Transfer-on-Death Deed Template for the State of Arizona

In the realm of estate planning, the Arizona Transfer-on-Death Deed (TOD) form stands out as a powerful tool for property owners looking to simplify the transfer of their real estate upon death. This deed allows individuals to designate beneficiaries who will automatically receive ownership of their property without the need for probate, thereby streamlining the process and reducing potential legal complications. One of the key advantages of the TOD is its flexibility; property owners can revoke or change beneficiaries at any time during their lifetime, ensuring that their estate reflects their current wishes. Additionally, the form is relatively straightforward to complete, requiring essential information such as the property description and the names of the beneficiaries. By utilizing the Arizona Transfer-on-Death Deed, individuals can maintain control over their assets while providing peace of mind to their loved ones, knowing that the transfer of property will occur seamlessly after their passing.

Common mistakes

-

Failing to include all required information, such as the legal description of the property, can lead to an incomplete deed.

-

Not properly identifying the beneficiaries can result in confusion or disputes later. Ensure names are spelled correctly and include full legal names.

-

Overlooking the requirement for the signatures of all owners of the property may invalidate the deed.

-

Neglecting to have the deed notarized can lead to issues with its acceptance by the county recorder’s office.

-

Using outdated forms or incorrect versions of the Transfer-on-Death Deed can cause legal complications.

-

Not providing the correct address for the property may result in difficulties in locating the deed in the future.

-

Failing to record the deed with the county recorder can mean that the transfer does not take effect upon death.

-

Not understanding the implications of the Transfer-on-Death Deed can lead to unintended tax consequences for beneficiaries.

-

Forgetting to inform beneficiaries about the existence of the deed can create confusion and complications after the property owner’s death.

-

Not reviewing the deed periodically to ensure that it reflects current wishes may lead to outdated beneficiary designations.

Other Common Transfer-on-Death Deed State Templates

Transfer on Death Deed Texas Form Free - A Transfer-on-Death Deed is advantageous for sole property owners who want their intentions clearly documented and executed.

Transfer on Death Deed Virginia - Creates a straightforward path for effective estate distribution.

The California Residential Lease Agreement is a legal document that outlines the terms and conditions between a landlord and tenant for renting a residential property. This form serves as a crucial tool to ensure both parties understand their rights and responsibilities. For a comprehensive template, you can refer to California Templates, which will help you fill out the form effectively and get started on your rental journey.

Transfer on Death Deed Washington State Form - The form can be especially beneficial for those with straightforward property ownership situations.

Key takeaways

Filling out and using the Arizona Transfer-on-Death Deed form can be a straightforward process, but it’s important to understand the key aspects to ensure everything is done correctly. Here are some essential takeaways:

- The Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries without going through probate.

- To be valid, the deed must be signed by the property owner and notarized.

- It is crucial to list the beneficiaries clearly, including their full names and any relevant details to avoid confusion.

- Once completed, the deed must be recorded with the county recorder’s office where the property is located.

- Beneficiaries do not have any rights to the property until the owner passes away.

- The deed can be revoked or changed at any time before the owner’s death, as long as the owner follows the proper legal procedures.

- Consulting with a legal professional is advisable to ensure that the deed meets all legal requirements and reflects the owner's intentions.

- Keep a copy of the recorded deed in a safe place and inform beneficiaries about its existence and location.

Understanding these points can help ensure that your intentions for property transfer are honored and that your loved ones are taken care of after your passing.

Arizona Transfer-on-Death Deed Example

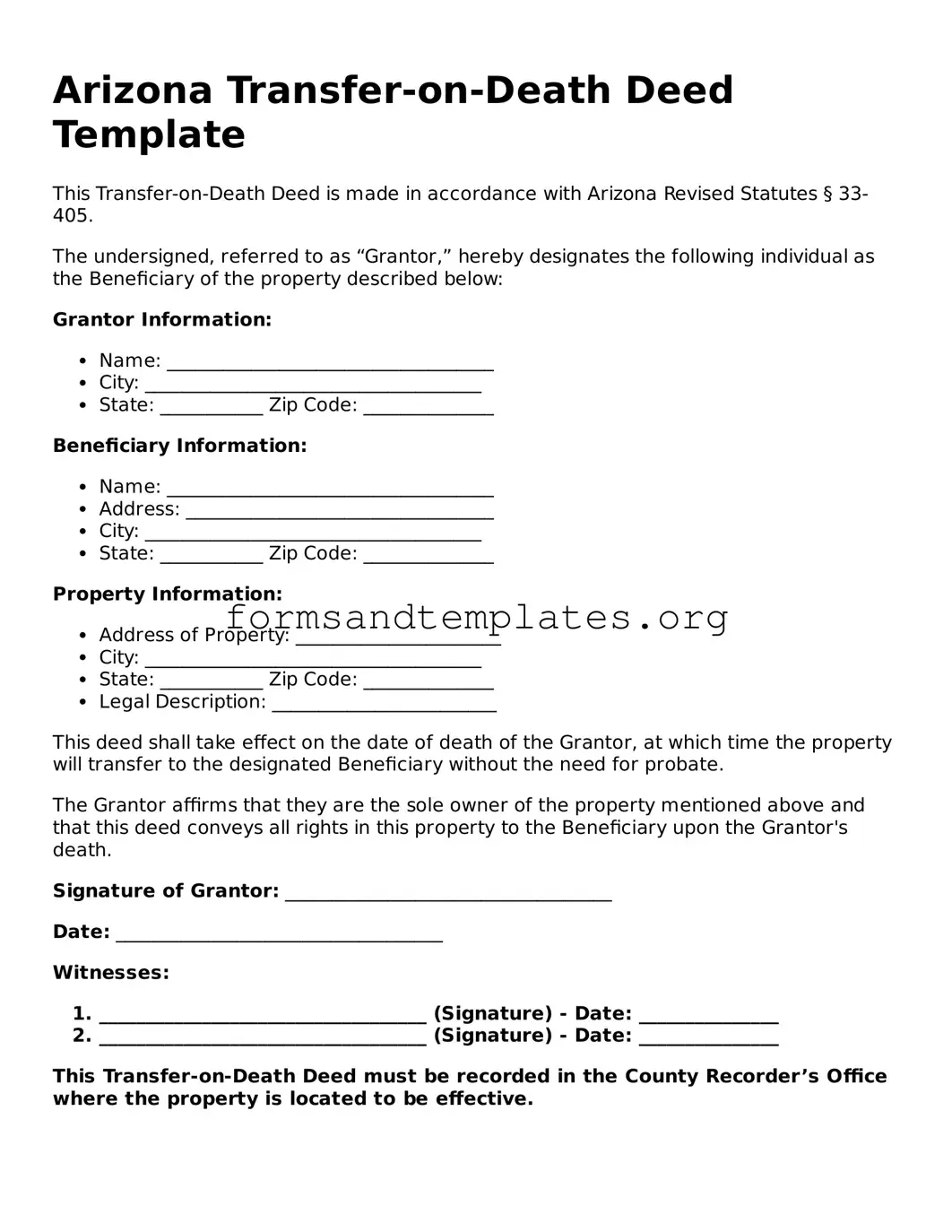

Arizona Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with Arizona Revised Statutes § 33-405.

The undersigned, referred to as “Grantor,” hereby designates the following individual as the Beneficiary of the property described below:

Grantor Information:

- Name: ___________________________________

- City: ____________________________________

- State: ___________ Zip Code: ______________

Beneficiary Information:

- Name: ___________________________________

- Address: _________________________________

- City: ____________________________________

- State: ___________ Zip Code: ______________

Property Information:

- Address of Property: ______________________

- City: ____________________________________

- State: ___________ Zip Code: ______________

- Legal Description: ________________________

This deed shall take effect on the date of death of the Grantor, at which time the property will transfer to the designated Beneficiary without the need for probate.

The Grantor affirms that they are the sole owner of the property mentioned above and that this deed conveys all rights in this property to the Beneficiary upon the Grantor's death.

Signature of Grantor: ___________________________________

Date: ___________________________________

Witnesses:

- ___________________________________ (Signature) - Date: _______________

- ___________________________________ (Signature) - Date: _______________

This Transfer-on-Death Deed must be recorded in the County Recorder’s Office where the property is located to be effective.

Understanding Arizona Transfer-on-Death Deed

- Obtain the appropriate form, which can often be found online or through legal resources.

- Fill out the form with the required information, including your name, the property description, and the names of the beneficiaries.

- Sign the deed in the presence of a notary public.

- Record the deed with the county recorder's office where the property is located.

What is a Transfer-on-Death Deed in Arizona?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Arizona to transfer real estate to designated beneficiaries upon their death. This deed enables property owners to avoid probate, simplifying the process of transferring ownership.

Who can create a Transfer-on-Death Deed?

Any individual who owns real estate in Arizona and is at least 18 years old can create a Transfer-on-Death Deed. It is important that the property owner is mentally competent at the time of creating the deed.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, follow these steps:

Is a Transfer-on-Death Deed revocable?

Yes, a Transfer-on-Death Deed is revocable. The property owner can change the beneficiaries or revoke the deed entirely at any time before their death. This can be done by executing a new deed or a revocation form.

What happens if a beneficiary dies before the property owner?

If a beneficiary named in the Transfer-on-Death Deed dies before the property owner, the property will not automatically transfer to that beneficiary’s heirs. Instead, the property will pass to the remaining beneficiaries listed in the deed. If no beneficiaries remain, the property will go through probate.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can only be used for real estate, such as land and buildings. It cannot be used for personal property, bank accounts, or other types of assets. Additionally, the property must be located in Arizona.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when executing a Transfer-on-Death Deed. The transfer of property does not occur until the death of the owner. However, beneficiaries may be subject to property taxes and potential capital gains taxes when they sell the property after inheriting it.

What if I want to change the beneficiaries on my Transfer-on-Death Deed?

To change beneficiaries, you must create a new Transfer-on-Death Deed that explicitly names the new beneficiaries. The previous deed should be revoked to avoid confusion. Ensure that the new deed is properly signed, notarized, and recorded.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to hire an attorney to create a Transfer-on-Death Deed, consulting with one is advisable. An attorney can provide guidance tailored to your specific situation and help ensure that the deed complies with Arizona law.

Where do I file the Transfer-on-Death Deed?

The Transfer-on-Death Deed must be filed with the county recorder's office in the county where the property is located. It is crucial to file the deed before the property owner’s death for it to be effective.

How to Use Arizona Transfer-on-Death Deed

Completing the Arizona Transfer-on-Death Deed form is an important step in ensuring your property is transferred according to your wishes. After filling out the form, it will need to be signed and recorded with the county recorder's office. This ensures that your intentions are legally recognized and respected.

- Obtain the Arizona Transfer-on-Death Deed form from a reliable source, such as a legal website or local government office.

- Fill in your full name as the owner of the property in the designated section.

- Provide the legal description of the property. This can usually be found on your property deed or tax records.

- Identify the beneficiary or beneficiaries who will receive the property upon your passing. Include their full names and any necessary identifying information.

- Sign the form in the presence of a notary public. Ensure that the notary public also signs and stamps the document.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the county recorder's office in the county where the property is located. Be aware of any filing fees that may apply.