Printable Citibank Direct Deposit Template

When it comes to managing your finances, setting up direct deposit can make a world of difference. The Citibank Direct Deposit form is a key tool in this process, allowing you to securely receive your paycheck or other payments directly into your bank account. This convenient method not only saves you time but also helps you avoid the hassle of cashing checks. The form typically requires basic information such as your name, account number, and the routing number for your Citibank account. You may also need to provide details about your employer or the organization making the deposit. Completing this form accurately is essential to ensure that your funds are deposited without delay. Once submitted, the direct deposit setup usually takes just a few business days to process, giving you peace of mind that your money will be available when you need it. Understanding how to fill out this form correctly can streamline your banking experience and enhance your financial management.

Common mistakes

-

Incorrect Account Number: Many individuals mistakenly enter the wrong account number. This can lead to funds being deposited into an unintended account, causing delays and complications.

-

Wrong Routing Number: Another common error involves the routing number. Using an incorrect routing number can prevent the deposit from being processed correctly.

-

Missing Signature: Some people forget to sign the form. A missing signature can render the form invalid, delaying the setup of direct deposit.

-

Not Updating Information: Individuals often fail to update their direct deposit information after changing banks or accounts. This can result in missed payments or deposits going to the wrong account.

Find Common Documents

Affidavit of Support - Along with the I-864, additional documentation may be necessary to prove income.

Collision Repair Auto Body Repair Estimate Template - Understanding your vehicle's repair needs starts here.

For those looking to finalize their RV purchase, the California RV Bill of Sale form is essential, as it clearly outlines the terms of the sale and protects both parties involved. To gain access to a template that streamlines this process, visit California Templates for a fillable version that meets all state requirements.

What Does a Esa Letter Look Like - Landlords may require this letter to ensure compliance with Fair Housing Act regulations.

Key takeaways

Understanding the Citibank Direct Deposit form is essential for ensuring that your funds are deposited accurately and efficiently. Below are key takeaways to consider when filling out and using this form.

- Gather necessary information, including your bank account number and routing number.

- Ensure that the name on the form matches the name associated with the bank account.

- Double-check the routing number; an incorrect number can delay deposits.

- Provide a valid email address for confirmation and updates regarding your direct deposit.

- Sign and date the form to validate your request for direct deposit.

- Submit the form to your employer or the organization that will be making the deposits.

- Keep a copy of the completed form for your records.

- Monitor your bank account after submission to confirm that deposits are being made.

- Update your direct deposit information promptly if you change banks or accounts.

- Contact Citibank customer service if you have questions or encounter issues with the form.

By following these guidelines, you can help ensure a smooth experience with your direct deposit setup. Taking these steps seriously can prevent potential complications and ensure timely access to your funds.

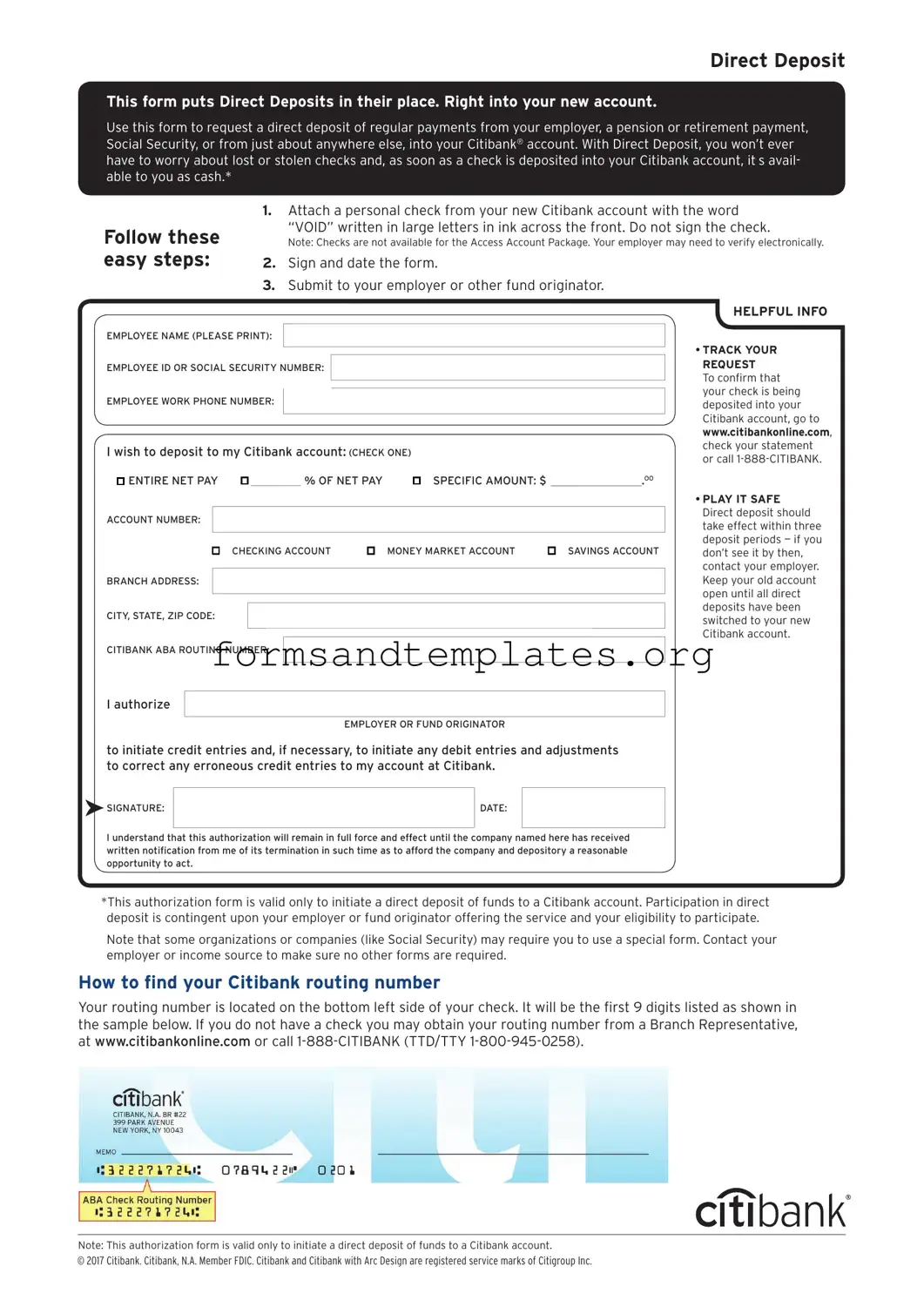

Citibank Direct Deposit Example

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

Understanding Citibank Direct Deposit

What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document that allows individuals to authorize their employer or other payers to deposit funds directly into their Citibank account. This process streamlines the payment method, ensuring funds are available immediately without the need for paper checks.

How do I obtain the Citibank Direct Deposit form?

You can obtain the Citibank Direct Deposit form through several channels:

- Visit the Citibank website and navigate to the direct deposit section.

- Contact Citibank customer service for assistance.

- Request a form from your employer's human resources department.

What information do I need to fill out the form?

To complete the Citibank Direct Deposit form, you will typically need the following information:

- Your Citibank account number.

- Your bank's routing number.

- Your personal identification details, such as your name and address.

- Your employer’s information, including name and address.

Is there a fee for using the Direct Deposit service?

Generally, there is no fee for setting up direct deposit with Citibank. However, it is advisable to check with your employer and review your account terms to confirm there are no associated charges.

How long does it take for direct deposits to start?

Once you submit the completed form to your employer or payer, it may take one to two pay cycles for direct deposits to begin. The exact timing can vary based on your employer’s payroll schedule and processing times.

Can I change my direct deposit information later?

Yes, you can change your direct deposit information at any time. To do this, you will need to fill out a new Citibank Direct Deposit form and submit it to your employer or payer. Ensure that you provide the updated account details to avoid any disruptions in your deposits.

What should I do if I don’t see my deposit in my account?

If you do not see your direct deposit in your account on the expected date, consider taking the following steps:

- Check with your employer to confirm that the deposit was processed.

- Verify that the information on your direct deposit form is accurate.

- Contact Citibank customer service for assistance with your account.

Is my information secure when I submit the form?

Yes, when you submit the Citibank Direct Deposit form, your information is protected. Citibank employs various security measures to ensure that your personal and financial details are kept confidential and secure.

Can I set up direct deposit for multiple accounts?

Yes, you can set up direct deposits for multiple accounts, but each account will require a separate direct deposit form. Make sure to provide the correct routing and account numbers for each account to avoid any issues.

What happens if I close my Citibank account?

If you close your Citibank account, you will need to notify your employer or payer immediately. It is essential to provide them with your new bank account information to ensure that future deposits are directed correctly. Failure to do so may result in delayed or missed payments.

How to Use Citibank Direct Deposit

Once you have the Citibank Direct Deposit form ready, you can begin filling it out. Make sure you have your bank account information and personal details at hand. Completing this form accurately is essential for setting up your direct deposit successfully.

- Start by entering your personal information at the top of the form. This typically includes your name, address, and Social Security number.

- Next, provide your bank account details. You will need to include your account number and the routing number for your Citibank account.

- Indicate the type of account you are using. Check the box for either savings or checking account.

- Fill in any additional information requested, such as your employer’s name and address if applicable.

- Review all the information you have entered to ensure it is correct. Mistakes can delay the setup process.

- Sign and date the form at the bottom. This confirms that you authorize the direct deposit.

- Finally, submit the completed form to your employer or the relevant department handling payroll.