Printable Cg 20 10 07 04 Liability Endorsement Template

The CG 20 10 07 04 Liability Endorsement form is an essential component of commercial general liability insurance, specifically designed to extend coverage to additional insured parties. This endorsement modifies the existing policy to include specified individuals or organizations as additional insureds, but only for liabilities related to bodily injury, property damage, or personal and advertising injury that arise from the actions of the named insured or those acting on their behalf. The form outlines the necessary details, such as the names of additional insured parties and the locations where the covered operations take place. Importantly, the coverage is limited to the extent permitted by law and cannot exceed what is stipulated in any relevant contracts. Furthermore, the endorsement includes specific exclusions, such as injuries or damages that occur after the completion of work or after the insured's work has been put to its intended use by others. Lastly, it sets clear limits on the insurance amounts available to additional insureds, ensuring that these limits do not exceed what is required by contractual obligations or the policy’s overall limits. Understanding this endorsement is crucial for both policyholders and additional insureds to ensure adequate protection and compliance with contractual requirements.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the name of the additional insured or the specific locations of covered operations, can lead to coverage issues.

-

Incorrect Policy Number: Entering the wrong policy number can result in delays or denials of claims. Always double-check this information.

-

Missing Signatures: Not signing the form or having an authorized representative sign it can invalidate the endorsement.

-

Failure to Review Exclusions: Ignoring the specific exclusions outlined in the endorsement may lead to misunderstandings about what is covered.

-

Not Understanding Limits of Insurance: Misinterpreting the limits on coverage for additional insureds can result in unexpected financial exposure.

-

Providing Broader Coverage than Required: Offering coverage that exceeds what is stipulated in the contract can create unnecessary liabilities.

-

Neglecting to Update Information: Failing to update the endorsement with new additional insureds or changes in operations can leave gaps in coverage.

-

Assuming Automatic Coverage: Believing that all parties involved are automatically covered without explicitly naming them can lead to disputes.

-

Not Consulting Legal or Insurance Experts: Attempting to fill out the form without guidance can lead to critical errors. Always seek professional advice if unsure.

Find Common Documents

Hurt Feelings Report - The report requires basic personal information from the individual filing it.

In the state of California, having a Power of Attorney form is crucial for anyone wanting to ensure their financial and legal decisions are managed properly. By designating an agent, you can rest assured that your wishes will be respected, especially in situations where you cannot make decisions yourself. For those looking to create or update this important document, resources like California Templates can be highly beneficial in guiding you through the process.

Bill Lading - Carriers rely on this document to ensure compliance with shipping regulations.

Key takeaways

Here are key takeaways for filling out and using the CG 20 10 07 04 Liability Endorsement form:

- Policy Number: Ensure you have the correct policy number for the Commercial General Liability coverage.

- Additional Insured: Clearly list the names of all additional insured persons or organizations in the designated section.

- Location of Operations: Specify the locations where the covered operations will take place.

- Liability Coverage: Understand that the additional insured is covered only for liabilities arising from your actions or those acting on your behalf.

- Contractual Limitations: The coverage for additional insureds cannot exceed what is required by any contract or agreement.

- Exclusions: Be aware that coverage does not apply if the work has been completed or if the work has been put to its intended use.

- Insurance Limits: The maximum amount payable to additional insureds is the lesser of the contract requirement or the policy limits.

- Read Carefully: Review the entire endorsement thoroughly to ensure compliance and understanding of the terms.

Cg 20 10 07 04 Liability Endorsement Example

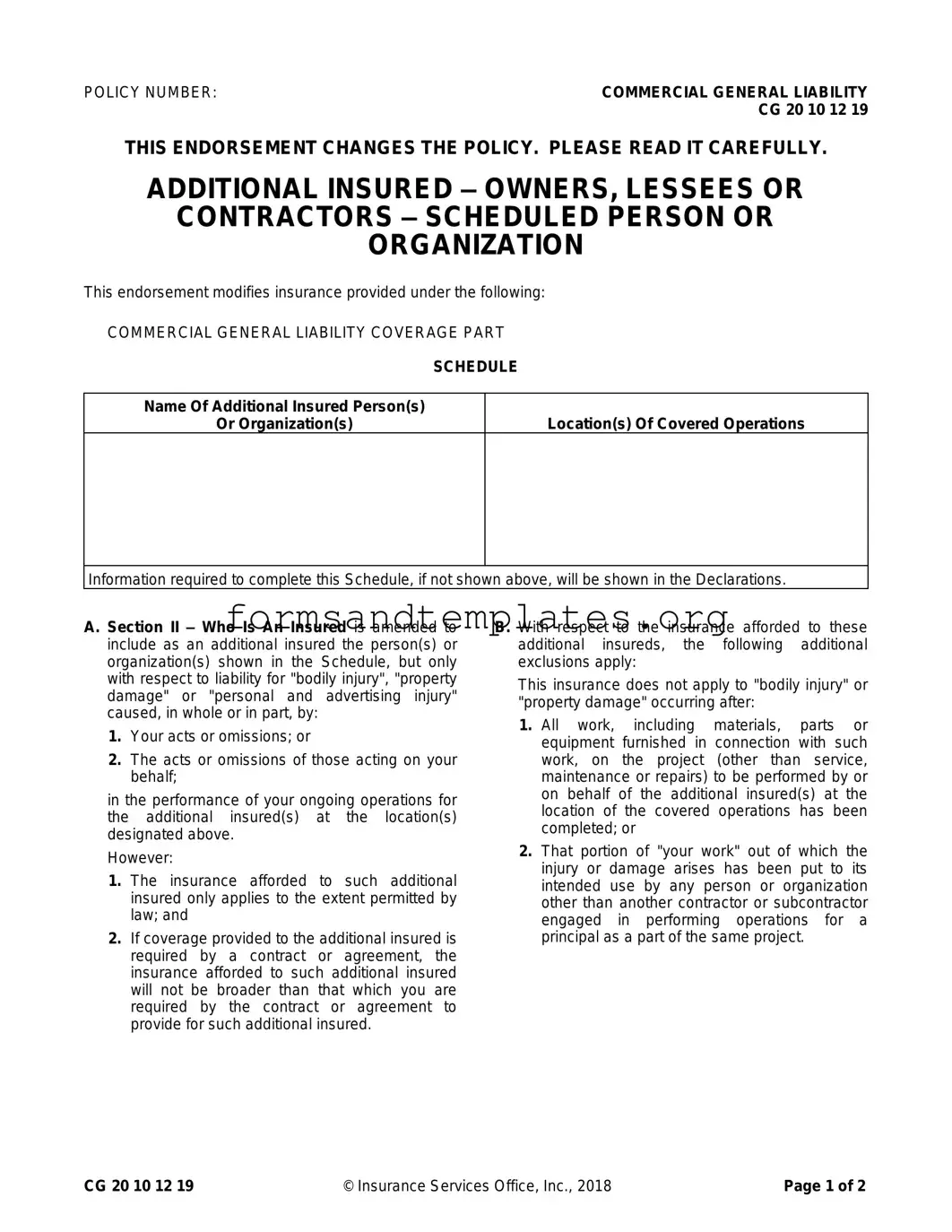

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 10 12 19 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – OWNERS, LESSEES OR

CONTRACTORS – SCHEDULED PERSON OR

ORGANIZATION

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

SCHEDULE

Name Of Additional Insured Person(s)

Or Organization(s)

Location(s) Of Covered Operations

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A. Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury", "property damage" or "personal and advertising injury" caused, in whole or in part, by:

1.Your acts or omissions; or

2.The acts or omissions of those acting on your behalf;

in the performance of your ongoing operations for the additional insured(s) at the location(s) designated above.

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following additional exclusions apply:

This insurance does not apply to "bodily injury" or "property damage" occurring after:

1.All work, including materials, parts or equipment furnished in connection with such work, on the project (other than service, maintenance or repairs) to be performed by or on behalf of the additional insured(s) at the location of the covered operations has been completed; or

2.That portion of "your work" out of which the injury or damage arises has been put to its intended use by any person or organization other than another contractor or subcontractor engaged in performing operations for a principal as a part of the same project.

CG 20 10 12 19 |

© Insurance Services Office, Inc., 2018 |

Page 1 of 2 |

C. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable limits of insurance;

whichever is less.

This endorsement shall not increase the applicable limits of insurance.

Page 2 of 2 |

© Insurance Services Office, Inc., 2018 |

CG 20 10 12 19 |

Understanding Cg 20 10 07 04 Liability Endorsement

What is the purpose of the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 Liability Endorsement form is used to add additional insured parties to a Commercial General Liability policy. This means that certain individuals or organizations can be protected under your policy for specific liabilities that arise from your work or actions.

Who can be named as an additional insured?

You can name individuals or organizations as additional insureds in the schedule provided on the endorsement form. These are typically owners, lessees, or contractors involved in your operations. The specific names and locations where coverage applies should be listed in the schedule section of the form.

What types of liabilities are covered under this endorsement?

The endorsement covers liabilities for bodily injury, property damage, or personal and advertising injury. However, the coverage is only applicable if these liabilities are caused by your actions or the actions of those acting on your behalf during the performance of ongoing operations for the additional insureds.

Are there any limitations to the coverage provided?

Yes, there are limitations. The coverage only applies to the extent permitted by law. If a contract requires you to provide coverage, it cannot exceed what is specified in that contract. Additionally, the coverage does not apply if the injury or damage occurs after your work has been completed or if the work has been put to its intended use by someone other than another contractor or subcontractor involved in the same project.

How are the limits of insurance determined for additional insureds?

The limits of insurance for additional insureds are determined by the contract or agreement that requires the coverage. The maximum amount payable will be the lesser of the amount specified in the contract or the applicable limits of your insurance policy. It is important to note that this endorsement does not increase the overall limits of your insurance policy.

What happens if the work is completed?

If all work related to the project is completed, the coverage for additional insureds will no longer apply. This includes any materials, parts, or equipment associated with that work. Coverage will also cease if the work has been put to its intended use by someone other than another contractor or subcontractor working on the same project.

Is it necessary to read the entire endorsement?

Yes, it is important to read the entire endorsement carefully. The language in the endorsement outlines specific conditions, limitations, and exclusions that may affect your coverage. Understanding these details can help you ensure that you and your additional insureds are adequately protected.

How to Use Cg 20 10 07 04 Liability Endorsement

Filling out the CG 20 10 07 04 Liability Endorsement form is a straightforward process, but it requires careful attention to detail. This form is designed to add additional insured parties to your commercial general liability policy. Completing it accurately ensures that the necessary parties are covered under your policy. Here’s how to proceed.

- Obtain the Form: Start by downloading or printing the CG 20 10 07 04 Liability Endorsement form.

- Policy Number: Locate the section labeled "POLICY NUMBER" at the top of the form. Enter your commercial general liability policy number here.

- Name of Additional Insured: In the "Name Of Additional Insured Person(s) Or Organization(s)" section, clearly list the names of the individuals or organizations you want to add as additional insureds.

- Location of Covered Operations: Next, provide the "Location(s) Of Covered Operations." Specify the addresses or locations where the covered operations related to the additional insureds will occur.

- Review the Declarations: If there is any information required to complete the schedule that is not included on the form, refer to your policy's Declarations page for that information.

- Sign and Date: Finally, ensure that you sign and date the form at the bottom, confirming that the information provided is accurate and complete.

After completing the form, make sure to keep a copy for your records. Submit the form to your insurance provider as instructed, ensuring that the additional insured parties are properly added to your policy. This will help protect all involved parties in the event of any claims arising from your operations.