Printable Business Credit Application Template

When it comes to establishing a business, securing credit is often a crucial step toward growth and sustainability. The Business Credit Application form plays a vital role in this process, serving as a bridge between businesses and potential lenders. This form typically requests essential information about your company, including its legal name, address, and structure. You’ll also need to provide details about your business’s financial health, such as revenue, expenses, and existing debts. Additionally, the application may ask for personal guarantees from business owners, ensuring that lenders have a safety net should the business struggle. By filling out this form accurately and thoroughly, you can present your business in the best light, increasing your chances of obtaining the credit you need to thrive. Understanding the nuances of this form can empower you to make informed decisions and foster strong relationships with financial institutions.

Common mistakes

-

Incomplete Information: Many applicants forget to fill out all sections of the form. Missing details can lead to delays in processing or even denial of credit. Ensure every field is filled out accurately.

-

Incorrect Business Structure: Some people mistakenly choose the wrong business structure. Whether it’s a sole proprietorship, partnership, or corporation, selecting the right type is crucial for credit assessment.

-

Neglecting Financial History: Applicants often overlook the importance of providing a complete financial history. This includes credit scores, outstanding debts, and previous loans. Lenders need this information to evaluate creditworthiness.

-

Not Reviewing Terms and Conditions: Some individuals skip reading the terms and conditions. Understanding the obligations and fees associated with the credit is vital. Failing to do so can lead to unexpected surprises later on.

Find Common Documents

5707e Form - The present occupation of each family member must be listed.

For those navigating the hiring process, understanding the intricacies of the Employment Verification requirements can streamline the verification process significantly. This form serves as a vital resource for employers looking to validate an applicant's work history and ensure compliance with employment laws.

Da 31 Form - The DA 31 may be updated occasionally; always check for the latest version.

Key takeaways

When filling out the Business Credit Application form, keep the following key takeaways in mind:

- Accuracy is crucial. Ensure all information is correct and up-to-date. Mistakes can delay the approval process.

- Provide complete documentation. Include all necessary financial statements and identification to support your application.

- Understand your credit history. Be aware that your credit score will be reviewed. A good score can improve your chances of approval.

- Follow up promptly. After submission, check in with the lender to confirm they received your application and to ask about the timeline for a decision.

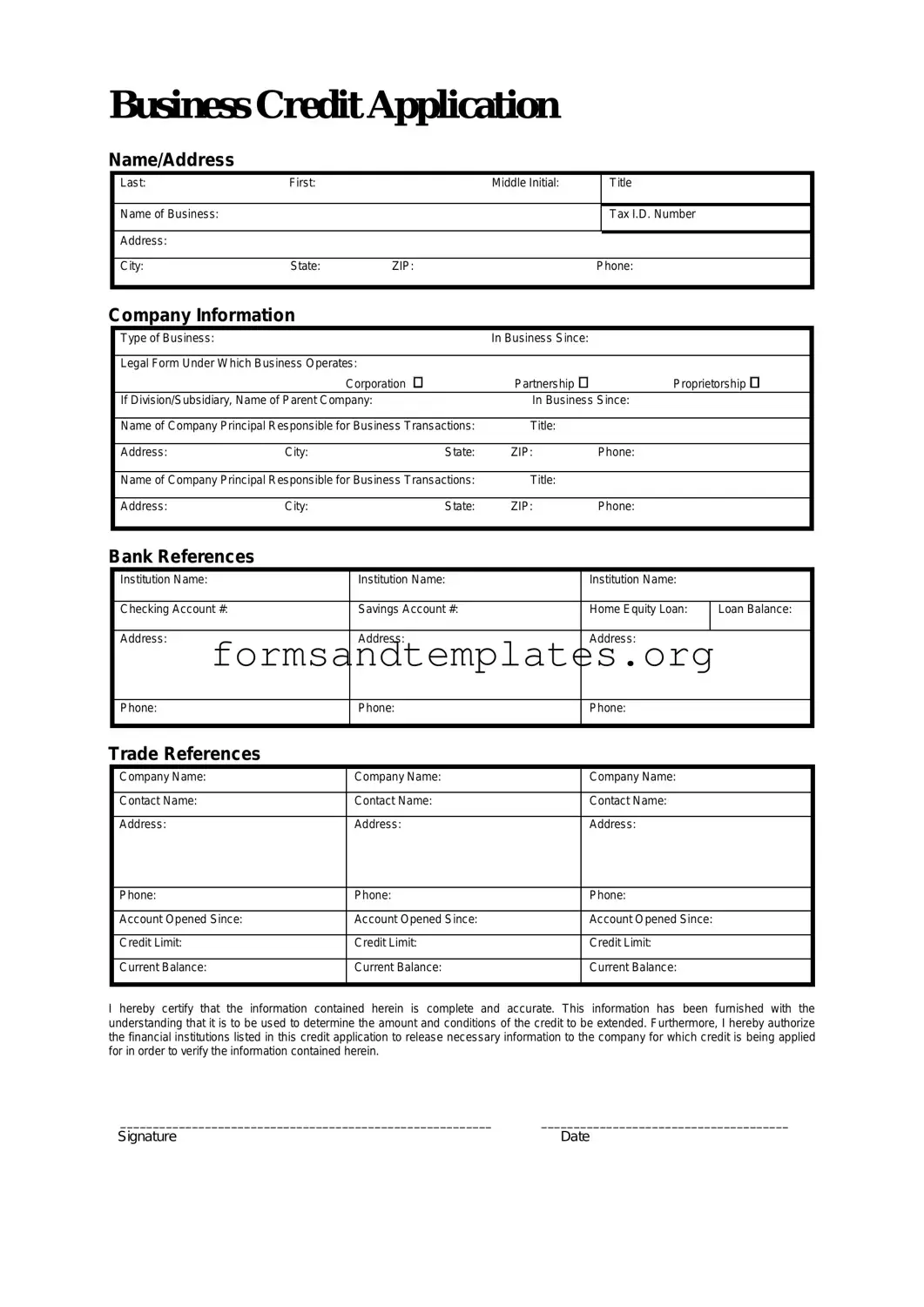

Business Credit Application Example

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Understanding Business Credit Application

What is the purpose of the Business Credit Application form?

The Business Credit Application form is designed to assess the creditworthiness of a business seeking credit. By collecting essential information about the business, its financial health, and its credit history, lenders can make informed decisions regarding credit limits and terms. This process helps ensure that both the lender and the business can establish a mutually beneficial relationship.

What information is typically required on the form?

When filling out the Business Credit Application form, you will generally need to provide the following information:

- Business Information: Name, address, and contact details.

- Ownership Structure: Details about the business owners, including their names and ownership percentages.

- Financial Information: Recent financial statements, tax returns, and any other relevant financial data.

- Bank References: Contact information for your business bank and any other financial institutions you work with.

- Trade References: Names and contact details of suppliers or other businesses that can vouch for your creditworthiness.

How long does the application process take?

The length of the application process can vary depending on the lender's policies and the completeness of your submission. Generally, you can expect a response within a few business days. However, if additional information is needed, it may take longer. It’s a good idea to follow up if you haven’t heard back within a week.

What happens after I submit the application?

Once you submit the Business Credit Application form, the lender will review the information provided. They will assess your creditworthiness based on your financial health, credit history, and the information from your references. After this review, you will receive a decision regarding your application. If approved, you will be informed of your credit limit and terms.

Can I apply for business credit if my business is new?

Yes, new businesses can apply for credit, but they may face additional scrutiny. Lenders typically look for personal guarantees or may require a co-signer with an established credit history. Providing a solid business plan and demonstrating potential for revenue can also enhance your chances of approval. It’s important to be prepared to explain your business model and financial projections.

How to Use Business Credit Application

Completing a Business Credit Application form is an important step for your business as it allows you to establish credit with potential lenders or suppliers. Once you've filled out the form, it will be reviewed by the financial institution or supplier, who will assess your application based on the information provided. Here are the steps to fill out the form accurately and efficiently.

- Read the Instructions: Before you start, carefully read any instructions provided with the form to understand what information is required.

- Provide Business Information: Fill in your business name, address, phone number, and email. Ensure that all details are accurate and up-to-date.

- List Business Structure: Indicate whether your business is a sole proprietorship, partnership, corporation, or LLC. This helps lenders understand your business type.

- Enter Ownership Details: Include the names and addresses of the owners or partners. This section may also require social security numbers or tax identification numbers.

- Financial Information: Provide details about your business's annual revenue, number of employees, and any existing credit lines. Be honest and precise.

- Bank References: List your business bank’s name, address, and contact information. This allows lenders to verify your financial history.

- Trade References: Include the names and contact details of suppliers or other creditors who can vouch for your creditworthiness.

- Review and Sign: Double-check all the information for accuracy. Once confirmed, sign and date the form. Your signature indicates that you authorize the lender to check your credit history.

After completing these steps, submit the application to the appropriate lender or supplier. They will process your application and get back to you with their decision. Patience is key during this time, as they may take a few days to review your information.