Articles of Incorporation Template for the State of Arizona

When starting a business in Arizona, one of the first critical steps is completing the Articles of Incorporation form. This document serves as the foundation for establishing a corporation in the state. It outlines essential information, including the corporation's name, its duration, and the purpose for which it is formed. Additionally, the form requires details about the registered agent, who will receive legal documents on behalf of the corporation. The Articles of Incorporation also specify the number of shares the corporation is authorized to issue, which is vital for future fundraising efforts. Filing this form with the Arizona Corporation Commission is not just a regulatory requirement; it is a crucial step toward formalizing your business structure and protecting your personal assets. Understanding the nuances of this form can streamline the incorporation process and set your business up for success.

Common mistakes

-

Incorrect Entity Type Selection: One common mistake is selecting the wrong type of corporation. Arizona offers various types, including nonprofit and for-profit. Ensure you choose the right one based on your business goals.

-

Missing or Incomplete Information: Failing to provide all required details can lead to delays. Double-check that every section is filled out completely, including the name, address, and purpose of the corporation.

-

Improper Corporate Name: The name of your corporation must be unique and not too similar to existing entities. Conduct a thorough search to avoid potential conflicts and ensure compliance with Arizona naming rules.

-

Failure to Designate a Statutory Agent: Every corporation in Arizona must have a statutory agent. This person or entity will receive legal documents on behalf of the corporation. Make sure to list a valid agent with a physical address in Arizona.

-

Omitting the Purpose Statement: The purpose of the corporation should be clearly stated. A vague or overly broad purpose can lead to complications. Be specific about the business activities you plan to engage in.

-

Neglecting to Include Initial Directors: The form requires you to list the initial directors. Forgetting to include this information can result in processing delays. Ensure that you have this information ready before submitting the form.

-

Not Understanding Filing Fees: Each type of corporation has different filing fees. Failing to include the correct payment can lead to rejection of your application. Check the latest fee schedule before submitting your form.

-

Ignoring Follow-Up Requirements: After filing, there are often follow-up actions required, such as obtaining an Employer Identification Number (EIN) or filing additional documents. Neglecting these steps can hinder your corporation's operations.

Other Common Articles of Incorporation State Templates

Incorporating in Tennessee - Offers protection for the corporate name under state laws.

Having the right legal documents in place is crucial for parents, especially when it comes to ensuring that decisions regarding their child's welfare can be made swiftly and efficiently. The California Power of Attorney for a Child form serves this purpose, granting specific authority to an adult when parents are unavailable. For further assistance in creating this important document, you can refer to California Templates to guide you through the process.

Virginia Llc Filing Fee - Incorporation should be approached with thorough planning and legal guidance to maximize benefits.

Texas Company Registration - Identify any conflicts of interest policies in place.

Key takeaways

When filling out and using the Arizona Articles of Incorporation form, several important points should be kept in mind to ensure a smooth process. Below are some key takeaways that can assist you in navigating this crucial step in forming a corporation in Arizona.

- Understand the Purpose: The Articles of Incorporation serve as the official document that establishes your corporation in Arizona. It outlines essential details about your business, including its name, purpose, and structure.

- Provide Accurate Information: Accuracy is vital. Ensure that all information, such as the corporation's name and address, is correct and complies with Arizona's naming requirements. A name that is too similar to an existing corporation can lead to rejection.

- Designate a Statutory Agent: Your corporation must have a statutory agent, also known as a registered agent. This individual or entity is responsible for receiving legal documents on behalf of the corporation. Make sure to provide their name and address in the form.

- Filing Fees and Submission: Be aware of the filing fees associated with submitting the Articles of Incorporation. Payment is typically required at the time of submission, and the form can be filed online or by mail, depending on your preference.

By following these guidelines, you can help ensure that your Articles of Incorporation are completed correctly, paving the way for your new corporation to operate smoothly in Arizona.

Arizona Articles of Incorporation Example

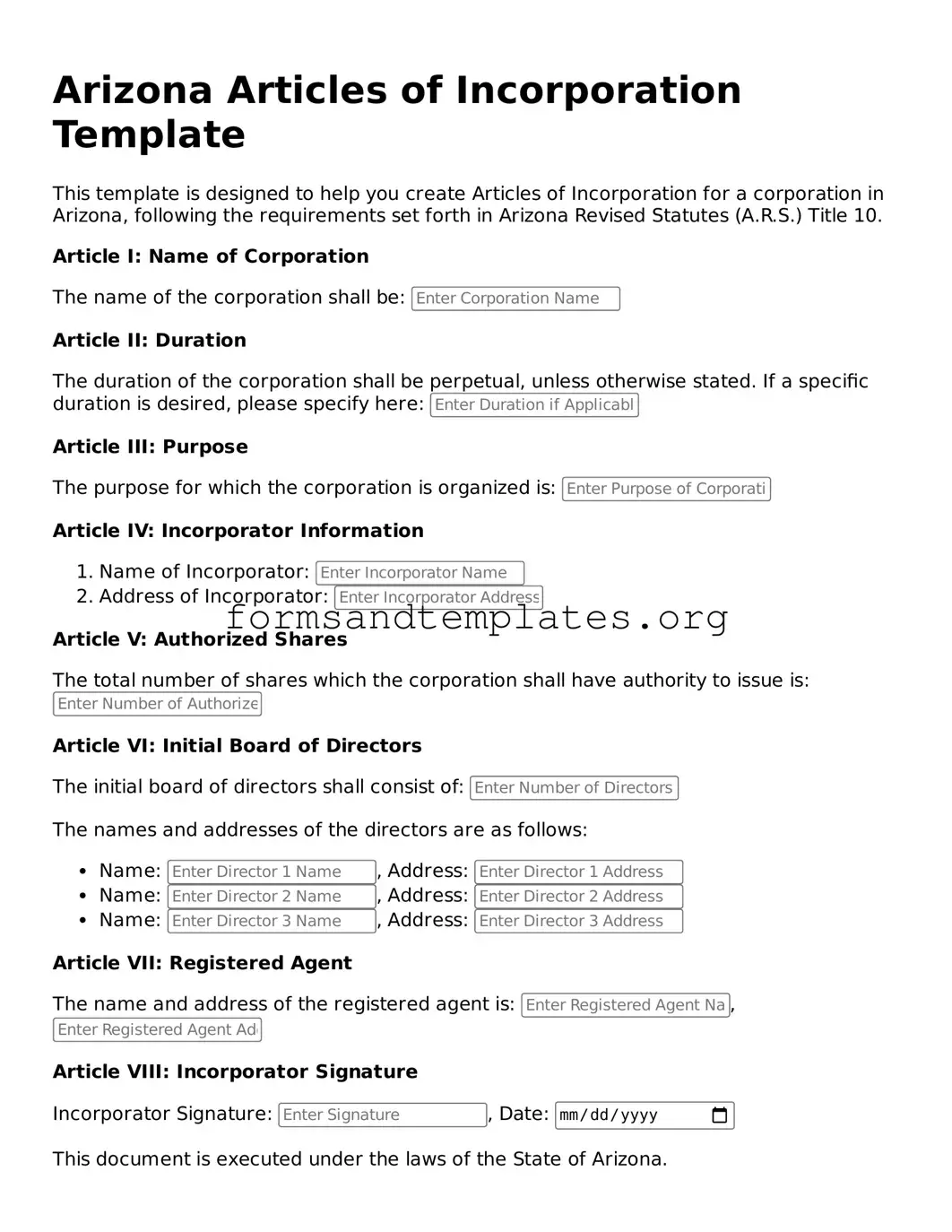

Arizona Articles of Incorporation Template

This template is designed to help you create Articles of Incorporation for a corporation in Arizona, following the requirements set forth in Arizona Revised Statutes (A.R.S.) Title 10.

Article I: Name of Corporation

The name of the corporation shall be:

Article II: Duration

The duration of the corporation shall be perpetual, unless otherwise stated. If a specific duration is desired, please specify here:

Article III: Purpose

The purpose for which the corporation is organized is:

Article IV: Incorporator Information

- Name of Incorporator:

- Address of Incorporator:

Article V: Authorized Shares

The total number of shares which the corporation shall have authority to issue is:

Article VI: Initial Board of Directors

The initial board of directors shall consist of:

The names and addresses of the directors are as follows:

- Name: , Address:

- Name: , Address:

- Name: , Address:

Article VII: Registered Agent

The name and address of the registered agent is: ,

Article VIII: Incorporator Signature

Incorporator Signature: , Date:

This document is executed under the laws of the State of Arizona.

Understanding Arizona Articles of Incorporation

What are the Articles of Incorporation in Arizona?

The Articles of Incorporation are legal documents that establish a corporation in Arizona. They provide essential information about the company, such as its name, purpose, and structure. Filing these documents with the Arizona Corporation Commission is a crucial step in forming a corporation.

What information is required to complete the Articles of Incorporation?

To complete the Articles of Incorporation, you will need to provide the following information:

- The name of the corporation

- The purpose of the corporation

- The address of the corporation's principal office

- The name and address of the statutory agent

- The number of shares the corporation is authorized to issue

- The names and addresses of the initial directors

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online, by mail, or in person. If filing online, visit the Arizona Corporation Commission's website. For mail or in-person submissions, send the completed form along with the required fee to the appropriate office. Ensure that all information is accurate to avoid delays.

What is the filing fee for the Articles of Incorporation?

The filing fee varies depending on the type of corporation you are forming. Typically, the fee ranges from $60 to $100. Check the Arizona Corporation Commission's website for the most current fee schedule and payment options.

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary. Generally, online filings are processed faster, often within a few business days. Mail filings may take longer, sometimes up to several weeks. For expedited processing, consider using the rush service option, if available.

Can I change the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. To do this, you will need to submit an amendment form along with any required fees. This is useful if you need to change the corporation's name, purpose, or other key details.

Do I need a lawyer to file the Articles of Incorporation?

No, you do not need a lawyer to file the Articles of Incorporation. Many people complete the process on their own. However, if you have specific legal questions or concerns, consulting with a lawyer may be beneficial to ensure compliance with all regulations.

How to Use Arizona Articles of Incorporation

After completing the Arizona Articles of Incorporation form, you will need to submit it to the Arizona Corporation Commission. This step is essential for officially establishing your business as a corporation in the state. Be sure to gather any additional documents or fees that may be required for submission.

- Visit the Arizona Corporation Commission website to access the Articles of Incorporation form.

- Choose the correct type of corporation you wish to form, such as a profit or nonprofit corporation.

- Fill in the name of your corporation. Ensure it complies with Arizona naming requirements.

- Provide the principal address of the corporation. This should be a physical address, not a P.O. Box.

- List the name and address of the statutory agent. This person or business will receive legal documents on behalf of your corporation.

- Indicate the number of shares your corporation is authorized to issue, if applicable.

- Include the names and addresses of the initial directors of the corporation.

- Sign and date the form. Ensure that the person signing has the authority to do so.

- Review the completed form for accuracy and completeness.

- Submit the form along with any required fees to the Arizona Corporation Commission, either online or by mail.