Printable Cash Receipt Template

The Cash Receipt form serves as a vital tool in the financial management of businesses and organizations, providing a clear and concise record of cash transactions. This document typically captures essential details, including the date of the transaction, the amount received, and the purpose of the payment. It also identifies the payer, ensuring that all parties involved have a transparent understanding of the exchange. Often, the form includes a unique receipt number, which aids in tracking and auditing financial records. By maintaining an organized system of cash receipts, businesses can enhance their accountability and streamline their accounting processes. Moreover, this form not only helps in reconciling cash flow but also serves as proof of payment, safeguarding both the payer and the recipient against potential disputes. Overall, the Cash Receipt form is an indispensable element of sound financial practices, promoting clarity and trust in monetary transactions.

Common mistakes

-

Incorrect Date Entry: People often forget to enter the date or mistakenly write the wrong date. This can lead to confusion regarding when the transaction took place.

-

Missing Customer Information: Failing to include the customer's name and contact details can create difficulties in tracking payments or addressing any disputes that may arise later.

-

Improper Amount Recording: Some individuals miscalculate the total amount due or enter the wrong figures. This mistake can result in discrepancies in financial records.

-

Omitting Payment Method: Not specifying how the payment was made—whether by cash, check, or credit card—can complicate accounting processes and audits.

-

Neglecting Signatures: Many forget to sign the form or fail to obtain the necessary signatures from the customer. This oversight can undermine the validity of the receipt.

Find Common Documents

Lien Release Requirements by State - Mechanics Liens can create a financial incentive for property owners to pay suppliers.

For individuals looking to secure rental arrangements, understanding the Georgia Lease Agreement guidelines is crucial. This document clarifies the responsibilities and expectations between landlords and tenants, providing a solid foundation for a successful leasing experience.

Band Seating Chart Generator - Good organization fosters a professional and efficient concert environment.

Key takeaways

When filling out and using the Cash Receipt form, keep these key takeaways in mind:

- Complete all required fields: Ensure that every necessary section of the form is filled out accurately. Missing information can lead to processing delays.

- Record the date: Always write the date when the cash is received. This helps in tracking transactions over time.

- Specify the amount: Clearly indicate the total amount of cash received. Double-check the figure to avoid errors.

- Include payer details: Write down the name and contact information of the person or entity making the payment. This is important for future reference.

- Provide a description: Add a brief description of the purpose of the payment. This can help clarify the transaction later.

- Keep a copy: Always make a copy of the completed Cash Receipt form for your records. This ensures you have proof of the transaction.

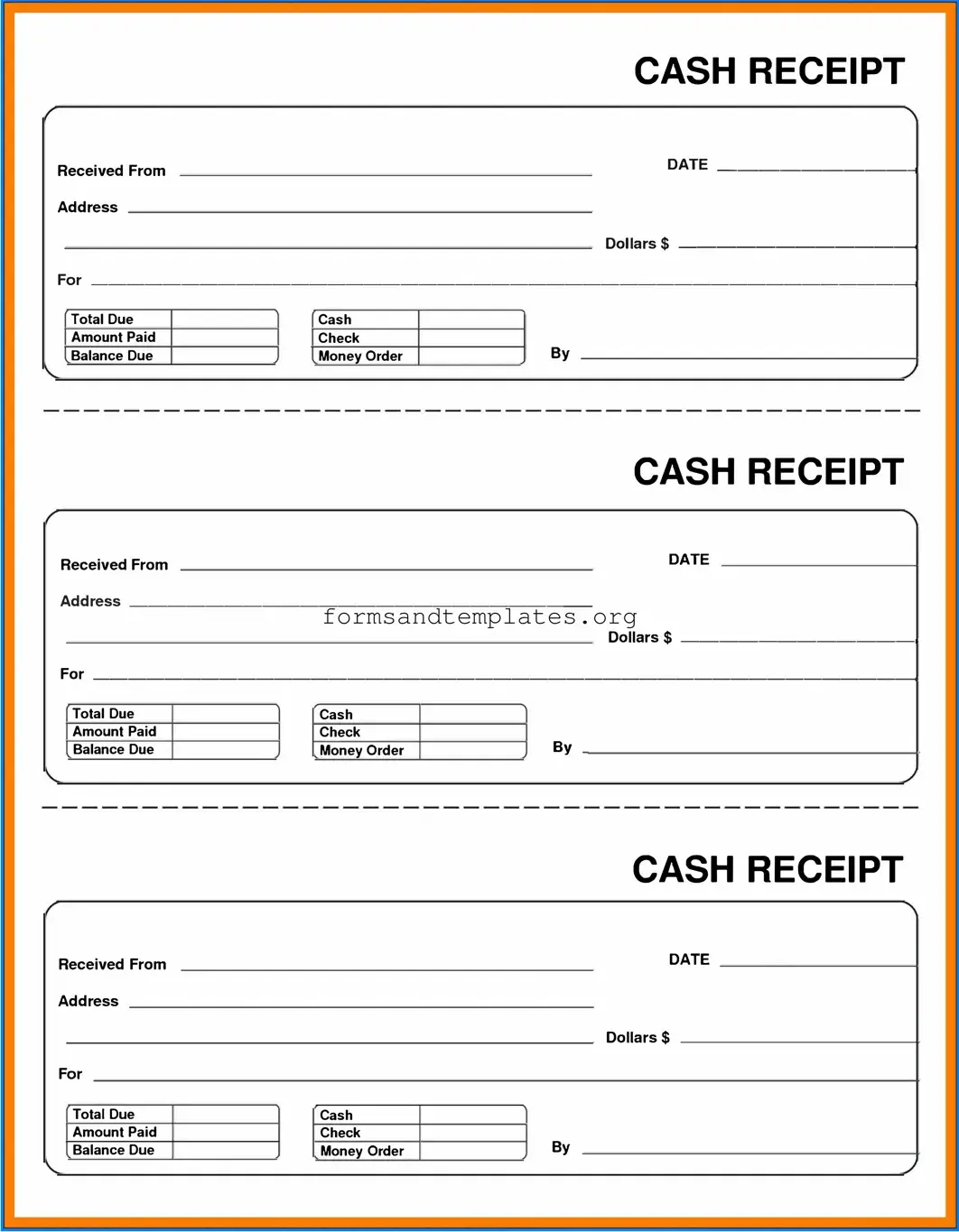

Cash Receipt Example

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Understanding Cash Receipt

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. This form is essential for maintaining accurate financial records and ensuring accountability in transactions. Typically, it includes details such as the date of the transaction, the amount received, the purpose of the payment, and the signature of the person receiving the cash. By using this form, businesses can track incoming cash flow and provide a clear audit trail for financial reporting.

When should I use a Cash Receipt form?

A Cash Receipt form should be used whenever a cash payment is received. Common scenarios include:

- Sales transactions where customers pay in cash.

- Payments received for services rendered.

- Deposits made by clients or customers.

- Any other situation involving cash exchange.

Using the form in these instances helps ensure that all cash transactions are properly documented and accounted for.

Who is responsible for filling out the Cash Receipt form?

The responsibility for completing the Cash Receipt form typically falls to the employee who receives the cash. This individual should ensure that all relevant information is accurately recorded. In some organizations, a designated cashier or finance officer may handle this task. It is crucial that the person filling out the form does so with attention to detail to avoid discrepancies in financial records.

How should I store completed Cash Receipt forms?

Completed Cash Receipt forms should be stored securely to protect sensitive financial information. Consider the following best practices for storage:

- Keep physical copies in a locked filing cabinet or safe.

- For electronic versions, use password-protected files or secure cloud storage solutions.

- Ensure that access to these forms is limited to authorized personnel only.

- Establish a retention policy to determine how long these records should be kept for auditing purposes.

By following these practices, organizations can maintain the integrity and confidentiality of their financial records.

How to Use Cash Receipt

Once you have the Cash Receipt form in front of you, it's time to fill it out accurately. This form is essential for tracking payments received. Follow these steps to ensure all necessary information is provided correctly.

- Begin by entering the date of the transaction at the top of the form.

- Next, write the name of the individual or organization making the payment.

- Fill in the amount of cash received. Be sure to use clear numbers.

- In the next section, specify the payment method (e.g., cash, check, credit card).

- If applicable, include any invoice number or reference number related to the payment.

- Sign your name in the prepared by section to confirm the receipt.

- Finally, make a copy of the completed form for your records.