form also outlines essential terms such as the loan amount, interest rate, and repayment schedule, providing clarity and structure to the borrowing process. Additionally, the Deed of Trust may include provisions related to property maintenance, insurance requirements, and the rights of each party involved. Understanding the implications of this document is vital for both borrowers and lenders, as it plays a pivotal role in safeguarding financial interests while facilitating property ownership.

Common mistakes

-

Incorrect Names: One common mistake is misspelling names or using incorrect legal names. It is crucial to ensure that the names of all parties involved are accurate and match their identification documents.

-

Wrong Property Description: Failing to provide a precise description of the property can lead to significant issues. The description should include the full address and any relevant parcel numbers.

-

Missing Signatures: All required parties must sign the document. Omitting a signature can render the deed invalid.

-

Not Notarizing: Many states require notarization of the Deed of Trust. Skipping this step can result in complications during the enforcement of the deed.

-

Improper Dates: Entering the wrong date or failing to date the document can create confusion regarding when the agreement was made.

-

Inaccurate Loan Amount: The loan amount must be clearly stated. Any discrepancies can lead to disputes later on.

-

Ignoring Local Laws: Each state has its own regulations regarding Deeds of Trust. Not adhering to these local laws can invalidate the document.

-

Failure to Record: After completing the Deed of Trust, it should be recorded with the appropriate local authority. Neglecting this step can affect the enforceability of the deed.

-

Not Reviewing the Document: Rushing through the process without a thorough review can lead to overlooked errors. Always take the time to double-check the entire document.

Create Popular Types of Deed of Trust Templates

Correction Deed Form California - The form protects parties involved from liability.

For those looking to transfer property in Georgia, utilizing the appropriate documentation is essential, and you can access this vital resource at Georgia PDF, where you'll find everything needed to ensure your deed form is correctly prepared.

Key takeaways

Understanding the Deed of Trust form is essential for anyone involved in real estate transactions. Here are ten key takeaways to consider:

- Purpose: A Deed of Trust secures a loan by using real property as collateral.

- Parties Involved: It involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee.

- Trustee's Role: The trustee holds the legal title to the property until the loan is paid off.

- Recording: The Deed of Trust must be recorded with the local government to provide public notice of the lien.

- Default Consequences: If the borrower defaults, the lender can initiate a foreclosure process through the trustee.

- Terms of the Loan: Clearly outline the loan amount, interest rate, and repayment schedule in the document.

- Legal Description: Include a precise legal description of the property being secured to avoid ambiguity.

- Signatures: Ensure all parties sign the document to validate the agreement.

- Notarization: Having the document notarized adds an extra layer of authenticity and can be required in some jurisdictions.

- Consultation: It is wise to consult with a legal professional when completing a Deed of Trust to ensure compliance with local laws.

By keeping these points in mind, you can navigate the process of using a Deed of Trust more effectively.

Deed of Trust Example

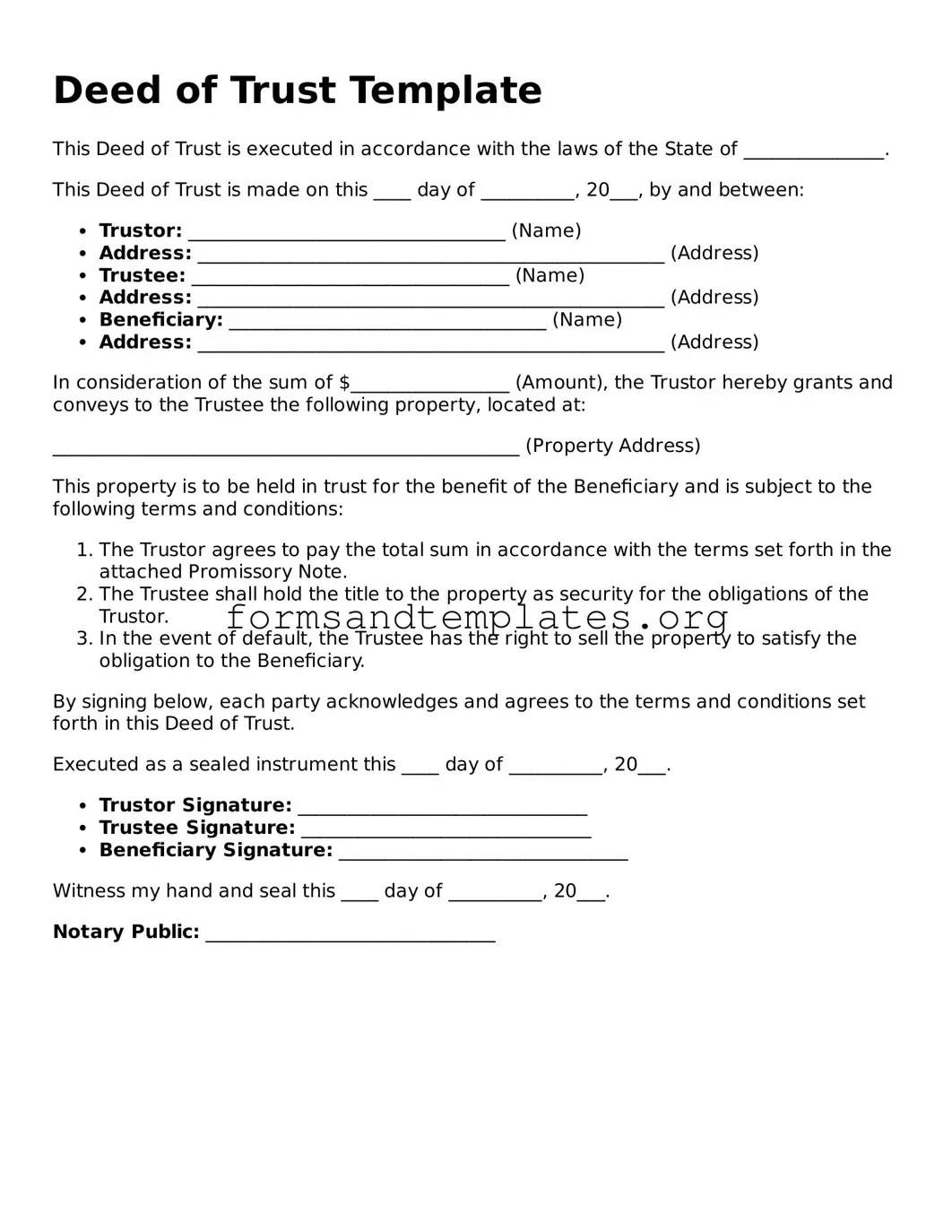

Deed of Trust Template

This Deed of Trust is executed in accordance with the laws of the State of _______________.

This Deed of Trust is made on this ____ day of __________, 20___, by and between:

- Trustor: __________________________________ (Name)

- Address: __________________________________________________ (Address)

- Trustee: __________________________________ (Name)

- Address: __________________________________________________ (Address)

- Beneficiary: __________________________________ (Name)

- Address: __________________________________________________ (Address)

In consideration of the sum of $_________________ (Amount), the Trustor hereby grants and conveys to the Trustee the following property, located at:

__________________________________________________ (Property Address)

This property is to be held in trust for the benefit of the Beneficiary and is subject to the following terms and conditions:

- The Trustor agrees to pay the total sum in accordance with the terms set forth in the attached Promissory Note.

- The Trustee shall hold the title to the property as security for the obligations of the Trustor.

- In the event of default, the Trustee has the right to sell the property to satisfy the obligation to the Beneficiary.

By signing below, each party acknowledges and agrees to the terms and conditions set forth in this Deed of Trust.

Executed as a sealed instrument this ____ day of __________, 20___.

- Trustor Signature: _______________________________

- Trustee Signature: _______________________________

- Beneficiary Signature: _______________________________

Witness my hand and seal this ____ day of __________, 20___.

Notary Public: _______________________________

Understanding Deed of Trust

What is a Deed of Trust?

A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a third party, known as a trustee, until the borrower repays the loan. This instrument is commonly used in real estate transactions, particularly in states that do not use mortgages. In essence, it acts as a safeguard for the lender, ensuring that they have a claim to the property if the borrower defaults on their loan obligations.

How does a Deed of Trust differ from a mortgage?

While both a Deed of Trust and a mortgage serve the same primary purpose—securing a loan—they differ in structure and execution. In a mortgage, the borrower directly pledges the property to the lender. Conversely, a Deed of Trust involves three parties: the borrower, the lender, and the trustee. The trustee holds the title until the loan is repaid, providing an additional layer of security for the lender. This arrangement can streamline the foreclosure process, making it generally faster and more efficient compared to a traditional mortgage.

What are the key components of a Deed of Trust?

A Deed of Trust typically includes several critical elements:

- Parties Involved: It identifies the borrower, the lender, and the trustee.

- Property Description: A detailed description of the property being secured is provided.

- Loan Amount: The total amount of the loan is specified.

- Terms and Conditions: This section outlines the obligations of the borrower, including payment terms and any penalties for default.

- Foreclosure Process: The document explains the steps that will be taken if the borrower fails to meet their obligations.

What happens if the borrower defaults on the loan?

If a borrower defaults on their loan, the trustee has the authority to initiate foreclosure proceedings. This process allows the lender to recover the outstanding loan amount by selling the property. Unlike traditional foreclosure processes, which can be lengthy and involve court proceedings, a Deed of Trust often allows for a non-judicial foreclosure. This means the trustee can sell the property without going to court, typically resulting in a quicker resolution.

Is a Deed of Trust necessary for all real estate transactions?

No, a Deed of Trust is not required for all real estate transactions. Its necessity largely depends on the state in which the property is located and the preferences of the parties involved. In some states, mortgages are more common, while in others, Deeds of Trust are the preferred method of securing a loan. It’s essential to consult with a real estate professional or legal expert to determine the best option for your specific situation.

Can a Deed of Trust be modified after it is signed?

Yes, a Deed of Trust can be modified, but this typically requires the consent of all parties involved—the borrower, the lender, and the trustee. Modifications may be necessary due to changes in loan terms, payment schedules, or other circumstances. It’s important to document any changes formally to ensure they are legally binding and enforceable.

How to Use Deed of Trust

Once you have the Deed of Trust form ready, it’s important to fill it out accurately to ensure that all necessary information is included. This form will require specific details about the parties involved, the property, and the terms of the trust. Follow these steps carefully to complete the form correctly.

- Begin by entering the date at the top of the form.

- Fill in the name of the borrower, also known as the trustor. This is the person or entity that will be borrowing money.

- Next, write the name of the lender, referred to as the beneficiary. This is the individual or institution providing the loan.

- Provide the name of the trustee. This is the person or entity that will hold the title to the property on behalf of the lender.

- Enter the property address, including the city, state, and ZIP code. Be sure to include any apartment or unit numbers if applicable.

- Specify the amount of the loan. This should be the total amount borrowed by the trustor.

- Detail the terms of the loan. Include information about the interest rate, payment schedule, and any other relevant terms.

- Include any additional provisions or conditions that apply to the Deed of Trust.

- Sign the form where indicated. The borrower and trustee should both sign the document.

- Have the signatures notarized. This step may be required for the Deed of Trust to be legally binding.

After completing the form, ensure that you keep a copy for your records. The original document should be filed with the appropriate local government office to make it official. This step is crucial for the validity of the Deed of Trust.