Printable Alabama Mvt 20 1 Template

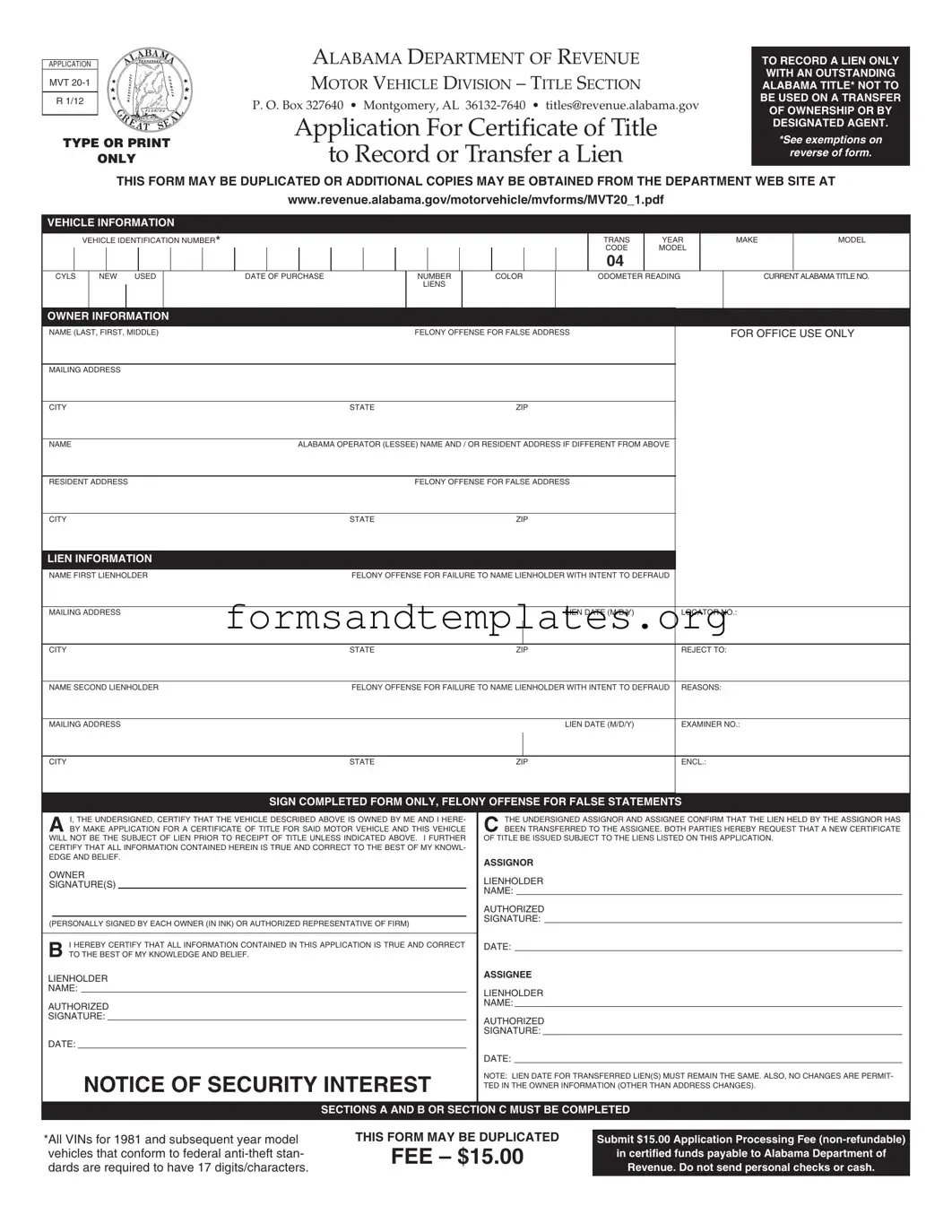

The Alabama Mvt 20 1 form serves a specific purpose within the state's motor vehicle division, primarily focusing on the recording or transferring of liens. This application is essential for lienholders who wish to secure their interests in vehicles that already possess an outstanding Alabama title. It is important to note that this form cannot be used for transferring ownership or by designated agents, who must utilize a different form for such transactions. The Mvt 20 1 requires detailed information about the vehicle, including its identification number, year, make, model, and current title number. Additionally, it collects owner information, such as the name and address of the vehicle owner and any lienholders involved. The form mandates that all parties involved certify the accuracy of the information provided, emphasizing the legal implications of false statements. Alongside the application, a non-refundable processing fee must be submitted, ensuring compliance with state regulations. Furthermore, specific exemptions apply to certain types of vehicles, particularly those over a certain age, which may not require a title at all. Understanding the nuances of this form is crucial for anyone involved in lien transactions in Alabama, as it helps protect the rights of all parties involved.

Common mistakes

-

Failure to Provide Accurate Vehicle Information: One common mistake occurs when applicants do not accurately complete the vehicle information section. This includes the Vehicle Identification Number (VIN), make, model, and year. Inaccurate details can lead to processing delays or rejection of the application.

-

Incorrect Owner Information: Applicants often misstate their personal information. This includes errors in the name, address, or other identifying details. Such inaccuracies can complicate the title transfer process and may require additional documentation to correct.

-

Neglecting to Include Required Supporting Documents: Another frequent error is failing to submit necessary supporting documents, such as the current Alabama title. Without these documents, the application will not be processed, resulting in further delays.

-

Improper Payment Method: Submitting the application fee in an incorrect format is a significant mistake. The Alabama Department of Revenue requires certified funds only, and personal checks or cash will not be accepted. This oversight can lead to the rejection of the application.

Find Common Documents

P60 Form - The form outlines important dates related to employment cessation.

For individuals seeking to manage their affairs effectively, the process of obtaining a comprehensive General Power of Attorney is crucial. This legal document empowers selected individuals to make important decisions on your behalf, ensuring that your financial and legal matters are handled appropriately at all times. To learn more about this valuable form, visit the General Power of Attorney essentials.

Can You Get a Dishonorable Discharge Changed - Using the DD 149, veterans can strive for acknowledgment of their service issues.

Chart in Word - A fantastic way to visualize data for presentations and reports.

Key takeaways

The Alabama MVT 20 1 form is essential for recording or transferring a lien on a vehicle with an existing Alabama title. Here are key takeaways for filling it out and using it effectively:

- Purpose: This form is specifically for recording a lien and should not be used for transferring ownership.

- Eligibility: Only vehicles with an outstanding Alabama title can utilize this form.

- Application Fee: A non-refundable fee of $15.00 is required, payable in certified funds to the Alabama Department of Revenue.

- Legibility: Ensure the form is typed or printed clearly. Illegible forms will be returned.

- Supporting Documents: The current Alabama title must accompany the application when submitted.

- Owner Information: The vehicle and owner information must match the details on the surrendered Alabama title, except for address changes.

- Signatures: All owners or authorized representatives must sign the form in ink.

- Exemptions: Certain vehicles, such as those older than 20 or 35 years, may not require a title. Review the specific exemptions before applying.

- Submission: Completed forms can be duplicated or downloaded from the Alabama Department of Revenue website.

Alabama Mvt 20 1 Example

|

ALABAMA DEPARTMENT OF REVENUE |

||

APPLICATION |

|

||

MVT |

|

MOTOR VEHICLE DIVISION – TITLE SECTION |

|

|

|

|

|

R 1/12 |

|

P. O. Box 327640 • Montgomery, AL |

|

|

|

||

TYPE OR PRINT |

Application For Certificate of Title |

||

to Record or Transfer a Lien |

|||

|

ONLY |

||

TO RECORD A LIEN ONLY WITH AN OUTSTANDING ALABAMA TITLE* NOT TO BE USED ON A TRANSFER OF OWNERSHIP OR BY DESIGNATED AGENT.

*See exemptions on reverse of form.

THIS FORM MAY BE DUPLICATED OR ADDITIONAL COPIES MAY BE OBTAINED FROM THE DEPARTMENT WEB SITE AT

www.revenue.alabama.gov/motorvehicle/mvforms/MVT20_1.pdf

VEHICLE INFORMATION

|

|

|

|

|

VEHICLE IDENTIFICATION NUMBER* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRANS |

YEAR |

|

|

MAKE |

|

MODEL |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CODE |

MODEL |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04 |

|

|

|

|

|

|

|

|

|

|

|

CYLS |

|

NEW USED |

|

|

|

DATE OF PURCHASE |

|

|

|

NUMBER |

|

|

|

COLOR |

|

|

ODOMETER READING |

|

|

|

|

CURRENT ALABAMA TITLE NO. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIENS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME (LAST, FIRST, MIDDLE) |

|

|

|

|

|

|

FELONY OFFENSE FOR FALSE ADDRESS |

|

|

|

|

|

FOR OFFICE USE ONLY |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

NAME |

|

|

|

|

|

|

|

|

|

|

ALABAMA OPERATOR (LESSEE) NAME AND / OR RESIDENT ADDRESS IF DIFFERENT FROM ABOVE |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

RESIDENT ADDRESS |

|

|

|

|

|

|

FELONY OFFENSE FOR FALSE ADDRESS |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

NAME FIRST LIENHOLDER |

|

|

|

FELONY OFFENSE FOR FAILURE TO NAME LIENHOLDER WITH INTENT TO DEFRAUD |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE (M/D/Y) |

|

|

LOCATOR NO.: |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

REJECT TO: |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

NAME SECOND LIENHOLDER |

|

|

|

FELONY OFFENSE FOR FAILURE TO NAME LIENHOLDER WITH INTENT TO DEFRAUD |

|

REASONS: |

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE (M/D/Y) |

|

|

EXAMINER NO.: |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

ENCL.: |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGN COMPLETED FORM ONLY, FELONY OFFENSE FOR FALSE STATEMENTS |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I, THE UNDERSIGNED, CERTIFY THAT THE VEHICLE DESCRIBED ABOVE IS OWNED BY ME AND I HERE- |

|

|

THE UNDERSIGNED ASSIGNOR AND ASSIGNEE CONFIRM THAT THE LIEN HELD BY THE ASSIGNOR HAS |

||||||||||||||||||||||||||||||||||||

|

A BY MAKE APPLICATION FOR A CERTIFICATE OF TITLE FOR SAID MOTOR VEHICLE AND THIS VEHICLE |

|

C BEEN TRANSFERRED TO THE ASSIGNEE. BOTH PARTIES HEREBY REQUEST THAT A NEW CERTIFICATE |

||||||||||||||||||||||||||||||||||||||

|

WILL NOT BE THE SUBJECT OF LIEN PRIOR TO RECEIPT OF TITLE UNLESS INDICATED ABOVE. I FURTHER |

|

OF TITLE BE ISSUED SUBJECT TO THE LIENS LISTED ON THIS APPLICATION. |

||||||||||||||||||||||||||||||||||||||

|

CERTIFY THAT ALL INFORMATION CONTAINED HEREIN IS TRUE AND CORRECT TO THE BEST OF MY KNOWL- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

EDGE AND BELIEF. |

|

|

|

|

|

|

|

|

|

|

ASSIGNOR |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

OWNER |

|

|

|

|

|

|

|

|

|

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

SIGNATURE(S) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

(PERSONALLY SIGNED BY EACH OWNER (IN INK) OR AUTHORIZED REPRESENTATIVE OF FIRM) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

I HEREBY CERTIFY THAT ALL INFORMATION CONTAINED IN THIS APPLICATION IS TRUE AND CORRECT |

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

B TO THE BEST OF MY KNOWLEDGE AND BELIEF. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

ASSIGNEE |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

NOTICE OF SECURITY INTEREST |

|

NOTE: LIEN DATE FOR TRANSFERRED LIEN(S) MUST REMAIN THE SAME. ALSO, NO CHANGES ARE PERMIT- |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

TED IN THE OWNER INFORMATION (OTHER THAN ADDRESS CHANGES). |

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*All VINs for 1981 and subsequent year model vehicles that conform to federal

SECTIONS A AND B OR SECTION C MUST BE COMPLETED

THIS FORM MAY BE DUPLICATED |

Submit $15.00 Application Processing Fee |

FEE – $15.00 |

in certified funds payable to Alabama Department of |

|

|

|

Revenue. Do not send personal checks or cash. |

|

|

Instructions

This form shall be typed or printed legibly.

Illegible forms will be returned.

This form is designed for use by a lienholder in order for an owner of a vehicle to comply with section

This form may not be used on a transfer of ownership or by designated agents. Designated agents shall use form MVT

NOTE: Vehicle information and owner information shall be identical to information appearing on surrendered alabama title except for current mailing address and current alabama resident address.

SUPPORTING DOCUMENTS – This application shall be accompanied by the current Alabama title to this vehicle and the title fee (certified funds only) payable to the Alabama Department of Revenue.

Exemptions

(1)Effective January 1, 2012, no certificate of title shall be issued for any manufactured homes, trail- er,

Example: As of January 1, 2012, all 1991 and prior year model manufactured homes, trailers,

(2)Effective January 1, 2012, no certificate of title shall be issued for any motor vehicle more than

Example: As of January 1, 2012, all 1976 and prior year model motor vehicles are exempt from the titling provisions of Chapter 8, Title 32, Code of Alabama 1975.

(3)Effective January 1, 2012, no certificate of title shall be issued for a low speed vehicle. A low speed vehicle is defined as a

NOTE: The exemption from titling does not invalidate any Alabama certificate of title that is currently in effect. However, no subsequent title, including a certificate of title to record or transfer a lien, can be issued if the vehicle is exempt from titling.

Understanding Alabama Mvt 20 1

What is the purpose of the Alabama Mvt 20 1 form?

The Alabama Mvt 20 1 form is used to apply for a certificate of title specifically to record or transfer a lien on a vehicle that already has an outstanding Alabama title. This form is not intended for transferring ownership of the vehicle or for use by designated agents.

Who should use the Mvt 20 1 form?

This form should be used by lienholders when an owner of a vehicle creates a security interest in that vehicle. It is important to note that designated agents should not use this form; they must use form MVT 5-1E instead.

What information is required on the form?

The form requires several pieces of information, including:

- Vehicle identification number (VIN)

- Year, make, model, and color of the vehicle

- Current Alabama title number

- Owner's name and address

- Liens information, including lienholder names and addresses

What is the fee associated with submitting the Mvt 20 1 form?

A non-refundable application processing fee of $15.00 must accompany the form. This fee should be paid in certified funds made out to the Alabama Department of Revenue. Personal checks and cash are not accepted.

What supporting documents are needed?

Along with the completed Mvt 20 1 form, the current Alabama title for the vehicle must be submitted. The title fee, also in certified funds, should be included as well.

Are there any exemptions for using this form?

Yes, there are specific exemptions. For example, vehicles that are more than 35 model years old or certain types of trailers that are over 20 years old may not require a title. Additionally, low-speed vehicles are also exempt from titling.

How should the form be completed?

The form must be typed or printed legibly. Illegible forms will be returned. Ensure that the vehicle and owner information matches what is on the surrendered Alabama title, except for any changes in mailing or resident addresses.

What happens if the form is filled out incorrectly?

If the form is filled out incorrectly or if any required information is missing, it may be returned to the applicant. It is crucial to double-check all entries for accuracy before submission.

Where can I obtain additional copies of the Mvt 20 1 form?

Additional copies of the Mvt 20 1 form can be obtained from the Alabama Department of Revenue's website. The form can also be duplicated for convenience.

What should I do if I have more questions about the form?

If you have further questions regarding the Mvt 20 1 form, you can contact the Alabama Department of Revenue directly via email at titles@revenue.alabama.gov or refer to their website for more information.

How to Use Alabama Mvt 20 1

Filling out the Alabama MVT 20-1 form is a straightforward process. This form is necessary for recording or transferring a lien on a vehicle. To ensure that your application is processed smoothly, follow these steps carefully.

- Obtain the Form: Download the Alabama MVT 20-1 form from the Alabama Department of Revenue website or make a copy of the form.

- Type or Print: Fill out the form using a typewriter or print legibly in black or blue ink. Illegible forms will be returned.

- Vehicle Information: Enter the vehicle identification number (VIN), year, make, model, color, odometer reading, current Alabama title number, and whether the vehicle is new or used.

- Owner Information: Provide the owner's full name, mailing address, and any felony offense information if applicable. If the owner has a different resident address, include that as well.

- First Lienholder Information: Fill in the name and mailing address of the first lienholder, the lien date, and any felony offense information if applicable.

- Second Lienholder Information: If applicable, provide the name and mailing address of the second lienholder and their lien date.

- Sign the Form: Ensure that all required signatures are present. The owner and lienholder must sign in ink, certifying that the information is true and correct.

- Submit Supporting Documents: Attach the current Alabama title for the vehicle and prepare the application processing fee of $15.00 in certified funds, payable to the Alabama Department of Revenue.

- Mail the Application: Send the completed form, supporting documents, and payment to the address provided on the form.

After submitting the form, you will receive confirmation from the Alabama Department of Revenue regarding the status of your application. Make sure to keep a copy of all documents for your records.