Printable Cash Drawer Count Sheet Template

The Cash Drawer Count Sheet is an essential tool for businesses that handle cash transactions. This form plays a crucial role in maintaining accurate financial records by providing a systematic way to document the cash on hand at the end of a business day or shift. It typically includes sections for recording the starting cash balance, cash sales, cash received from various sources, and any discrepancies that may arise during the counting process. By utilizing this form, businesses can ensure that all cash transactions are accounted for, reducing the risk of theft or errors. Moreover, the Cash Drawer Count Sheet serves as a valuable resource for audits and financial reviews, allowing for easy tracking of cash flow and helping to identify trends in sales or discrepancies. Its structured format not only streamlines the counting process but also enhances accountability among employees handling cash, ultimately contributing to better financial management.

Common mistakes

-

Inaccurate Counting: One of the most common mistakes is miscounting the cash. It’s easy to lose track, especially if there are a lot of bills and coins. Always double-check your totals.

-

Not Including All Denominations: People often forget to account for all denominations of bills and coins. Ensure that every type of currency is included in the count.

-

Failing to Record Changes: If there are any discrepancies or changes from the previous count, failing to note these can lead to confusion later. Always document any adjustments made.

-

Illegible Handwriting: If the form is filled out by hand, unclear handwriting can cause misunderstandings. Take your time to write clearly or consider using a digital format.

-

Not Signing the Form: A signature is often required to verify that the count was completed accurately. Forgetting to sign can lead to issues during audits.

-

Ignoring Instructions: Each Cash Drawer Count Sheet may have specific instructions. Overlooking these can result in incomplete or incorrect submissions. Always read the guidelines carefully.

Find Common Documents

What Is an Abn in Healthcare - This document is crucial for avoiding unexpected medical bills for patients.

When engaging in the sale or purchase of a vehicle, it is important to use the appropriate documentation for a smooth transaction. The Florida Motor Vehicle Bill of Sale form provides a comprehensive summary of the agreement between the buyer and the seller, ensuring that all vehicle details, such as make, model, year, and VIN, are accurately recorded. For those looking for a template, you can find one here: https://floridaforms.net/blank-motor-vehicle-bill-of-sale-form, which will help facilitate the process and protect both parties legally.

Alabama Lost Title - Understanding the distinction between lien records and ownership transfers will aid in completing the correct form in future transactions.

Hosanna College of Health Transcript Request - Transcripts provide an important record of your academic achievements.

Key takeaways

When using the Cash Drawer Count Sheet form, it is essential to follow certain guidelines to ensure accuracy and efficiency. Here are some key takeaways:

- Always start with a clean cash drawer. This helps in maintaining an accurate count.

- Record the date and time at the top of the sheet. This information is crucial for tracking purposes.

- Count all cash, including bills and coins, and enter the amounts in the designated fields.

- Include any checks or credit card receipts as part of the total cash count.

- Double-check your calculations. Mistakes can lead to discrepancies that are difficult to resolve.

- Have a second person verify the count for added accuracy.

- Store the completed sheet in a secure location for future reference and audits.

- Regularly review your cash drawer counts to identify any patterns or issues.

- Use the form consistently for every cash drawer count to maintain uniformity in your records.

By following these guidelines, you can effectively manage cash drawer counts and ensure financial accuracy in your operations.

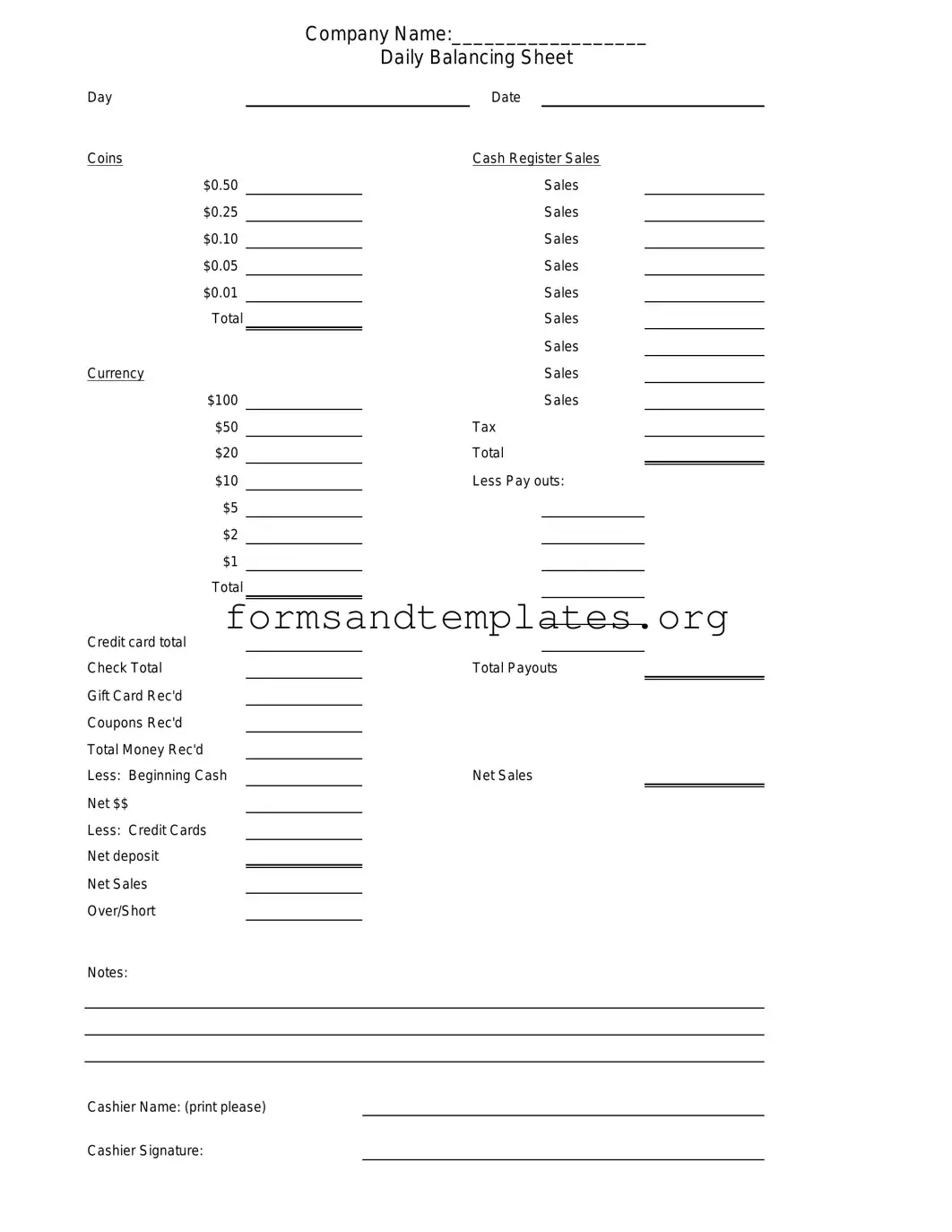

Cash Drawer Count Sheet Example

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Understanding Cash Drawer Count Sheet

What is a Cash Drawer Count Sheet?

A Cash Drawer Count Sheet is a document used by businesses to track the cash in their cash drawers. It helps ensure that the amount of cash on hand matches the sales records. This form is essential for maintaining accurate financial records and preventing discrepancies.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for several reasons:

- It helps identify any cash shortages or overages.

- It provides a clear record for audits and financial reviews.

- It assists in managing cash flow effectively.

- It promotes accountability among employees handling cash.

How do I fill out a Cash Drawer Count Sheet?

To fill out a Cash Drawer Count Sheet, follow these steps:

- Start by entering the date and the name of the person completing the count.

- Count the cash in the drawer, including bills and coins.

- Record the amount of each denomination in the designated sections.

- Calculate the total cash amount and write it at the bottom of the sheet.

- Sign the form to confirm the count is accurate.

How often should I complete a Cash Drawer Count Sheet?

It is recommended to complete a Cash Drawer Count Sheet at the end of each shift or daily. Frequent counts help catch errors early and maintain accurate cash records. Some businesses may also conduct counts during busy periods or after significant transactions.

What should I do if I find a discrepancy in the cash count?

If you discover a discrepancy, take the following steps:

- Double-check your count to ensure accuracy.

- Review recent transactions to identify possible errors.

- Consult with other employees who handled the cash during the shift.

- Document the discrepancy on the Cash Drawer Count Sheet.

- Report the issue to your supervisor or manager for further investigation.

Can I use a digital version of the Cash Drawer Count Sheet?

Yes, many businesses opt for digital versions of the Cash Drawer Count Sheet. Digital forms can streamline the counting process, reduce errors, and simplify record-keeping. Ensure that any digital version maintains the same essential information as the paper form.

What happens if I lose a Cash Drawer Count Sheet?

If a Cash Drawer Count Sheet is lost, it is important to recreate the count as accurately as possible. Gather information from sales records and any other related documents. Report the loss to your supervisor and implement measures to prevent future occurrences.

Is there a specific format for the Cash Drawer Count Sheet?

While there is no universally mandated format, a Cash Drawer Count Sheet should include key elements such as:

- Date of the count

- Name of the person conducting the count

- Breakdown of cash denominations

- Total cash amount

- Signature of the person completing the count

Customizing the format to suit your business needs is acceptable, as long as it captures all necessary information.

Who is responsible for completing the Cash Drawer Count Sheet?

The responsibility typically falls on the employee managing the cash drawer during their shift. However, businesses may designate specific personnel, such as a manager or supervisor, to oversee the counting process and ensure accuracy.

How to Use Cash Drawer Count Sheet

After obtaining the Cash Drawer Count Sheet form, you will proceed to accurately document the cash and other forms of payment in the drawer. This process is essential for maintaining financial integrity and ensuring that all transactions are accounted for properly.

- Begin by entering the date at the top of the form.

- Write your name or the name of the individual responsible for the cash drawer count.

- List the starting cash amount in the designated section. This is the total amount of cash in the drawer at the beginning of the counting process.

- Count each denomination of cash (e.g., $1, $5, $10, $20, $50, $100) separately and record the quantity of each denomination in the corresponding fields.

- Calculate the total for each denomination by multiplying the quantity by the value of the denomination, and write this total in the appropriate column.

- Add up the totals for all denominations to find the overall cash total. Write this amount in the designated "Total Cash" section.

- Record any other forms of payment (e.g., checks, credit card receipts) in the appropriate sections of the form.

- Calculate the total amount of all forms of payment combined and enter this in the "Total Payments" section.

- Review all entries for accuracy before finalizing the form.

- Sign and date the form to confirm that the count has been completed.