Promissory Note Template for the State of Arizona

The Arizona Promissory Note form serves as a crucial financial document that outlines the terms of a loan agreement between a borrower and a lender. This legally binding instrument details the amount borrowed, the interest rate applicable, and the repayment schedule, ensuring both parties have a clear understanding of their obligations. In Arizona, this form is particularly important as it adheres to state laws governing loans and interest rates, providing protection for both lenders and borrowers. The document typically includes essential elements such as the names and addresses of the involved parties, the date of the agreement, and any provisions for default or late payments. Additionally, it may specify whether the loan is secured or unsecured, which can significantly impact the lender's rights in the event of non-payment. Overall, the Arizona Promissory Note form is designed to facilitate transparent financial transactions while safeguarding the interests of all parties involved.

Common mistakes

-

Inaccurate Information: One common mistake is providing incorrect details about the borrower or lender. This includes names, addresses, and contact information. It is essential that all personal information is accurate to avoid future disputes or complications.

-

Missing Signatures: Failing to sign the document is another frequent error. Both the borrower and the lender must sign the Promissory Note for it to be legally binding. Without these signatures, the note may not hold up in court.

-

Omitting Payment Terms: Some individuals neglect to clearly outline the payment terms. This includes the interest rate, repayment schedule, and any late fees. Clearly defined terms help ensure that both parties understand their obligations and can prevent misunderstandings.

-

Not Including a Default Clause: Many people overlook the importance of a default clause. This clause specifies what happens if the borrower fails to make payments as agreed. Including this information can protect the lender's interests and provide clarity on the next steps in case of default.

Other Common Promissory Note State Templates

Washington Promissory Note - The document serves as evidence in case of disputes over repayment obligations.

Create Promissory Note - Lenders ought to verify the borrower’s identity and creditworthiness before issuing a promissory note.

When engaging in a motor vehicle sale in California, it is crucial to utilize the appropriate documentation to formalize the transaction. The California Motor Vehicle Bill of Sale form acts as a comprehensive record of the transfer, encompassing necessary details such as the vehicle's identification number and sale price. For a reliable and user-friendly experience in preparing this essential document, you can access resources from California Templates.

How to Do a Promissory Note - The note must be clear and concise to avoid confusion.

Key takeaways

When filling out and using the Arizona Promissory Note form, there are several important points to consider. Understanding these can help ensure that the document serves its intended purpose effectively.

- Clear Identification: Clearly identify the parties involved. This includes the lender and the borrower. Full names and addresses should be provided to avoid confusion.

- Loan Amount: Specify the exact amount of money being borrowed. This figure should be accurate and clearly stated to prevent disputes later on.

- Interest Rate: If applicable, include the interest rate. This should be stated as an annual percentage rate and should comply with state laws to ensure it is enforceable.

- Repayment Terms: Outline the repayment schedule. This includes the frequency of payments (monthly, quarterly, etc.) and the duration of the loan. Clarity here is essential.

- Signatures: Ensure that all parties sign the document. Signatures validate the agreement and signify that both parties understand and accept the terms outlined in the note.

By keeping these key takeaways in mind, individuals can create a more effective and legally sound promissory note in Arizona.

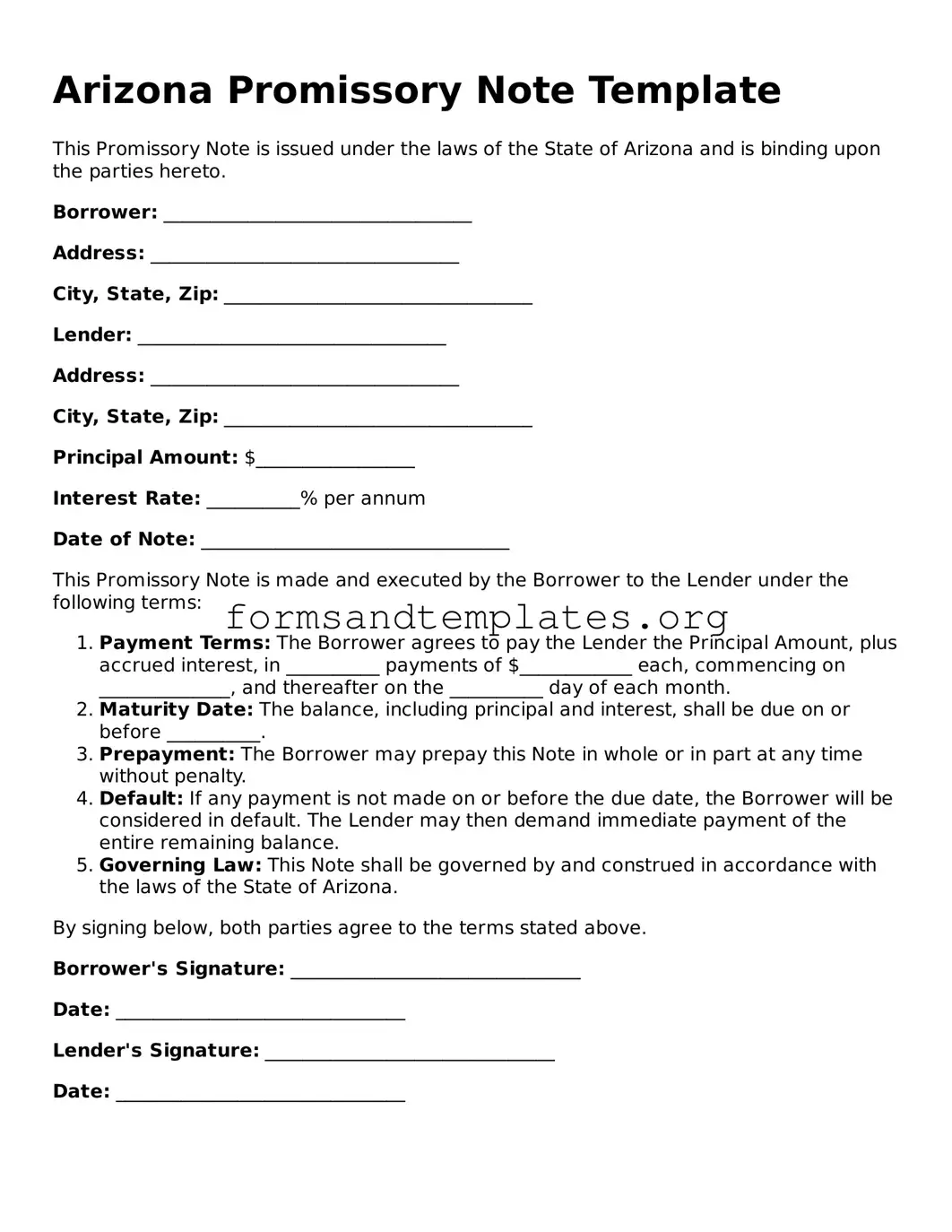

Arizona Promissory Note Example

Arizona Promissory Note Template

This Promissory Note is issued under the laws of the State of Arizona and is binding upon the parties hereto.

Borrower: _________________________________

Address: _________________________________

City, State, Zip: _________________________________

Lender: _________________________________

Address: _________________________________

City, State, Zip: _________________________________

Principal Amount: $_________________

Interest Rate: __________% per annum

Date of Note: _________________________________

This Promissory Note is made and executed by the Borrower to the Lender under the following terms:

- Payment Terms: The Borrower agrees to pay the Lender the Principal Amount, plus accrued interest, in __________ payments of $____________ each, commencing on ______________, and thereafter on the __________ day of each month.

- Maturity Date: The balance, including principal and interest, shall be due on or before __________.

- Prepayment: The Borrower may prepay this Note in whole or in part at any time without penalty.

- Default: If any payment is not made on or before the due date, the Borrower will be considered in default. The Lender may then demand immediate payment of the entire remaining balance.

- Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of Arizona.

By signing below, both parties agree to the terms stated above.

Borrower's Signature: _______________________________

Date: _______________________________

Lender's Signature: _______________________________

Date: _______________________________

Understanding Arizona Promissory Note

What is a Promissory Note in Arizona?

A Promissory Note is a legal document that outlines a borrower's promise to repay a specified sum of money to a lender under agreed-upon terms. In Arizona, this document serves as evidence of a debt and includes important details such as the amount borrowed, interest rate, repayment schedule, and any collateral securing the loan. It is essential for both parties to understand the terms clearly to avoid disputes in the future.

What are the key components of an Arizona Promissory Note?

Several critical elements must be included in a Promissory Note for it to be valid in Arizona:

- Names of the parties: The full legal names of both the borrower and the lender.

- Principal amount: The total amount of money being borrowed.

- Interest rate: The rate at which interest will accrue on the principal amount.

- Repayment terms: A detailed schedule outlining when payments are due and the amount of each payment.

- Default conditions: Conditions under which the borrower may be considered in default and the consequences of default.

- Governing law: A statement indicating that Arizona law will govern the terms of the note.

How does one execute a Promissory Note in Arizona?

To execute a Promissory Note in Arizona, the following steps should be followed:

- Draft the Promissory Note, ensuring that all required elements are included.

- Both the borrower and lender should review the document to confirm understanding and agreement on the terms.

- Sign the document in the presence of a witness or notary public, if desired, to enhance its legal enforceability.

- Provide copies of the signed note to both parties for their records.

What should I do if I need to modify an existing Promissory Note?

If modifications to an existing Promissory Note are necessary, both parties must agree to the changes. The process typically involves:

- Discussing the desired changes and reaching a mutual agreement.

- Drafting an amendment to the original Promissory Note that clearly outlines the modifications.

- Both parties should sign the amendment, and it is advisable to have it witnessed or notarized.

- Keep a copy of the amendment with the original Promissory Note for future reference.

How to Use Arizona Promissory Note

After obtaining the Arizona Promissory Note form, you will need to fill it out carefully. This document will require specific information regarding the parties involved, the loan amount, and the terms of repayment. It is important to ensure that all details are accurate to avoid any potential disputes in the future.

- Begin by entering the date at the top of the form. This should reflect the date you are completing the document.

- Identify the borrower by writing their full legal name. If the borrower is a business, include the business name as well.

- Next, provide the lender's full legal name. Again, if the lender is a business, include the business name.

- Clearly state the principal amount of the loan in numbers and words. For example, if the loan is for $5,000, write "Five Thousand Dollars" next to the numerical amount.

- Specify the interest rate, if applicable. Write this as a percentage, for instance, "5% per annum."

- Detail the repayment terms. Indicate how often payments will be made (monthly, quarterly, etc.) and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable. Clearly outline the terms for these fees.

- Sign the form where indicated. The borrower must sign to acknowledge the terms of the loan.

- If required, have a witness sign the document as well. This may depend on the specific requirements for your situation.

- Finally, make copies of the completed form for both the borrower and the lender for their records.