Printable California Affidavit of Death of a Trustee Template

In the realm of estate planning and trust administration, the California Affidavit of Death of a Trustee form plays a pivotal role when a trustee passes away. This important document serves as an official declaration that a designated trustee has died, thereby facilitating the seamless transition of responsibilities to a successor trustee. By providing essential information such as the deceased trustee's name, date of death, and details of the trust, this affidavit not only helps in maintaining the integrity of the trust but also ensures that the trust's assets are managed according to the deceased's wishes. Additionally, the form may require the signatures of witnesses or notaries, further solidifying its authenticity and legal standing. Understanding the nuances of this form is crucial for beneficiaries and successor trustees alike, as it lays the groundwork for effective trust administration and protects the interests of all parties involved. As the process unfolds, the affidavit serves as a key document in confirming the change in trusteeship, ensuring that the trust continues to operate smoothly and in accordance with the law.

Common mistakes

-

Failing to include the trustee's full name as it appears in the trust document.

-

Not providing the date of death of the trustee, which is crucial for the affidavit.

-

Omitting the trust name, which can lead to confusion about which trust is being referenced.

-

Incorrectly stating the trustee's address or failing to update it if it has changed.

-

Not signing the affidavit in front of a notary public, which is a required step for validation.

-

Forgetting to include additional documentation, such as a death certificate, if required.

-

Using outdated or incorrect forms, which can lead to delays or rejections.

-

Failing to provide contact information for the individual filing the affidavit, making follow-up difficult.

-

Not reviewing the form for accuracy before submission, which can result in errors being overlooked.

-

Neglecting to check the filing requirements for the specific county, as they can vary.

Find Common Documents

Aaa International Drivers License - This permit can save you from complications while driving abroad.

For those looking to complete the necessary documentation for their vehicle transaction, the California Motor Vehicle Bill of Sale form can be conveniently accessed through California Templates, ensuring that all crucial details are properly recorded and legally binding.

Tattoo Contract Agreement - Payments to the artist will be issued without any deductions for taxes, placing tax responsibilities solely on the artist.

Key takeaways

When dealing with the California Affidavit of Death of a Trustee form, it is essential to understand its purpose and the necessary steps for proper completion. Below are key takeaways that can guide individuals through the process.

- Purpose of the Affidavit: This form serves to formally acknowledge the death of a trustee in a trust, which is crucial for the administration of the trust and the distribution of its assets.

- Required Information: Accurate details about the deceased trustee must be provided, including their full name, date of death, and the trust's name. This information helps establish clarity and validity.

- Signature and Notarization: The affidavit must be signed by the remaining trustee or a successor trustee. Additionally, it needs to be notarized to ensure its legal standing.

- Filing the Affidavit: Once completed, the affidavit should be filed with the appropriate county recorder's office. This step is vital for updating public records and facilitating the trust's administration.

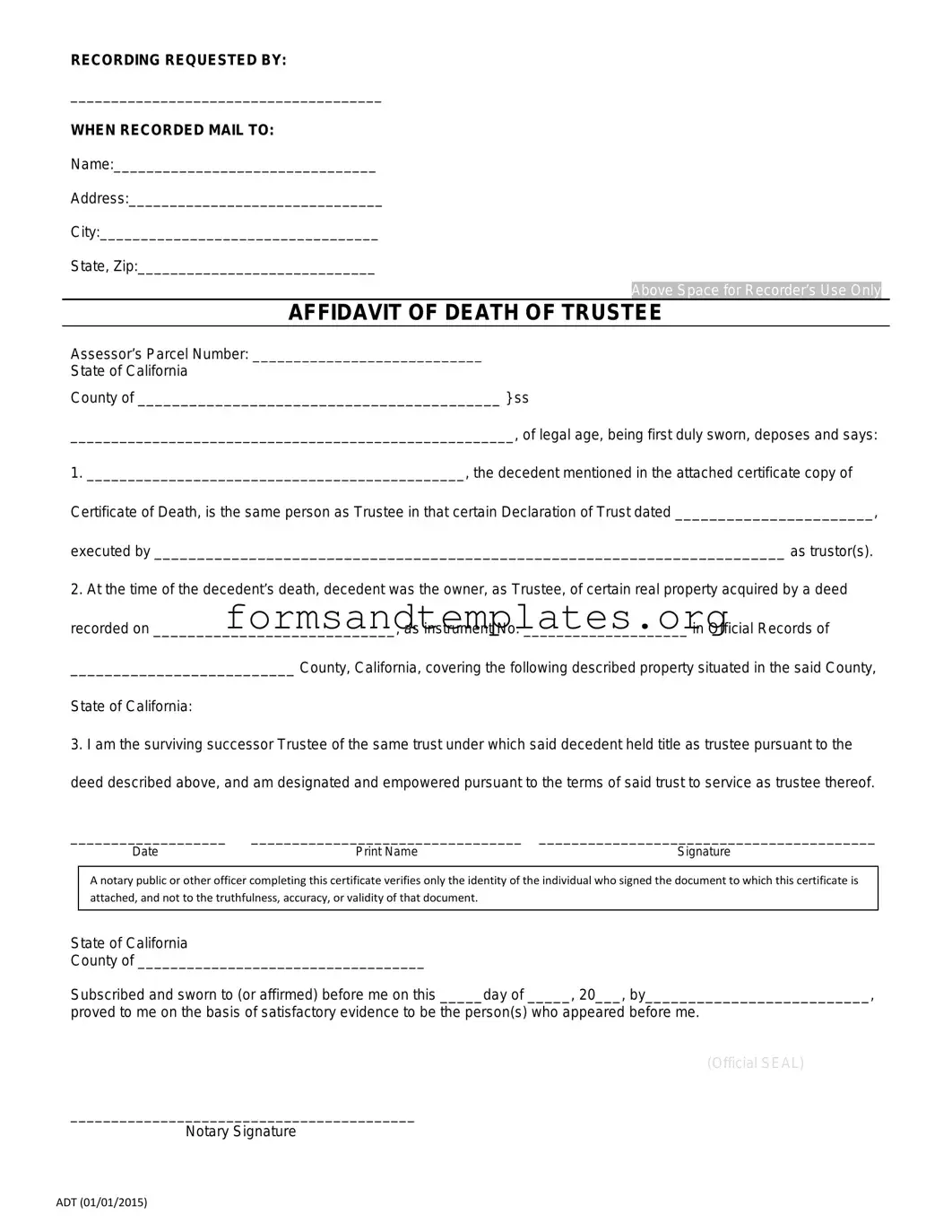

California Affidavit of Death of a Trustee Example

RECORDING REQUESTED BY:

______________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:_______________________________

City:__________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF TRUSTEE

Assessor’s Parcel Number: ____________________________

State of California

County of __________________________________________ } ss

______________________________________________________, of legal age, being first duly sworn, deposes and says:

1.______________________________________________, the decedent mentioned in the attached certificate copy of Certificate of Death, is the same person as Trustee in that certain Declaration of Trust dated _______________________, executed by _________________________________________________________________________ as trustor(s).

2.At the time of the decedent’s death, decedent was the owner, as Trustee, of certain real property acquired by a deed recorded on ____________________________, as instrument No. ____________________ in Official Records of

__________________________ County, California, covering the following described property situated in the said County,

State of California:

3.I am the surviving successor Trustee of the same trust under which said decedent held title as trustee pursuant to the deed described above, and am designated and empowered pursuant to the terms of said trust to service as trustee thereof.

___________________ |

_________________________________ |

_________________________________________ |

Date |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

__________________________________________

Notary Signature

ADT (01/01/2015)

Understanding California Affidavit of Death of a Trustee

What is the California Affidavit of Death of a Trustee form?

The California Affidavit of Death of a Trustee form is a legal document used to officially notify interested parties that a trustee has passed away. This form is essential for the proper administration of a trust, as it helps ensure that the trust can continue to be managed according to its terms. By completing this affidavit, the successor trustee or a designated party can establish their authority to act on behalf of the trust and manage its assets moving forward.

Who should complete the Affidavit of Death of a Trustee?

The affidavit should be completed by the successor trustee or an individual who has been granted the authority to act on behalf of the trust. This person is typically named in the trust document itself. If no successor trustee is named, beneficiaries of the trust may need to work together to appoint someone to complete the affidavit. It's important that the person completing the form has a clear understanding of the trust and its terms to ensure accurate representation of the deceased trustee's status.

What information is required on the form?

The form requires specific information to be filled out accurately. Key details include:

- The name of the deceased trustee.

- The date of the trustee's death.

- The name of the successor trustee or individual completing the affidavit.

- Details about the trust, including its name and date of creation.

- A statement affirming that the affiant is entitled to act on behalf of the trust.

Providing this information ensures that the affidavit serves its purpose and can be used effectively in managing the trust's assets.

What happens after the affidavit is filed?

Once the Affidavit of Death of a Trustee is completed and filed, it becomes an official record that can be used to inform banks, financial institutions, and other relevant parties about the change in trusteeship. This step is crucial for accessing trust assets and continuing the management of the trust. The successor trustee can then take the necessary actions to fulfill their responsibilities, which may include distributing assets, paying debts, and ensuring that the trust is managed according to the deceased trustee's wishes. It is advisable to keep copies of the affidavit for personal records and to provide to any institutions that require proof of the trustee's death.

How to Use California Affidavit of Death of a Trustee

After completing the California Affidavit of Death of a Trustee form, you'll need to file it with the appropriate court or office. This step is crucial for ensuring that the trust administration proceeds smoothly and in accordance with California law. Follow these steps to fill out the form accurately.

- Obtain the Form: Download or request a copy of the California Affidavit of Death of a Trustee form from a reliable source, such as the California court website or your attorney.

- Fill in the Trustee's Information: At the top of the form, enter the name of the deceased trustee, their date of death, and any relevant trust information.

- Provide Your Information: Include your name, address, and relationship to the deceased trustee. This helps establish your authority to file the affidavit.

- List the Trust Details: Clearly identify the trust by providing its name and date of creation. If applicable, include the trust's identification number.

- Sign the Affidavit: Sign and date the affidavit at the designated area. Ensure that your signature is legible and matches the name you provided earlier.

- Notarize the Document: Have the affidavit notarized to validate your signature. This step is often required for legal documents.

- Make Copies: Before submitting, make copies of the signed and notarized affidavit for your records and any other interested parties.

- File the Affidavit: Submit the completed affidavit to the appropriate court or office, following any local filing requirements.