Printable Adp Pay Stub Template

The ADP Pay Stub form is an essential document for employees, providing a clear breakdown of earnings, deductions, and net pay for each pay period. This form typically includes vital information such as the employee's name, identification number, pay period dates, and the total hours worked. It also outlines various deductions, including taxes, insurance, and retirement contributions, ensuring transparency in how gross pay is transformed into take-home pay. Understanding this form is crucial for employees to verify their earnings and ensure that all deductions are accurate. Furthermore, the ADP Pay Stub serves as a valuable resource for budgeting and financial planning, offering insights into income patterns and expenses. Familiarity with the details of the pay stub can empower employees to address any discrepancies promptly and maintain accurate financial records.

Common mistakes

-

Incorrect Employee Information: Many individuals fail to double-check their name, address, or Social Security number. This can lead to significant issues with tax reporting and payroll processing.

-

Wrong Pay Period Dates: Entering incorrect pay period start and end dates can cause confusion regarding when the pay is for. Always ensure these dates align with your company's payroll schedule.

-

Missing Hours Worked: Some people forget to include the total hours worked, especially if they have fluctuating schedules. Accurate hour reporting is essential for correct pay calculations.

-

Errors in Pay Rate: Misstating the hourly rate or salary can result in underpayment or overpayment. Verify your pay rate against your employment agreement.

-

Overlooking Deductions: Failing to account for deductions, such as taxes or benefits, can lead to an inaccurate net pay amount. Review all deductions carefully.

-

Not Updating for Changes: If there have been changes in employment status, such as a promotion or a change in tax withholding, these should be updated on the pay stub promptly.

-

Neglecting to Review for Accuracy: Some individuals submit their forms without reviewing them for errors. Always take a moment to proofread your information before finalizing.

-

Failing to Keep Copies: Not retaining a copy of the submitted pay stub can create problems later, especially if discrepancies arise. Always keep a record for your files.

Find Common Documents

Health Insurance Marketplace Statement - Examining your 1095-A may help you make informed decisions about future health coverage.

To ensure a smooth employment process, employers often rely on the essential Employment Verification form for confirming an individual's work history and suitability. This form is pivotal in maintaining compliance and protecting the interests of all parties involved. For more information on how to complete this essential document, visit the important Employment Verification requirements.

Baseball Tryout Evaluation Form - Collect information to identify strengths and weaknesses.

Key takeaways

When it comes to understanding your pay stub from ADP, there are several important points to keep in mind. These key takeaways will help you navigate the form and make sense of the information presented.

- Understand the Basics: The pay stub provides a breakdown of your earnings, deductions, and net pay for a specific pay period.

- Review Your Earnings: Your gross pay is listed at the top, showing the total amount earned before any deductions.

- Deductions Matter: Look closely at the deductions section. This includes taxes, health insurance, retirement contributions, and other withholdings.

- Net Pay is Key: The net pay is the amount you take home after all deductions. It's crucial to know this figure for budgeting.

- Check for Accuracy: Always verify that the hours worked and pay rates are correct. Mistakes can happen, and it’s important to address them promptly.

- Tax Information: Your pay stub includes information about federal, state, and local taxes. This helps you understand your tax obligations.

- Year-to-Date Totals: Look for year-to-date totals for earnings and deductions. This information is useful for tracking your financial progress.

- Understand Your Benefits: The pay stub may also outline benefits such as health insurance and retirement contributions, giving you a clear picture of your overall compensation.

- Keep Records: Save your pay stubs for future reference. They can be important for tax filing or loan applications.

- Contact HR for Questions: If you have questions or concerns about your pay stub, don’t hesitate to reach out to your HR department for clarification.

By keeping these points in mind, you can better understand your ADP pay stub and ensure that your financial records are accurate and up to date.

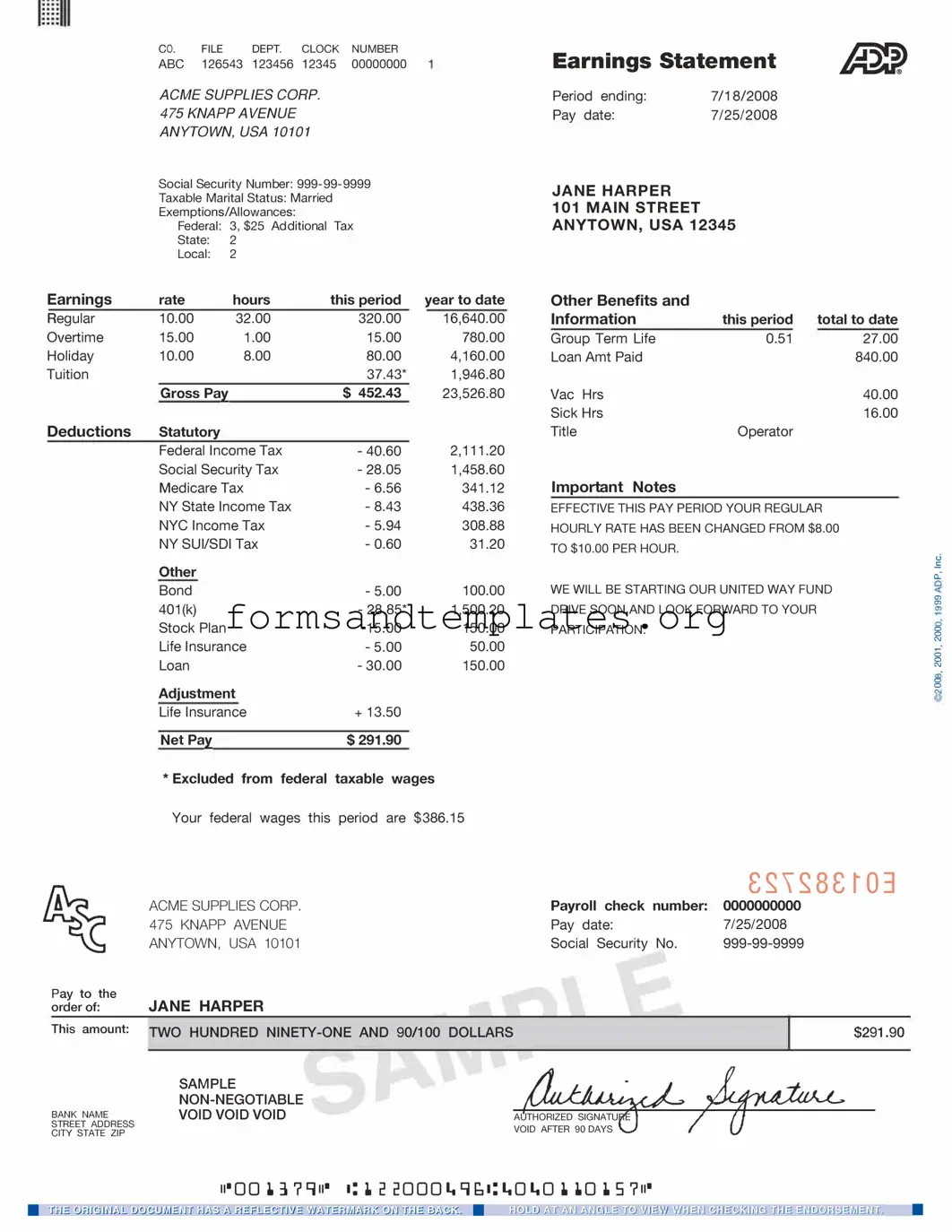

Adp Pay Stub Example

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Understanding Adp Pay Stub

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll processing company, that details an employee's earnings for a specific pay period. It includes important information such as gross pay, deductions, and net pay. Employees typically receive this stub alongside their paycheck or through an online portal.

What information is included on an ADP Pay Stub?

An ADP Pay Stub generally contains the following information:

- Employee name and identification number

- Pay period dates

- Gross earnings

- Deductions (such as taxes, health insurance, and retirement contributions)

- Net pay (the amount the employee takes home)

- Year-to-date totals for earnings and deductions

How can I access my ADP Pay Stub?

Employees can access their ADP Pay Stub in several ways:

- Through the ADP mobile app, available for both iOS and Android devices.

- By logging into the ADP website using your employee credentials.

- In some cases, your employer may provide physical copies of pay stubs.

What should I do if I notice an error on my ADP Pay Stub?

If you find an error on your pay stub, it is essential to address it promptly. First, review the information carefully to confirm the mistake. Then, contact your HR department or payroll administrator to report the issue. They can investigate the discrepancy and make necessary corrections.

Are ADP Pay Stubs secure?

ADP takes security seriously. Pay stubs accessed online are protected by encryption and secure login protocols. However, it is advisable to be cautious and not share your login information with others. For added security, consider using strong passwords and enabling two-factor authentication if available.

Can I receive my ADP Pay Stub electronically?

Yes, many employers offer electronic delivery of pay stubs through ADP. This option allows employees to receive their pay stubs via email or through the ADP online portal. Electronic delivery is often more convenient and environmentally friendly than receiving paper copies.

What should I do if I lose my ADP Pay Stub?

If you lose your pay stub, you can easily retrieve it. Simply log into your ADP account online or through the mobile app. If you do not have online access, reach out to your HR department for assistance. They can provide you with a duplicate copy of your pay stub.

How to Use Adp Pay Stub

Filling out the ADP Pay Stub form is a straightforward process that allows you to ensure your pay information is accurate. This form captures essential details about your earnings, deductions, and taxes. Follow these steps to complete the form effectively.

- Begin by entering your employee ID in the designated field. This number uniquely identifies you within the payroll system.

- Next, fill in your name as it appears on your official documents. Make sure to include your first and last name.

- Provide your address in the appropriate section. Include your street address, city, state, and ZIP code.

- Indicate your pay period by entering the start and end dates. This information is crucial for determining the timeframe of your earnings.

- List your gross earnings for the pay period. This amount represents your total earnings before any deductions.

- Detail any deductions that apply to your pay. This may include taxes, retirement contributions, and health insurance premiums.

- Calculate your net pay by subtracting the total deductions from your gross earnings. This is the amount you will receive.

- Finally, review all the information for accuracy. Ensure that everything is correct before submitting the form.

Once you have completed the form, you can submit it to your payroll department or keep it for your records, depending on your organization’s procedures.