Attorney-Verified Deed in Lieu of Foreclosure Template

The Deed in Lieu of Foreclosure is an important legal instrument that serves as an alternative to the traditional foreclosure process. Homeowners facing financial difficulties may find this option appealing as it allows them to transfer ownership of their property back to the lender, thereby avoiding the lengthy and often distressing foreclosure proceedings. This form typically outlines the terms under which the homeowner voluntarily surrenders their property, effectively releasing them from the mortgage obligation. It also includes provisions regarding any potential deficiency judgments, which can arise if the property’s value is less than the outstanding mortgage balance. By executing this deed, homeowners may mitigate the damage to their credit scores and expedite the resolution of their financial issues. Additionally, lenders benefit from a more streamlined process, reducing costs associated with foreclosure. Understanding the nuances of this form can empower homeowners to make informed decisions during challenging financial times.

Common mistakes

-

Incomplete Information: Many people fail to fill in all required fields. Leaving out essential details can lead to delays or rejection of the form.

-

Incorrect Property Description: Providing an inaccurate description of the property can create confusion. It's vital to ensure that the address and legal description match official records.

-

Not Understanding the Consequences: Some individuals do not fully grasp the implications of signing a Deed in Lieu of Foreclosure. This action can impact credit scores and future borrowing capabilities.

-

Failure to Consult Professionals: Skipping the advice of a legal or financial advisor can lead to mistakes. Professional guidance can help navigate the complexities of the process.

-

Ignoring Lender Requirements: Each lender may have specific requirements for the Deed in Lieu of Foreclosure. Not adhering to these can result in the form being rejected.

Create Popular Types of Deed in Lieu of Foreclosure Templates

Free Deed of Trust Template - Both lender and borrower benefit from the clarity a Deed of Trust provides.

The New York Mobile Home Bill of Sale form is a legal document used to transfer ownership of a mobile home from one party to another. This form outlines essential details such as the buyer and seller's information, the mobile home's description, and the sale price. Understanding this document is crucial for ensuring a smooth transaction and protecting both parties' rights. You can find a template for this essential form at the Mobile Home Bill of Sale form.

Lady Bird Deed Form Michigan - By using a Lady Bird Deed, property owners may retain their homestead exemption benefits.

Tod in California - A Transfer-on-Death Deed allows property owners to designate beneficiaries for their real estate upon their death.

Key takeaways

When considering a Deed in Lieu of Foreclosure, it’s important to understand the implications and processes involved. Here are some key takeaways to keep in mind:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. This can help mitigate the negative impact on credit scores.

- Eligibility Requirements: Not all homeowners will qualify. Lenders typically require that the homeowner is experiencing financial hardship and has exhausted other options like loan modifications or short sales.

- Property Condition Matters: The lender will often require an assessment of the property’s condition. If the property is not well-maintained, the lender may reject the Deed in Lieu.

- Potential Tax Implications: There may be tax consequences associated with a Deed in Lieu of Foreclosure. Homeowners should consult a tax professional to understand any potential liabilities.

- Documenting the Process: It's crucial to keep thorough records throughout the process. Document all communications with the lender and retain copies of all signed forms to ensure clarity and protection.

By understanding these key points, homeowners can make informed decisions regarding a Deed in Lieu of Foreclosure and navigate the process more effectively.

Deed in Lieu of Foreclosure Example

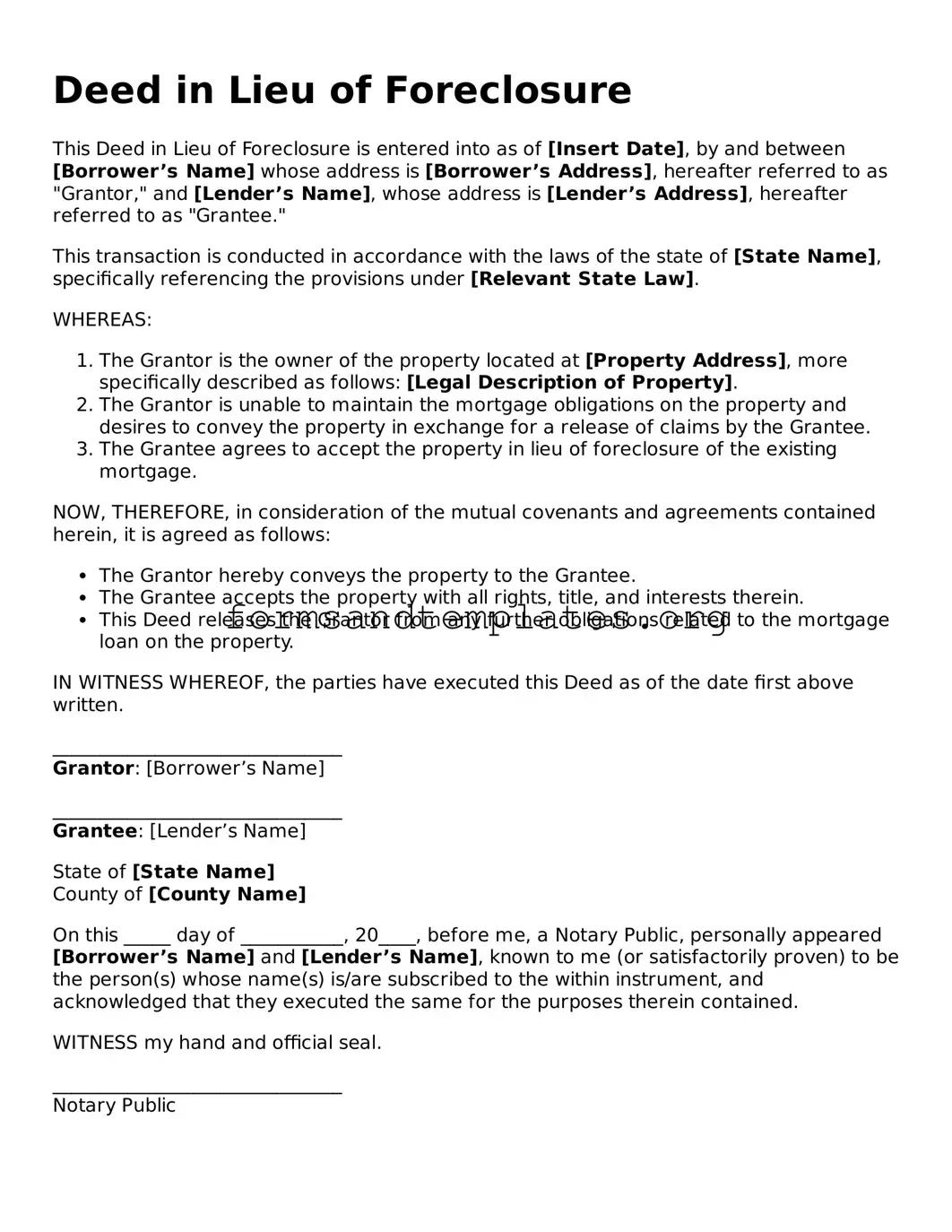

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is entered into as of [Insert Date], by and between [Borrower’s Name] whose address is [Borrower’s Address], hereafter referred to as "Grantor," and [Lender’s Name], whose address is [Lender’s Address], hereafter referred to as "Grantee."

This transaction is conducted in accordance with the laws of the state of [State Name], specifically referencing the provisions under [Relevant State Law].

WHEREAS:

- The Grantor is the owner of the property located at [Property Address], more specifically described as follows: [Legal Description of Property].

- The Grantor is unable to maintain the mortgage obligations on the property and desires to convey the property in exchange for a release of claims by the Grantee.

- The Grantee agrees to accept the property in lieu of foreclosure of the existing mortgage.

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, it is agreed as follows:

- The Grantor hereby conveys the property to the Grantee.

- The Grantee accepts the property with all rights, title, and interests therein.

- This Deed releases the Grantor from any further obligations related to the mortgage loan on the property.

IN WITNESS WHEREOF, the parties have executed this Deed as of the date first above written.

_______________________________

Grantor: [Borrower’s Name]

_______________________________

Grantee: [Lender’s Name]

State of [State Name]

County of [County Name]

On this _____ day of ___________, 20____, before me, a Notary Public, personally appeared [Borrower’s Name] and [Lender’s Name], known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

WITNESS my hand and official seal.

_______________________________

Notary Public

Understanding Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers the ownership of their property to the lender to avoid foreclosure. This option is typically considered when the homeowner is unable to continue making mortgage payments and wants to prevent the lengthy and damaging process of foreclosure. By opting for this route, the homeowner can often settle their mortgage debt more quickly and with less impact on their credit score.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to choosing a Deed in Lieu of Foreclosure:

- Less damage to credit: A Deed in Lieu may have a less severe impact on your credit score compared to a foreclosure.

- Faster process: This option can expedite the resolution of the mortgage default, allowing homeowners to move on more quickly.

- Relief from debt: Homeowners can often be released from the remaining mortgage debt, depending on the agreement with the lender.

- Potential for relocation assistance: Some lenders may offer financial assistance to help homeowners relocate after the deed transfer.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

While there are benefits, there are also some potential drawbacks to consider:

- Eligibility requirements: Not all homeowners will qualify for a Deed in Lieu. Lenders may have specific criteria that must be met.

- Tax implications: Depending on the circumstances, there may be tax consequences related to the cancellation of debt.

- Loss of property: Homeowners will lose their home and any equity they may have built up.

How does the process work?

The process for executing a Deed in Lieu of Foreclosure typically involves several steps:

- Contact the lender: Homeowners should reach out to their mortgage lender to discuss their situation and express interest in a Deed in Lieu.

- Submit documentation: Lenders may require financial documents to evaluate the homeowner's situation.

- Negotiate terms: The homeowner and lender will negotiate the terms of the deed transfer, including any potential forgiveness of remaining debt.

- Sign the deed: Once an agreement is reached, the homeowner will sign the Deed in Lieu, transferring ownership to the lender.

- Complete the process: The lender will then file the deed with the appropriate local government office.

Can I still get a mortgage after a Deed in Lieu of Foreclosure?

Yes, it is possible to obtain a mortgage after a Deed in Lieu of Foreclosure, but it may take some time. Lenders will typically view this option more favorably than a foreclosure. However, it will still impact your credit score. Homeowners may need to wait a few years before qualifying for a new mortgage, depending on the lender's policies and the homeowner's overall financial situation.

What should I do if I’m considering a Deed in Lieu of Foreclosure?

If you are contemplating a Deed in Lieu of Foreclosure, it is essential to take the following steps:

- Consult a financial advisor or attorney to understand the implications.

- Review your financial situation and explore all options, including loan modifications or short sales.

- Communicate openly with your lender to discuss your circumstances and express your interest in a Deed in Lieu.

How to Use Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate lender or financial institution. They will review the information provided and may contact you for further clarification or additional documentation. It is important to keep a copy of the completed form for your records.

- Begin by entering the date at the top of the form.

- Fill in your name and address in the designated sections.

- Provide the name and address of the lender or financial institution.

- Include a description of the property involved, such as the address and any relevant identifying information.

- State the reason for the deed in lieu of foreclosure clearly.

- Sign and date the form where indicated.

- Have the signature notarized, if required.

- Make copies of the completed form for your records.

- Submit the original form to the lender or financial institution.