Printable Auto Insurance Card Template

The Auto Insurance Card is a crucial document for drivers, serving as proof of insurance coverage while on the road. This card includes several important details that are essential for both the insured and law enforcement. Key elements on the card consist of the insurance company number, policy number, effective date, and expiration date, all of which confirm the validity of the insurance coverage. Additionally, the card lists the year, make, and model of the insured vehicle, along with its Vehicle Identification Number (VIN). It is issued by the insurance agency or company and must be kept in the insured vehicle at all times. In the event of an accident, the card must be presented upon demand. Furthermore, drivers are reminded to report any accidents to their insurance agent or company promptly, gathering necessary information such as the names and addresses of all drivers, passengers, and witnesses involved, as well as the insurance details of other vehicles. Notably, the card features an artificial watermark for security purposes, which can be viewed by holding it at an angle. This comprehensive overview underscores the importance of the Auto Insurance Card in ensuring compliance with state regulations and facilitating the claims process.

Common mistakes

-

Omitting the Effective and Expiration Dates: Many individuals forget to fill in the effective and expiration dates of their insurance policy. This information is crucial as it indicates the validity of the coverage. Without these dates, the card may not be accepted during an accident or traffic stop.

-

Incorrect Vehicle Identification Number (VIN): The VIN is unique to each vehicle and must be accurate. A simple typo can lead to significant issues, including delays in processing claims. Always double-check this number against the vehicle’s registration documents.

-

Failure to Include the Company Policy Number: The policy number links the insured vehicle to the specific insurance coverage. Leaving this field blank or entering it incorrectly can create confusion when filing a claim or verifying coverage.

-

Using Abbreviated Vehicle Make/Model: Some people abbreviate the make or model of their vehicle, thinking it will suffice. However, insurance companies require full names for accurate identification. This mistake can complicate matters during an accident.

-

Not Keeping the Card in the Vehicle: It is essential to keep the insurance card in the vehicle at all times. Many individuals forget this requirement, leading to potential fines or complications if they are involved in an accident.

-

Ignoring the Important Notice: The reverse side of the card often contains vital information regarding reporting accidents and what to do in case of an incident. Failing to read and understand this notice can result in missed steps that are crucial for proper claims handling.

Find Common Documents

Writing Daily Activity Security Guard Daily Report Sample - Date documentation is crucial for tracking incidents and activities.

The California Residential Lease Agreement is a legal document that outlines the terms and conditions between a landlord and tenant for renting a residential property. This form serves as a crucial tool to ensure both parties understand their rights and responsibilities. For your convenience, you can access the necessary documentation through California Templates to get started on your rental journey.

Hurt Feelings Report - It invites individuals to express their emotional experiences without judgment.

Key takeaways

When filling out and using the Auto Insurance Card form, consider the following key takeaways:

- Keep it in the vehicle: Always store the insurance card in the insured vehicle. It should be readily accessible for presentation if needed.

- Understand the information: Familiarize yourself with the details on the card, including the company number, policy number, and effective dates.

- Report accidents promptly: In case of an accident, report it to your insurance agent or company as soon as possible to ensure proper handling of your claim.

- Collect important information: Gather names and addresses of all drivers, passengers, and witnesses involved in an accident for accurate reporting.

- Document insurance details: Make sure to note the name of the insurance company and policy number for each vehicle involved in any incident.

- Check for authenticity: The front of the card features an artificial watermark. Hold it at an angle to confirm its legitimacy.

- Review the expiration date: Keep track of the expiration date on your insurance card to ensure that your coverage remains valid.

- Consult the reverse side: Important notices or additional information may be provided on the back of the card, so be sure to read it.

- Use clear and legible writing: If you need to fill out any additional information, use clear handwriting to avoid confusion.

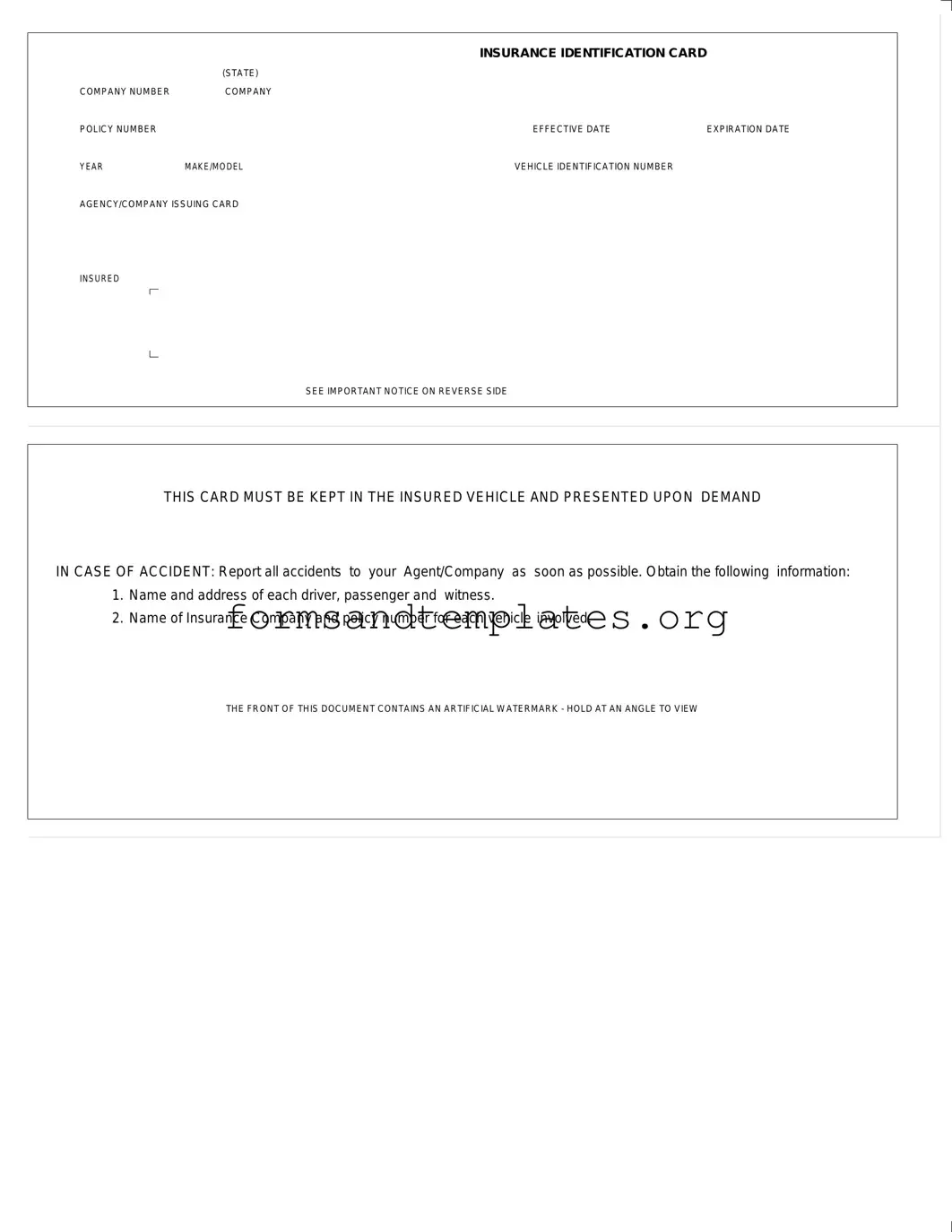

Auto Insurance Card Example

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Understanding Auto Insurance Card

What is an Auto Insurance Card?

An Auto Insurance Card is a document that provides proof of insurance coverage for a vehicle. It includes essential information such as the insurance company's name, policy number, and the effective and expiration dates of the coverage. This card must be kept in the insured vehicle and presented upon request during traffic stops or in the event of an accident.

What information is included on the Auto Insurance Card?

The Auto Insurance Card contains the following key details:

- Insurance identification card (state)

- Company number

- Company policy number

- Effective date of the policy

- Expiration date of the policy

- Year, make, and model of the vehicle

- Vehicle identification number (VIN)

- Agency or company issuing the card

Why is it important to keep the Auto Insurance Card in the vehicle?

Keeping the Auto Insurance Card in the vehicle is crucial for several reasons. First, it serves as proof of insurance, which is legally required in most states. Second, in case of an accident, having the card readily available allows for a quicker exchange of information with other parties involved. Lastly, it helps avoid potential fines or penalties for not having proof of insurance during traffic stops.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, contact your insurance agent or company immediately. They can issue a replacement card, often available digitally or by mail. It’s important to have a valid card on hand to avoid complications during traffic stops or in the event of an accident.

What steps should I take after an accident?

After an accident, follow these steps:

- Ensure everyone's safety and call for medical assistance if needed.

- Exchange information with the other driver(s), including names, addresses, and insurance details.

- Collect contact information from any witnesses.

- Report the accident to your insurance agent or company as soon as possible.

How can I verify the authenticity of my Auto Insurance Card?

The front of the Auto Insurance Card contains an artificial watermark. To verify its authenticity, hold the card at an angle to view the watermark. If you have any doubts about the card's validity, contact your insurance provider for confirmation.

What happens if I don’t present my Auto Insurance Card when required?

Failing to present your Auto Insurance Card when required can lead to serious consequences. You may face fines, penalties, or even suspension of your vehicle registration. Additionally, not having proof of insurance can complicate the claims process if you are involved in an accident.

How to Use Auto Insurance Card

Completing the Auto Insurance Card form requires careful attention to detail. Each section of the form must be filled out accurately to ensure that the information is both complete and correct. Following the steps outlined below will help you navigate the process smoothly.

- Locate the form titled "INSURANCE IDENTIFICATION CARD (STATE)" and ensure you have a pen or pencil ready for writing.

- In the first section, fill in the COMPANY NUMBER provided by your insurance company.

- Next, enter the COMPANY POLICY NUMBER associated with your insurance policy.

- Record the EFFECTIVE DATE of your insurance coverage, ensuring the format is correct (usually MM/DD/YYYY).

- Then, indicate the EXPIRATION DATE of your policy, following the same date format.

- Provide the YEAR, MAKE/MODEL of your vehicle, ensuring accuracy to avoid any discrepancies.

- Next, enter the VEHICLE IDENTIFICATION NUMBER (VIN), which can typically be found on your vehicle registration or title.

- Fill in the name of the AGENCY/COMPANY ISSUING CARD, which is usually your insurance provider.

- Review the form for any errors or omissions before finalizing your entries.

Once the form is completed, it is essential to keep it in your vehicle at all times. This ensures that you can present it upon demand in the event of an accident. Remember to report any accidents to your insurance agent or company promptly, and gather necessary information from all parties involved.