Attorney-Verified Business Bill of Sale Template

The Business Bill of Sale form serves as a vital document in the transaction of business assets, ensuring that both the buyer and seller have a clear record of the sale. This form typically includes essential details such as the names and addresses of both parties, a description of the assets being sold, and the agreed-upon purchase price. Additionally, it may outline any warranties or guarantees related to the assets, providing further protection for both parties involved. By documenting the transfer of ownership, the form helps to establish a legal framework that can prevent disputes in the future. It is important for both parties to review the form carefully before signing, as it serves not only as proof of the transaction but also as a reference for any potential legal matters that may arise later on. Understanding the components of the Business Bill of Sale form is crucial for anyone engaged in buying or selling business assets, as it lays the groundwork for a smooth and transparent transaction.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. This includes not only the names of the buyer and seller but also the business name, address, and contact information. Missing even one piece of information can lead to confusion or disputes later on.

-

Incorrect Business Valuation: Accurately assessing the value of the business is crucial. Overestimating or underestimating can lead to financial losses or legal complications. It's essential to conduct thorough research or consult a professional before determining the sale price.

-

Omitting Terms of Sale: The terms of sale, including payment methods, timelines, and any contingencies, should be clearly outlined. Failing to specify these can lead to misunderstandings and disputes between parties.

-

Not Including Assets and Liabilities: Listing all assets being sold, as well as any liabilities that the buyer will assume, is critical. Without this information, the buyer may face unexpected challenges after the sale.

-

Ignoring Legal Requirements: Each state has specific legal requirements for business transactions. Ignoring these can result in the sale being deemed invalid. Always verify that the form complies with local laws and regulations.

-

Failure to Sign: A signed document is essential for the validity of the sale. Both parties must sign the Business Bill of Sale. Without signatures, the agreement may not hold up in court.

-

Neglecting to Keep Copies: After the form is filled out and signed, it’s vital to keep copies for both the buyer and seller. This documentation serves as proof of the transaction and can be crucial if any disputes arise in the future.

Create Popular Types of Business Bill of Sale Templates

Separate Bill of Sale for Furniture - A document for transferring ownership of furniture between parties.

A Florida Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. This form serves as proof of the transaction and outlines essential details such as the buyer, seller, and description of the item being sold. For those looking for the necessary documentation, you can find the appropriate templates through Florida Forms, which can help ensure a smooth and transparent exchange.

Key takeaways

When filling out and using the Business Bill of Sale form, there are several important points to keep in mind.

- Identify the Parties: Clearly state the names and addresses of both the seller and the buyer. This ensures that both parties are recognized in the transaction.

- Describe the Business: Provide a detailed description of the business being sold. Include information such as the name, location, and type of business.

- Specify the Terms: Outline the terms of the sale, including the purchase price and any payment arrangements. This helps avoid misunderstandings later.

- Include Assets: List any assets included in the sale, such as equipment, inventory, or intellectual property. This ensures clarity on what is being transferred.

- Signatures Required: Both the seller and buyer must sign the document. This formalizes the agreement and makes it legally binding.

By paying attention to these key points, you can ensure that the Business Bill of Sale is completed accurately and effectively.

Business Bill of Sale Example

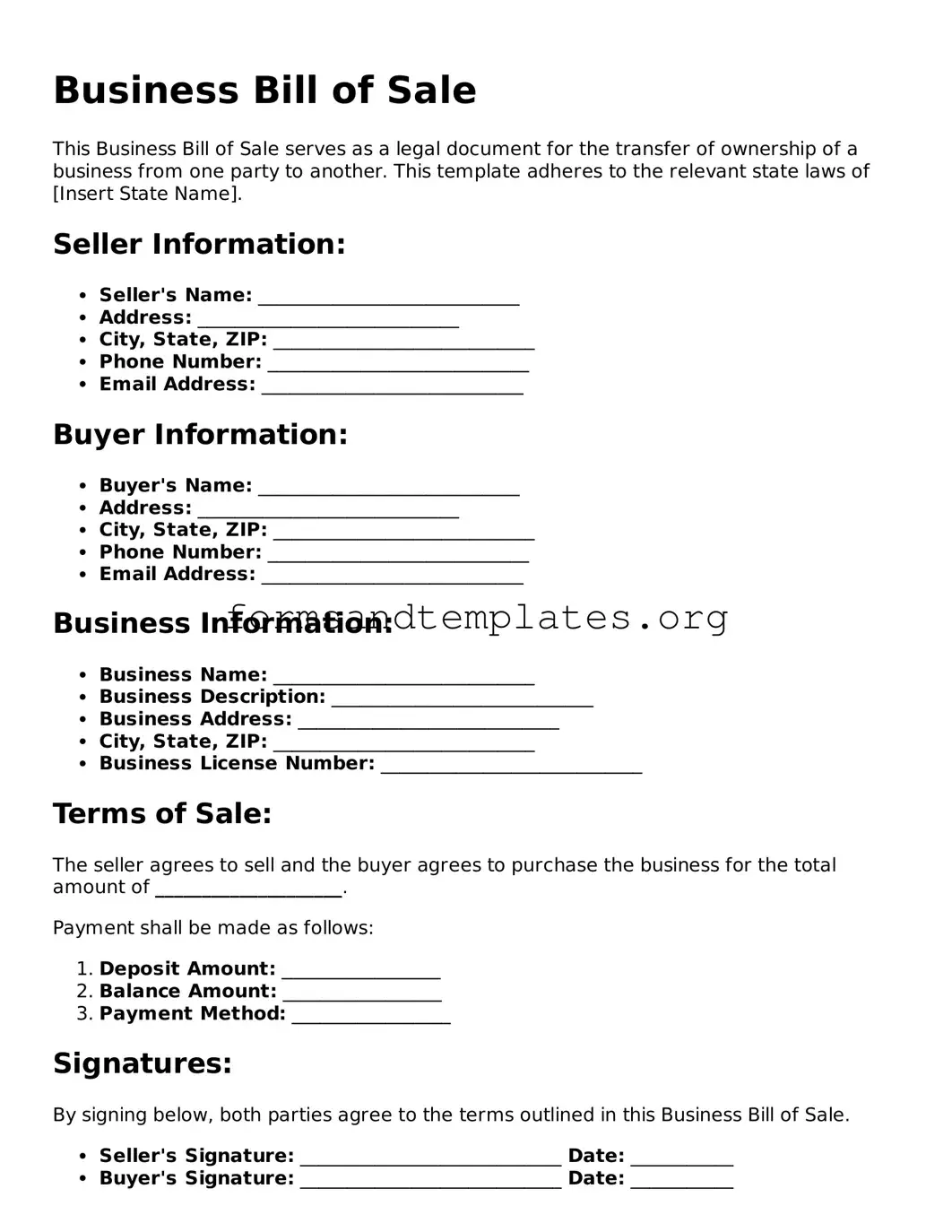

Business Bill of Sale

This Business Bill of Sale serves as a legal document for the transfer of ownership of a business from one party to another. This template adheres to the relevant state laws of [Insert State Name].

Seller Information:

- Seller's Name: ____________________________

- Address: ____________________________

- City, State, ZIP: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Buyer Information:

- Buyer's Name: ____________________________

- Address: ____________________________

- City, State, ZIP: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Business Information:

- Business Name: ____________________________

- Business Description: ____________________________

- Business Address: ____________________________

- City, State, ZIP: ____________________________

- Business License Number: ____________________________

Terms of Sale:

The seller agrees to sell and the buyer agrees to purchase the business for the total amount of ____________________.

Payment shall be made as follows:

- Deposit Amount: _________________

- Balance Amount: _________________

- Payment Method: _________________

Signatures:

By signing below, both parties agree to the terms outlined in this Business Bill of Sale.

- Seller's Signature: ____________________________ Date: ___________

- Buyer's Signature: ____________________________ Date: ___________

This document may need to be notarized as per state regulations. Please consult local laws to ensure compliance.

Understanding Business Bill of Sale

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the transfer of ownership of a business from one party to another. This form outlines the details of the transaction, including the names of the buyer and seller, the purchase price, and a description of the business being sold. It serves as proof of the sale and can be used for tax and legal purposes.

When should I use a Business Bill of Sale?

You should use a Business Bill of Sale when you are buying or selling a business. This document is essential for any transfer of ownership, whether it involves the entire business or specific assets. It is advisable to have this form completed before the transaction is finalized to ensure that both parties have a clear understanding of the terms and conditions.

What information is typically included in a Business Bill of Sale?

A typical Business Bill of Sale includes the following information:

- The names and addresses of the buyer and seller

- The date of the sale

- A detailed description of the business being sold

- The purchase price

- Any terms or conditions related to the sale

This information is crucial for ensuring that both parties are on the same page regarding the sale.

Do I need a lawyer to create a Business Bill of Sale?

While it is not strictly necessary to hire a lawyer to create a Business Bill of Sale, consulting with a legal professional is recommended. A lawyer can help ensure that the document meets all legal requirements and adequately protects your interests. If you choose to draft the form yourself, make sure to include all relevant details and follow any state-specific regulations.

Is a Business Bill of Sale legally binding?

Yes, a Business Bill of Sale is a legally binding document once it is signed by both parties. It signifies that the buyer and seller agree to the terms outlined in the document. However, for it to be enforceable, both parties must adhere to the terms and conditions set forth in the agreement. It is essential to keep a copy of the signed document for your records.

How to Use Business Bill of Sale

Filling out a Business Bill of Sale form is an important step in the process of transferring ownership of a business. It helps ensure that both parties are clear on the terms of the sale and protects their interests. Follow these steps carefully to complete the form accurately.

- Begin by entering the date of the sale at the top of the form.

- Provide the full legal name of the seller. This should match the name on the business's legal documents.

- Next, include the seller's contact information, such as their address and phone number.

- Enter the full legal name of the buyer, ensuring it matches their identification.

- Provide the buyer's contact information, including their address and phone number.

- Clearly describe the business being sold. This includes the business name, location, and any relevant details about its operations.

- Specify the purchase price agreed upon by both parties. Ensure that this amount is accurate and reflects any negotiations.

- Indicate the payment method. This could be cash, check, or another form of payment.

- If applicable, list any assets included in the sale, such as equipment, inventory, or intellectual property.

- Include any warranties or representations made by the seller regarding the business's condition or operations.

- Both the seller and the buyer should sign and date the form to confirm their agreement to the terms outlined.

Once you have completed the Business Bill of Sale form, make sure to keep copies for both parties. This document serves as a record of the transaction and may be needed for future reference or legal purposes.