Printable Advance Beneficiary Notice of Non-coverage Template

The Advance Beneficiary Notice of Non-coverage (ABN) form plays a crucial role in the healthcare landscape, particularly for Medicare beneficiaries. This form serves as a notification tool that informs patients when a healthcare provider believes that a specific service or item may not be covered by Medicare. By issuing an ABN, providers help ensure that patients are aware of potential out-of-pocket costs before receiving care. The form outlines the specific service in question, the reason for the anticipated non-coverage, and the patient’s options moving forward. Patients are given the opportunity to accept or refuse the service, which empowers them to make informed decisions about their healthcare. Understanding the ABN is essential for beneficiaries, as it not only clarifies their financial responsibilities but also enhances communication between patients and providers. Furthermore, the proper use of the ABN can help prevent billing disputes and foster a more transparent healthcare experience.

Common mistakes

-

Not Understanding the Purpose of the Form: Many individuals fill out the Advance Beneficiary Notice of Non-coverage (ABN) without fully grasping its significance. This form is crucial because it informs beneficiaries that Medicare may not cover a specific service or item. Without this understanding, individuals may overlook important details.

-

Failing to Provide Accurate Information: Accuracy is key when completing the ABN. Some people mistakenly enter incorrect personal details or service information. This can lead to confusion and delays in processing claims. Always double-check that names, dates, and service descriptions are correct.

-

Not Signing the Form: A common oversight is neglecting to sign the ABN. Without a signature, the form is incomplete, and Medicare may not recognize it as valid. This step is essential to indicate that the beneficiary understands the information presented.

-

Ignoring the Options Provided: The ABN typically includes different options regarding how to proceed with the service. Some individuals fail to consider these choices carefully. It is important to understand the implications of each option, as they can affect out-of-pocket costs and coverage decisions.

Find Common Documents

Ca Sdi - Filing the DE 2501 can assist those unable to work due to a medical condition.

For those interested in conducting a transaction, an informative resource is the guide to completing a Motorcycle Bill of Sale, which outlines the necessary steps to ensure a smooth transfer of ownership.

Make a Fake Insurance Card - This card may be required for vehicle registrations.

Key takeaways

The Advance Beneficiary Notice of Non-coverage (ABN) form is an important document for Medicare beneficiaries. Understanding how to fill it out and use it can help avoid unexpected costs. Here are key takeaways regarding the ABN:

- The ABN informs beneficiaries that a service may not be covered by Medicare.

- It must be filled out by the healthcare provider before the service is rendered.

- Beneficiaries should carefully read the form to understand their financial responsibilities.

- Signing the ABN indicates that the beneficiary agrees to pay for the service if Medicare denies coverage.

- Providers must offer the ABN when they believe a service may not be medically necessary.

- Beneficiaries have the right to refuse the service after receiving the ABN.

- Keep a copy of the signed ABN for personal records and future reference.

Using the ABN correctly can help beneficiaries make informed decisions about their healthcare services.

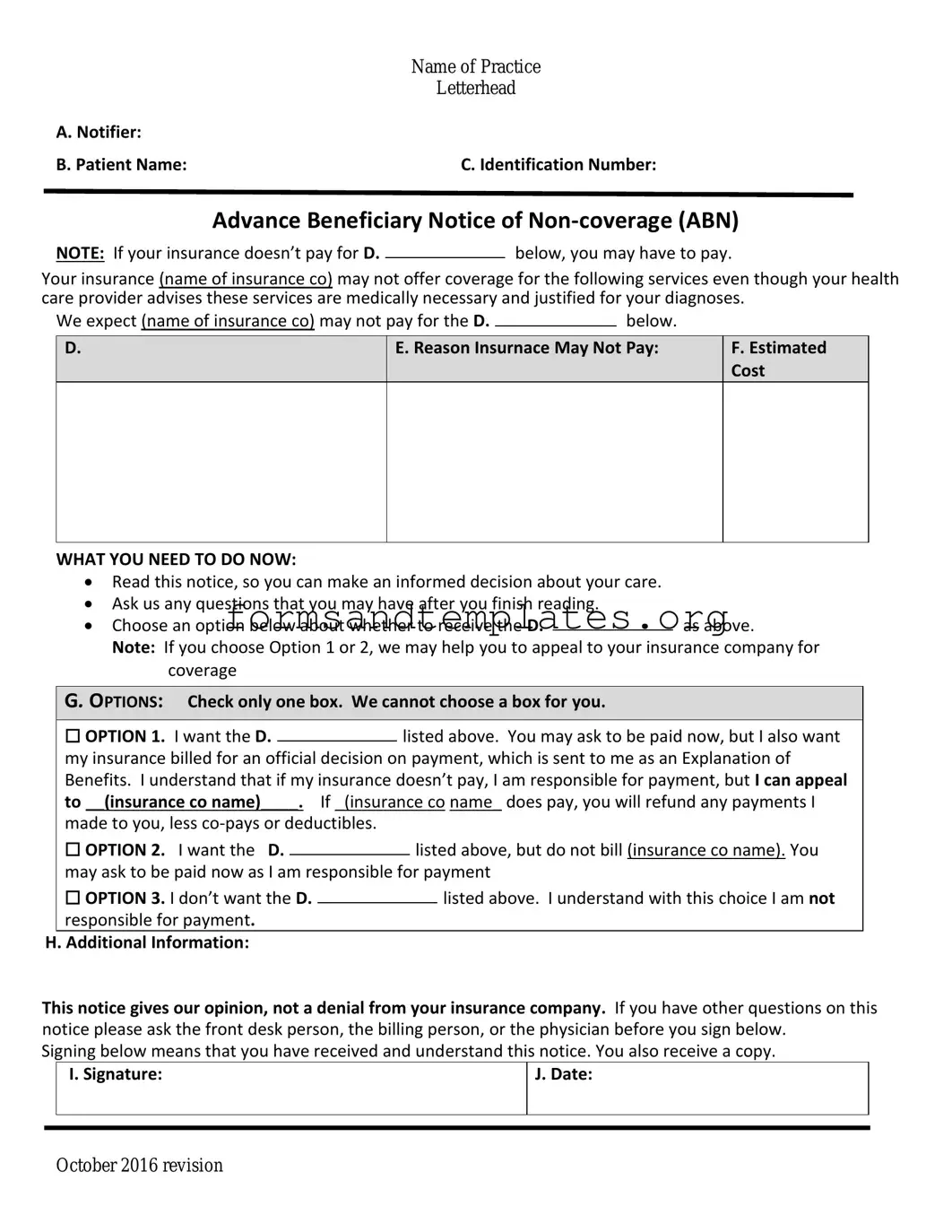

Advance Beneficiary Notice of Non-coverage Example

|

Name of Practice |

|

Letterhead |

A. Notifier: |

|

B. Patient Name: |

C. Identification Number: |

Advance Beneficiary Notice of

NOTE: If your insurance doesn’t pay for D.below, you may have to pay.

Your insurance (name of insurance co) may not offer coverage for the following services even though your health care provider advises these services are medically necessary and justified for your diagnoses.

We expect (name of insurance co) may not pay for the D. |

|

below. |

|

D.

E. Reason Insurnace May Not Pay:

F.Estimated Cost

WHAT YOU NEED TO DO NOW:

Read this notice, so you can make an informed decision about your care.

Ask us any questions that you may have after you finish reading.

Choose an option below about whether to receive the D.as above.

Note: If you choose Option 1 or 2, we may help you to appeal to your insurance company for coverage

G. OPTIONS: Check only one box. We cannot choose a box for you.

|

☐ OPTION 1. I want the D. |

|

listed above. You may ask to be paid now, but I also want |

||||

|

|

||||||

|

my insurance billed for an official decision on payment, which is sent to me as an Explanation of |

||||||

|

Benefits. I understand that if my insurance doesn’t pay, I am responsible for payment, but I can appeal |

||||||

|

to __(insurance co name)____. If _(insurance co name_ does pay, you will refund any payments I |

||||||

|

made to you, less |

|

|

|

|||

|

☐ OPTION 2. I want the D. |

|

|

listed above, but do not bill (insurance co name). You |

|||

|

|

|

|||||

|

may ask to be paid now as I am responsible for payment |

||||||

|

☐ OPTION 3. I don’t want the D. |

|

|

|

listed above. I understand with this choice I am not |

||

|

|

|

|

||||

|

responsible for payment. |

|

|

|

|||

H. Additional Information: |

|

|

|

||||

This notice gives our opinion, not a denial from your insurance company. If you have other questions on this notice please ask the front desk person, the billing person, or the physician before you sign below.

Signing below means that you have received and understand this notice. You also receive a copy.

|

I. Signature: |

J. Date: |

|

|

|

|

|

|

October 2016 revision

Understanding Advance Beneficiary Notice of Non-coverage

What is the Advance Beneficiary Notice of Non-coverage (ABN)?

The Advance Beneficiary Notice of Non-coverage, commonly referred to as ABN, is a form used by healthcare providers in the United States. It informs patients that Medicare may not cover a specific service or item. By receiving this notice, patients can make informed decisions about their care and understand their potential financial responsibilities.

When should I receive an ABN?

You should receive an ABN when a healthcare provider believes that a service or item may not be covered by Medicare. This typically happens before the service is provided. The provider must explain why they think Medicare will deny coverage and give you the opportunity to either proceed with the service or decline it.

What should I do if I receive an ABN?

If you receive an ABN, review it carefully. It will outline the service in question, the reason for the potential denial, and your options. You can choose to accept the service and agree to pay for it if Medicare denies coverage or decline the service altogether. Make sure to ask your provider any questions you may have about the notice or your options.

Will I be responsible for payment if I sign the ABN?

Yes, if you sign the ABN and Medicare denies coverage for the service, you will be responsible for paying for that service. However, signing the ABN does not guarantee that Medicare will deny coverage. It simply acknowledges that you understand the potential for non-coverage and are willing to proceed.

Can I appeal if Medicare denies coverage after I signed the ABN?

Yes, you can appeal Medicare's decision if they deny coverage for a service you received after signing the ABN. The appeal process allows you to present your case and provide any additional information that may support your claim for coverage. Keep in mind that the appeal process can take time, and you will still be responsible for payment during this period.

Are there any exceptions to when an ABN is required?

Yes, there are exceptions. An ABN is not required for services that are clearly not covered by Medicare, such as certain cosmetic procedures. Additionally, if the provider is certain that the service will be covered, they do not need to issue an ABN. However, it is always best to clarify with your provider if you have concerns about coverage.

How to Use Advance Beneficiary Notice of Non-coverage

After you have obtained the Advance Beneficiary Notice of Non-coverage (ABN) form, you will need to fill it out accurately to ensure clarity regarding your healthcare services. This form is crucial for understanding potential costs associated with services that Medicare may not cover. Follow the steps below to complete the form.

- Begin by entering your personal information at the top of the form. This includes your name, address, and Medicare number.

- Identify the healthcare service or item that may not be covered by Medicare. Write a clear description in the designated space.

- Next, indicate the reason why you believe the service may not be covered. This could be due to various factors such as the service being deemed not medically necessary.

- Check the appropriate box to indicate whether you want the service to be provided or if you wish to decline it.

- In the section for the provider’s information, fill in the name and contact details of the healthcare provider or facility that will be delivering the service.

- Sign and date the form at the bottom to confirm that you understand the information provided and agree to the terms outlined.

Once you have completed the form, keep a copy for your records. Provide the original to your healthcare provider to ensure that they are aware of your preferences regarding coverage.