Deed in Lieu of Foreclosure Template for the State of Arizona

The Arizona Deed in Lieu of Foreclosure form serves as an important tool for homeowners facing financial difficulties and potential foreclosure. This legal document allows a property owner to voluntarily transfer their property title to the lender in exchange for the cancellation of the mortgage debt. By opting for a deed in lieu, individuals can avoid the lengthy and often stressful foreclosure process. This option can be beneficial for both parties; lenders can recover their investment more quickly, while homeowners may be able to protect their credit scores and minimize the emotional strain associated with foreclosure. The form typically requires details such as the property description, the parties involved, and any existing liens on the property. Additionally, it may include provisions for the homeowner to vacate the property and any potential tax implications. Understanding the implications and requirements of the Arizona Deed in Lieu of Foreclosure is essential for homeowners considering this route as a means of addressing their financial challenges.

Common mistakes

-

Failing to provide accurate property information. Ensure that the legal description of the property is complete and correct. Inaccuracies can lead to complications in the transfer process.

-

Not obtaining the necessary signatures. All parties involved must sign the document. Missing signatures can invalidate the deed.

-

Overlooking the requirement for notarization. The deed must be notarized to be legally binding. Without a notary, the document may not hold up in court.

-

Neglecting to review any outstanding liens or encumbrances. It is important to identify any existing debts tied to the property. Failure to address these can result in future legal issues.

-

Assuming the lender will automatically accept the deed. Communication with the lender is crucial. They must agree to the terms and conditions outlined in the deed.

-

Not consulting with a legal expert. Legal advice can provide clarity on the implications of signing a deed in lieu of foreclosure. Ignoring this step may lead to unintended consequences.

Other Common Deed in Lieu of Foreclosure State Templates

Deed in Lieu of Mortgage - The deed simplifies the transfer process, preventing prolonged disputes.

Before finalizing your transaction, it's important to understand the various components of the sale, including the necessity of documentation. For comprehensive resources on properly managing such transactions, visit California Templates, where you can find a fillable Motor Vehicle Bill of Sale template that simplifies the process significantly.

Key takeaways

Filling out and using the Arizona Deed in Lieu of Foreclosure form requires careful attention to detail. Here are key takeaways to consider:

- The deed allows homeowners to transfer property ownership to the lender to avoid foreclosure.

- Both parties must agree to the deed; it is not a unilateral decision.

- Homeowners should ensure all mortgage obligations are clearly outlined before proceeding.

- Consulting with a legal professional is advisable to understand potential consequences.

- All documents must be filled out accurately to avoid delays in processing.

- Homeowners should obtain a copy of the deed for their records after it is executed.

- Filing the deed with the county recorder's office is essential for it to be legally binding.

- Consider the impact on credit scores, as this may still be reported negatively.

- Seek to negotiate any deficiencies with the lender to avoid future liability.

- Timing is crucial; act quickly to prevent foreclosure proceedings from advancing.

Arizona Deed in Lieu of Foreclosure Example

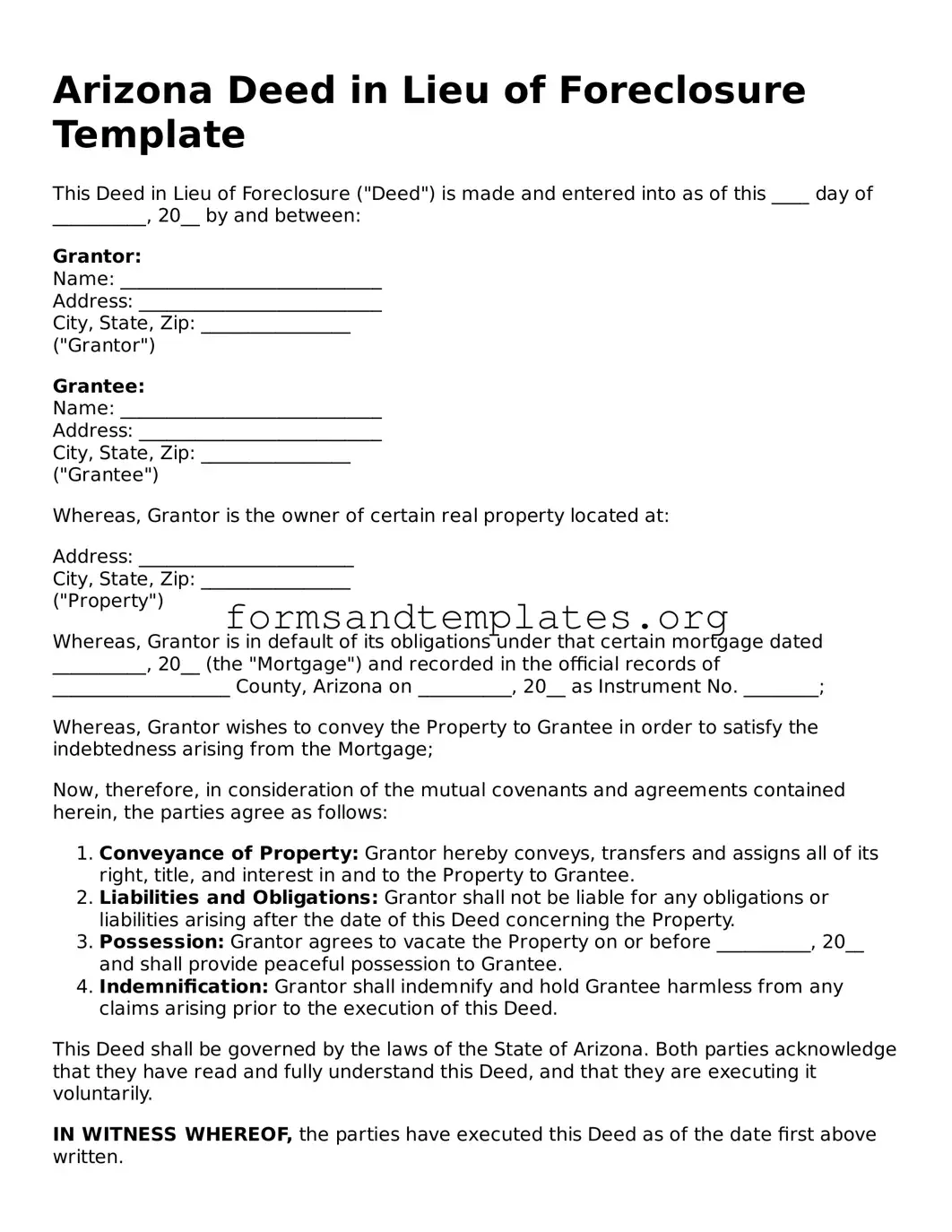

Arizona Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is made and entered into as of this ____ day of __________, 20__ by and between:

Grantor:

Name: ____________________________

Address: __________________________

City, State, Zip: ________________

("Grantor")

Grantee:

Name: ____________________________

Address: __________________________

City, State, Zip: ________________

("Grantee")

Whereas, Grantor is the owner of certain real property located at:

Address: _______________________

City, State, Zip: ________________

("Property")

Whereas, Grantor is in default of its obligations under that certain mortgage dated __________, 20__ (the "Mortgage") and recorded in the official records of ___________________ County, Arizona on __________, 20__ as Instrument No. ________;

Whereas, Grantor wishes to convey the Property to Grantee in order to satisfy the indebtedness arising from the Mortgage;

Now, therefore, in consideration of the mutual covenants and agreements contained herein, the parties agree as follows:

- Conveyance of Property: Grantor hereby conveys, transfers and assigns all of its right, title, and interest in and to the Property to Grantee.

- Liabilities and Obligations: Grantor shall not be liable for any obligations or liabilities arising after the date of this Deed concerning the Property.

- Possession: Grantor agrees to vacate the Property on or before __________, 20__ and shall provide peaceful possession to Grantee.

- Indemnification: Grantor shall indemnify and hold Grantee harmless from any claims arising prior to the execution of this Deed.

This Deed shall be governed by the laws of the State of Arizona. Both parties acknowledge that they have read and fully understand this Deed, and that they are executing it voluntarily.

IN WITNESS WHEREOF, the parties have executed this Deed as of the date first above written.

Grantor:

______________________________

Signature

Date:

______________________________

Grantee:

______________________________

Signature

Date:

______________________________

Understanding Arizona Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This process allows the homeowner to walk away from the mortgage obligation without the lengthy and often stressful foreclosure process. It can be a beneficial option for those facing financial difficulties and wanting to minimize the impact on their credit score.

How does the Deed in Lieu of Foreclosure process work?

The process typically involves several steps:

- The homeowner contacts their lender to discuss their financial situation and express interest in a Deed in Lieu of Foreclosure.

- The lender reviews the homeowner’s financial records and property value to determine eligibility.

- If approved, both parties will sign the deed, transferring ownership of the property to the lender.

- The lender may then forgive the remaining mortgage debt, but this can vary based on individual agreements.

Once the deed is signed, the homeowner will no longer be responsible for the mortgage payments, and the lender can proceed with selling the property.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure offers several advantages:

- Less damage to credit score: It typically has a less severe impact on credit compared to a foreclosure.

- Faster resolution: The process can be quicker than going through a foreclosure, allowing homeowners to move on sooner.

- Potential for debt forgiveness: Homeowners may have their remaining mortgage balance forgiven, depending on the agreement with the lender.

- Less stress: It can alleviate the emotional burden associated with foreclosure.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential drawbacks to consider:

- Impact on credit: Although less severe than foreclosure, a Deed in Lieu can still negatively affect your credit score.

- Tax implications: The forgiven debt may be considered taxable income, which could lead to unexpected tax liabilities.

- Eligibility requirements: Not all lenders accept Deeds in Lieu, and homeowners must meet specific criteria to qualify.

Can I still pursue a Deed in Lieu of Foreclosure if I have a second mortgage?

Yes, it is possible to pursue a Deed in Lieu of Foreclosure even if you have a second mortgage. However, this can complicate the process. The lender holding the first mortgage must agree to the deed, and the second mortgage lender may still have a claim on the property. It’s essential to communicate with both lenders and understand their policies regarding Deeds in Lieu. Consulting with a financial advisor or legal expert can provide clarity on your specific situation.

How to Use Arizona Deed in Lieu of Foreclosure

After you have completed the Arizona Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate parties involved in your mortgage agreement. This may include your lender and possibly the county recorder's office. Be sure to keep copies of all documents for your records. Following these steps will help ensure that the process goes smoothly.

- Begin by obtaining the Arizona Deed in Lieu of Foreclosure form from a reliable source, such as your lender or a legal website.

- Fill in the names of the parties involved. This typically includes your name as the borrower and the name of the lender.

- Provide the address of the property that is subject to the deed.

- Include the legal description of the property. This can usually be found on your mortgage documents or property tax statements.

- Indicate the date of the transfer. This is the date you are signing the document.

- Sign the form in the designated area. Ensure that you are signing as the borrower.

- Have the form notarized. A notary public must witness your signature to validate the document.

- Make copies of the completed and notarized form for your records.

- Submit the original form to your lender and any other required parties.