Printable Acord 50 WM Template

The Acord 50 WM form serves as a crucial tool in the realm of insurance, particularly for those involved in the management of workers' compensation claims. This form, designed to streamline the process of reporting and documenting workplace injuries, encompasses a variety of essential elements. It provides a standardized method for employers to communicate vital information about an incident, including details about the injured employee, the nature of the injury, and the circumstances surrounding the event. Additionally, the Acord 50 WM form facilitates the collection of data necessary for the assessment of claims, ensuring that all relevant parties have access to accurate and comprehensive information. By employing this form, employers not only enhance their compliance with state regulations but also promote a more efficient claims process, ultimately benefiting both the injured worker and the employer. Its structured layout allows for clarity and ease of use, making it an indispensable resource for those navigating the complexities of workers' compensation insurance.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required information. Each section must be filled out thoroughly to avoid delays in processing.

-

Incorrect Policy Numbers: Entering the wrong policy number can lead to confusion and miscommunication. Always double-check to ensure accuracy.

-

Omitting Contact Information: Not including your contact details, such as phone number or email address, can hinder follow-ups and clarification requests.

-

Using Abbreviations: Abbreviating terms or using shorthand can create misunderstandings. It's best to write out all terms clearly.

-

Ignoring Signature Requirements: Failing to sign the form or provide the necessary signatures can result in the form being rejected. Make sure to check for all required signatures.

-

Not Reviewing for Errors: Skipping the review process often leads to overlooked mistakes. Take a moment to read through the form before submission.

-

Missing Dates: Dates are crucial for tracking and processing. Forgetting to include the date can cause delays.

-

Providing Outdated Information: Using old data can create discrepancies. Always ensure that the information is current and accurate.

-

Failure to Follow Submission Instructions: Not adhering to the specific submission guidelines can lead to complications. Always read the instructions carefully.

Find Common Documents

Free Printable Puppy Shot Record - Track your dog’s vaccination dates conveniently.

To ensure your protection during events, you may want to explore the vital considerations surrounding a Hold Harmless Agreement form and understand its implications for risk management and liability. For more information, please visit important resources on Hold Harmless Agreement insights.

How to Make a Doctor's Excuse - Can shield patients from penalties related to missed obligations.

Welder Qualification - The form helps demonstrate compliance with industry standards.

Key takeaways

The Acord 50 WM form is an essential document for those involved in the insurance industry. Here are key takeaways to keep in mind when filling out and using this form:

- Understand the Purpose: The Acord 50 WM form is used for workers' compensation insurance. It provides vital information about the insured entity.

- Accurate Information: Ensure all details entered are accurate. This includes the business name, address, and contact information.

- Classification Codes: Use the correct classification codes for your business. These codes determine the insurance premium and coverage.

- Signature Requirement: The form must be signed by an authorized representative. This validates the information provided.

- Review Before Submission: Double-check all entries before submitting the form. Errors can lead to delays or coverage issues.

- Keep Copies: Retain copies of the completed form for your records. This can be helpful for future reference or disputes.

- Consult Professionals: If unsure about any part of the form, consult an insurance professional for guidance.

- Timely Submission: Submit the form promptly to avoid any gaps in coverage. Timeliness is crucial in maintaining continuous insurance protection.

By following these takeaways, you can navigate the Acord 50 WM form with confidence and ensure that your insurance needs are met effectively.

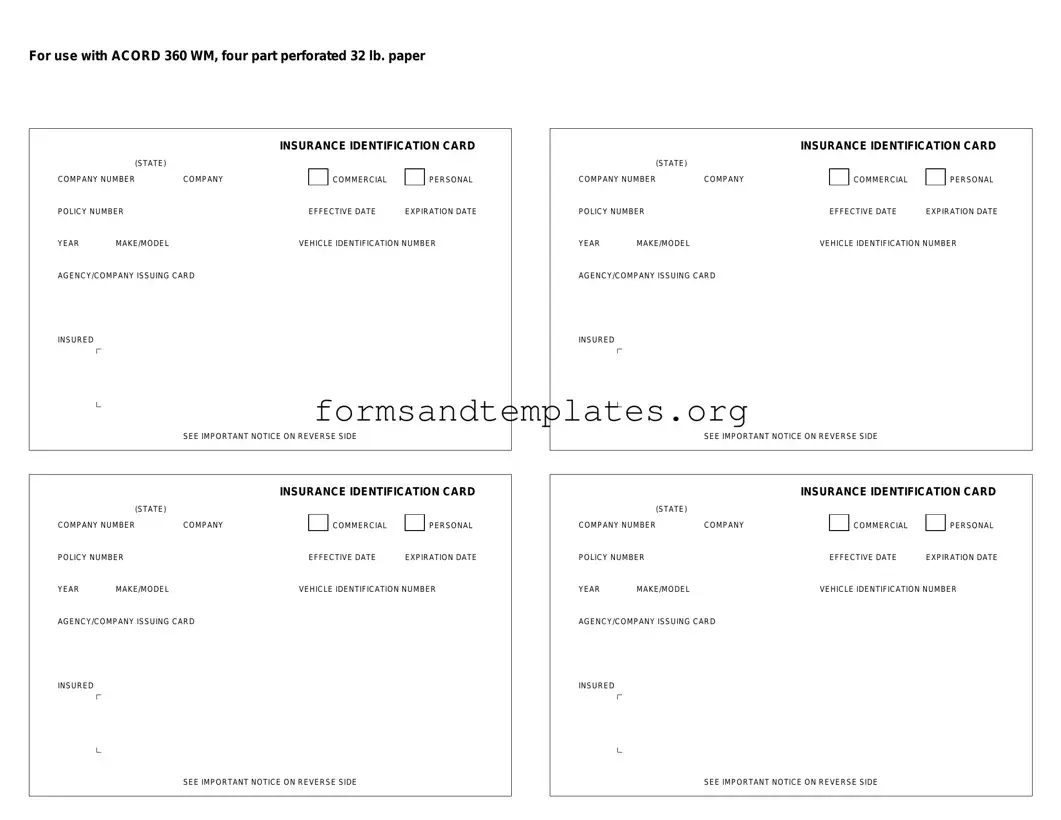

Acord 50 WM Example

For use with ACORD 360 WM, four part perforated 32 lb. paper

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

Understanding Acord 50 WM

What is the Acord 50 WM form?

The Acord 50 WM form is a standardized document used primarily in the insurance industry. It serves as a certificate of workers' compensation insurance. This form provides essential information about the coverage, including the policyholder's details, the insurance provider, and the effective dates of the coverage.

Who needs to use the Acord 50 WM form?

Businesses that require proof of workers' compensation insurance often need to use the Acord 50 WM form. This includes employers in various industries who want to demonstrate compliance with state laws and regulations regarding employee safety and insurance coverage.

How do I complete the Acord 50 WM form?

To complete the Acord 50 WM form, follow these steps:

- Gather necessary information about your business, including your name, address, and contact details.

- Collect details about your insurance provider, such as the company name and policy number.

- Fill in the effective date and expiration date of your workers' compensation policy.

- Review the completed form for accuracy before submitting it.

Where can I obtain the Acord 50 WM form?

You can obtain the Acord 50 WM form from various sources, including:

- The official ACORD website, where you can download the form directly.

- Your insurance agent or broker, who can provide you with the latest version.

- Insurance industry associations that may offer resources and templates.

Is the Acord 50 WM form accepted in all states?

The Acord 50 WM form is widely accepted, but requirements can vary by state. It's crucial to check with your state's workers' compensation board or regulatory agency to ensure that this form meets local requirements.

What should I do if my information changes?

If your business information changes, such as your address or insurance provider, you need to update the Acord 50 WM form. Submit a new form reflecting the current details to any parties who require proof of your workers' compensation coverage.

Can I use the Acord 50 WM form for multiple policies?

The Acord 50 WM form is typically used for a single workers' compensation policy. If you have multiple policies, you should complete a separate form for each one to provide accurate information to stakeholders.

What happens if I do not provide the Acord 50 WM form?

Failing to provide the Acord 50 WM form when required can lead to several issues. You may face penalties from regulatory agencies, or your business could be deemed non-compliant with state workers' compensation laws. This could result in fines, legal complications, or increased scrutiny from insurance providers.

How to Use Acord 50 WM

Completing the Acord 50 WM form requires careful attention to detail. This form is essential for providing necessary information to your insurance provider. Follow these steps to ensure that you fill out the form accurately and completely.

- Begin by entering the name of the insured individual or business at the top of the form.

- Provide the complete address of the insured, including street, city, state, and zip code.

- In the designated section, indicate the type of coverage being requested.

- List any additional insured parties, if applicable. Include their names and addresses.

- Specify the effective date of the insurance coverage you are seeking.

- Fill out the details of the insurance agent or broker, including their name and contact information.

- Review all entries for accuracy and completeness before signing the form.

- Sign and date the form to validate your application.

After completing the form, it is important to submit it to your insurance provider as soon as possible. This will help expedite the processing of your insurance request.