Printable Childcare Receipt Template

The Childcare Receipt form serves as a crucial document for parents and childcare providers alike, facilitating clear communication and record-keeping regarding childcare services rendered. This form captures essential details, including the date of service, the total amount paid, and the names of the children receiving care. It also specifies the period during which the childcare services were provided, ensuring that both parties have a clear understanding of the timeframe involved. A signature from the provider is included to authenticate the receipt, reinforcing the legitimacy of the transaction. By utilizing this form, parents can maintain accurate records for their financial planning or tax purposes, while providers can efficiently track their services and payments. Overall, the Childcare Receipt form is designed to simplify the documentation process and promote transparency in childcare transactions.

Common mistakes

-

Neglecting to Include the Date: Failing to write the date can lead to confusion about when services were provided. Always ensure the date is clearly filled in.

-

Incorrect Amount Entry: Double-check the amount being entered. A simple mistake in the dollar amount can create discrepancies in financial records.

-

Missing Child’s Name: Omitting the names of the child or children receiving care can complicate the receipt’s validity. Ensure that all names are accurately listed.

-

Incomplete Service Dates: Failing to specify the start and end dates of the childcare services can lead to misunderstandings. Both dates should be clearly indicated.

-

Provider’s Signature Omission: Not signing the receipt can render it invalid. Always ensure that the provider’s signature is included at the bottom of the form.

Find Common Documents

Western Union Receipt - Trust Western Union for secure transactions every step of the way.

To ensure a smooth and legally compliant transfer of ownership, it is important to utilize the appropriate documentation, such as the Florida Motor Vehicle Bill of Sale form. For those looking to obtain a copy, you can find it on floridaforms.net/blank-motor-vehicle-bill-of-sale-form, where it is available for download, providing buyers and sellers with the necessary framework for their transaction.

Blank Bill of Lading - Shippers should ensure all details are accurate to avoid delays.

Yugioh Deck List Sheet - Ensuring your deck matches tournament rules is crucial for participation.

Key takeaways

When filling out the Childcare Receipt form, it is essential to pay attention to several key details. Here are some important takeaways:

- Ensure that the date is clearly written to reflect the day the childcare services were provided.

- Fill in the amount accurately. This should reflect the total cost for the childcare services rendered.

- Clearly state the name of the individual or organization receiving the payment.

- List the names of the child(ren) who received childcare services. This helps in maintaining clear records.

- Indicate the dates of service accurately, specifying the start and end dates of the childcare period.

- The provider must sign the form to confirm that the services were provided. This adds authenticity to the receipt.

- Keep a copy of the filled-out receipt for personal records. This can be helpful for future reference or tax purposes.

- Use the form as proof of payment when applying for childcare subsidies or tax credits. It may be required by financial institutions or government agencies.

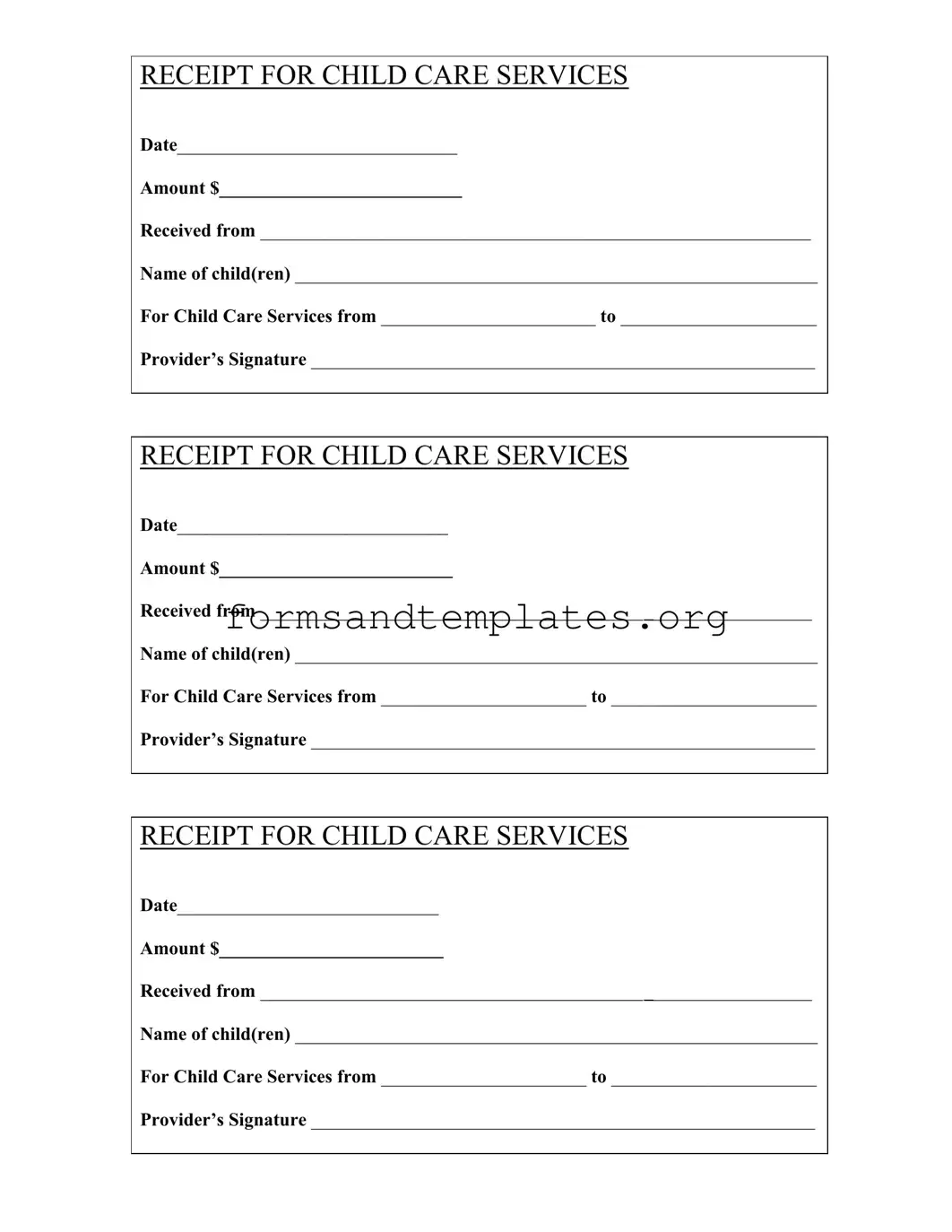

Childcare Receipt Example

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Understanding Childcare Receipt

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as a formal record of payment for childcare services. Parents or guardians receive this receipt from childcare providers to document the amount paid, the dates of service, and the names of the children enrolled. This documentation can be essential for tax purposes or reimbursement requests.

What information is required on the Childcare Receipt form?

The form requires several key pieces of information, including:

- Date of the transaction

- Amount paid

- Name of the person making the payment

- Name(s) of the child(ren) receiving care

- Dates of the childcare services provided

- Provider's signature

Completing all fields accurately ensures the receipt is valid and useful.

Who should fill out the Childcare Receipt form?

The childcare provider is responsible for filling out the form. After completing the necessary fields, the provider should present it to the parent or guardian who made the payment. This ensures that the receipt accurately reflects the transaction.

How can I use the Childcare Receipt form for tax purposes?

Parents can use the Childcare Receipt form to claim childcare expenses on their tax returns. The IRS allows eligible taxpayers to deduct certain childcare costs. Having a properly filled-out receipt serves as proof of payment, which may be required when filing taxes or applying for tax credits.

What should I do if I lose my Childcare Receipt?

If you lose your Childcare Receipt, contact your childcare provider as soon as possible. They can issue a duplicate receipt or provide the necessary details to recreate the document. Keeping records organized can help prevent this issue in the future.

Can I request a Childcare Receipt for partial payments?

Yes, you can request a Childcare Receipt for partial payments. Each payment made for childcare services can be documented separately. Ensure that the provider records the amount paid, along with the relevant details, on the receipt.

Is the Childcare Receipt form the same for all childcare providers?

While the basic elements of the Childcare Receipt form are generally consistent, specific formats may vary between providers. Each provider may have their own template or style, but the essential information should remain the same. Always check that the receipt includes all necessary details.

How often should I request a Childcare Receipt?

It is advisable to request a Childcare Receipt after each payment. This practice helps maintain accurate records and ensures that you have all necessary documentation for tax purposes or reimbursement requests. Regularly obtaining receipts can simplify your financial management.

What if the childcare provider refuses to issue a receipt?

If a childcare provider refuses to issue a receipt, it is important to address the issue directly. Politely explain the need for documentation, especially for tax purposes. If the provider continues to decline, consider discussing the matter with a supervisor or seeking alternative childcare options that comply with proper documentation practices.

How to Use Childcare Receipt

Filling out the Childcare Receipt form is straightforward. Ensure you have all the necessary information at hand. This form will help you document the childcare services provided and the payments made. Follow the steps below to complete the form accurately.

- Write the Date of the receipt in the designated space.

- Enter the Amount received for the childcare services.

- Fill in the name of the person or entity Received from.

- List the Name of child(ren) who received the childcare services.

- Indicate the period for which the services were provided by filling in the For Child Care Services from and to fields.

- Obtain the Provider’s Signature to finalize the receipt.